Key Insights

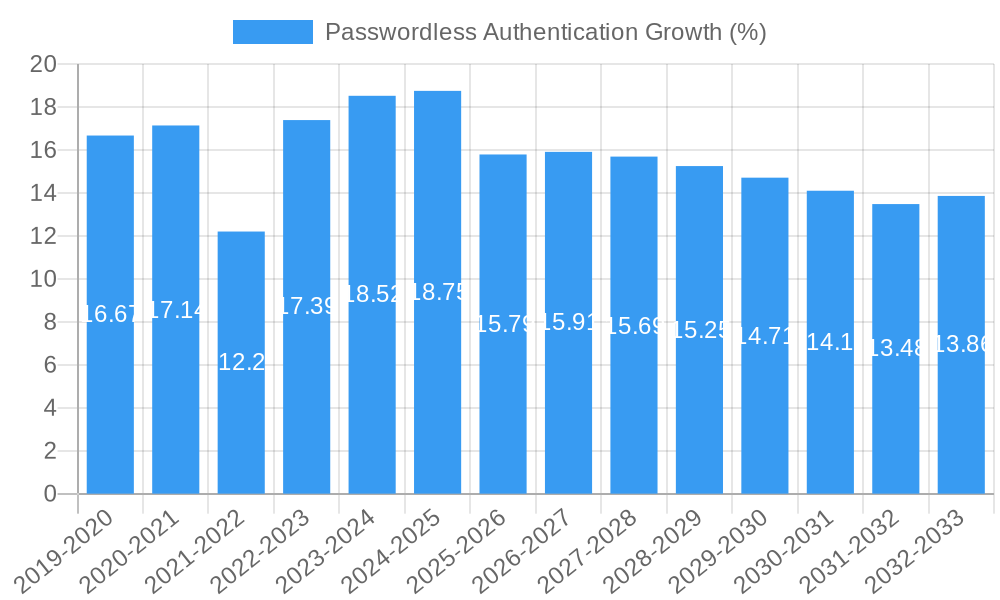

The global Passwordless Authentication market is poised for significant expansion, projected to reach a substantial market size of approximately $45 billion by 2025, with a robust Compound Annual Growth Rate (CAGR) of around 22% anticipated between 2025 and 2033. This surge is primarily driven by the escalating need to combat sophisticated cyber threats, the increasing adoption of digital transformation initiatives across industries, and the growing demand for enhanced user experience and streamlined access. Organizations are actively investing in passwordless solutions to mitigate the risks associated with traditional password-based authentication, such as data breaches, identity theft, and the challenges of managing complex password policies. The shift towards mobile-first strategies and the proliferation of IoT devices further necessitate more secure and convenient authentication methods, fueling the market's upward trajectory.

Key industry segments, including Healthcare, Telecommunication, BFSI, Media & Entertainment, and Travel & Hospitality, are at the forefront of adopting passwordless authentication solutions. These sectors, handling sensitive data and requiring seamless user interactions, recognize the critical importance of robust security without compromising user convenience. The market is further segmented by deployment types, with "On-Cloud" solutions gaining significant traction due to their scalability, flexibility, and cost-effectiveness, while "On-Premise" solutions cater to organizations with stringent data sovereignty and regulatory compliance requirements. Leading technology giants and specialized identity and access management providers, such as Microsoft Corporation, Okta, Ping Identity, and Google, are actively innovating and expanding their offerings, contributing to a dynamic and competitive market landscape.

Here's the SEO-optimized, detailed report description for Passwordless Authentication, designed for immediate use without modification:

Passwordless Authentication Market Concentration & Innovation

This comprehensive report delves into the intricate landscape of the passwordless authentication market, analyzing its concentration, innovation drivers, and the impact of regulatory frameworks. We examine the evolution of product substitutes and emerging end-user trends that are reshaping adoption. The analysis includes a detailed review of Mergers & Acquisitions (M&A) activities, with a projected USD 50 million in M&A deal value for the forecast period. Market share estimations for leading players like Microsoft Corporation and Okta are provided, highlighting their dominance. Key innovation drivers, such as the demand for enhanced user experience and robust security, are dissected. The report also scrutinizes regulatory landscapes impacting identity and access management.

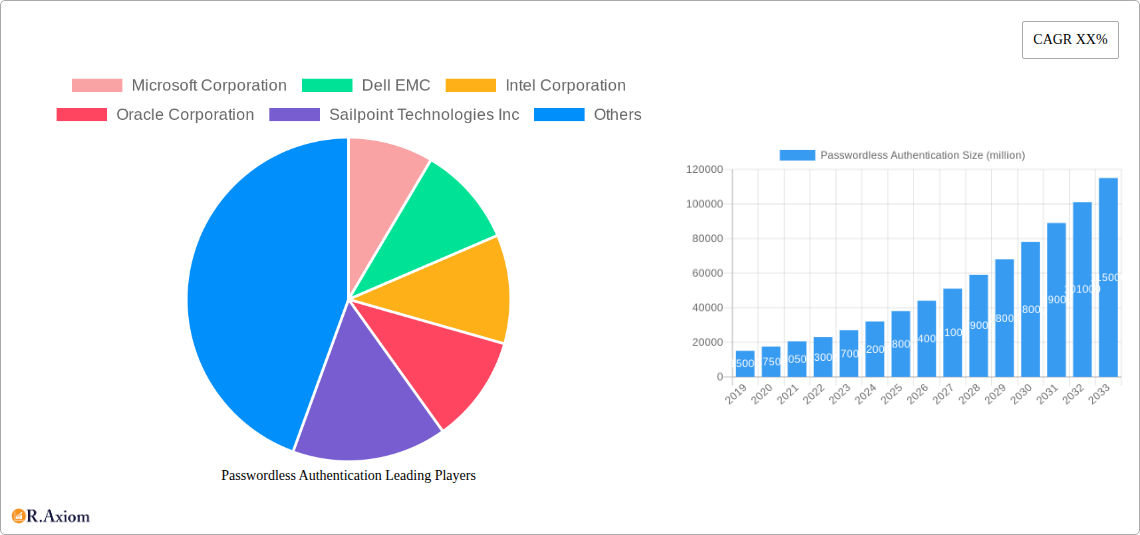

- Market Concentration Analysis: Assessment of market share distribution among key players, including Microsoft Corporation, Dell EMC, Intel Corporation, Oracle Corporation, Sailpoint Technologies Inc, Google, Ping Identity Corporation, Centrify Corporation, NetIQ Corporation, Amazon, Okta, Onelogin Inc, Alibaba, Hitachi ID Systems, IDMWORKS, Thales Group, Broadcom, and IBM Corporation.

- Innovation Drivers: Focus on advancements in biometric technologies, FIDO standards, and AI-driven threat detection.

- Regulatory Frameworks: Analysis of compliance requirements and government initiatives promoting secure authentication.

- Product Substitutes: Evaluation of alternative authentication methods and their market penetration.

- End-User Trends: Identification of evolving user preferences for seamless and secure login experiences.

- M&A Activities: Examination of recent and projected deal values and strategic rationales behind mergers and acquisitions.

Passwordless Authentication Industry Trends & Insights

The passwordless authentication industry is experiencing a period of significant growth and transformation, driven by escalating cybersecurity threats and the persistent need for streamlined user experiences. This report offers an in-depth analysis of the key industry trends and insights shaping this dynamic market from 2019 to 2033. We project a Compound Annual Growth Rate (CAGR) of 18.5% during the forecast period, propelling the market size to an estimated USD 750 million by 2033. Technological disruptions, including the widespread adoption of multi-factor authentication (MFA) and the emergence of passwordless solutions like biometrics and hardware tokens, are fundamentally altering the authentication paradigm. Consumer preferences are increasingly leaning towards convenience and security, with users actively seeking alternatives to traditional password-based systems that are prone to breaches and complexity. The competitive dynamics are intensifying, with established technology giants and innovative startups vying for market share. Companies such as Microsoft Corporation, Google, and Okta are heavily investing in research and development to offer comprehensive passwordless solutions. Emerging players are focusing on niche solutions and specialized applications, creating a vibrant and competitive ecosystem. The report further explores the impact of cloud migration on the adoption of passwordless authentication, as organizations move their applications and data to cloud environments, necessitating more agile and secure access controls. We also examine the growing adoption of mobile-first authentication strategies, capitalizing on the ubiquity of smartphones and their advanced biometric capabilities. The integration of passwordless solutions within broader identity and access management (IAM) platforms is a key trend, enabling a unified approach to user authentication and authorization across diverse applications and services. The evolving threat landscape, characterized by increasingly sophisticated phishing attacks and credential stuffing, further underscores the imperative for robust passwordless authentication methods. This section provides actionable insights for stakeholders seeking to navigate and capitalize on these evolving trends.

Dominant Markets & Segments in Passwordless Authentication

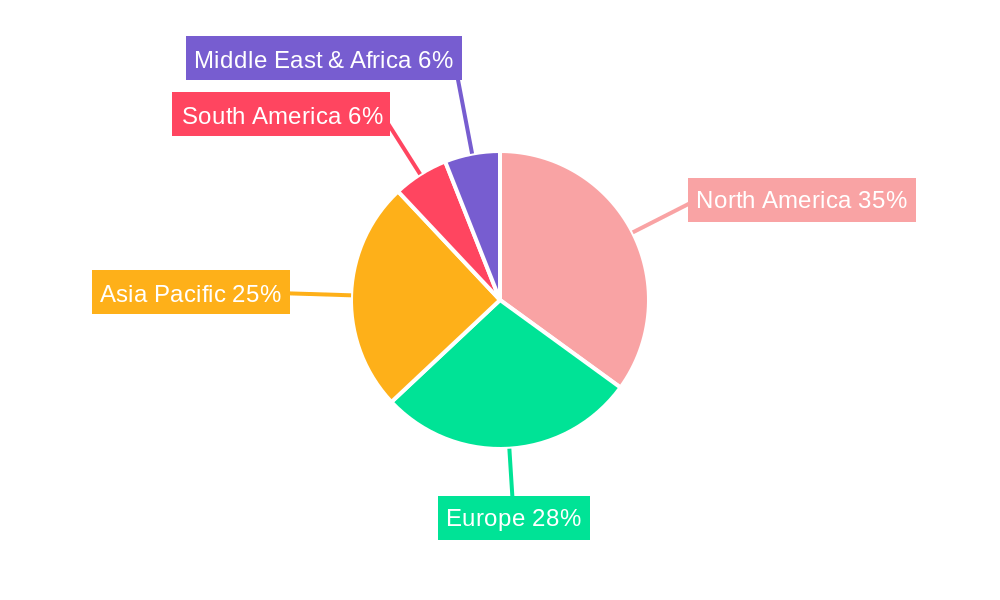

The passwordless authentication market exhibits varied dominance across different geographical regions and industry segments. The BFSI (Banking, Financial Services, and Insurance) sector is emerging as a dominant segment, driven by stringent regulatory compliance requirements and the critical need for highly secure transaction environments. Estimated market penetration in BFSI is projected to reach 45% by 2033. Economic policies encouraging digital transformation and robust cybersecurity infrastructure in regions like North America and Europe further contribute to their leading positions.

Key Drivers of Dominance in BFSI:

- Regulatory Compliance: Strict mandates from bodies like PCI DSS and GDPR necessitate advanced security measures, making passwordless authentication a crucial component.

- Fraud Prevention: The high value of financial transactions makes BFSI a prime target for cybercriminals, pushing for more secure authentication methods.

- Customer Trust: Enhancing customer experience through seamless yet secure login processes is vital for customer retention and trust.

The On-Cloud deployment model is projected to hold the largest market share, estimated at 70% of the total market by 2033. This is largely due to the scalability, flexibility, and cost-effectiveness offered by cloud-based solutions, aligning with the digital transformation initiatives of businesses across all sectors. Cloud providers and Software-as-a-Service (SaaS) vendors are increasingly integrating passwordless authentication capabilities into their offerings, further accelerating adoption.

Key Drivers of On-Cloud Dominance:

- Scalability and Flexibility: Cloud solutions can easily scale to meet fluctuating user demands, a critical factor for growing organizations.

- Reduced IT Overhead: Businesses can offload infrastructure management and maintenance to cloud providers, reducing operational costs.

- Faster Deployment: Cloud-based passwordless solutions can be implemented more rapidly compared to on-premise deployments.

In terms of geographical regions, North America is expected to maintain its leadership position, accounting for an estimated 35% of the global market share by 2033. This dominance is attributed to early adoption of advanced technologies, a strong presence of key market players, and a proactive approach to cybersecurity.

Key Drivers of North American Dominance:

- Technological Innovation Hub: Presence of leading technology companies and research institutions fostering innovation.

- High Cybersecurity Awareness: Strong emphasis on cybersecurity by both businesses and consumers.

- Government Initiatives: Supportive policies and funding for cybersecurity research and adoption.

The Telecommunication sector also demonstrates significant adoption due to the need for secure access to customer accounts and sensitive network infrastructure.

Passwordless Authentication Product Developments

The passwordless authentication market is witnessing a surge in innovative product developments focused on enhancing security, user experience, and integration capabilities. Companies are prioritizing biometric authentication, including fingerprint scanning, facial recognition, and voice biometrics, offering intuitive and secure access. FIDO2 compliance and passkeys are gaining traction, providing a standardized and phishing-resistant approach to passwordless logins. Advancements in hardware security keys and adaptive authentication, which dynamically adjusts security based on context, are further strengthening the market. The competitive advantage lies in seamless integration with existing IT infrastructures and a broad range of applications, ensuring broad adoption and user acceptance.

Report Scope & Segmentation Analysis

This report segments the passwordless authentication market comprehensively, covering key Application areas: Healthcare, Telecommunication, BFSI, Media & Entertainment, and Travel & Hospitality. Each segment is analyzed for its unique adoption drivers, challenges, and growth projections. The Type segmentation includes On-Cloud and On-Premise deployment models, with detailed insights into their respective market sizes and competitive dynamics.

Healthcare: Projected to grow at a CAGR of 19.2%, driven by the need for secure patient data access and compliance with HIPAA. Market size estimated at USD 80 million by 2033. Telecommunication: Expected to reach USD 95 million by 2033, with a CAGR of 18.8%, due to the increasing demand for secure customer account management. BFSI: The largest segment, projected to reach USD 150 million by 2033, with a CAGR of 18.5%, driven by stringent regulatory demands and fraud prevention needs. Media & Entertainment: Estimated at USD 60 million by 2033, with a CAGR of 17.9%, as platforms focus on secure content access and user authentication. Travel & Hospitality: Projected to reach USD 70 million by 2033, with a CAGR of 18.1%, driven by the need for seamless guest experiences and secure booking systems. On-Cloud: Dominant segment, expected to reach USD 525 million by 2033, with a CAGR of 19.0%. On-Premise: Projected to reach USD 225 million by 2033, with a CAGR of 17.5%.

Key Drivers of Passwordless Authentication Growth

The growth of the passwordless authentication market is propelled by several critical factors. Firstly, the escalating sophistication and frequency of cyberattacks, including phishing and ransomware, necessitate stronger security measures beyond traditional passwords. Secondly, the increasing demand for enhanced user experience and convenience, as consumers and employees alike seek faster and simpler authentication processes. Thirdly, regulatory mandates and industry best practices, such as those driven by GDPR and CCPA, are pushing organizations to adopt more secure identity management solutions. The widespread adoption of mobile devices and the advancement of biometric technologies like fingerprint and facial recognition further contribute to this growth by providing readily available and secure authentication methods. Furthermore, the ongoing digital transformation across industries, leading to a proliferation of cloud-based applications and services, creates a fertile ground for passwordless authentication.

Challenges in the Passwordless Authentication Sector

Despite its significant growth potential, the passwordless authentication sector faces several challenges. A primary restraint is the complexity of integration with legacy systems, which can hinder widespread adoption by organizations with older IT infrastructures. The cost of implementation for certain advanced passwordless solutions can also be a barrier, especially for small and medium-sized enterprises. User adoption and education remain crucial; ensuring that all users, including those less tech-savvy, are comfortable and understand how to use new passwordless methods is vital. Furthermore, interoperability issues between different vendors and standards can create fragmentation in the market, making it difficult for organizations to choose a unified solution. Regulatory fragmentation across different regions can also pose challenges for global enterprises.

Emerging Opportunities in Passwordless Authentication

The passwordless authentication market is ripe with emerging opportunities. The increasing adoption of the Internet of Things (IoT) presents a significant avenue for passwordless solutions, securing access to a vast array of connected devices. The ongoing growth of remote work and the hybrid work model further amplifies the need for secure and seamless access to corporate resources, making passwordless authentication a key enabler. Advancements in behavioral biometrics, which analyze user patterns to verify identity, offer a highly sophisticated and less intrusive authentication method. The development of decentralized identity solutions and blockchain-based authentication could revolutionize secure identity management. Furthermore, the expansion of passwordless solutions into emerging markets with a growing digital footprint offers substantial untapped potential.

Leading Players in the Passwordless Authentication Market

- Microsoft Corporation

- Dell EMC

- Intel Corporation

- Oracle Corporation

- Sailpoint Technologies Inc

- Ping Identity Corporation

- Centrify Corporation

- NetIQ Corporation

- Amazon

- Okta

- Onelogin Inc

- Alibaba

- Hitachi ID Systems

- IDMWORKS

- Thales Group

- Broadcom

- IBM Corporation

Key Developments in Passwordless Authentication Industry

- 2023 July: Microsoft Corporation announces enhanced FIDO2 support for Windows 11, further solidifying passwordless login capabilities for enterprise users.

- 2023 September: Okta acquires Auth0, expanding its identity platform and strengthening its position in the developer-focused identity market.

- 2024 February: Google rolls out Passkeys support across its Android ecosystem, making passwordless login more accessible to a wider user base.

- 2024 April: Intel Corporation announces advancements in its hardware-based security solutions to support emerging passwordless authentication standards.

- 2024 June: Ping Identity Corporation releases new features for its platform, emphasizing adaptive authentication for passwordless scenarios.

- 2025 January: Thales Group acquires a leading biometric authentication startup, bolstering its portfolio of passwordless solutions.

- 2025 March: Sailpoint Technologies Inc integrates advanced AI for behavioral biometrics in its identity governance solutions.

- 2025 May: Amazon Web Services (AWS) announces native support for FIDO2 compliant authenticators for its identity services.

Strategic Outlook for Passwordless Authentication Market

The strategic outlook for the passwordless authentication market is exceptionally positive, driven by an undeniable industry imperative to enhance security and user experience. Future growth will be fueled by continued innovation in biometric technologies, the standardization and widespread adoption of passkeys, and the integration of passwordless solutions into a broader spectrum of digital interactions, from IoT devices to virtual environments. Strategic partnerships and mergers between cybersecurity firms and technology providers will continue to consolidate the market and offer more comprehensive solutions. The increasing emphasis on zero-trust architectures further positions passwordless authentication as a foundational element for secure access in a perimeter-less world, promising sustained expansion and market evolution.

Passwordless Authentication Segmentation

-

1. Application

- 1.1. Healthcare

- 1.2. Telecommunication

- 1.3. BFSI

- 1.4. Media & Entertainment

- 1.5. Travel & Hospitality

-

2. Types

- 2.1. On-Cloud

- 2.2. On-Premise

Passwordless Authentication Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Passwordless Authentication REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Passwordless Authentication Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Healthcare

- 5.1.2. Telecommunication

- 5.1.3. BFSI

- 5.1.4. Media & Entertainment

- 5.1.5. Travel & Hospitality

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. On-Cloud

- 5.2.2. On-Premise

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Passwordless Authentication Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Healthcare

- 6.1.2. Telecommunication

- 6.1.3. BFSI

- 6.1.4. Media & Entertainment

- 6.1.5. Travel & Hospitality

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. On-Cloud

- 6.2.2. On-Premise

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Passwordless Authentication Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Healthcare

- 7.1.2. Telecommunication

- 7.1.3. BFSI

- 7.1.4. Media & Entertainment

- 7.1.5. Travel & Hospitality

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. On-Cloud

- 7.2.2. On-Premise

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Passwordless Authentication Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Healthcare

- 8.1.2. Telecommunication

- 8.1.3. BFSI

- 8.1.4. Media & Entertainment

- 8.1.5. Travel & Hospitality

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. On-Cloud

- 8.2.2. On-Premise

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Passwordless Authentication Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Healthcare

- 9.1.2. Telecommunication

- 9.1.3. BFSI

- 9.1.4. Media & Entertainment

- 9.1.5. Travel & Hospitality

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. On-Cloud

- 9.2.2. On-Premise

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Passwordless Authentication Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Healthcare

- 10.1.2. Telecommunication

- 10.1.3. BFSI

- 10.1.4. Media & Entertainment

- 10.1.5. Travel & Hospitality

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. On-Cloud

- 10.2.2. On-Premise

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Microsoft Corporation

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Dell EMC

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Intel Corporation

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Oracle Corporation

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Sailpoint Technologies Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Google

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Ping Identity Corporation

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Centrify Corporation

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 NetIQ Corporation

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Amazon

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Okta

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Onelogin Inc

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Alibaba

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Hitachi ID Systems

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 IDMWORKS

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Thales Group

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Broadcom

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 IBM Corporation

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.1 Microsoft Corporation

List of Figures

- Figure 1: Global Passwordless Authentication Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Passwordless Authentication Revenue (million), by Application 2024 & 2032

- Figure 3: North America Passwordless Authentication Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Passwordless Authentication Revenue (million), by Types 2024 & 2032

- Figure 5: North America Passwordless Authentication Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Passwordless Authentication Revenue (million), by Country 2024 & 2032

- Figure 7: North America Passwordless Authentication Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Passwordless Authentication Revenue (million), by Application 2024 & 2032

- Figure 9: South America Passwordless Authentication Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Passwordless Authentication Revenue (million), by Types 2024 & 2032

- Figure 11: South America Passwordless Authentication Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Passwordless Authentication Revenue (million), by Country 2024 & 2032

- Figure 13: South America Passwordless Authentication Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Passwordless Authentication Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Passwordless Authentication Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Passwordless Authentication Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Passwordless Authentication Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Passwordless Authentication Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Passwordless Authentication Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Passwordless Authentication Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Passwordless Authentication Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Passwordless Authentication Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Passwordless Authentication Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Passwordless Authentication Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Passwordless Authentication Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Passwordless Authentication Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Passwordless Authentication Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Passwordless Authentication Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Passwordless Authentication Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Passwordless Authentication Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Passwordless Authentication Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Passwordless Authentication Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Passwordless Authentication Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Passwordless Authentication Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Passwordless Authentication Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Passwordless Authentication Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Passwordless Authentication Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Passwordless Authentication Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Passwordless Authentication Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Passwordless Authentication Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Passwordless Authentication Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Passwordless Authentication Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Passwordless Authentication Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Passwordless Authentication Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Passwordless Authentication Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Passwordless Authentication Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Passwordless Authentication Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Passwordless Authentication Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Passwordless Authentication Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Passwordless Authentication Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Passwordless Authentication Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Passwordless Authentication Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Passwordless Authentication Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Passwordless Authentication Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Passwordless Authentication Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Passwordless Authentication Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Passwordless Authentication Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Passwordless Authentication Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Passwordless Authentication Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Passwordless Authentication Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Passwordless Authentication Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Passwordless Authentication Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Passwordless Authentication Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Passwordless Authentication Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Passwordless Authentication Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Passwordless Authentication Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Passwordless Authentication Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Passwordless Authentication Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Passwordless Authentication Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Passwordless Authentication Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Passwordless Authentication Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Passwordless Authentication Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Passwordless Authentication Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Passwordless Authentication Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Passwordless Authentication Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Passwordless Authentication Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Passwordless Authentication Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Passwordless Authentication Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Passwordless Authentication?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Passwordless Authentication?

Key companies in the market include Microsoft Corporation, Dell EMC, Intel Corporation, Oracle Corporation, Sailpoint Technologies Inc, Google, Ping Identity Corporation, Centrify Corporation, NetIQ Corporation, Amazon, Okta, Onelogin Inc, Alibaba, Hitachi ID Systems, IDMWORKS, Thales Group, Broadcom, IBM Corporation.

3. What are the main segments of the Passwordless Authentication?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Passwordless Authentication," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Passwordless Authentication report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Passwordless Authentication?

To stay informed about further developments, trends, and reports in the Passwordless Authentication, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence