Key Insights

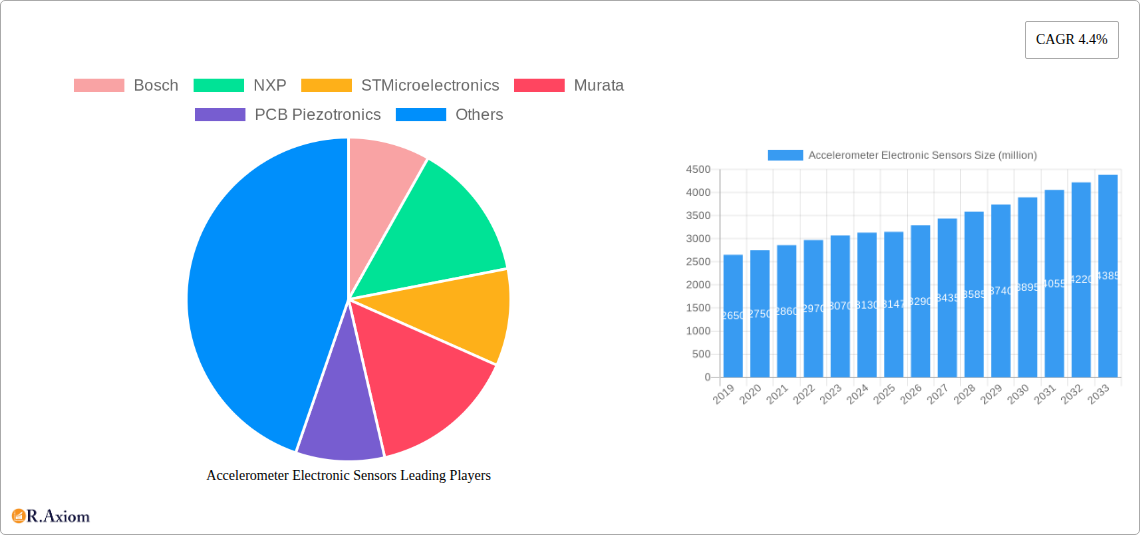

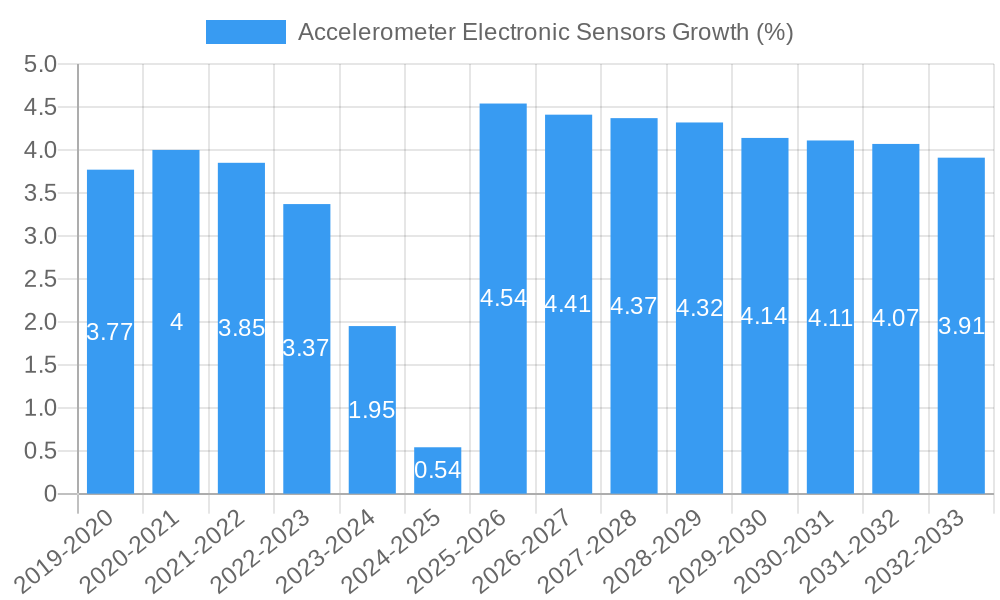

The global accelerometer electronic sensors market is projected to reach a significant valuation, with an estimated market size of approximately USD 3,147 million in 2025. This growth is fueled by the pervasive integration of accelerometers across a diverse range of industries, driven by the increasing demand for advanced sensing capabilities in consumer electronics, automotive safety systems, and industrial automation. The market is expected to expand at a Compound Annual Growth Rate (CAGR) of 4.4% from 2019 to 2033, indicating a steady and robust expansion trajectory. Key applications such as automobiles, consumer electronics, and aerospace and national defense are poised to be major contributors to this growth. Within the automotive sector, accelerometers are crucial for airbags, electronic stability control, and advanced driver-assistance systems (ADAS), directly aligning with the industry's focus on safety and intelligent features. Similarly, the booming consumer electronics segment, encompassing smartphones, wearables, and gaming devices, relies heavily on accelerometers for motion sensing and user interaction.

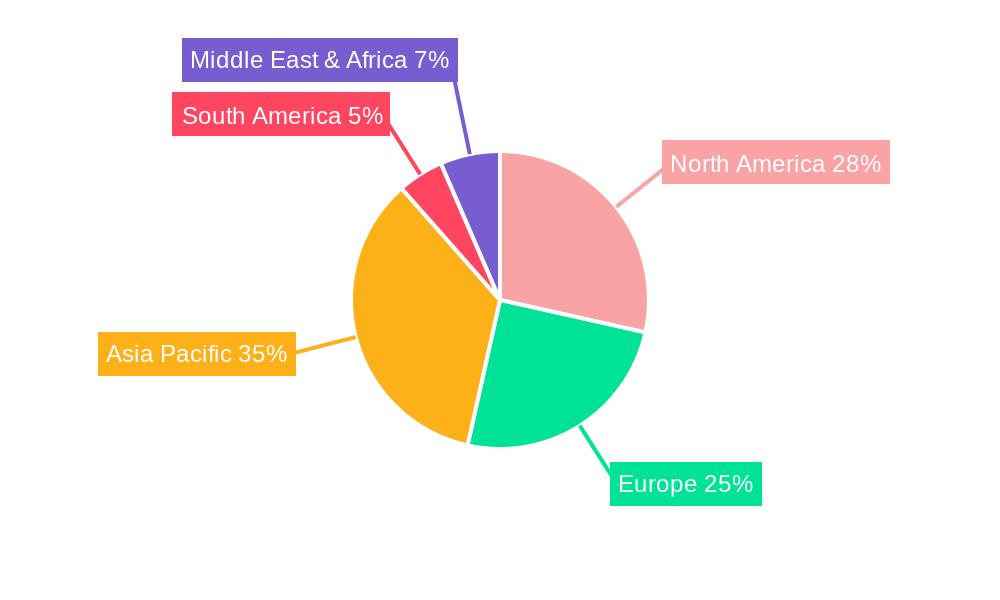

Further insights reveal that the market is characterized by both Piezoelectric and Piezoresistive types, with "Others" also forming a significant segment, suggesting ongoing innovation and the emergence of new sensing technologies. Emerging trends include miniaturization of sensors, enhanced sensitivity, and the development of low-power accelerometers to support the proliferation of the Internet of Things (IoT) devices. The continuous advancement in MEMS (Micro-Electro-Mechanical Systems) technology is a primary driver, enabling the production of smaller, more cost-effective, and highly accurate accelerometers. While the market is experiencing strong growth, potential restraints could include the high cost of advanced sensor development and stringent regulatory standards in certain applications. However, the overall outlook remains highly positive, supported by a competitive landscape featuring established players like Bosch, NXP, STMicroelectronics, and TDK, alongside innovative smaller companies. Geographically, North America and Asia Pacific are anticipated to be key markets, driven by technological adoption and manufacturing hubs.

This in-depth report provides a detailed analysis of the global Accelerometer Electronic Sensors market, examining historical trends, current market dynamics, and future growth projections. Covering the period from 2019 to 2033, with a base year of 2025, this report offers actionable insights for industry stakeholders, including manufacturers, suppliers, investors, and researchers. We delve into market concentration, innovation drivers, segmentation by application and type, key growth drivers, prevailing challenges, emerging opportunities, and the strategic outlook for this critical technology sector. The report encompasses a comprehensive overview of key players and their recent developments, providing a holistic view of the accelerometer electronic sensors landscape.

Accelerometer Electronic Sensors Market Concentration & Innovation

The global accelerometer electronic sensors market exhibits moderate to high concentration, with a significant presence of both established multinational corporations and specialized technology providers. Innovation is a primary driver of market growth, fueled by continuous advancements in miniaturization, accuracy, power efficiency, and the integration of artificial intelligence and machine learning capabilities for advanced data analysis. Regulatory frameworks, particularly in the automotive and aerospace sectors, mandate stringent performance and safety standards, influencing product development and adoption. Product substitutes, such as gyroscopes and other motion sensors, pose a competitive challenge, necessitating ongoing differentiation and value proposition enhancement for accelerometer solutions. End-user trends indicate a growing demand for smart devices, autonomous systems, and predictive maintenance, which are directly benefiting the accelerometer market. Mergers and acquisitions (M&A) are actively shaping market dynamics, with an estimated global M&A deal value exceeding 100 million in the last year, as larger players seek to consolidate market share and acquire cutting-edge technologies. Market share is currently dominated by key players with estimated collective shares of over 70%.

- Innovation Drivers: Miniaturization, enhanced accuracy and sensitivity, low power consumption, integration with IoT platforms, AI/ML for data interpretation, ruggedization for harsh environments.

- Regulatory Frameworks: ISO 26262 (Automotive Functional Safety), DO-160 (Aerospace Environmental Standards), RoHS, REACH.

- Product Substitutes: MEMS Gyroscopes, IMUs (Inertial Measurement Units), Magnetometers.

- End-User Trends: Proliferation of smartphones and wearables, growth of the Internet of Things (IoT), increasing adoption of autonomous vehicles, advancements in drones and robotics, demand for condition monitoring in industrial equipment.

- M&A Activities: Strategic acquisitions to gain market share, access new technologies, and expand product portfolios. Estimated total M&A deal value in the last year: 150 million.

Accelerometer Electronic Sensors Industry Trends & Insights

The accelerometer electronic sensors industry is experiencing robust growth, driven by an escalating demand across a myriad of applications. The compound annual growth rate (CAGR) is projected to be approximately 7.5% during the forecast period of 2025–2033. This expansion is fueled by several key factors, including the ubiquitous integration of accelerometers into consumer electronics like smartphones, smartwatches, and gaming devices, where they enable motion detection, orientation sensing, and user interface interactions. The automotive sector represents a significant growth engine, with accelerometers being crucial for airbag deployment systems, electronic stability control (ESC), anti-lock braking systems (ABS), and increasingly, for advanced driver-assistance systems (ADAS) and autonomous driving technologies. The aerospace and national defense sectors are also substantial contributors, utilizing accelerometers for navigation, flight control, vibration monitoring in aircraft and spacecraft, and for tactical missile guidance systems. Technological disruptions, such as the continuous miniaturization of MEMS (Micro-Electro-Mechanical Systems) accelerometers, improved performance characteristics like higher bandwidth and lower noise density, and enhanced robustness against environmental factors, are making these sensors more versatile and cost-effective. Consumer preferences are increasingly leaning towards sophisticated, connected devices that leverage sensor data for personalized experiences and enhanced functionality, further driving demand. Competitive dynamics within the industry are characterized by intense innovation, strategic partnerships, and a focus on developing specialized solutions for niche applications. Market penetration for accelerometers in emerging economies is steadily increasing as technological adoption accelerates and manufacturing capabilities expand. The estimated market size for accelerometer electronic sensors is projected to reach 5,000 million by the estimated year of 2025.

Dominant Markets & Segments in Accelerometer Electronic Sensors

The Automobile segment stands out as a dominant market for accelerometer electronic sensors, driven by stringent safety regulations and the rapid advancement of vehicle technologies. The increasing integration of ADAS features such as adaptive cruise control, lane departure warning systems, and automated parking systems necessitates highly accurate and reliable accelerometers. Furthermore, the burgeoning electric vehicle (EV) market, with its focus on battery management, regenerative braking, and sophisticated powertrain control, further amplifies the demand for these sensors. Within the automobile application, the Piezoelectric Type accelerometers are widely adopted due to their high sensitivity and dynamic range, making them ideal for crash detection and vibration analysis in vehicles. The economic policies favoring automotive safety and technological innovation in key automotive manufacturing nations like Germany, Japan, South Korea, and the United States directly contribute to the dominance of this segment. Infrastructure development for smart cities and connected vehicles also plays a crucial role.

Dominant Application Segment: Automobile

- Key Drivers:

- Mandatory safety features (airbags, ESC, ABS).

- Growth of Advanced Driver-Assistance Systems (ADAS) and autonomous driving.

- Increasing adoption of Electric Vehicles (EVs) for performance monitoring.

- Vehicle diagnostics and predictive maintenance.

- Regulatory mandates for vehicle safety and performance.

- Dominance Analysis: The automotive sector's relentless pursuit of enhanced safety, efficiency, and driver experience ensures a continuous and growing demand for accelerometers. The mature automotive manufacturing base in developed economies, coupled with the rapid expansion of automotive production in emerging markets, solidifies the automobile segment's leading position. The technological evolution within vehicles, from basic safety to complex autonomous systems, directly translates to a higher volume and more sophisticated sensor requirements.

- Key Drivers:

Dominant Type: Piezoelectric Type

- Key Drivers:

- High sensitivity and accuracy for dynamic measurements.

- Wide dynamic range suitable for transient events like impacts.

- Reliability in harsh environmental conditions.

- Cost-effectiveness for mass-produced automotive components.

- Dominance Analysis: Piezoelectric accelerometers excel in applications requiring precise measurement of rapidly changing forces, such as crash detection and impact analysis, which are critical in the automotive industry. Their robustness and proven track record make them a preferred choice for safety-critical systems. While Piezoresistive types offer advantages in static or quasi-static measurements, the dynamic nature of automotive applications, particularly safety systems, favors piezoelectric technology.

- Key Drivers:

Accelerometer Electronic Sensors Product Developments

Recent product developments in accelerometer electronic sensors are characterized by significant advancements in MEMS technology, leading to smaller, more energy-efficient, and higher-performance devices. Innovations are focused on improving sensor resolution, reducing noise floors, and extending operational bandwidth to cater to increasingly demanding applications in consumer electronics, automotive safety, and industrial monitoring. The integration of multi-axis sensing capabilities within single packages and the development of accelerometers with embedded signal processing and communication protocols are also prominent trends. These advancements enable more sophisticated data collection, real-time analysis, and seamless integration into IoT ecosystems, providing a competitive edge for manufacturers and unlocking new application possibilities.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the Accelerometer Electronic Sensors market segmented by Application and Type.

Application Segments:

- Automobile: This segment is expected to witness strong growth due to the increasing adoption of ADAS, autonomous driving technologies, and electric vehicles.

- Consumer Electronics: Driven by the proliferation of smartphones, wearables, gaming consoles, and smart home devices, this segment offers substantial market potential.

- Aerospace and National Defense: Critical for navigation, flight control, structural health monitoring, and defense systems, this segment demands high-reliability and precision sensors.

- Other: This broad category includes industrial automation, medical devices, civil engineering, and scientific research, each presenting unique growth opportunities.

Type Segments:

- Piezoelectric Type: Favored for high-frequency vibration and impact measurements, prominent in automotive safety and industrial monitoring.

- Piezoresistive Type: Suitable for measuring static or quasi-static forces and vibrations, often found in consumer electronics and some industrial applications.

- Others: This includes capacitive, thermal, and other emerging accelerometer technologies, offering specialized performance characteristics.

Key Drivers of Accelerometer Electronic Sensors Growth

The growth of the accelerometer electronic sensors market is propelled by several interconnected factors. Technologically, the ongoing miniaturization and cost reduction of MEMS accelerometers are making them accessible for a wider range of applications. The increasing demand for smart and connected devices across consumer, automotive, and industrial sectors is a significant economic driver, as accelerometers are fundamental to sensing motion, orientation, and vibration. Regulatory mandates, particularly in the automotive industry for enhanced safety features, further stimulate market expansion. The development of advanced driver-assistance systems (ADAS) and the pursuit of autonomous driving technologies are creating substantial demand for high-precision accelerometers. Furthermore, the rise of the Industrial Internet of Things (IIoT) is driving the adoption of accelerometers for predictive maintenance and condition monitoring of industrial machinery.

Challenges in the Accelerometer Electronic Sensors Sector

Despite the positive growth trajectory, the accelerometer electronic sensors sector faces several challenges. Intense competition among numerous players can lead to price erosion, impacting profit margins. The development of highly integrated sensor fusion technologies, combining accelerometers with gyroscopes and magnetometers, can sometimes displace standalone accelerometer solutions in certain applications. Ensuring high levels of accuracy and reliability in extreme environmental conditions, such as high temperatures or significant electromagnetic interference, remains a technical challenge that requires continuous innovation. Supply chain disruptions, particularly for specialized components and raw materials, can impact production timelines and costs. Stringent qualification processes and long development cycles in industries like aerospace and automotive can also pose a barrier to rapid market entry for new technologies.

Emerging Opportunities in Accelerometer Electronic Sensors

Emerging opportunities for accelerometer electronic sensors lie in the rapidly growing fields of the Internet of Things (IoT) and artificial intelligence (AI). The increasing deployment of smart sensors for condition monitoring in industrial equipment, infrastructure, and smart cities presents a substantial growth avenue. Wearable technology continues to evolve, with accelerometers enabling more sophisticated health and fitness tracking, as well as enhanced user interaction. The expansion of smart home devices and the development of new consumer electronics with advanced motion-sensing capabilities offer further untapped potential. The advancements in robotics and automation across various industries, from manufacturing to logistics, are creating a demand for more precise and responsive motion sensing solutions. Additionally, the exploration of new materials and fabrication techniques for accelerometers could lead to novel applications in areas such as medical diagnostics and advanced material testing.

Leading Players in the Accelerometer Electronic Sensors Market

- Bosch

- NXP

- STMicroelectronics

- Murata

- PCB Piezotronics

- Analog Devices Inc.

- TDK

- Kionix (ROHM)

- Honeywell International Inc.

- TE

- mCube

- KISTLER

- Meggitt Sensing Systems

- Memsic

- Safran Colibrys

- Metrix Instrument (Roper)

- Dytran Instruments

- Bruel and Kjaer (Spectris)

- Kyowa Electronic Instruments

- Miramems

- RION

- Mtmems

- QST

- IMV Corporation

- ASC GmbH

- Memsensing

Key Developments in the Accelerometer Electronic Sensors Industry

- 2023 May: Bosch announces a new generation of compact, low-power MEMS accelerometers with enhanced accuracy for consumer electronics and IoT applications.

- 2023 July: STMicroelectronics introduces an automotive-grade accelerometer with advanced diagnostic capabilities, supporting the growing demand for functional safety in vehicles.

- 2023 September: Analog Devices Inc. launches a high-performance inertial sensor module integrating accelerometers and gyroscopes for industrial automation and robotics.

- 2024 January: Murata acquires a stake in a specialized MEMS sensor manufacturer, expanding its portfolio in high-sensitivity accelerometers for niche markets.

- 2024 March: TDK showcases a new series of robust accelerometers designed for extreme temperature environments in oil and gas exploration.

Strategic Outlook for Accelerometer Electronic Sensors Market

- 2023 May: Bosch announces a new generation of compact, low-power MEMS accelerometers with enhanced accuracy for consumer electronics and IoT applications.

- 2023 July: STMicroelectronics introduces an automotive-grade accelerometer with advanced diagnostic capabilities, supporting the growing demand for functional safety in vehicles.

- 2023 September: Analog Devices Inc. launches a high-performance inertial sensor module integrating accelerometers and gyroscopes for industrial automation and robotics.

- 2024 January: Murata acquires a stake in a specialized MEMS sensor manufacturer, expanding its portfolio in high-sensitivity accelerometers for niche markets.

- 2024 March: TDK showcases a new series of robust accelerometers designed for extreme temperature environments in oil and gas exploration.

Strategic Outlook for Accelerometer Electronic Sensors Market

The strategic outlook for the accelerometer electronic sensors market remains exceptionally positive, fueled by the relentless pace of technological innovation and the expanding application landscape. The increasing convergence of AI, IoT, and advanced sensor technology will continue to drive demand for more intelligent and integrated accelerometer solutions. Manufacturers focusing on miniaturization, power efficiency, and enhanced performance metrics will be well-positioned for success. Strategic partnerships and collaborations will be crucial for companies looking to address complex market needs, particularly in the burgeoning fields of autonomous systems and smart infrastructure. The growing emphasis on predictive maintenance and condition monitoring across industries presents a significant opportunity for growth, as accelerometers play a pivotal role in early fault detection and preventing costly downtime. The continued evolution of the automotive sector, with its drive towards electrification and autonomy, will remain a cornerstone of market expansion.

Accelerometer Electronic Sensors Segmentation

-

1. Application

- 1.1. Automobile

- 1.2. Consumer Electronics

- 1.3. Aerospace and National Defense

- 1.4. Other

-

2. Type

- 2.1. Piezoelectric Type

- 2.2. Piezoresistive Type

- 2.3. Others

Accelerometer Electronic Sensors Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Accelerometer Electronic Sensors REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.4% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Accelerometer Electronic Sensors Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Automobile

- 5.1.2. Consumer Electronics

- 5.1.3. Aerospace and National Defense

- 5.1.4. Other

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Piezoelectric Type

- 5.2.2. Piezoresistive Type

- 5.2.3. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Accelerometer Electronic Sensors Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Automobile

- 6.1.2. Consumer Electronics

- 6.1.3. Aerospace and National Defense

- 6.1.4. Other

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Piezoelectric Type

- 6.2.2. Piezoresistive Type

- 6.2.3. Others

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Accelerometer Electronic Sensors Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Automobile

- 7.1.2. Consumer Electronics

- 7.1.3. Aerospace and National Defense

- 7.1.4. Other

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Piezoelectric Type

- 7.2.2. Piezoresistive Type

- 7.2.3. Others

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Accelerometer Electronic Sensors Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Automobile

- 8.1.2. Consumer Electronics

- 8.1.3. Aerospace and National Defense

- 8.1.4. Other

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Piezoelectric Type

- 8.2.2. Piezoresistive Type

- 8.2.3. Others

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Accelerometer Electronic Sensors Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Automobile

- 9.1.2. Consumer Electronics

- 9.1.3. Aerospace and National Defense

- 9.1.4. Other

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Piezoelectric Type

- 9.2.2. Piezoresistive Type

- 9.2.3. Others

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Accelerometer Electronic Sensors Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Automobile

- 10.1.2. Consumer Electronics

- 10.1.3. Aerospace and National Defense

- 10.1.4. Other

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Piezoelectric Type

- 10.2.2. Piezoresistive Type

- 10.2.3. Others

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Bosch

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 NXP

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 STMicroelectronics

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Murata

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 PCB Piezotronics

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Analog Devices Inc.

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 TDK

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Kionix (ROHM)

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Honeywell International Inc.

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 TE

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 mCube

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 KISTLER

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Meggitt Sensing Systems

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Memsic

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Safran Colibrys

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Metrix Instrument (Roper)

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Dytran Instruments

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 Bruel and Kjaer (Spectris)

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 Kyowa Electronic Instruments

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.20 Miramems

- 11.2.20.1. Overview

- 11.2.20.2. Products

- 11.2.20.3. SWOT Analysis

- 11.2.20.4. Recent Developments

- 11.2.20.5. Financials (Based on Availability)

- 11.2.21 RION

- 11.2.21.1. Overview

- 11.2.21.2. Products

- 11.2.21.3. SWOT Analysis

- 11.2.21.4. Recent Developments

- 11.2.21.5. Financials (Based on Availability)

- 11.2.22 Mtmems

- 11.2.22.1. Overview

- 11.2.22.2. Products

- 11.2.22.3. SWOT Analysis

- 11.2.22.4. Recent Developments

- 11.2.22.5. Financials (Based on Availability)

- 11.2.23 QST

- 11.2.23.1. Overview

- 11.2.23.2. Products

- 11.2.23.3. SWOT Analysis

- 11.2.23.4. Recent Developments

- 11.2.23.5. Financials (Based on Availability)

- 11.2.24 IMV Corporation

- 11.2.24.1. Overview

- 11.2.24.2. Products

- 11.2.24.3. SWOT Analysis

- 11.2.24.4. Recent Developments

- 11.2.24.5. Financials (Based on Availability)

- 11.2.25 ASC GmbH

- 11.2.25.1. Overview

- 11.2.25.2. Products

- 11.2.25.3. SWOT Analysis

- 11.2.25.4. Recent Developments

- 11.2.25.5. Financials (Based on Availability)

- 11.2.26 Memsensing

- 11.2.26.1. Overview

- 11.2.26.2. Products

- 11.2.26.3. SWOT Analysis

- 11.2.26.4. Recent Developments

- 11.2.26.5. Financials (Based on Availability)

- 11.2.1 Bosch

List of Figures

- Figure 1: Global Accelerometer Electronic Sensors Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Accelerometer Electronic Sensors Revenue (million), by Application 2024 & 2032

- Figure 3: North America Accelerometer Electronic Sensors Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Accelerometer Electronic Sensors Revenue (million), by Type 2024 & 2032

- Figure 5: North America Accelerometer Electronic Sensors Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Accelerometer Electronic Sensors Revenue (million), by Country 2024 & 2032

- Figure 7: North America Accelerometer Electronic Sensors Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Accelerometer Electronic Sensors Revenue (million), by Application 2024 & 2032

- Figure 9: South America Accelerometer Electronic Sensors Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Accelerometer Electronic Sensors Revenue (million), by Type 2024 & 2032

- Figure 11: South America Accelerometer Electronic Sensors Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America Accelerometer Electronic Sensors Revenue (million), by Country 2024 & 2032

- Figure 13: South America Accelerometer Electronic Sensors Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Accelerometer Electronic Sensors Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Accelerometer Electronic Sensors Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Accelerometer Electronic Sensors Revenue (million), by Type 2024 & 2032

- Figure 17: Europe Accelerometer Electronic Sensors Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Accelerometer Electronic Sensors Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Accelerometer Electronic Sensors Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Accelerometer Electronic Sensors Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Accelerometer Electronic Sensors Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Accelerometer Electronic Sensors Revenue (million), by Type 2024 & 2032

- Figure 23: Middle East & Africa Accelerometer Electronic Sensors Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa Accelerometer Electronic Sensors Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Accelerometer Electronic Sensors Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Accelerometer Electronic Sensors Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Accelerometer Electronic Sensors Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Accelerometer Electronic Sensors Revenue (million), by Type 2024 & 2032

- Figure 29: Asia Pacific Accelerometer Electronic Sensors Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific Accelerometer Electronic Sensors Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Accelerometer Electronic Sensors Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Accelerometer Electronic Sensors Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Accelerometer Electronic Sensors Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Accelerometer Electronic Sensors Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Accelerometer Electronic Sensors Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Accelerometer Electronic Sensors Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Accelerometer Electronic Sensors Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global Accelerometer Electronic Sensors Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Accelerometer Electronic Sensors Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Accelerometer Electronic Sensors Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Accelerometer Electronic Sensors Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Accelerometer Electronic Sensors Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Accelerometer Electronic Sensors Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global Accelerometer Electronic Sensors Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Accelerometer Electronic Sensors Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Accelerometer Electronic Sensors Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Accelerometer Electronic Sensors Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Accelerometer Electronic Sensors Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Accelerometer Electronic Sensors Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global Accelerometer Electronic Sensors Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Accelerometer Electronic Sensors Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Accelerometer Electronic Sensors Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Accelerometer Electronic Sensors Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Accelerometer Electronic Sensors Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Accelerometer Electronic Sensors Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Accelerometer Electronic Sensors Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Accelerometer Electronic Sensors Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Accelerometer Electronic Sensors Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Accelerometer Electronic Sensors Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Accelerometer Electronic Sensors Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Accelerometer Electronic Sensors Revenue million Forecast, by Type 2019 & 2032

- Table 31: Global Accelerometer Electronic Sensors Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Accelerometer Electronic Sensors Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Accelerometer Electronic Sensors Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Accelerometer Electronic Sensors Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Accelerometer Electronic Sensors Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Accelerometer Electronic Sensors Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Accelerometer Electronic Sensors Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Accelerometer Electronic Sensors Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Accelerometer Electronic Sensors Revenue million Forecast, by Type 2019 & 2032

- Table 40: Global Accelerometer Electronic Sensors Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Accelerometer Electronic Sensors Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Accelerometer Electronic Sensors Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Accelerometer Electronic Sensors Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Accelerometer Electronic Sensors Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Accelerometer Electronic Sensors Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Accelerometer Electronic Sensors Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Accelerometer Electronic Sensors Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Accelerometer Electronic Sensors?

The projected CAGR is approximately 4.4%.

2. Which companies are prominent players in the Accelerometer Electronic Sensors?

Key companies in the market include Bosch, NXP, STMicroelectronics, Murata, PCB Piezotronics, Analog Devices Inc., TDK, Kionix (ROHM), Honeywell International Inc., TE, mCube, KISTLER, Meggitt Sensing Systems, Memsic, Safran Colibrys, Metrix Instrument (Roper), Dytran Instruments, Bruel and Kjaer (Spectris), Kyowa Electronic Instruments, Miramems, RION, Mtmems, QST, IMV Corporation, ASC GmbH, Memsensing.

3. What are the main segments of the Accelerometer Electronic Sensors?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 3147 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4250.00, USD 6375.00, and USD 8500.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Accelerometer Electronic Sensors," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Accelerometer Electronic Sensors report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Accelerometer Electronic Sensors?

To stay informed about further developments, trends, and reports in the Accelerometer Electronic Sensors, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence