Key Insights

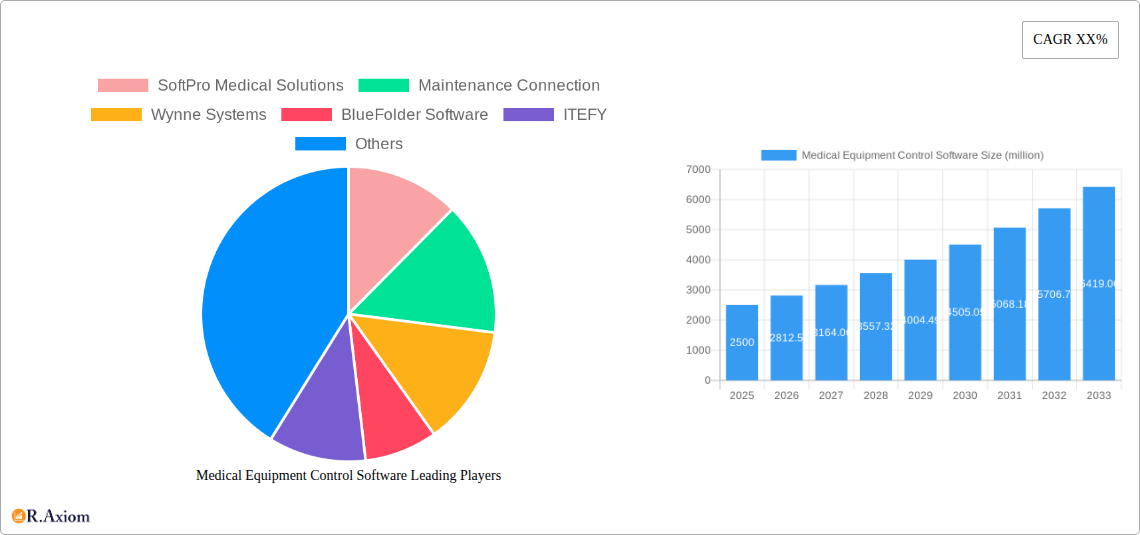

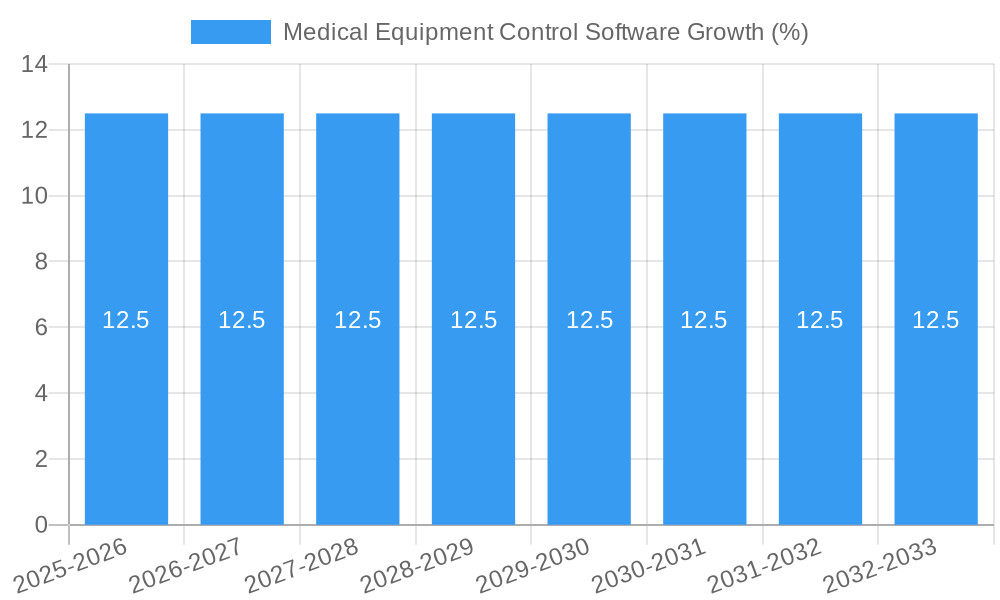

The global Medical Equipment Control Software market is projected to reach an estimated USD 2,500 million in 2025, exhibiting a robust Compound Annual Growth Rate (CAGR) of 12.5% through 2033. This significant expansion is fueled by the increasing complexity of medical devices, the growing demand for enhanced patient safety, and the critical need for efficient asset management within healthcare facilities. The stringent regulatory landscape surrounding medical devices, mandating detailed tracking and control, further propels the adoption of these sophisticated software solutions. Key drivers include the rising prevalence of chronic diseases, necessitating advanced diagnostic and therapeutic equipment, and the continuous technological advancements in medical devices, which require specialized software for their effective operation and maintenance. The market is witnessing a pronounced shift towards cloud-based solutions, offering greater scalability, accessibility, and data analytics capabilities, thereby optimizing operational workflows and reducing downtime.

The market is segmented across various applications, with Hospitals representing the largest share due to their extensive medical equipment inventory and critical need for regulatory compliance and operational efficiency. The Class II Medical Equipment Control Software segment is expected to witness substantial growth, driven by the increasing deployment of moderately complex medical devices that require rigorous control and monitoring. Key trends shaping the market include the integration of Artificial Intelligence (AI) and Machine Learning (ML) for predictive maintenance, real-time equipment performance monitoring, and proactive issue resolution. Furthermore, the growing emphasis on cybersecurity within healthcare is leading to increased demand for robust software solutions that ensure data integrity and patient privacy. Restraints include the initial high implementation costs and the need for skilled IT professionals to manage and operate these complex systems. However, the long-term benefits of improved patient outcomes, reduced operational expenses, and enhanced regulatory adherence are expected to outweigh these challenges, positioning the Medical Equipment Control Software market for sustained and dynamic growth.

Medical Equipment Control Software Market Concentration & Innovation

The Medical Equipment Control Software market exhibits a dynamic landscape characterized by moderate concentration and a strong emphasis on continuous innovation. Key players are actively engaged in research and development to enhance compliance, streamline operations, and improve patient safety. SoftPro Medical Solutions, Maintenance Connection, and Wynne Systems are among the prominent companies driving innovation, alongside emerging contenders like ITEFY and Timly. Regulatory frameworks, particularly those from the FDA and EMA, significantly influence product development and market entry strategies, pushing for robust data security and validation protocols. The threat of product substitutes, such as manual tracking systems or less integrated software solutions, remains a consideration, but the increasing complexity and interconnectedness of medical devices favor specialized software. End-user trends lean towards cloud-based solutions for enhanced accessibility and scalability, with hospitals representing the largest segment. Mergers and acquisitions (M&A) are anticipated to play a crucial role in shaping market concentration. Several significant M&A deals are projected, with an estimated aggregate value of over $1,500 million during the forecast period. For instance, the acquisition of a specialized medical asset management company by a larger healthcare IT provider is expected to further consolidate market share.

Medical Equipment Control Software Industry Trends & Insights

The Medical Equipment Control Software market is poised for robust expansion, driven by an increasing demand for efficient, compliant, and data-driven healthcare operations. The market is projected to grow at a Compound Annual Growth Rate (CAGR) of approximately 14.5% from 2025 to 2033. This impressive growth is underpinned by several key factors. Firstly, the escalating complexity of medical devices, coupled with stringent regulatory requirements for their lifecycle management, necessitates sophisticated control software. Hospitals and healthcare facilities are investing heavily in solutions that ensure asset traceability, maintenance scheduling, and regulatory adherence, thereby minimizing risks and optimizing resource allocation. The adoption of digital health technologies and the growing emphasis on patient safety are further accelerating market penetration. Furthermore, the rise of IoT-enabled medical equipment generates vast amounts of data, creating a significant need for integrated software platforms capable of managing, analyzing, and securing this information. Technological disruptions, such as the integration of Artificial Intelligence (AI) and Machine Learning (ML) for predictive maintenance and advanced analytics, are transforming the capabilities of these software solutions. AI-powered algorithms can now predict equipment failures before they occur, reducing downtime and associated costs. Consumer preferences are shifting towards user-friendly, cloud-based platforms that offer seamless integration with existing hospital information systems (HIS) and electronic health records (EHRs). The competitive dynamics are characterized by intense innovation, strategic partnerships, and a focus on delivering comprehensive lifecycle management solutions. Companies are differentiating themselves through advanced features, specialized modules for different medical equipment classes, and superior customer support. The global market penetration of medical equipment control software is projected to reach over 55% by 2033, indicating a substantial market opportunity. The increasing awareness of the benefits of digitized asset management, including improved operational efficiency, enhanced patient outcomes, and reduced costs, is driving this widespread adoption.

Dominant Markets & Segments in Medical Equipment Control Software

The Medical Equipment Control Software market is experiencing significant growth and evolution across various applications and equipment types.

Dominant Application Segment: Hospital

- Market Size: The hospital segment is projected to hold the largest market share, estimated at over $3,500 million by 2033.

- Key Drivers:

- Regulatory Compliance: Hospitals are under immense pressure to comply with stringent healthcare regulations (e.g., FDA, HIPAA, JCAHO) regarding medical equipment maintenance, calibration, and safety. Control software provides the necessary audit trails and documentation.

- Operational Efficiency: Managing a vast inventory of diverse medical equipment requires sophisticated software for tracking asset location, utilization, and maintenance schedules, leading to optimized resource allocation and reduced downtime.

- Patient Safety: Ensuring that all medical devices are properly maintained and calibrated is paramount for patient safety. Control software plays a critical role in preventing equipment malfunctions that could lead to adverse patient events.

- Cost Management: Proactive maintenance scheduling and optimized asset utilization through software can lead to significant cost savings by extending equipment lifespan and reducing emergency repair expenses.

- Technological Advancements: The increasing adoption of advanced medical technologies and connected devices within hospitals necessitates integrated control and management solutions.

Dominant Type Segment: Class III Medical Equipment Control Software

- Market Share: This segment is expected to capture a substantial market share, estimated at over $2,800 million by 2033.

- Key Drivers:

- High Risk and Complexity: Class III medical devices, such as pacemakers, ventilators, and defibrillators, are life-sustaining or life-supporting and carry the highest risk associated with malfunction. This demands the most rigorous control and oversight.

- Stringent Regulatory Scrutiny: Regulatory bodies impose the most stringent requirements on the design, manufacturing, and post-market surveillance of Class III devices, necessitating specialized control software for comprehensive lifecycle management.

- Advanced Maintenance and Calibration: These devices often require complex, highly specialized maintenance and calibration procedures, which are effectively managed and documented by dedicated control software.

- Investment in Critical Assets: Hospitals and healthcare providers invest heavily in Class III medical equipment, making robust control and management a priority to protect these high-value assets and ensure their optimal performance.

- Innovation in Devices: Continuous innovation in Class III medical devices, including advancements in implantable devices and complex diagnostic equipment, drives the need for equally advanced control software.

The Household and Other application segments, while smaller, are expected to demonstrate steady growth, driven by the increasing decentralization of healthcare services and the rise of home-based medical care. Similarly, Class I and Class II Medical Equipment Control Software will continue to be vital, catering to a broad range of medical devices with varying risk profiles. The market’s expansion is also influenced by economic policies that support healthcare infrastructure development and government initiatives promoting the digitization of healthcare systems globally.

Medical Equipment Control Software Product Developments

Product developments in the Medical Equipment Control Software market are heavily focused on enhancing cybersecurity, integrating AI for predictive maintenance, and offering cloud-native solutions for greater accessibility and scalability. Companies are introducing features that enable real-time monitoring of device performance, automated compliance reporting, and seamless integration with electronic health records (EHRs). The competitive advantage lies in providing comprehensive, end-to-end lifecycle management from procurement and installation to maintenance, calibration, and decommissioning. Innovations are also targeting user experience, with intuitive dashboards and mobile accessibility becoming standard, ensuring efficient management of diverse medical assets across healthcare settings.

Report Scope & Segmentation Analysis

This report analyzes the Medical Equipment Control Software market across key segments, providing detailed insights into their growth trajectories and market sizes.

- Application: Hospital: This segment, representing the largest market share, is projected to reach over $3,500 million by 2033. Growth is fueled by stringent regulatory demands and the need for operational efficiency in managing extensive medical equipment inventories.

- Application: Household: While a smaller segment, the household application is anticipated to experience substantial growth, driven by the expansion of home healthcare services and the increasing use of medical devices in domestic settings. Projected market size is around $800 million by 2033.

- Application: Other: This segment encompasses specialized healthcare facilities, research institutions, and veterinary clinics, and is expected to grow steadily, reaching an estimated $1,200 million by 2033, driven by the diverse needs of these entities.

- Type: Class I Medical Equipment Control Software: This segment caters to low-risk devices and is projected to reach approximately $1,000 million by 2033, driven by widespread use in basic healthcare settings.

- Type: Class II Medical Equipment Control Software: Addressing moderate-risk devices, this segment is expected to grow to over $2,000 million by 2033, reflecting its critical role in standard medical procedures.

- Type: Class III Medical Equipment Control Software: As the highest-risk category, this segment commands the largest share within the types, projected at over $2,800 million by 2033, due to its essential role in life-sustaining and life-supporting devices.

Key Drivers of Medical Equipment Control Software Growth

The growth of the Medical Equipment Control Software market is propelled by a confluence of factors. Increasingly stringent regulatory mandates worldwide are a primary driver, compelling healthcare providers to adopt software for compliance and audit readiness. The escalating cost of healthcare and the imperative to optimize operational efficiency, reduce equipment downtime, and extend asset lifespan through proactive maintenance also contribute significantly. Furthermore, the growing complexity and interconnectedness of modern medical devices, including the proliferation of IoT-enabled equipment, necessitate sophisticated management and control solutions. Advancements in cloud computing and data analytics are enabling more accessible, scalable, and intelligent software platforms, further fueling market expansion.

Challenges in the Medical Equipment Control Software Sector

Despite significant growth potential, the Medical Equipment Control Software sector faces several challenges. Cybersecurity threats to sensitive patient data and operational integrity remain a paramount concern, requiring continuous investment in robust security measures. The high initial cost of implementation and integration with existing legacy systems can be a barrier for smaller healthcare providers. Furthermore, the complexity of navigating diverse and evolving regulatory landscapes across different regions poses a continuous challenge for software developers and users. A shortage of skilled IT professionals capable of managing and maintaining these sophisticated systems also presents a restraint. Finally, the resistance to change within some healthcare organizations can slow down the adoption of new software solutions.

Emerging Opportunities in Medical Equipment Control Software

Emerging opportunities in the Medical Equipment Control Software market are abundant, particularly in the realm of predictive maintenance powered by AI and machine learning, promising to significantly reduce equipment downtime. The expansion of telehealth and remote patient monitoring creates a demand for integrated software that can track and manage medical devices used outside traditional hospital settings. The growing focus on sustainability and the circular economy in healthcare presents an opportunity for software solutions that optimize equipment lifecycle management and promote responsible disposal or refurbishment. Furthermore, the increasing adoption of digital twins for medical equipment offers enhanced simulation and predictive capabilities, opening new avenues for development and market penetration.

Leading Players in the Medical Equipment Control Software Market

- SoftPro Medical Solutions

- Maintenance Connection

- Wynne Systems

- BlueFolder Software

- ITEFY

- FSM Grid

- SoftExpert Software

- Hippo

- Timly

- WellSky

- Miracle Service

- QuikAllot

- Datamoto

- Crothall Healthcare

- FieldEZ

- Brightly

Key Developments in Medical Equipment Control Software Industry

- 2023 Q4: Launch of AI-powered predictive maintenance modules by several leading vendors, enhancing proactive equipment servicing.

- 2023 Q3: Increased M&A activity with the acquisition of specialized medical asset tracking startups by larger healthcare IT firms, consolidating market share.

- 2023 Q2: Introduction of enhanced cybersecurity features, including zero-trust architecture, across major Medical Equipment Control Software platforms.

- 2023 Q1: Significant partnerships formed between software providers and medical device manufacturers to enable seamless data integration and device management.

- 2022 Q4: Expansion of cloud-based solutions, offering greater scalability and accessibility for healthcare organizations globally.

Strategic Outlook for Medical Equipment Control Software Market

- 2023 Q4: Launch of AI-powered predictive maintenance modules by several leading vendors, enhancing proactive equipment servicing.

- 2023 Q3: Increased M&A activity with the acquisition of specialized medical asset tracking startups by larger healthcare IT firms, consolidating market share.

- 2023 Q2: Introduction of enhanced cybersecurity features, including zero-trust architecture, across major Medical Equipment Control Software platforms.

- 2023 Q1: Significant partnerships formed between software providers and medical device manufacturers to enable seamless data integration and device management.

- 2022 Q4: Expansion of cloud-based solutions, offering greater scalability and accessibility for healthcare organizations globally.

Strategic Outlook for Medical Equipment Control Software Market

The strategic outlook for the Medical Equipment Control Software market is highly positive, characterized by sustained growth driven by technological innovation and evolving healthcare needs. The increasing emphasis on data-driven decision-making, patient safety, and regulatory compliance will continue to be primary growth catalysts. Opportunities lie in the further integration of AI for predictive analytics, the development of comprehensive cybersecurity solutions, and the expansion of offerings tailored to the burgeoning home healthcare market. Strategic partnerships and targeted acquisitions will remain crucial for market players to enhance their product portfolios and expand their geographical reach, ensuring continued relevance and market leadership in the years to come.

Medical Equipment Control Software Segmentation

-

1. Application

- 1.1. Hospital

- 1.2. Household

- 1.3. Other

-

2. Types

- 2.1. Class I Medical Equipment Control Software

- 2.2. Class II Medical Equipment Control Software

- 2.3. Class III Medical Equipment Control Software

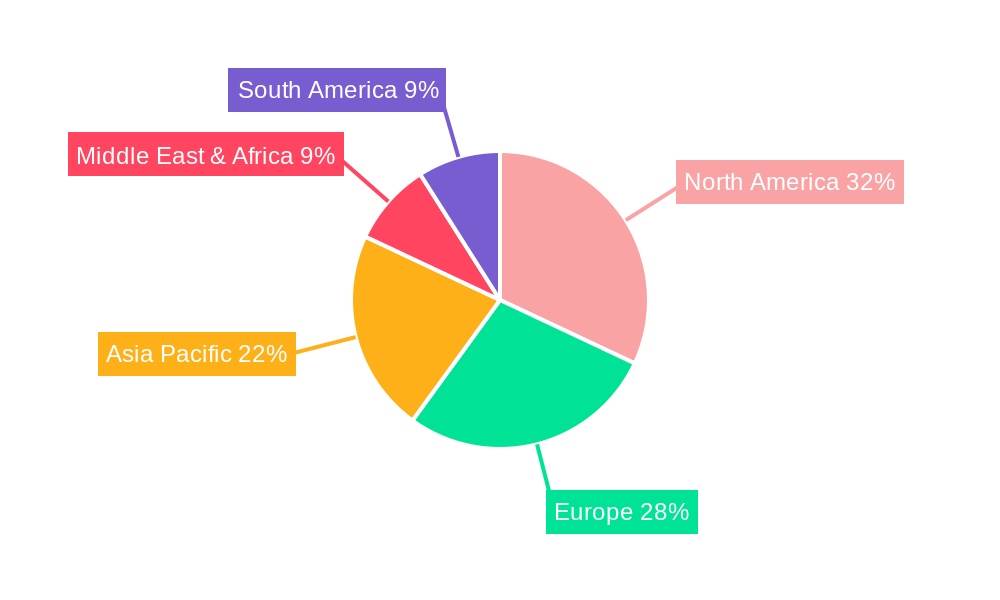

Medical Equipment Control Software Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Medical Equipment Control Software REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Medical Equipment Control Software Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Hospital

- 5.1.2. Household

- 5.1.3. Other

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Class I Medical Equipment Control Software

- 5.2.2. Class II Medical Equipment Control Software

- 5.2.3. Class III Medical Equipment Control Software

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Medical Equipment Control Software Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Hospital

- 6.1.2. Household

- 6.1.3. Other

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Class I Medical Equipment Control Software

- 6.2.2. Class II Medical Equipment Control Software

- 6.2.3. Class III Medical Equipment Control Software

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Medical Equipment Control Software Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Hospital

- 7.1.2. Household

- 7.1.3. Other

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Class I Medical Equipment Control Software

- 7.2.2. Class II Medical Equipment Control Software

- 7.2.3. Class III Medical Equipment Control Software

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Medical Equipment Control Software Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Hospital

- 8.1.2. Household

- 8.1.3. Other

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Class I Medical Equipment Control Software

- 8.2.2. Class II Medical Equipment Control Software

- 8.2.3. Class III Medical Equipment Control Software

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Medical Equipment Control Software Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Hospital

- 9.1.2. Household

- 9.1.3. Other

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Class I Medical Equipment Control Software

- 9.2.2. Class II Medical Equipment Control Software

- 9.2.3. Class III Medical Equipment Control Software

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Medical Equipment Control Software Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Hospital

- 10.1.2. Household

- 10.1.3. Other

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Class I Medical Equipment Control Software

- 10.2.2. Class II Medical Equipment Control Software

- 10.2.3. Class III Medical Equipment Control Software

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 SoftPro Medical Solutions

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Maintenance Connection

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Wynne Systems

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 BlueFolder Software

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 ITEFY

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 FSM Grid

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 SoftExpert Software

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Hippo

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Timly

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 WellSky

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Miracle Service

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 QuikAllot

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Datamoto

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Crothall Healthcare

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 FieldEZ

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Brightly

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.1 SoftPro Medical Solutions

List of Figures

- Figure 1: Global Medical Equipment Control Software Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Medical Equipment Control Software Revenue (million), by Application 2024 & 2032

- Figure 3: North America Medical Equipment Control Software Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Medical Equipment Control Software Revenue (million), by Types 2024 & 2032

- Figure 5: North America Medical Equipment Control Software Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Medical Equipment Control Software Revenue (million), by Country 2024 & 2032

- Figure 7: North America Medical Equipment Control Software Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Medical Equipment Control Software Revenue (million), by Application 2024 & 2032

- Figure 9: South America Medical Equipment Control Software Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Medical Equipment Control Software Revenue (million), by Types 2024 & 2032

- Figure 11: South America Medical Equipment Control Software Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Medical Equipment Control Software Revenue (million), by Country 2024 & 2032

- Figure 13: South America Medical Equipment Control Software Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Medical Equipment Control Software Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Medical Equipment Control Software Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Medical Equipment Control Software Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Medical Equipment Control Software Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Medical Equipment Control Software Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Medical Equipment Control Software Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Medical Equipment Control Software Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Medical Equipment Control Software Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Medical Equipment Control Software Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Medical Equipment Control Software Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Medical Equipment Control Software Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Medical Equipment Control Software Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Medical Equipment Control Software Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Medical Equipment Control Software Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Medical Equipment Control Software Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Medical Equipment Control Software Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Medical Equipment Control Software Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Medical Equipment Control Software Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Medical Equipment Control Software Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Medical Equipment Control Software Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Medical Equipment Control Software Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Medical Equipment Control Software Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Medical Equipment Control Software Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Medical Equipment Control Software Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Medical Equipment Control Software Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Medical Equipment Control Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Medical Equipment Control Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Medical Equipment Control Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Medical Equipment Control Software Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Medical Equipment Control Software Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Medical Equipment Control Software Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Medical Equipment Control Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Medical Equipment Control Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Medical Equipment Control Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Medical Equipment Control Software Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Medical Equipment Control Software Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Medical Equipment Control Software Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Medical Equipment Control Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Medical Equipment Control Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Medical Equipment Control Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Medical Equipment Control Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Medical Equipment Control Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Medical Equipment Control Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Medical Equipment Control Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Medical Equipment Control Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Medical Equipment Control Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Medical Equipment Control Software Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Medical Equipment Control Software Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Medical Equipment Control Software Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Medical Equipment Control Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Medical Equipment Control Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Medical Equipment Control Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Medical Equipment Control Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Medical Equipment Control Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Medical Equipment Control Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Medical Equipment Control Software Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Medical Equipment Control Software Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Medical Equipment Control Software Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Medical Equipment Control Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Medical Equipment Control Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Medical Equipment Control Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Medical Equipment Control Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Medical Equipment Control Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Medical Equipment Control Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Medical Equipment Control Software Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Medical Equipment Control Software?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Medical Equipment Control Software?

Key companies in the market include SoftPro Medical Solutions, Maintenance Connection, Wynne Systems, BlueFolder Software, ITEFY, FSM Grid, SoftExpert Software, Hippo, Timly, WellSky, Miracle Service, QuikAllot, Datamoto, Crothall Healthcare, FieldEZ, Brightly.

3. What are the main segments of the Medical Equipment Control Software?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4900.00, USD 7350.00, and USD 9800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Medical Equipment Control Software," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Medical Equipment Control Software report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Medical Equipment Control Software?

To stay informed about further developments, trends, and reports in the Medical Equipment Control Software, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence