Key Insights

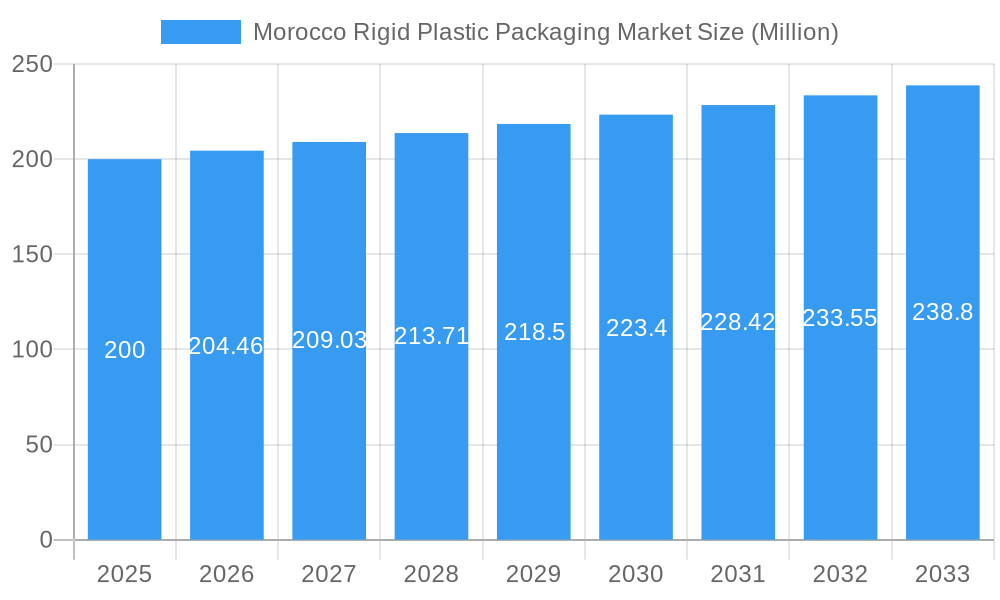

The Morocco rigid plastic packaging market is projected to reach $221.07 billion by 2025, with a compound annual growth rate (CAGR) of 4.1% from 2025 to 2033. Key growth drivers include the burgeoning food and beverage industry and rising consumer demand for conveniently packaged goods. The inherent advantages of plastic packaging, such as cost-effectiveness, durability, and lightweight properties, further propel market expansion. Government efforts to boost domestic manufacturing and industrial development also indirectly support the sector. However, environmental concerns and the growing adoption of sustainable alternatives present significant market restraints. The market is segmented by product type (e.g., bottles, containers), application (e.g., food & beverage, pharmaceuticals), and material (e.g., PET, HDPE).

Morocco Rigid Plastic Packaging Market Market Size (In Billion)

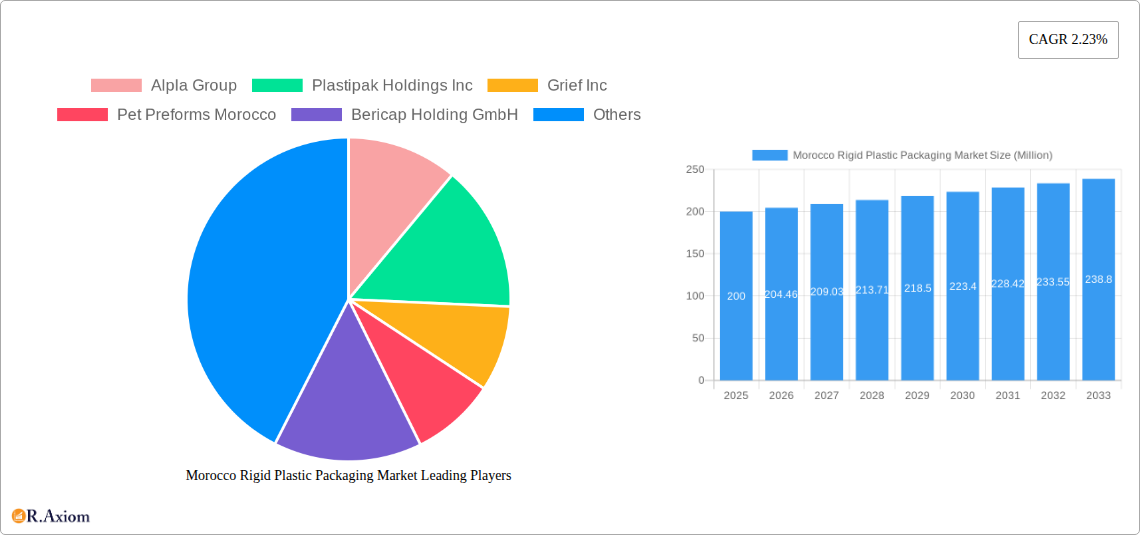

Key market participants, including Alpla Group, Plastipak Holdings Inc., and Grief Inc., alongside emerging local enterprises like Sumilon Eco PET SARL, are actively influencing market dynamics. The competitive environment is characterized by price sensitivity and a growing emphasis on innovative, sustainable packaging solutions. The forecast period anticipates continued, moderate market expansion, influenced by evolving government sustainability policies, shifting consumer preferences towards eco-friendly options, and the capacity of local manufacturers to integrate sustainable practices. The long-term outlook for the Morocco rigid plastic packaging market remains favorable, underpinned by economic growth and an expanding consumer base. Strategic focus on sustainable solutions and robust supply chain management will be crucial for market players to capitalize on emerging opportunities.

Morocco Rigid Plastic Packaging Market Company Market Share

Morocco Rigid Plastic Packaging Market: A Comprehensive Report (2019-2033)

This comprehensive report provides a detailed analysis of the Morocco Rigid Plastic Packaging Market, covering the historical period (2019-2024), the base year (2025), and forecasting the market's trajectory until 2033. The report offers invaluable insights into market dynamics, competitive landscapes, and emerging trends, enabling stakeholders to make informed strategic decisions. This in-depth analysis incorporates market sizing, segmentation, growth drivers, challenges, opportunities, and key player profiles. The report utilizes a robust methodology, including heat map analysis and competitor profiling (emerging vs. established players), providing a 360-degree view of this dynamic market.

Morocco Rigid Plastic Packaging Market Concentration & Innovation

The Moroccan rigid plastic packaging market exhibits a moderately concentrated structure, with a few established players holding significant market share. Alpla Group, Plastipak Holdings Inc., and Grief Inc. are among the dominant players, collectively accounting for an estimated xx% of the market in 2025. However, the emergence of smaller, innovative companies like Sumilon Eco PET SARL is challenging the established order, driving competition and innovation.

- Market Concentration: The Herfindahl-Hirschman Index (HHI) for the market is estimated at xx in 2025, indicating a moderately concentrated market.

- Innovation Drivers: Growing demand for sustainable packaging, technological advancements in lightweighting and material science, and increasing focus on product differentiation are key drivers of innovation.

- Regulatory Framework: The Moroccan government's regulations concerning plastic waste management and sustainable practices are shaping industry trends, pushing manufacturers towards eco-friendly solutions. Compliance costs are impacting market dynamics.

- Product Substitutes: While rigid plastic packaging dominates, competition from alternative materials like paperboard and glass is increasing, particularly in segments emphasizing sustainability.

- End-User Trends: Shifting consumer preferences toward convenience, product safety, and environmentally responsible packaging are influencing market demand. The demand for customized packaging solutions is also on the rise.

- M&A Activities: Recent mergers and acquisitions, such as Grief Inc.'s acquisition of Reliance Products Inc. in October 2023 (estimated value: xx Million), demonstrate the strategic importance of market consolidation and expansion in the Moroccan rigid plastic packaging market. These activities are expected to continue, driving market restructuring.

Morocco Rigid Plastic Packaging Market Industry Trends & Insights

The Moroccan rigid plastic packaging market is experiencing robust growth, driven by expanding industrial activity, a burgeoning food and beverage sector, and increasing consumer spending. The market is projected to register a CAGR of xx% during the forecast period (2025-2033). This growth is fueled by technological advancements, changing consumer preferences, and competitive dynamics.

Technological disruptions are reshaping the industry, particularly with advancements in recycled plastic utilization and the adoption of automation in manufacturing processes. The preference for lightweighting and the increasing adoption of sustainable materials, such as rPET, are significantly influencing market trends. The market penetration of recycled plastic packaging is expected to increase from xx% in 2025 to xx% by 2033, driven by consumer demand and regulatory pressure. Intense competition among existing players and the entry of new participants are further contributing to market dynamism. The ongoing focus on brand differentiation through innovative packaging design will also influence market trends.

Dominant Markets & Segments in Morocco Rigid Plastic Packaging Market

The dominant segment within the Moroccan rigid plastic packaging market is the food and beverage sector, accounting for approximately xx% of the total market volume in 2025. This dominance is driven by strong consumption patterns and the increasing demand for packaged food and beverages. The urban areas of Morocco exhibit higher growth rates compared to rural regions due to factors like higher purchasing power and better infrastructure.

- Key Drivers in the Food and Beverage Sector:

- Growing middle class with increasing disposable incomes.

- Expansion of organized retail and supermarkets.

- Rising demand for convenience foods.

- Favorable government policies supporting the food processing industry.

The dominance of the food and beverage segment is further strengthened by robust export opportunities, with significant quantities of packaged food and beverages being exported from Morocco to neighboring countries. Government initiatives and investments in infrastructure are further bolstering the market growth.

Morocco Rigid Plastic Packaging Market Product Developments

Recent innovations in the Moroccan rigid plastic packaging market include a notable shift towards sustainable and eco-friendly packaging solutions. This is evident through the increased use of recycled PET (rPET) materials and the development of biodegradable plastics. The market is witnessing the adoption of lighter-weight packaging designs to reduce plastic consumption and enhance logistical efficiency. These product developments are aligning with both environmental concerns and the pursuit of cost optimization within the industry. Lightweighting, while advantageous for cost reduction and transport, needs careful consideration for product protection and shelf life.

Report Scope & Segmentation Analysis

This report segments the Moroccan rigid plastic packaging market based on material type (PET, HDPE, PP, other), packaging type (bottles, jars, containers, tubs, other), end-use industry (food and beverage, pharmaceuticals, consumer goods, other), and region (major cities and rural areas). Each segment’s market size, growth projections, and competitive dynamics are thoroughly analyzed to provide a comprehensive overview. The market size for each segment is estimated for 2025 and projected for 2033, revealing different growth trajectories based on consumer trends and economic factors. The competitive landscape within each segment is assessed, identifying key players and their market strategies.

Key Drivers of Morocco Rigid Plastic Packaging Market Growth

The growth of the Moroccan rigid plastic packaging market is propelled by several factors: Firstly, the expanding food and beverage industry fuels demand for packaging solutions. Secondly, government initiatives promoting industrial growth and economic development are creating a supportive environment. Thirdly, the increasing popularity of convenience foods and packaged goods among consumers drives sales. Furthermore, technological advancements in packaging materials and production techniques contribute to efficiency and cost reduction, creating positive market momentum.

Challenges in the Morocco Rigid Plastic Packaging Market Sector

Challenges facing the Moroccan rigid plastic packaging market include the rising costs of raw materials, stringent environmental regulations regarding plastic waste management, and increasing competition from both domestic and international players. Supply chain disruptions, particularly felt during periods of global economic uncertainty, also impact production and delivery timelines, affecting overall market stability. The cost of waste management and disposal poses a financial burden on companies, prompting a stronger focus on eco-friendly solutions.

Emerging Opportunities in Morocco Rigid Plastic Packaging Market

Emerging opportunities lie in the increasing demand for sustainable and eco-friendly packaging options, presenting a chance for companies to innovate and develop recyclable or biodegradable alternatives. The growing e-commerce sector necessitates more robust and efficient packaging for online deliveries, providing further market expansion prospects. Finally, focusing on customized and value-added packaging solutions to meet individual customer needs can create significant opportunities for growth.

Leading Players in the Morocco Rigid Plastic Packaging Market Market

- Alpla Group

- Plastipak Holdings Inc.

- Grief Inc.

- Pet Preforms Morocco

- Bericap Holding GmbH

- Sumilon Eco PET SARL

- Blowtec Morocco

- Intel Plast

- Mikafric

Key Developments in Morocco Rigid Plastic Packaging Market Industry

- October 2023: Grief Inc. acquired Reliance Products Inc., expanding its product portfolio and market reach.

- May 2024: Plastipak Holding GmbH partnered with Kraft Heinz to produce containers from 100% rPET, promoting sustainable packaging practices.

Strategic Outlook for Morocco Rigid Plastic Packaging Market Market

The Moroccan rigid plastic packaging market is poised for continued growth, driven by economic expansion, changing consumer preferences, and increasing focus on sustainable packaging solutions. The market presents opportunities for companies to capitalize on innovations in material science, packaging design, and waste management technologies. A strategic focus on sustainability and efficient supply chain management will be crucial for success in this dynamic market.

Morocco Rigid Plastic Packaging Market Segmentation

-

1. Product Type

- 1.1. Bottles and Jars

- 1.2. Trays and Containers

- 1.3. Caps and Closures

- 1.4. Intermediate Bulk Containers (IBCs)

- 1.5. Drums

- 1.6. Pallets

- 1.7. Other Product Types

-

2. Material

-

2.1. Polyethylene (PE)**

- 2.1.1. LDPE & LLDPE

- 2.1.2. HDPE

- 2.2. Polyethylene Terephthalate (PET)

- 2.3. Polypropylene (PP)

- 2.4. Polystyrene (PS) and Expanded polystyrene (EPS

- 2.5. Polyvinyl chloride (PVC)

- 2.6. Other Rigid Plastic Packaging Materials

-

2.1. Polyethylene (PE)**

-

3. End-use Industries

-

3.1. Food**

- 3.1.1. Candy and Confectionery

- 3.1.2. Frozen Foods

- 3.1.3. Fresh Produce

- 3.1.4. Dairy Products

- 3.1.5. Dry Foods

- 3.1.6. Meat, Poultry, and Seafood

- 3.1.7. Pet Food

- 3.1.8. Other Food Products

-

3.2. Foodservice**

- 3.2.1. Quick Service Restaurants (QSRs)

- 3.2.2. Full-Service Restaurants (FSRs)

- 3.2.3. Coffee and Snack Outlets

- 3.2.4. Retail Establishments

- 3.2.5. Institutional

- 3.2.6. Hospitality

- 3.2.7. Other Foodservice End Uses

- 3.3. Beverage

- 3.4. Healthcare

- 3.5. Cosmetics and Personal Care

- 3.6. Industrial

- 3.7. Building and Construction

- 3.8. Automotive

- 3.9. Other En

-

3.1. Food**

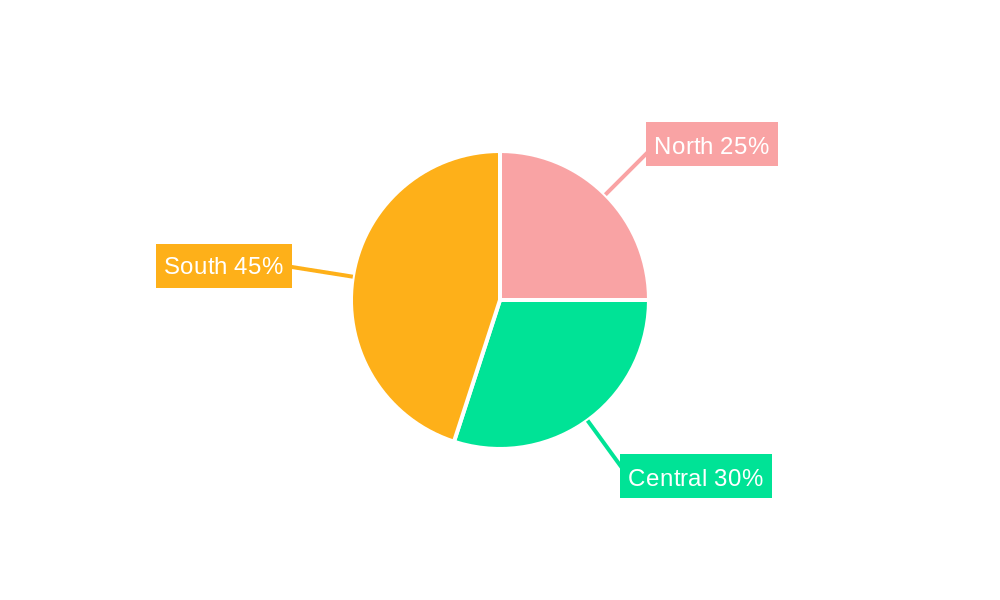

Morocco Rigid Plastic Packaging Market Segmentation By Geography

- 1. Morocco

Morocco Rigid Plastic Packaging Market Regional Market Share

Geographic Coverage of Morocco Rigid Plastic Packaging Market

Morocco Rigid Plastic Packaging Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Food Industry in Morocco; Availability of Customized Rigid Plastic Packaging Solutions

- 3.3. Market Restrains

- 3.3.1. Growing Food Industry in Morocco; Availability of Customized Rigid Plastic Packaging Solutions

- 3.4. Market Trends

- 3.4.1. Polyethylene Terephthalate (PET) Segment is Estimated to Have the Largest Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Morocco Rigid Plastic Packaging Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Bottles and Jars

- 5.1.2. Trays and Containers

- 5.1.3. Caps and Closures

- 5.1.4. Intermediate Bulk Containers (IBCs)

- 5.1.5. Drums

- 5.1.6. Pallets

- 5.1.7. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by Material

- 5.2.1. Polyethylene (PE)**

- 5.2.1.1. LDPE & LLDPE

- 5.2.1.2. HDPE

- 5.2.2. Polyethylene Terephthalate (PET)

- 5.2.3. Polypropylene (PP)

- 5.2.4. Polystyrene (PS) and Expanded polystyrene (EPS

- 5.2.5. Polyvinyl chloride (PVC)

- 5.2.6. Other Rigid Plastic Packaging Materials

- 5.2.1. Polyethylene (PE)**

- 5.3. Market Analysis, Insights and Forecast - by End-use Industries

- 5.3.1. Food**

- 5.3.1.1. Candy and Confectionery

- 5.3.1.2. Frozen Foods

- 5.3.1.3. Fresh Produce

- 5.3.1.4. Dairy Products

- 5.3.1.5. Dry Foods

- 5.3.1.6. Meat, Poultry, and Seafood

- 5.3.1.7. Pet Food

- 5.3.1.8. Other Food Products

- 5.3.2. Foodservice**

- 5.3.2.1. Quick Service Restaurants (QSRs)

- 5.3.2.2. Full-Service Restaurants (FSRs)

- 5.3.2.3. Coffee and Snack Outlets

- 5.3.2.4. Retail Establishments

- 5.3.2.5. Institutional

- 5.3.2.6. Hospitality

- 5.3.2.7. Other Foodservice End Uses

- 5.3.3. Beverage

- 5.3.4. Healthcare

- 5.3.5. Cosmetics and Personal Care

- 5.3.6. Industrial

- 5.3.7. Building and Construction

- 5.3.8. Automotive

- 5.3.9. Other En

- 5.3.1. Food**

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Morocco

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Alpla Group

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Plastipak Holdings Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Grief Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Pet Preforms Morocco

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Bericap Holding GmbH

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Sumilon Eco PET SARL

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Blowtec Morocco

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Intel Plast

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Mikafric8 2 Heat Map Analysis8 3 Competitor Analysis - Emerging vs Established Player

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Alpla Group

List of Figures

- Figure 1: Morocco Rigid Plastic Packaging Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Morocco Rigid Plastic Packaging Market Share (%) by Company 2025

List of Tables

- Table 1: Morocco Rigid Plastic Packaging Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: Morocco Rigid Plastic Packaging Market Revenue billion Forecast, by Material 2020 & 2033

- Table 3: Morocco Rigid Plastic Packaging Market Revenue billion Forecast, by End-use Industries 2020 & 2033

- Table 4: Morocco Rigid Plastic Packaging Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Morocco Rigid Plastic Packaging Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 6: Morocco Rigid Plastic Packaging Market Revenue billion Forecast, by Material 2020 & 2033

- Table 7: Morocco Rigid Plastic Packaging Market Revenue billion Forecast, by End-use Industries 2020 & 2033

- Table 8: Morocco Rigid Plastic Packaging Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Morocco Rigid Plastic Packaging Market?

The projected CAGR is approximately 4.1%.

2. Which companies are prominent players in the Morocco Rigid Plastic Packaging Market?

Key companies in the market include Alpla Group, Plastipak Holdings Inc, Grief Inc, Pet Preforms Morocco, Bericap Holding GmbH, Sumilon Eco PET SARL, Blowtec Morocco, Intel Plast, Mikafric8 2 Heat Map Analysis8 3 Competitor Analysis - Emerging vs Established Player.

3. What are the main segments of the Morocco Rigid Plastic Packaging Market?

The market segments include Product Type, Material, End-use Industries.

4. Can you provide details about the market size?

The market size is estimated to be USD 221.07 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing Food Industry in Morocco; Availability of Customized Rigid Plastic Packaging Solutions.

6. What are the notable trends driving market growth?

Polyethylene Terephthalate (PET) Segment is Estimated to Have the Largest Market Share.

7. Are there any restraints impacting market growth?

Growing Food Industry in Morocco; Availability of Customized Rigid Plastic Packaging Solutions.

8. Can you provide examples of recent developments in the market?

May 2024: Plastipak Holding GmbH, a US-based manufacturer with operations in Morocco, teamed up with Kraft Heinz, a US-based food giant, to produce KRAFT Real Mayo and MIRACLE WHIP containers exclusively from recycled PET (rPET) material. Through this collaboration, Plastipak is committed to assisting Kraft Heinz in achieving a 20% reduction in the use of virgin plastic across its global packaging portfolio by 2030.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Morocco Rigid Plastic Packaging Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Morocco Rigid Plastic Packaging Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Morocco Rigid Plastic Packaging Market?

To stay informed about further developments, trends, and reports in the Morocco Rigid Plastic Packaging Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence