Key Insights

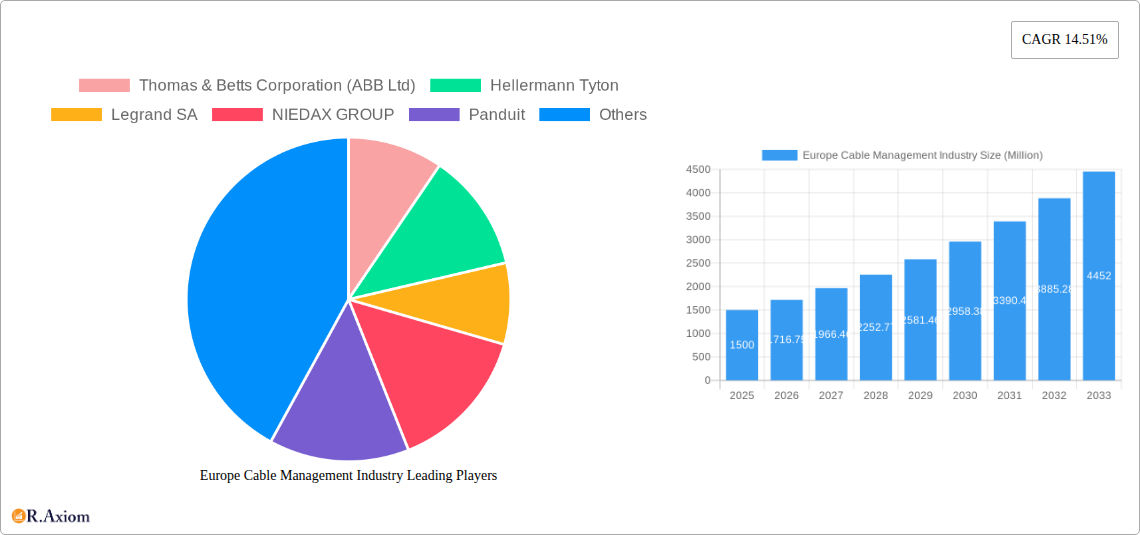

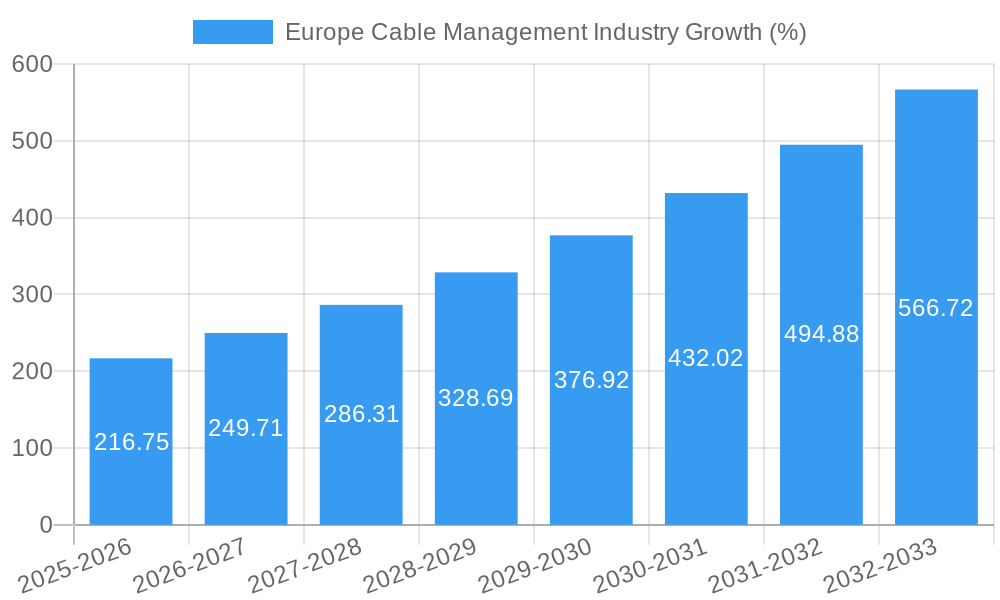

The European cable management market, valued at approximately €X million in 2025 (estimated based on provided CAGR and market size), is experiencing robust growth, projected to maintain a Compound Annual Growth Rate (CAGR) of 14.51% from 2025 to 2033. This expansion is driven by several key factors. Firstly, the burgeoning IT and telecommunications sector, coupled with increasing infrastructure development across various end-user industries like construction, energy, and manufacturing, fuels significant demand for efficient cable management solutions. Secondly, the rising adoption of smart buildings and smart cities initiatives necessitates advanced cable management systems to accommodate the complex network infrastructure. Furthermore, stringent safety regulations and the need for improved data center efficiency are pushing the adoption of high-quality, reliable cable management products. Growth is particularly strong in countries like Germany, the UK, and France, which are major economic hubs within Europe, driving significant market share. However, challenges such as fluctuating raw material prices and economic uncertainty in certain regions could potentially restrain market growth. The market is segmented by product type (cable trays, raceways, conduits, etc.), end-user industry (IT, construction, energy, etc.), and material (metallic, non-metallic), providing diverse opportunities for specialized manufacturers.

The competitive landscape is characterized by a mix of established global players like ABB, Legrand, and Schneider Electric, and smaller specialized companies. These companies are focusing on product innovation, strategic partnerships, and geographic expansion to capture a larger market share. The increasing demand for sustainable and environmentally friendly cable management solutions is also influencing market dynamics, with manufacturers emphasizing eco-friendly materials and production processes. The forecast period suggests continued growth, with the market potentially exceeding €Y million by 2033 (estimated based on CAGR). The market will likely witness further consolidation and increased competition as companies strive to meet the escalating demand for sophisticated cable management systems across diverse applications. Continuous technological advancements and evolving industry standards will also shape the trajectory of this dynamic market.

Europe Cable Management Industry: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Europe cable management industry, covering market size, growth drivers, key players, and future trends. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The report offers valuable insights for industry stakeholders, investors, and businesses seeking to understand this dynamic market.

Europe Cable Management Industry Market Concentration & Innovation

The European cable management market exhibits a moderately concentrated landscape, with several major players holding significant market share. While precise figures for market share fluctuate annually, leading companies such as ABB Ltd, Legrand SA, Schneider Electric SE, and Eaton Corporation PLC collectively account for a substantial portion (estimated xx%) of the total revenue. This concentration is driven by extensive product portfolios, strong brand recognition, and established distribution networks.

Innovation in the sector is fueled by the increasing demand for efficient, safe, and sustainable cable management solutions. Stringent regulatory frameworks, particularly concerning environmental compliance and safety standards, are shaping product development. The rise of smart buildings and Industry 4.0 are further driving the adoption of advanced cable management systems. Product substitutes, such as wireless technologies, pose a limited threat, as wired connections remain crucial for high-bandwidth applications. The industry witnesses frequent mergers and acquisitions (M&A) activities, aimed at expanding market reach and technological capabilities. Recent M&A deal values have ranged from xx Million to xx Million, reflecting the consolidation trends within the market.

Europe Cable Management Industry Industry Trends & Insights

The European cable management industry is experiencing robust growth, driven by several key factors. The surging demand for robust and efficient data centers is a significant contributor, necessitating sophisticated cable management solutions to meet stringent performance requirements. Moreover, expanding infrastructure projects across various sectors, including construction, energy, and telecommunications, fuel the demand for cable management systems. Technological advancements, such as the integration of smart technologies into cable management solutions, are also boosting market expansion. The industry is witnessing a shift towards sustainable and eco-friendly materials, reflecting a growing awareness of environmental concerns. Consumer preferences are leaning towards solutions that offer ease of installation, flexibility, and long-term reliability. The competitive landscape is characterized by intense competition, with companies focusing on product innovation, strategic partnerships, and geographical expansion to gain a competitive edge. The Compound Annual Growth Rate (CAGR) for the forecast period (2025-2033) is estimated at xx%, indicating substantial market growth potential. Market penetration is relatively high in developed economies like the UK and Germany, while untapped opportunities remain in other regions.

Dominant Markets & Segments in Europe Cable Management Industry

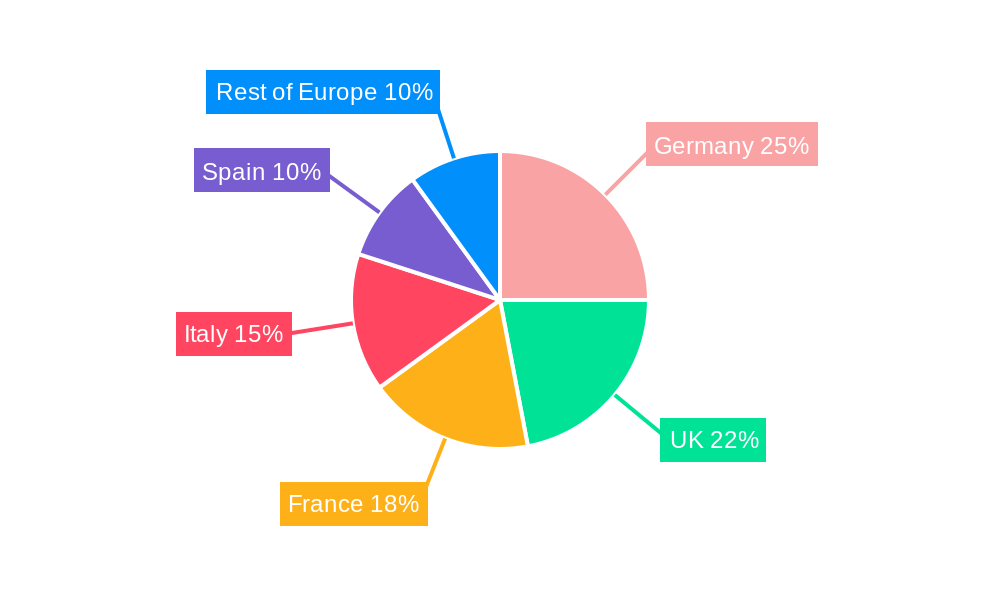

Dominant Regions/Countries: The United Kingdom, Germany, and France currently represent the largest markets within Europe, driven by robust construction activities, substantial investments in infrastructure development, and a high concentration of data centers and industrial facilities. These regions benefit from well-established infrastructure, strong economic growth, and supportive government policies.

Dominant Product Types: Cable trays maintain a significant market share, owing to their versatility and ability to accommodate large cable bundles. Cable conduits, cable raceways, and connectors/glands also hold considerable market share due to their widespread applications across various sectors.

Dominant End-User Industries: The IT and telecommunication sector, followed by the construction and energy & utility sectors, are major consumers of cable management solutions. The rising demand for data centers and the expansion of renewable energy infrastructure are key factors driving growth in these sectors.

- Key Drivers:

- Robust construction activities

- Expansion of renewable energy infrastructure

- Growing data center market

- Investments in smart city initiatives

- Stringent safety and environmental regulations

Dominant Applications: Commercial and industrial applications currently dominate the market, driven by the need for efficient cable management in large-scale projects and industrial facilities.

Dominant Materials: Metallic materials, primarily steel and aluminum, maintain a larger share due to their strength and durability. However, the demand for non-metallic materials, such as PVC and plastic, is growing, driven by their cost-effectiveness and lightweight properties.

Europe Cable Management Industry Product Developments

Recent product innovations reflect the industry’s focus on enhanced safety, improved efficiency, and sustainable materials. The launch of HellermannTyton’s Hela DoubleGuardSruglit Conduit, a two-piece solution offering flexible corrugated protection, exemplifies this trend. Such innovations aim to address specific market needs and provide competitive advantages through improved functionality, ease of installation, and enhanced durability. The integration of smart technologies is also gaining traction, with solutions incorporating sensors and data analytics to optimize cable management and improve operational efficiency.

Report Scope & Segmentation Analysis

This report segments the European cable management market across various parameters:

By Country: United Kingdom, Germany, France, Italy, Spain, Russia, and Other Countries. Growth projections vary significantly across countries, with the UK, Germany, and France exhibiting higher growth rates.

By Product Type: Cable Trays, Cable Raceways, Cable Conduits, Connectors and Glands, Cable Carriers, Cable Lugs, Junction/Distribution Boxes, and Other Product Types (Ties, Covers, Fasteners, and Clips). Market sizes and competitive dynamics differ significantly across product types.

By End-User Industry: IT and Telecommunication, Construction, Energy and Utility, Manufacturing, Commercial, and Other End-User Industries. Each end-user industry exhibits unique needs and demands, impacting product selection and market size.

By Application: Residential, Commercial, and Industrial. Market size and growth projections vary across application segments.

By Material: Metallic and Non-metallic. The choice of material significantly influences product cost, performance, and sustainability.

Key Drivers of Europe Cable Management Industry Growth

The growth of the European cable management industry is driven by several factors:

- Technological advancements: The development of innovative cable management solutions with enhanced features, such as integrated sensors and smart functionalities.

- Infrastructure development: Significant investments in infrastructure projects across various sectors, including construction, energy, and telecommunications, fuels demand.

- Stringent regulations: Stricter regulations on safety and environmental compliance drive the adoption of advanced, compliant solutions.

Challenges in the Europe Cable Management Industry Sector

The European cable management industry faces challenges, including:

- Supply chain disruptions: Global supply chain uncertainties impact material availability and production costs.

- Intense competition: The market is characterized by intense competition, affecting pricing and profitability.

- Fluctuating raw material prices: Increases in the cost of raw materials, such as steel and plastics, directly impact production expenses.

Emerging Opportunities in Europe Cable Management Industry

Emerging opportunities exist in:

- Smart cable management systems: Integration of smart technologies offers opportunities for improved efficiency and data-driven optimization.

- Sustainable solutions: The growing demand for eco-friendly materials and sustainable manufacturing practices.

- Expansion into Eastern European markets: Untapped potential exists in less developed markets.

Leading Players in the Europe Cable Management Industry Market

- ABB Ltd (Thomas & Betts Corporation)

- HellermannTyton

- Legrand SA

- NIEDAX GROUP

- Panduit

- Vantrunk International

- Marco Cable Management

- TE Connectivity

- Schneider Electric SE

- Eaton Corporation PLC

- Leviton Manufacturing UK Limited

- Hubbell

Key Developments in Europe Cable Management Industry Industry

August 2022: HellermannTyton launches Hela DoubleGuardSruglit Conduit, a two-piece solution offering flexible corrugated protection for cable bundles. This launch enhances the company's product portfolio and caters to the growing demand for innovative cable management solutions.

May 2022: Nexans secures a USD 100 Million contract with Enedis for medium-voltage power distribution services and cables over four years. This significant deal strengthens Nexans’ position in the French market and underscores the growing demand for sustainable electrification solutions.

Strategic Outlook for Europe Cable Management Industry Market

The future of the European cable management industry is promising, driven by sustained growth in key sectors, technological advancements, and rising investments in infrastructure development. The increasing demand for data centers, renewable energy infrastructure, and smart city initiatives will continue to propel market growth. Companies focusing on innovation, sustainability, and efficient supply chain management are poised to benefit from the expanding market opportunities. The industry will likely see further consolidation through mergers and acquisitions, leading to a more concentrated yet technologically advanced market landscape.

Europe Cable Management Industry Segmentation

-

1. Product Type

- 1.1. Cable Trays

- 1.2. Cable Raceways

- 1.3. Cable Conduits

- 1.4. Connectors and Glands

- 1.5. Cable Carriers

- 1.6. Cable Lugs

- 1.7. Junction/Distribution Boxes

- 1.8. Other Pr

-

2. End-User Industry

- 2.1. IT and Telecommunication

- 2.2. Construction

- 2.3. Energy and Utility

- 2.4. Manufacturing

- 2.5. Commercial

- 2.6. Other End-User Industries

-

3. Application

- 3.1. Residential

- 3.2. Commercial

- 3.3. Industrial

-

4. Material

- 4.1. Metallic

-

4.2. Non-metallic

- 4.2.1. PVC

- 4.2.2. PP

- 4.2.3. PE

- 4.2.4. Other Materials

Europe Cable Management Industry Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Cable Management Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 14.51% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Innovation and Development in the Cable Management Market; Upgrade and Renewal of Existing Networks in the Developed Economies

- 3.3. Market Restrains

- 3.3.1. Fluctuating Market Demands and Customization Issues

- 3.4. Market Trends

- 3.4.1. IT and Telecom Industry to drive the market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Cable Management Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Cable Trays

- 5.1.2. Cable Raceways

- 5.1.3. Cable Conduits

- 5.1.4. Connectors and Glands

- 5.1.5. Cable Carriers

- 5.1.6. Cable Lugs

- 5.1.7. Junction/Distribution Boxes

- 5.1.8. Other Pr

- 5.2. Market Analysis, Insights and Forecast - by End-User Industry

- 5.2.1. IT and Telecommunication

- 5.2.2. Construction

- 5.2.3. Energy and Utility

- 5.2.4. Manufacturing

- 5.2.5. Commercial

- 5.2.6. Other End-User Industries

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Residential

- 5.3.2. Commercial

- 5.3.3. Industrial

- 5.4. Market Analysis, Insights and Forecast - by Material

- 5.4.1. Metallic

- 5.4.2. Non-metallic

- 5.4.2.1. PVC

- 5.4.2.2. PP

- 5.4.2.3. PE

- 5.4.2.4. Other Materials

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Germany Europe Cable Management Industry Analysis, Insights and Forecast, 2019-2031

- 7. France Europe Cable Management Industry Analysis, Insights and Forecast, 2019-2031

- 8. Italy Europe Cable Management Industry Analysis, Insights and Forecast, 2019-2031

- 9. United Kingdom Europe Cable Management Industry Analysis, Insights and Forecast, 2019-2031

- 10. Netherlands Europe Cable Management Industry Analysis, Insights and Forecast, 2019-2031

- 11. Sweden Europe Cable Management Industry Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Europe Europe Cable Management Industry Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Thomas & Betts Corporation (ABB Ltd)

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Hellermann Tyton

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Legrand SA

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 NIEDAX GROUP

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Panduit

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Vantrunk International

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Marco Cable Management

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 TE Connectivity

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Schneider Electric SE

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Eaton Corporation PLC

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 Leviton Manufacturing UK Limited

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.12 Hubbell*List Not Exhaustive

- 13.2.12.1. Overview

- 13.2.12.2. Products

- 13.2.12.3. SWOT Analysis

- 13.2.12.4. Recent Developments

- 13.2.12.5. Financials (Based on Availability)

- 13.2.1 Thomas & Betts Corporation (ABB Ltd)

List of Figures

- Figure 1: Europe Cable Management Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe Cable Management Industry Share (%) by Company 2024

List of Tables

- Table 1: Europe Cable Management Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe Cable Management Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 3: Europe Cable Management Industry Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 4: Europe Cable Management Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 5: Europe Cable Management Industry Revenue Million Forecast, by Material 2019 & 2032

- Table 6: Europe Cable Management Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 7: Europe Cable Management Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Germany Europe Cable Management Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: France Europe Cable Management Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Italy Europe Cable Management Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: United Kingdom Europe Cable Management Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Netherlands Europe Cable Management Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Sweden Europe Cable Management Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Rest of Europe Europe Cable Management Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Europe Cable Management Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 16: Europe Cable Management Industry Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 17: Europe Cable Management Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 18: Europe Cable Management Industry Revenue Million Forecast, by Material 2019 & 2032

- Table 19: Europe Cable Management Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Europe Cable Management Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Germany Europe Cable Management Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: France Europe Cable Management Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Italy Europe Cable Management Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Spain Europe Cable Management Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Netherlands Europe Cable Management Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Belgium Europe Cable Management Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Sweden Europe Cable Management Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Norway Europe Cable Management Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Poland Europe Cable Management Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Denmark Europe Cable Management Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Cable Management Industry?

The projected CAGR is approximately 14.51%.

2. Which companies are prominent players in the Europe Cable Management Industry?

Key companies in the market include Thomas & Betts Corporation (ABB Ltd), Hellermann Tyton, Legrand SA, NIEDAX GROUP, Panduit, Vantrunk International, Marco Cable Management, TE Connectivity, Schneider Electric SE, Eaton Corporation PLC, Leviton Manufacturing UK Limited, Hubbell*List Not Exhaustive.

3. What are the main segments of the Europe Cable Management Industry?

The market segments include Product Type, End-User Industry, Application, Material.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Innovation and Development in the Cable Management Market; Upgrade and Renewal of Existing Networks in the Developed Economies.

6. What are the notable trends driving market growth?

IT and Telecom Industry to drive the market.

7. Are there any restraints impacting market growth?

Fluctuating Market Demands and Customization Issues.

8. Can you provide examples of recent developments in the market?

August 2022 - HellermannTytonh has announced the launch of Hela DoubleGuardSruglit Conduit. The twopiece solution is composed of one rigid tube that attaches to the other and wraps itself in a bundle of cables or wires. This means that, in addition to the wires which are already connected at one end, flexible corrugated protection can be added.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Cable Management Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Cable Management Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Cable Management Industry?

To stay informed about further developments, trends, and reports in the Europe Cable Management Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence