Key Insights

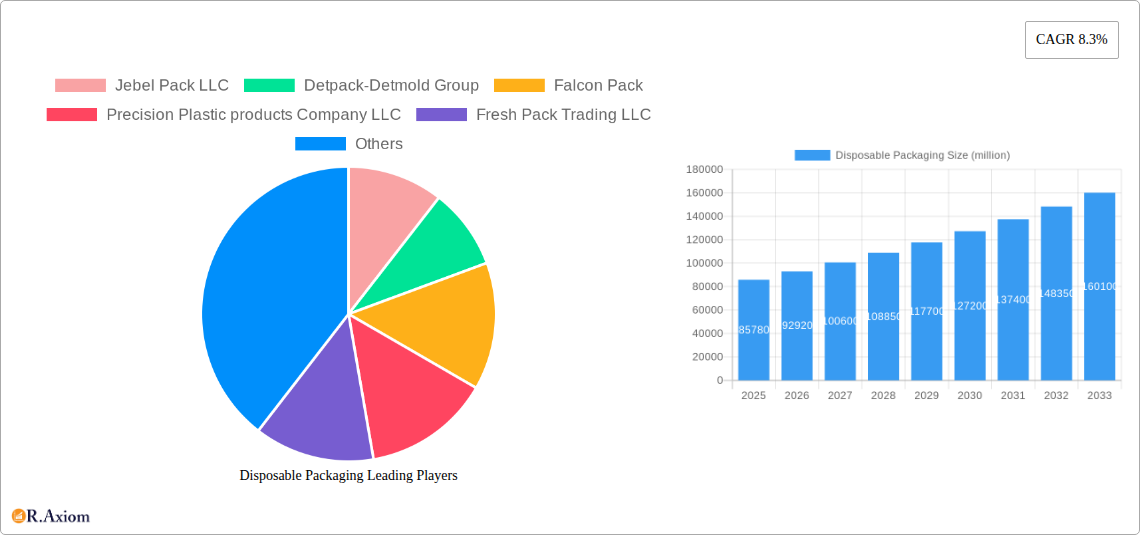

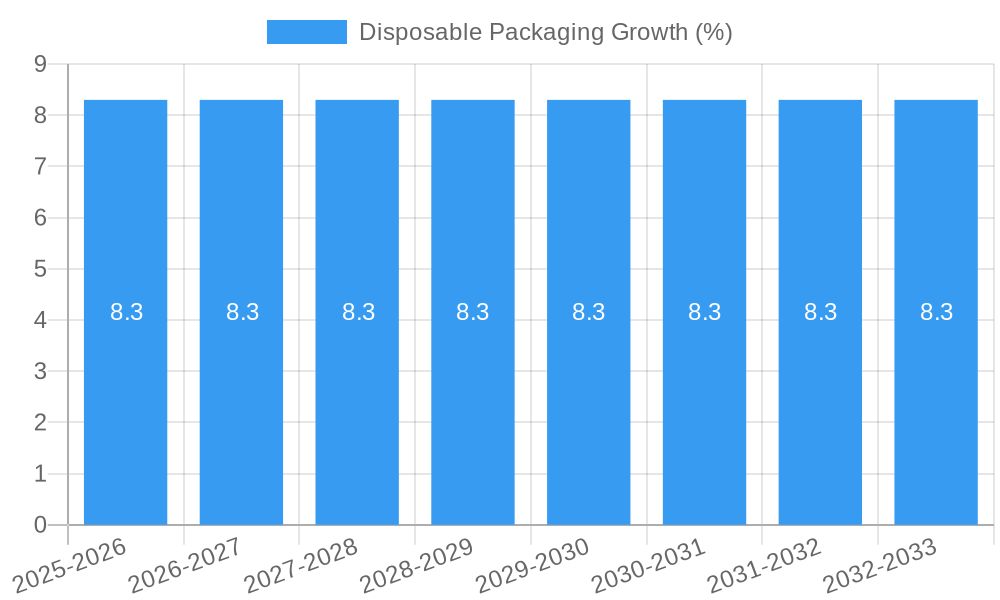

The global disposable packaging market is poised for significant expansion, projected to reach an estimated market size of $85,780 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of 8.3% expected to propel it to approximately $175,000 million by 2033. This surge is primarily driven by the escalating demand for convenience and single-use solutions across various sectors, particularly in the food service industry. Quick Service Restaurants (QSRs) and coffee and snack outlets are leading the charge, fueled by changing consumer lifestyles and the increasing popularity of on-the-go dining. The market's growth is further bolstered by the expansion of retail establishments, which increasingly rely on efficient and hygienic packaging for their products. Innovations in material science, leading to the development of more sustainable and cost-effective disposable packaging options, are also acting as key accelerators. The increasing adoption of advanced packaging technologies that offer enhanced shelf-life and portability for food products will continue to shape market dynamics, catering to the ever-growing need for convenience and safety in consumer goods.

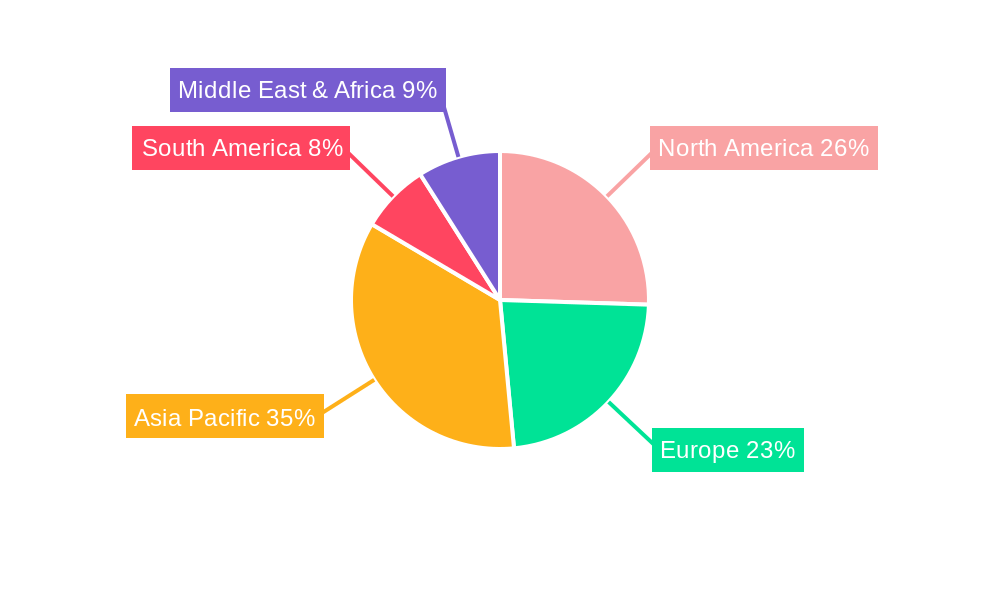

Despite the promising growth trajectory, certain restraints are influencing the market's pace. Growing environmental concerns and increasing regulatory pressure to reduce single-use plastic waste are prompting a shift towards sustainable alternatives and reusable packaging solutions. This evolving regulatory landscape and heightened consumer awareness are creating a significant challenge for traditional disposable packaging manufacturers. However, the market is demonstrating adaptability through innovation, with a growing focus on biodegradable, compostable, and recyclable materials. Key trends include the rise of eco-friendly packaging solutions, the integration of smart packaging technologies for enhanced traceability and consumer engagement, and the customization of packaging designs to meet specific brand requirements. The market segmentation reveals a strong demand for plates, food containers, bowls, and cups and lids, indicating their integral role in the food and beverage industry. Geographically, Asia Pacific, led by China and India, is emerging as a dominant region due to its large population, rapid urbanization, and burgeoning food service sector, closely followed by North America and Europe.

Disposable Packaging Market Concentration & Innovation

The disposable packaging market is characterized by a moderate level of concentration, with a mix of large global players and a significant number of regional and specialized manufacturers. The global market size for disposable packaging is estimated to reach over $150 million by 2033. Innovation is primarily driven by the demand for sustainable materials, enhanced product functionality, and cost-effectiveness. Regulatory frameworks, particularly concerning single-use plastics and environmental impact, are increasingly shaping product development and market entry strategies. Key innovation drivers include:

- Sustainable Materials: Development of biodegradable, compostable, and recyclable packaging solutions from sources like paper, plant-based plastics, and recycled content.

- Enhanced Functionality: Innovations focusing on improved barrier properties, temperature resistance, leak-proofing, and user convenience.

- Cost Optimization: Streamlining manufacturing processes and utilizing efficient material sourcing to maintain competitive pricing.

Product substitutes, such as reusable containers and innovative dispensing systems, pose a growing challenge. End-user trends, particularly in the food service and retail sectors, are gravitating towards convenience, hygiene, and a visible commitment to environmental responsibility. Mergers and acquisitions (M&A) activities are present, though not at an extremely high pace, with deal values typically ranging in the millions as companies seek to expand their product portfolios, geographical reach, or technological capabilities. Recent M&A activities in the sector have amounted to over $50 million in combined deal values, reflecting strategic consolidation.

Disposable Packaging Industry Trends & Insights

The disposable packaging industry is poised for robust growth, projected to witness a Compound Annual Growth Rate (CAGR) of approximately 5.5% from 2025 to 2033. This expansion is fueled by a confluence of factors including a burgeoning global population, rapid urbanization, and the escalating demand for convenience across various consumer segments. The food service sector, particularly Quick Service Restaurants (QSRs) and coffee/snack outlets, continues to be a primary engine for this growth, driven by their fast-paced operational models and consumer preference for on-the-go consumption. The market penetration of disposable packaging in these segments is already substantial, estimated to be over 70%, with continuous expansion in emerging economies.

Technological disruptions are playing a pivotal role in reshaping the industry. Advancements in material science are yielding innovative, eco-friendly alternatives to traditional plastics, such as advanced bioplastics, molded fiber, and compostable polymers. These innovations not only address environmental concerns but also offer enhanced performance characteristics, including superior insulation and barrier properties. Automation and advanced manufacturing techniques are optimizing production efficiencies, reducing costs, and enabling greater customization for clients. Consumer preferences are increasingly leaning towards packaging that is not only functional and aesthetically appealing but also demonstrably sustainable. This shift is compelling manufacturers to invest heavily in research and development for greener packaging solutions, thereby influencing product design and material selection.

The competitive dynamics within the disposable packaging sector are intensifying. Established players are focusing on strategic partnerships and acquisitions to broaden their market reach and product offerings, while new entrants are leveraging innovative technologies and niche market focus. The growing awareness of the environmental impact of packaging waste is leading to stricter regulations and consumer pressure, further intensifying the competitive landscape and rewarding companies that can demonstrate a commitment to circular economy principles. The market is projected to exceed $160 million in market size by the end of the forecast period.

Dominant Markets & Segments in Disposable Packaging

The Quick Service Restaurants (QSR) segment stands out as the dominant application within the disposable packaging market. This dominance is underpinned by several critical factors, including the inherent business model of QSRs that relies on high volume, fast turnover, and on-the-go consumption. The convenience factor is paramount for QSR customers, making disposable packaging an indispensable component of their operations. Economic policies that favor streamlined food service operations and a growing disposable income among a large segment of the population further bolster the demand for disposable packaging in this sector.

Geographically, the Asia-Pacific region is emerging as a significant growth hub, driven by rapid economic development, increasing urbanization, and a burgeoning middle class with a growing appetite for convenience food and beverages. Government initiatives supporting the food processing and retail sectors, coupled with investments in infrastructure, contribute to the robust expansion of the disposable packaging market in this region.

Within the product types, Food Containers and Cups and Lids are expected to hold the largest market share. Food containers are essential for a wide array of food items, from meals in QSRs to packaged goods in retail. The versatility and variety of food containers, including those designed for hot, cold, and frozen foods, contribute to their widespread adoption. Cups and lids are indispensable for the beverage industry, encompassing everything from coffee and tea to soft drinks and juices. The sheer volume of beverage consumption, especially in on-the-go scenarios, fuels the sustained demand for these items.

- Key Drivers for QSR Dominance:

- High volume of on-the-go food consumption.

- Emphasis on speed and convenience in service.

- Growing disposable income and urbanization.

- Hygiene and food safety standards.

- Key Drivers for Asia-Pacific Growth:

- Rapid economic expansion and rising middle class.

- Increasing urbanization and demand for convenience.

- Growth of the food service and retail industries.

- Government support for food infrastructure development.

- Key Drivers for Food Containers and Cups & Lids Dominance:

- Versatility in packaging diverse food and beverage items.

- Essential for portability and consumption outside the home.

- Continuous innovation in material and design for optimal performance.

- High-frequency purchase cycles.

Disposable Packaging Product Developments

Recent product developments in disposable packaging are heavily focused on sustainability and enhanced functionality. Innovations include the introduction of fully compostable food containers derived from sugarcane bagasse, offering excellent heat resistance and grease-proofing. Biodegradable paper cups with advanced lining technology are addressing the long-standing challenge of recyclability. Furthermore, advancements in smart packaging, such as those with integrated temperature indicators, are enhancing product safety and consumer experience, particularly for perishable goods. These developments are aimed at meeting stringent environmental regulations and catering to the growing consumer preference for eco-conscious choices, thereby providing a significant competitive advantage to manufacturers.

Report Scope & Segmentation Analysis

This report meticulously analyzes the global disposable packaging market, segmented by Application and Type. The Application segments include Quick Service Restaurants, Coffee and Snack Outlets, Retail Establishments, and Others. Each segment is analyzed for its growth projections, estimated market sizes, and competitive dynamics throughout the forecast period.

The Type segmentation encompasses Plates, Food Containers, Bowls, Bottles, Cups and Lids, and Others. Detailed insights into the market share, growth drivers, and competitive landscape for each of these product categories are provided. For instance, the Food Containers segment is projected to experience a market size of over $50 million by 2033, driven by its widespread use in takeaway and delivery services. Similarly, Cups and Lids are anticipated to reach a market size exceeding $40 million, fueled by the robust coffee and beverage culture.

Key Drivers of Disposable Packaging Growth

The disposable packaging market is propelled by a multi-faceted set of growth drivers. Economically, rising disposable incomes and the expansion of the middle class, particularly in emerging economies, lead to increased consumption of convenience foods and beverages, directly boosting demand for disposable packaging. Technologically, advancements in material science are yielding more sustainable and functional alternatives to traditional plastics, such as biodegradable polymers and advanced paper-based solutions, which are crucial for market acceptance and regulatory compliance. Regulatory frameworks, while sometimes presenting challenges, also act as drivers by encouraging innovation towards eco-friendly packaging and creating a more level playing field for sustainable products. The burgeoning food delivery and e-commerce sectors are also significant economic drivers, necessitating secure and convenient packaging solutions for product transit.

Challenges in the Disposable Packaging Sector

Despite its growth trajectory, the disposable packaging sector faces significant challenges. The primary restraint is the increasing global concern over plastic pollution and its environmental impact, leading to stringent regulations and bans on certain single-use plastic items in numerous regions. These regulatory hurdles often necessitate substantial investment in research and development for alternative materials and compliance measures. Supply chain disruptions, exacerbated by geopolitical events and raw material price volatility, can impact production costs and lead times, affecting overall market stability. Furthermore, intense competitive pressures from both established players and new entrants focused on disruptive technologies and sustainable solutions can lead to price wars and squeezed profit margins.

Emerging Opportunities in Disposable Packaging

Emerging opportunities within the disposable packaging market are largely centered on sustainability and novel applications. The growing demand for genuinely compostable and biodegradable packaging presents a significant opportunity for manufacturers investing in these technologies. The rise of the circular economy model is fostering innovation in recyclable and reusable disposable packaging systems, creating niche markets. Furthermore, the expansion of food delivery services and the growing trend of meal kits present opportunities for specialized, functional, and aesthetically pleasing disposable packaging solutions that enhance the consumer unboxing experience. The penetration of disposable packaging into developing markets, driven by urbanization and changing lifestyles, also offers substantial untapped potential.

Leading Players in the Disposable Packaging Market

- Jebel Pack LLC

- Detpack-Detmold Group

- Falcon Pack

- Precision Plastic products Company LLC

- Fresh Pack Trading LLC

- AVECO Packaging

- Formacia

- Genpak

- Global Packaging Solutions

- Caterpack-me

- Packware

- Damati

Key Developments in Disposable Packaging Industry

- 2023: Launch of advanced compostable food containers made from agricultural waste by a leading European manufacturer, targeting the QSR sector.

- 2023: A major North American packaging company acquired a specialized bioplastics producer, expanding its sustainable material portfolio.

- 2022: Introduction of a new generation of recyclable hot beverage cups with improved insulation properties by a prominent Asian supplier.

- 2022: Several countries implemented stricter regulations on single-use plastic cutlery and straws, driving demand for paper and bamboo alternatives.

- 2021: A global food service provider partnered with a packaging innovator to develop a closed-loop system for reusable disposable containers in select markets.

- 2021: Significant investment in R&D for plant-based barrier coatings for paper packaging, aiming to replace plastic laminations.

- 2020: The COVID-19 pandemic saw a surge in demand for single-use food packaging for takeout and delivery services.

Strategic Outlook for Disposable Packaging Market

The strategic outlook for the disposable packaging market is optimistic, driven by an accelerating demand for convenience and a persistent, albeit evolving, need for single-use solutions. The key growth catalysts lie in embracing sustainability as a core tenet, rather than a mere compliance measure. Companies that invest in and master the production of truly biodegradable, compostable, and highly recyclable packaging materials will gain a significant competitive edge. Furthermore, focusing on innovation that enhances functionality, such as superior barrier properties and thermal insulation, while simultaneously minimizing material usage and environmental footprint, will be crucial. Strategic collaborations and partnerships will be vital for navigating complex regulatory landscapes and for expanding into new geographical markets with diverse consumer preferences and environmental mandates.

Disposable Packaging Segmentation

-

1. Application

- 1.1. Quick Service Restaurants

- 1.2. Coffee and Snack Outlets

- 1.3. Retail Establishments

- 1.4. Others

-

2. Type

- 2.1. Plates

- 2.2. Food Containers

- 2.3. Bowls

- 2.4. Bottles

- 2.5. Cups and Lids

- 2.6. Others

Disposable Packaging Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Disposable Packaging REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 8.3% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Disposable Packaging Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Quick Service Restaurants

- 5.1.2. Coffee and Snack Outlets

- 5.1.3. Retail Establishments

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Plates

- 5.2.2. Food Containers

- 5.2.3. Bowls

- 5.2.4. Bottles

- 5.2.5. Cups and Lids

- 5.2.6. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Disposable Packaging Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Quick Service Restaurants

- 6.1.2. Coffee and Snack Outlets

- 6.1.3. Retail Establishments

- 6.1.4. Others

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Plates

- 6.2.2. Food Containers

- 6.2.3. Bowls

- 6.2.4. Bottles

- 6.2.5. Cups and Lids

- 6.2.6. Others

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Disposable Packaging Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Quick Service Restaurants

- 7.1.2. Coffee and Snack Outlets

- 7.1.3. Retail Establishments

- 7.1.4. Others

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Plates

- 7.2.2. Food Containers

- 7.2.3. Bowls

- 7.2.4. Bottles

- 7.2.5. Cups and Lids

- 7.2.6. Others

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Disposable Packaging Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Quick Service Restaurants

- 8.1.2. Coffee and Snack Outlets

- 8.1.3. Retail Establishments

- 8.1.4. Others

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Plates

- 8.2.2. Food Containers

- 8.2.3. Bowls

- 8.2.4. Bottles

- 8.2.5. Cups and Lids

- 8.2.6. Others

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Disposable Packaging Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Quick Service Restaurants

- 9.1.2. Coffee and Snack Outlets

- 9.1.3. Retail Establishments

- 9.1.4. Others

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Plates

- 9.2.2. Food Containers

- 9.2.3. Bowls

- 9.2.4. Bottles

- 9.2.5. Cups and Lids

- 9.2.6. Others

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Disposable Packaging Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Quick Service Restaurants

- 10.1.2. Coffee and Snack Outlets

- 10.1.3. Retail Establishments

- 10.1.4. Others

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Plates

- 10.2.2. Food Containers

- 10.2.3. Bowls

- 10.2.4. Bottles

- 10.2.5. Cups and Lids

- 10.2.6. Others

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Jebel Pack LLC

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Detpack-Detmold Group

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Falcon Pack

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Precision Plastic products Company LLC

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Fresh Pack Trading LLC

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 AVECO Packaging

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Formacia

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Genpak

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Global Packaging Solutions

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Caterpack-me

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Packware

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Damati

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Jebel Pack LLC

List of Figures

- Figure 1: Global Disposable Packaging Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Disposable Packaging Revenue (million), by Application 2024 & 2032

- Figure 3: North America Disposable Packaging Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Disposable Packaging Revenue (million), by Type 2024 & 2032

- Figure 5: North America Disposable Packaging Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Disposable Packaging Revenue (million), by Country 2024 & 2032

- Figure 7: North America Disposable Packaging Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Disposable Packaging Revenue (million), by Application 2024 & 2032

- Figure 9: South America Disposable Packaging Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Disposable Packaging Revenue (million), by Type 2024 & 2032

- Figure 11: South America Disposable Packaging Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America Disposable Packaging Revenue (million), by Country 2024 & 2032

- Figure 13: South America Disposable Packaging Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Disposable Packaging Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Disposable Packaging Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Disposable Packaging Revenue (million), by Type 2024 & 2032

- Figure 17: Europe Disposable Packaging Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Disposable Packaging Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Disposable Packaging Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Disposable Packaging Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Disposable Packaging Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Disposable Packaging Revenue (million), by Type 2024 & 2032

- Figure 23: Middle East & Africa Disposable Packaging Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa Disposable Packaging Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Disposable Packaging Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Disposable Packaging Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Disposable Packaging Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Disposable Packaging Revenue (million), by Type 2024 & 2032

- Figure 29: Asia Pacific Disposable Packaging Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific Disposable Packaging Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Disposable Packaging Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Disposable Packaging Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Disposable Packaging Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Disposable Packaging Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Disposable Packaging Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Disposable Packaging Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Disposable Packaging Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global Disposable Packaging Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Disposable Packaging Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Disposable Packaging Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Disposable Packaging Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Disposable Packaging Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Disposable Packaging Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global Disposable Packaging Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Disposable Packaging Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Disposable Packaging Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Disposable Packaging Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Disposable Packaging Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Disposable Packaging Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global Disposable Packaging Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Disposable Packaging Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Disposable Packaging Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Disposable Packaging Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Disposable Packaging Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Disposable Packaging Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Disposable Packaging Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Disposable Packaging Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Disposable Packaging Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Disposable Packaging Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Disposable Packaging Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Disposable Packaging Revenue million Forecast, by Type 2019 & 2032

- Table 31: Global Disposable Packaging Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Disposable Packaging Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Disposable Packaging Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Disposable Packaging Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Disposable Packaging Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Disposable Packaging Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Disposable Packaging Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Disposable Packaging Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Disposable Packaging Revenue million Forecast, by Type 2019 & 2032

- Table 40: Global Disposable Packaging Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Disposable Packaging Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Disposable Packaging Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Disposable Packaging Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Disposable Packaging Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Disposable Packaging Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Disposable Packaging Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Disposable Packaging Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Disposable Packaging?

The projected CAGR is approximately 8.3%.

2. Which companies are prominent players in the Disposable Packaging?

Key companies in the market include Jebel Pack LLC, Detpack-Detmold Group, Falcon Pack, Precision Plastic products Company LLC, Fresh Pack Trading LLC, AVECO Packaging, Formacia, Genpak, Global Packaging Solutions, Caterpack-me, Packware, Damati.

3. What are the main segments of the Disposable Packaging?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Disposable Packaging," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Disposable Packaging report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Disposable Packaging?

To stay informed about further developments, trends, and reports in the Disposable Packaging, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence