Key Insights

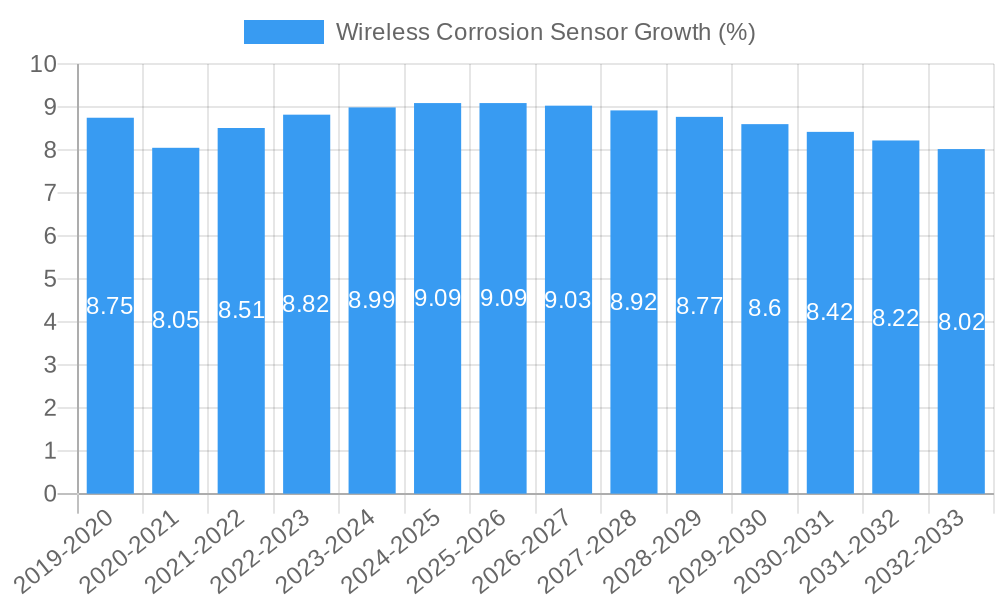

The global Wireless Corrosion Sensor market is experiencing robust expansion, projected to reach an estimated USD 850 million by 2025, with a significant Compound Annual Growth Rate (CAGR) of 14.5% over the forecast period of 2025-2033. This growth is primarily fueled by the escalating need for enhanced asset integrity management and proactive maintenance strategies across various industries, particularly in the oil and gas sector. The increasing complexity of industrial infrastructure, coupled with stringent safety regulations and the economic imperative to minimize operational downtime and repair costs, are driving the adoption of advanced wireless corrosion monitoring solutions. Key applications such as oil-fields operations and general O&G infrastructure are at the forefront of this demand, necessitating reliable and real-time data to prevent catastrophic failures and ensure operational efficiency.

The market's trajectory is further bolstered by ongoing technological advancements in sensor technology, including the development of more sophisticated Sulfate Reducing Bacteria (SRB) sensors, biocide sensors, and residual corrosion sensors. These innovations enable more precise and comprehensive corrosion detection, allowing for targeted interventions and optimized treatment programs. While the market exhibits strong growth drivers, certain restraints, such as the initial investment cost of sophisticated systems and the need for skilled personnel to interpret data, may pose challenges. However, the long-term benefits of reduced maintenance expenditures, extended asset lifespan, and improved safety compliance are expected to outweigh these initial hurdles, ensuring continued market penetration and expansion, especially in regions with substantial industrial investments like North America and Asia Pacific.

Wireless Corrosion Sensor Market Concentration & Innovation

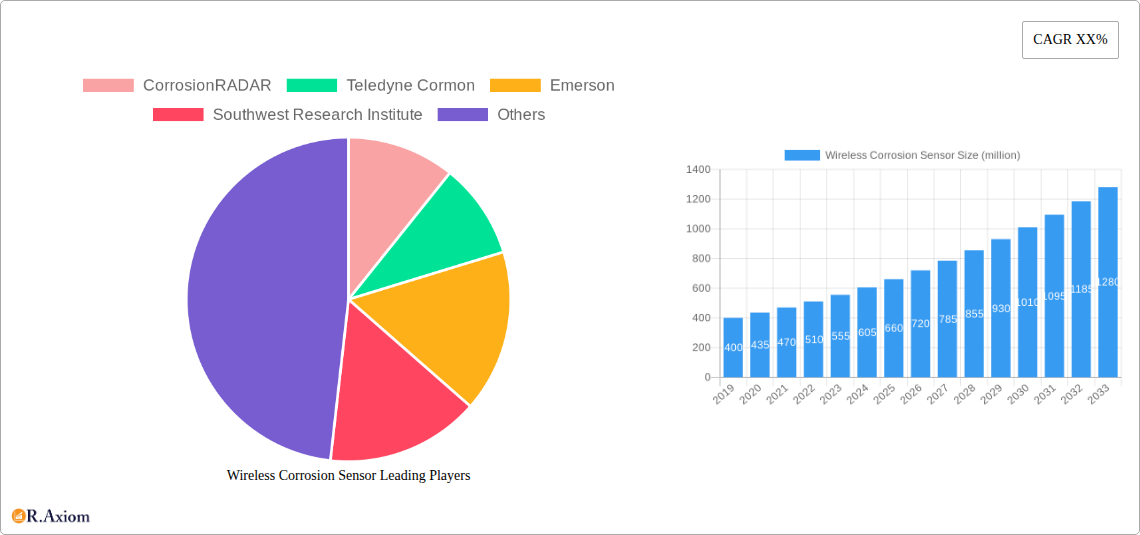

The global wireless corrosion sensor market is characterized by a moderate level of concentration, with several key players vying for dominance. Leading companies such as Emerson, Teledyne Cormon, and CorrosionRADAR are actively investing in research and development to introduce advanced sensing technologies. Innovation drivers include the increasing demand for real-time monitoring of critical infrastructure, stringent safety regulations across various industries, and the drive for operational efficiency and cost reduction. The adoption of IoT and AI technologies is further accelerating product innovation, enabling more predictive and prescriptive maintenance solutions. Regulatory frameworks, particularly in the oil and gas, and energy sectors, are pushing for enhanced safety and environmental compliance, indirectly boosting the demand for sophisticated corrosion monitoring systems. While direct product substitutes are limited, the increasing availability of advanced wired sensor solutions and manual inspection methods presents indirect competitive pressure. End-user trends are shifting towards a preference for wireless, non-intrusive, and data-driven monitoring solutions that offer comprehensive insights into asset integrity. Mergers and acquisitions (M&A) activities are observed as companies seek to expand their product portfolios, geographical reach, and technological capabilities. For instance, M&A deals in the broader industrial IoT and sensor market have reached several million dollars, indicating a consolidation trend and strategic investments in companies with promising wireless sensing technologies. The market share of top players is estimated to be in the range of 15-25% each, with the top five companies collectively holding approximately 60-70% of the market.

Wireless Corrosion Sensor Industry Trends & Insights

The wireless corrosion sensor industry is poised for substantial growth, driven by a confluence of technological advancements, evolving industry needs, and increasing regulatory mandates. The projected Compound Annual Growth Rate (CAGR) for the forecast period 2025–2033 is estimated at a robust xx%, reflecting the accelerating adoption of these critical monitoring systems. This growth is fueled by the escalating need for proactive asset management and the prevention of costly corrosion-related failures across diverse industrial sectors. The energy sector, particularly oil and gas operations, remains a primary beneficiary, as the industry grapples with aging infrastructure and the imperative to enhance safety and environmental protection. The penetration of wireless corrosion sensors in these high-risk environments is expected to increase significantly, moving from xx% in 2024 to an estimated xx% by 2033. Technological disruptions are a key theme, with the integration of advanced materials, miniaturized electronics, and sophisticated data analytics platforms enhancing the capabilities and applicability of wireless corrosion sensors. This includes the development of sensors capable of detecting specific corrosion mechanisms, such as those induced by sulfate-reducing bacteria (SRB) or measuring residual biocide levels, providing granular insights for targeted mitigation strategies. Consumer preferences are aligning with the industry's trajectory, with a growing demand for intelligent, connected, and easy-to-deploy sensing solutions that offer real-time data access and remote monitoring capabilities. The competitive dynamics are characterized by intense innovation, with companies striving to differentiate themselves through enhanced accuracy, extended battery life, robust connectivity, and specialized sensing functionalities. The market penetration of wireless corrosion sensors is expected to surpass xx million units globally by 2033, with a market value in the hundreds of millions of dollars. The shift from reactive maintenance to predictive and prescriptive approaches is a significant trend, further solidifying the importance of wireless corrosion sensors in industrial operations.

Dominant Markets & Segments in Wireless Corrosion Sensor

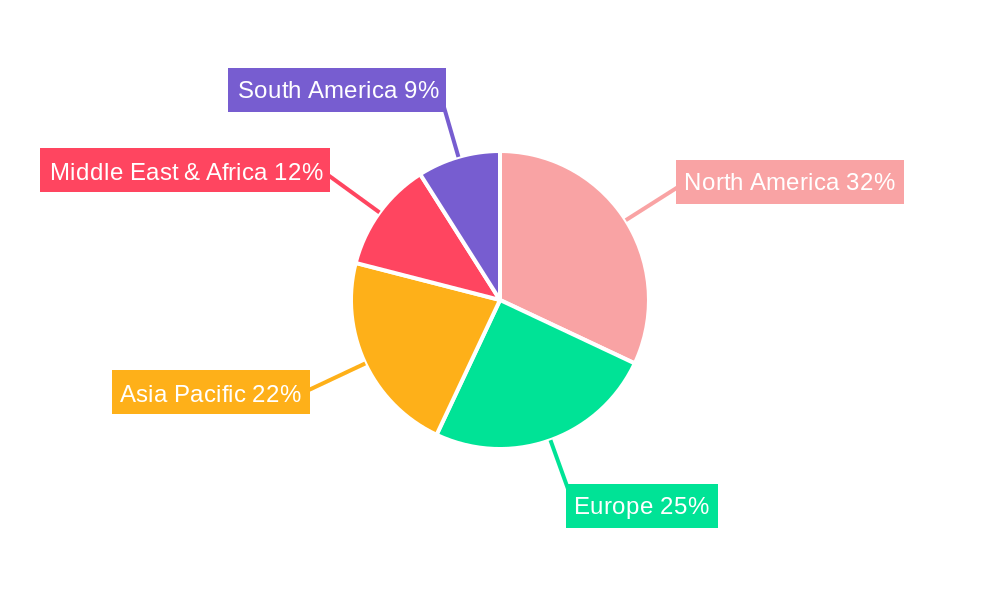

The global wireless corrosion sensor market exhibits distinct regional and segmental dominance, driven by specific industrial needs, economic policies, and infrastructure development.

Regional Dominance:

North America is anticipated to be a leading region, driven by its vast oil and gas infrastructure, stringent environmental regulations, and high adoption rate of advanced technologies. The extensive exploration and production activities, coupled with significant investments in maintaining aging pipelines and offshore platforms, create a substantial demand for reliable corrosion monitoring solutions. Government initiatives promoting industrial safety and sustainability further bolster market growth.

- Key Drivers:

- Presence of mature oil and gas fields requiring continuous integrity management.

- Strict adherence to safety and environmental regulations (e.g., EPA mandates).

- High technological adoption rate and investment in R&D.

- Significant presence of key end-users like major oil and gas companies and energy providers.

- Key Drivers:

The Middle East is another crucial market, owing to its substantial oil and gas reserves and ongoing expansion of exploration and production facilities. The critical need to protect critical infrastructure from harsh environmental conditions, including high salinity and temperature, drives the adoption of advanced corrosion monitoring technologies. Government support for infrastructure development and a focus on maximizing resource extraction efficiency contribute to market expansion.

- Key Drivers:

- Massive oil and gas reserves and production capacity.

- Harsh operating environments demanding robust asset protection.

- Government focus on energy security and infrastructure modernization.

- Increasing investments in offshore and onshore exploration.

- Key Drivers:

Segmental Dominance:

Application: Oil-Fields Operations emerges as the dominant application segment. The inherent risks of corrosion in upstream, midstream, and downstream oil and gas operations, including pipelines, storage tanks, and processing facilities, necessitate constant monitoring. The potential for catastrophic failures, environmental spills, and significant financial losses makes corrosion management a top priority.

- Key Drivers:

- High-risk operating environments and potential for environmental damage.

- Aging infrastructure requiring diligent integrity management.

- Economic imperative to prevent production downtime and asset loss.

- Regulatory compliance and safety standards in the O&G sector.

- Key Drivers:

Application: O&G as a broader segment, encompassing all facets of the oil and gas industry, naturally dominates due to the extensive application of corrosion sensors in exploration, extraction, transportation, and refining processes.

- Key Drivers:

- Ubiquitous nature of corrosion challenges across the entire O&G value chain.

- Demand for real-time monitoring to ensure operational continuity and safety.

- Significant capital expenditure on infrastructure asset protection.

- Key Drivers:

Type: Sulfate Reducing Bacteria (SRB) Sensor is a particularly critical sub-segment within the wireless corrosion sensor market. SRBs are a major contributor to microbiologically influenced corrosion (MIC), posing a significant threat to metallic structures, especially in oil and gas pipelines and storage tanks. The ability to detect and monitor SRB activity in real-time allows for targeted biocide application and preventative measures, averting severe damage. The market for SRB sensors is projected to see substantial growth, with an estimated market size of several million dollars annually.

- Key Drivers:

- Prevalence of SRB in various industrial environments, particularly in O&G.

- High damage potential and difficulty in traditional detection of SRB.

- Demand for proactive and targeted MIC mitigation strategies.

- Advancements in biosensing technologies enabling accurate SRB detection.

- Key Drivers:

Type: Residual Corrosion Sensor also holds significant importance. These sensors provide continuous data on the rate of corrosion, allowing operators to assess the effectiveness of corrosion inhibitors and understand the overall corrosivity of the environment. This enables optimized chemical treatment programs and helps in predicting the remaining service life of assets. The market for residual corrosion sensors is valued in the tens of millions of dollars, with steady growth anticipated.

- Key Drivers:

- Need for continuous monitoring of corrosion rates and inhibitor efficacy.

- Optimization of chemical treatment programs to reduce costs.

- Predictive maintenance capabilities based on real-time corrosion data.

- Ensuring the long-term integrity of critical infrastructure.

- Key Drivers:

Wireless Corrosion Sensor Product Developments

The wireless corrosion sensor market is experiencing rapid innovation, with companies like CorrosionRADAR, Giatec Scientific Inc., and InfraSensing leading the charge. Recent product developments focus on enhancing sensor accuracy, extending battery life for remote deployments, and improving data transmission capabilities through advanced wireless protocols like LoRaWAN and NB-IoT. The integration of AI and machine learning algorithms is enabling predictive analytics, allowing for early detection of potential corrosion issues before they become critical. Application-specific sensors, such as those for detecting Sulfate Reducing Bacteria (SRB) and monitoring residual biocide levels, are gaining traction, offering targeted solutions for niche challenges. Competitive advantages are being built around non-intrusive designs, ease of installation, robust environmental resilience, and comprehensive cloud-based data management platforms. The market is witnessing a trend towards miniaturized, low-power sensors that can be deployed in large numbers across extensive infrastructure, providing an unprecedented level of monitoring. The estimated market value for advanced wireless corrosion sensor solutions is in the hundreds of millions of dollars.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the global wireless corrosion sensor market, segmented across key applications and sensor types to offer granular insights into market dynamics and growth opportunities.

- Application: Oil-Fields Operations: This segment focuses on the deployment of wireless corrosion sensors in upstream, midstream, and downstream oil and gas operations, including exploration, production, transportation, and refining. The market for this application is projected to reach several hundred million dollars by 2033, driven by the critical need for asset integrity management in this high-risk industry. Competitive dynamics are shaped by specialized solutions for harsh environments and remote monitoring.

- Application: O&G: This broader segment encompasses the entire oil and gas industry value chain. It represents a significant portion of the market, with continued demand driven by the ongoing need to maintain and protect aging infrastructure. Growth projections for this segment are robust, estimated in the hundreds of millions of dollars.

- Application: Energy: This segment includes applications beyond oil and gas, such as power generation (including renewable energy infrastructure), and other energy-related facilities where corrosion poses a threat to operational reliability and safety. While currently smaller than the O&G segment, it presents significant growth potential, with projected market sizes in the tens of millions of dollars.

- Type: Sulfate Reducing Bacteria (SRB) Sensor: This specialized segment addresses the growing concern of microbiologically influenced corrosion (MIC) caused by SRBs. The market is driven by the need for early detection and targeted mitigation strategies. Growth is projected to be strong, with a market value in the tens of millions of dollars, fueled by technological advancements in biosensing.

- Type: Biocide Sensor: This segment focuses on sensors that monitor the concentration and efficacy of biocides used to control microbial growth and prevent corrosion. The market is driven by the optimization of chemical treatment programs and the need to ensure effective corrosion inhibition. Projected market growth is steady, with a market size in the tens of millions of dollars.

- Type: Residual Corrosion Sensor: This segment encompasses sensors that continuously measure the rate of corrosion, providing real-time data on asset degradation. These sensors are crucial for predictive maintenance and optimizing corrosion management strategies. The market is expected to see consistent growth, with a market size in the tens of millions of dollars.

Key Drivers of Wireless Corrosion Sensor Growth

The wireless corrosion sensor market is experiencing robust growth driven by several key factors. Firstly, the increasing demand for real-time, continuous monitoring of critical infrastructure, particularly in the oil and gas and energy sectors, is paramount. This is to prevent costly failures, environmental disasters, and ensure operational safety. Secondly, stringent regulatory frameworks worldwide are compelling industries to adopt advanced asset integrity management solutions, thereby driving the adoption of wireless corrosion sensors. Technological advancements, such as the Internet of Things (IoT), artificial intelligence (AI), and improved wireless communication technologies, are making these sensors more accurate, cost-effective, and easier to deploy. The drive for operational efficiency and reduced maintenance costs also plays a significant role, as predictive maintenance enabled by these sensors helps avoid unplanned downtime and expensive repairs. Finally, the growing awareness of the detrimental impact of corrosion on infrastructure lifespan and economic productivity is pushing industries to invest in proactive corrosion prevention strategies.

Challenges in the Wireless Corrosion Sensor Sector

Despite its promising growth, the wireless corrosion sensor sector faces several challenges. One significant barrier is the initial cost of deployment, which can be substantial for large-scale installations across extensive infrastructure, particularly for companies with limited capital expenditure budgets. Regulatory hurdles, while often drivers of adoption, can also be complex and time-consuming to navigate, requiring adherence to various standards and certifications across different regions. Supply chain issues, including the availability of specialized components and raw materials, can lead to production delays and increased costs. Competitive pressures from established wired sensor solutions and traditional inspection methods, though becoming less prevalent, still exist. Furthermore, ensuring the long-term reliability and accuracy of wireless sensors in harsh industrial environments, subject to extreme temperatures, humidity, and electromagnetic interference, remains a technical challenge that requires continuous innovation. The need for robust data security and privacy protocols for the vast amounts of data generated by these sensors is also a growing concern.

Emerging Opportunities in Wireless Corrosion Sensor

The wireless corrosion sensor market is ripe with emerging opportunities. The expansion of the renewable energy sector, including wind turbines and solar farms, presents a new frontier for corrosion monitoring, as these assets are often exposed to harsh environmental conditions. The growing adoption of smart city initiatives and the need to monitor the integrity of urban infrastructure, such as bridges, pipelines, and water systems, will create significant demand. Advancements in battery technology and energy harvesting are enabling the development of self-powered wireless sensors, further reducing maintenance costs and increasing deployment feasibility. The integration of sensors with digital twins and advanced simulation platforms offers opportunities for more sophisticated predictive modeling and risk assessment. Furthermore, the increasing focus on sustainability and environmental protection is driving demand for sensors that can monitor and mitigate corrosion-induced leaks and emissions. The development of novel sensing materials and techniques that can detect a wider range of corrosion mechanisms and contaminants will also unlock new market segments.

Leading Players in the Wireless Corrosion Sensor Market

- CorrosionRADAR

- Teledyne Cormon

- Emerson

- Southwest Research Institute

- Corr Instruments, LLC

- InfraSensing

- Giatec Scientific Inc.

- Pepperl+Fuchs

- Franklin Fueling Systems

- Walchem

- Hitachi

- JFE Techno-Research

- Cosasco

- Pyxis Lab

Key Developments in Wireless Corrosion Sensor Industry

- 2023 October: CorrosionRADAR launched its next-generation wireless corrosion monitoring system with enhanced AI capabilities for predictive maintenance in the oil and gas sector.

- 2023 July: Giatec Scientific Inc. announced the integration of its wireless concrete sensors with a leading asset management platform, expanding its reach into infrastructure monitoring.

- 2023 March: Emerson introduced new wireless corrosion sensors designed for extreme environments, offering greater durability and accuracy in offshore applications.

- 2022 December: Teledyne Cormon expanded its portfolio with the acquisition of a specialized manufacturer of subsea corrosion monitoring solutions, strengthening its presence in offshore energy.

- 2022 September: Southwest Research Institute showcased advancements in non-intrusive sensing technologies for pipeline integrity, including novel wireless corrosion detection methods.

- 2022 May: InfraSensing developed advanced wireless sensors for monitoring corrosion in wind turbine towers, addressing a critical need in the renewable energy sector.

- 2022 January: Corr Instruments, LLC introduced a new line of wireless sensors for monitoring corrosion in water treatment facilities, highlighting its expansion beyond the O&G sector.

- 2021 November: Pepperl+Fuchs unveiled an enhanced industrial IoT platform that integrates seamlessly with their range of wireless sensors, including corrosion monitoring solutions.

- 2021 August: Franklin Fueling Systems announced the integration of wireless corrosion monitoring capabilities into its underground storage tank systems, enhancing leak detection and prevention.

- 2021 April: Walchem, a division of Iwaki America, expanded its offering of wireless controllers with integrated corrosion monitoring functions for industrial water treatment.

Strategic Outlook for Wireless Corrosion Sensor Market

The strategic outlook for the wireless corrosion sensor market remains highly positive, driven by the persistent need for robust asset integrity management across critical industries. Future growth will be significantly influenced by the continued integration of advanced technologies like AI, machine learning, and 5G connectivity, which will enable more sophisticated predictive analytics and real-time decision-making. The expansion into new market segments, such as renewable energy infrastructure and smart city applications, presents substantial untapped potential. Companies that focus on developing user-friendly, scalable, and cost-effective solutions, coupled with strong data security and analytics capabilities, will be well-positioned for success. Strategic collaborations, partnerships, and potential M&A activities will likely continue to shape the market landscape, fostering innovation and market consolidation. The ongoing global emphasis on safety, environmental protection, and operational efficiency will ensure sustained demand for wireless corrosion sensor technology for years to come.

Wireless Corrosion Sensor Segmentation

-

1. Application

- 1.1. Oil-Fields Operations

- 1.2. O&G

- 1.3. Energy

-

2. Types

- 2.1. Sulfate Reducing Bacteria Sensor

- 2.2. Biocide Sensor

- 2.3. Residual Corrosion Sensor

Wireless Corrosion Sensor Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Wireless Corrosion Sensor REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Wireless Corrosion Sensor Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Oil-Fields Operations

- 5.1.2. O&G

- 5.1.3. Energy

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Sulfate Reducing Bacteria Sensor

- 5.2.2. Biocide Sensor

- 5.2.3. Residual Corrosion Sensor

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Wireless Corrosion Sensor Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Oil-Fields Operations

- 6.1.2. O&G

- 6.1.3. Energy

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Sulfate Reducing Bacteria Sensor

- 6.2.2. Biocide Sensor

- 6.2.3. Residual Corrosion Sensor

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Wireless Corrosion Sensor Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Oil-Fields Operations

- 7.1.2. O&G

- 7.1.3. Energy

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Sulfate Reducing Bacteria Sensor

- 7.2.2. Biocide Sensor

- 7.2.3. Residual Corrosion Sensor

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Wireless Corrosion Sensor Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Oil-Fields Operations

- 8.1.2. O&G

- 8.1.3. Energy

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Sulfate Reducing Bacteria Sensor

- 8.2.2. Biocide Sensor

- 8.2.3. Residual Corrosion Sensor

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Wireless Corrosion Sensor Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Oil-Fields Operations

- 9.1.2. O&G

- 9.1.3. Energy

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Sulfate Reducing Bacteria Sensor

- 9.2.2. Biocide Sensor

- 9.2.3. Residual Corrosion Sensor

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Wireless Corrosion Sensor Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Oil-Fields Operations

- 10.1.2. O&G

- 10.1.3. Energy

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Sulfate Reducing Bacteria Sensor

- 10.2.2. Biocide Sensor

- 10.2.3. Residual Corrosion Sensor

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 CorrosionRADAR

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Teledyne Cormon

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Emerson

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Southwest Research Institute

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Southwest Research Institute

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Corr Instruments

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 LLC

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 InfraSensing

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Giatec Scientific Inc.

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Pepperl+Fuchs

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Franklin Fueling Systems

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Walchem

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Hitachi

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 JFE Techno-Research

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Cosasco

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Pyxis Lab

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.1 CorrosionRADAR

List of Figures

- Figure 1: Global Wireless Corrosion Sensor Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Wireless Corrosion Sensor Revenue (million), by Application 2024 & 2032

- Figure 3: North America Wireless Corrosion Sensor Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Wireless Corrosion Sensor Revenue (million), by Types 2024 & 2032

- Figure 5: North America Wireless Corrosion Sensor Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Wireless Corrosion Sensor Revenue (million), by Country 2024 & 2032

- Figure 7: North America Wireless Corrosion Sensor Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Wireless Corrosion Sensor Revenue (million), by Application 2024 & 2032

- Figure 9: South America Wireless Corrosion Sensor Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Wireless Corrosion Sensor Revenue (million), by Types 2024 & 2032

- Figure 11: South America Wireless Corrosion Sensor Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Wireless Corrosion Sensor Revenue (million), by Country 2024 & 2032

- Figure 13: South America Wireless Corrosion Sensor Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Wireless Corrosion Sensor Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Wireless Corrosion Sensor Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Wireless Corrosion Sensor Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Wireless Corrosion Sensor Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Wireless Corrosion Sensor Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Wireless Corrosion Sensor Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Wireless Corrosion Sensor Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Wireless Corrosion Sensor Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Wireless Corrosion Sensor Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Wireless Corrosion Sensor Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Wireless Corrosion Sensor Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Wireless Corrosion Sensor Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Wireless Corrosion Sensor Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Wireless Corrosion Sensor Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Wireless Corrosion Sensor Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Wireless Corrosion Sensor Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Wireless Corrosion Sensor Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Wireless Corrosion Sensor Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Wireless Corrosion Sensor Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Wireless Corrosion Sensor Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Wireless Corrosion Sensor Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Wireless Corrosion Sensor Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Wireless Corrosion Sensor Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Wireless Corrosion Sensor Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Wireless Corrosion Sensor Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Wireless Corrosion Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Wireless Corrosion Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Wireless Corrosion Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Wireless Corrosion Sensor Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Wireless Corrosion Sensor Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Wireless Corrosion Sensor Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Wireless Corrosion Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Wireless Corrosion Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Wireless Corrosion Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Wireless Corrosion Sensor Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Wireless Corrosion Sensor Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Wireless Corrosion Sensor Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Wireless Corrosion Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Wireless Corrosion Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Wireless Corrosion Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Wireless Corrosion Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Wireless Corrosion Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Wireless Corrosion Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Wireless Corrosion Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Wireless Corrosion Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Wireless Corrosion Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Wireless Corrosion Sensor Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Wireless Corrosion Sensor Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Wireless Corrosion Sensor Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Wireless Corrosion Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Wireless Corrosion Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Wireless Corrosion Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Wireless Corrosion Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Wireless Corrosion Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Wireless Corrosion Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Wireless Corrosion Sensor Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Wireless Corrosion Sensor Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Wireless Corrosion Sensor Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Wireless Corrosion Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Wireless Corrosion Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Wireless Corrosion Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Wireless Corrosion Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Wireless Corrosion Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Wireless Corrosion Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Wireless Corrosion Sensor Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Wireless Corrosion Sensor?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Wireless Corrosion Sensor?

Key companies in the market include CorrosionRADAR, Teledyne Cormon, Emerson, Southwest Research Institute, Southwest Research Institute, Corr Instruments, LLC, InfraSensing, Giatec Scientific Inc., Pepperl+Fuchs, Franklin Fueling Systems, Walchem, Hitachi, JFE Techno-Research, Cosasco, Pyxis Lab.

3. What are the main segments of the Wireless Corrosion Sensor?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4900.00, USD 7350.00, and USD 9800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Wireless Corrosion Sensor," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Wireless Corrosion Sensor report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Wireless Corrosion Sensor?

To stay informed about further developments, trends, and reports in the Wireless Corrosion Sensor, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence