Key Insights

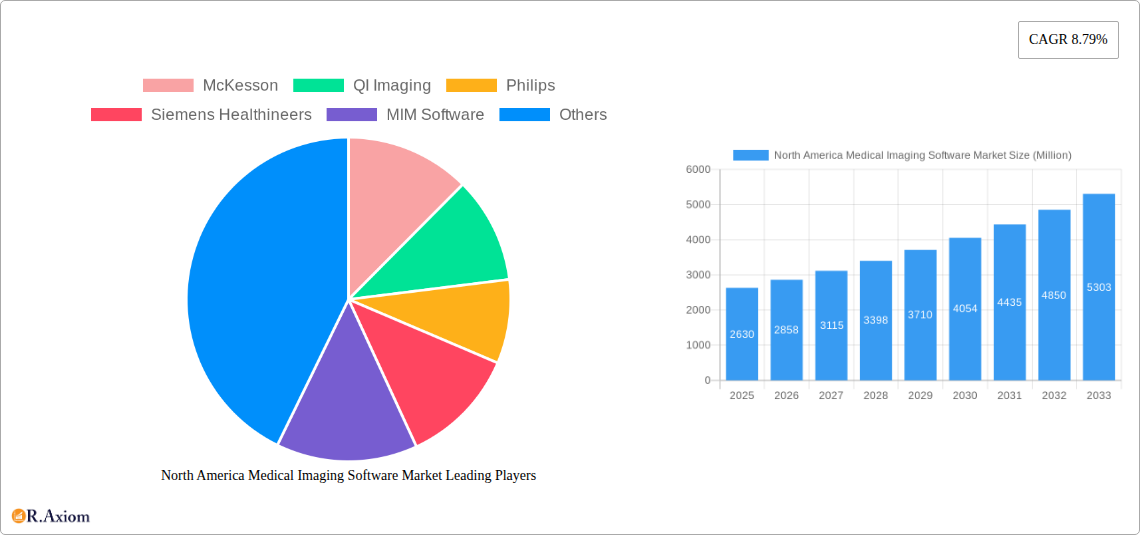

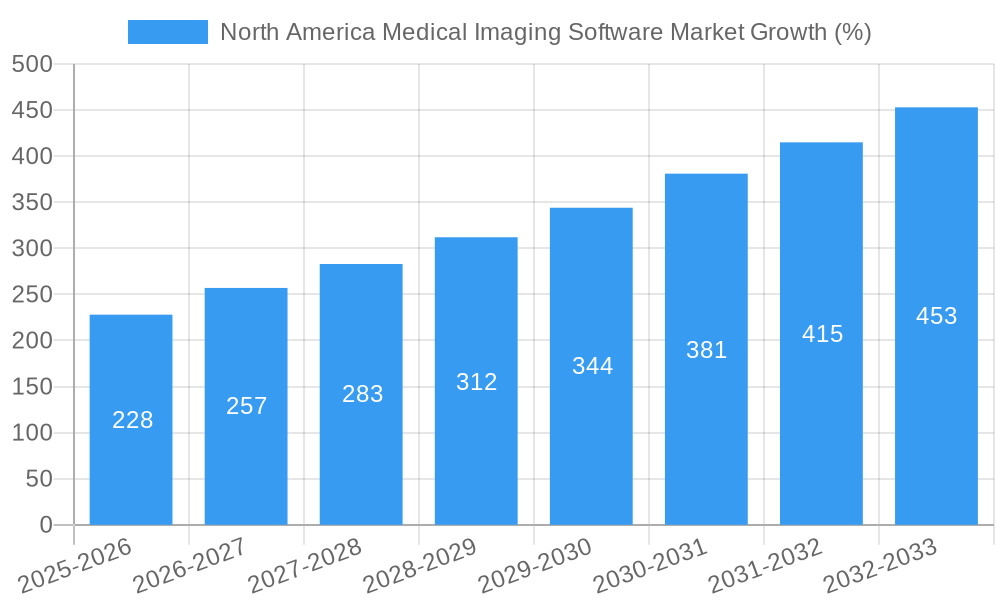

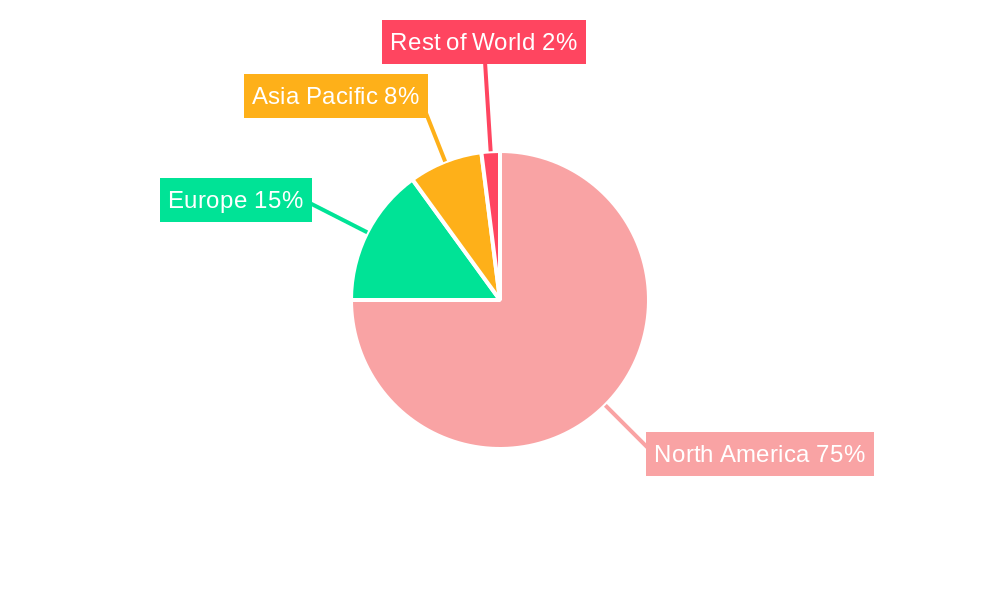

The North America medical imaging software market, valued at $2.63 billion in 2025, is projected to experience robust growth, driven by a compound annual growth rate (CAGR) of 8.79% from 2025 to 2033. This expansion is fueled by several key factors. Technological advancements, particularly in artificial intelligence (AI) and machine learning (ML), are enhancing diagnostic accuracy and efficiency, leading to wider adoption across various medical specialties. The increasing prevalence of chronic diseases, coupled with a growing aging population, necessitates more sophisticated diagnostic tools, further boosting market demand. Furthermore, rising investments in healthcare infrastructure and the increasing emphasis on preventative care contribute to market growth. The market is segmented by imaging type (2D, 3D, 4D), application (dental, orthopedic, cardiology, obstetrics & gynecology, mammography, urology & nephrology, other applications), and geography (United States, Canada, and Mexico, representing the core of the North American market). Major players like McKesson, Philips, Siemens Healthineers, and others are strategically investing in R&D and acquisitions to strengthen their market positions and capitalize on emerging opportunities. The competitive landscape is characterized by both established players and innovative startups, resulting in continuous product development and market innovation.

The United States dominates the North American market, accounting for the largest share due to its advanced healthcare infrastructure, high technological adoption rates, and substantial funding for medical research. Canada also represents a significant market segment, with increasing investments in healthcare technology and a growing focus on improving patient outcomes. While the market faces certain restraints, such as high software costs and the need for skilled professionals to operate advanced imaging systems, the overall growth trajectory remains positive, driven by the aforementioned factors. Future growth will likely be shaped by advancements in cloud-based solutions, improved interoperability between different imaging systems, and the increasing integration of telehealth platforms. The focus on data security and regulatory compliance will also play a significant role in shaping the market's future.

This detailed report provides a comprehensive analysis of the North America medical imaging software market, covering the period 2019-2033. It offers actionable insights into market dynamics, growth drivers, challenges, and emerging opportunities, equipping stakeholders with the knowledge needed to navigate this rapidly evolving landscape. The report incorporates data from the base year 2025, with projections extending to 2033, supported by historical data from 2019-2024. The market is segmented by imaging type (2D, 3D, 4D), application (dental, orthopedic, cardiology, obstetrics & gynecology, mammography, urology & nephrology, other), and country (United States, Canada). Key players analyzed include McKesson, QI Imaging, Philips, Siemens Healthineers, MIM Software, Brain Innovation, Carestream Health, VidiStar LLC, Amirsys, Toshiba, Claron Technology, Esaote, Medviso, General Electric Healthcare, and Riverain Technologies (list not exhaustive).

North America Medical Imaging Software Market Concentration & Innovation

The North American medical imaging software market exhibits a moderately concentrated structure, with a few major players holding significant market share. However, the presence of numerous smaller, specialized firms fosters innovation. The market share of the top five companies is estimated at xx%, indicating a competitive yet consolidated landscape. Innovation is primarily driven by advancements in AI, machine learning, and cloud computing, leading to improved image analysis, diagnostic accuracy, and workflow efficiency. Stringent regulatory frameworks, particularly from the FDA, influence product development and market access. The increasing adoption of PACS (Picture Archiving and Communication Systems) and DICOM (Digital Imaging and Communications in Medicine) standards promotes interoperability and data exchange. Substitutes, such as traditional film-based imaging, are gradually diminishing due to the advantages of digital imaging. End-user trends favor integrated solutions offering comprehensive imaging capabilities and streamlined workflows. Mergers and acquisitions (M&A) activity is prevalent, with deal values exceeding xx Million in recent years, reflecting industry consolidation and strategic expansion. Recent examples include:

- January 2024: MIM Software's acquisition by GE HealthCare.

- June 2023: Medviso's FDA clearance for InterView FUSION and InterView XP software.

These activities highlight the dynamic nature of the market and the pursuit of enhanced market share and technological capabilities.

North America Medical Imaging Software Market Industry Trends & Insights

The North American medical imaging software market is experiencing robust growth, with a projected CAGR of xx% during the forecast period (2025-2033). This growth is fueled by several factors: increasing prevalence of chronic diseases requiring advanced imaging techniques, rising adoption of advanced imaging modalities like 3D and 4D imaging, growing demand for efficient and cost-effective healthcare solutions, and increasing investments in healthcare IT infrastructure. Technological disruptions, such as the integration of AI and cloud technologies, are revolutionizing diagnostic capabilities and streamlining workflows, driving market penetration. Consumer preferences are shifting towards user-friendly interfaces, seamless integration with existing systems, and enhanced security features. Competitive dynamics are shaped by continuous innovation, strategic partnerships, and M&A activity. The market penetration of AI-powered diagnostic tools is expected to reach xx% by 2033. This signifies a substantial shift towards intelligent imaging solutions that improve accuracy and efficiency. The increasing adoption of telehealth and remote patient monitoring further fuels the demand for sophisticated imaging software facilitating remote diagnosis and collaboration.

Dominant Markets & Segments in North America Medical Imaging Software Market

The United States dominates the North American medical imaging software market, owing to its advanced healthcare infrastructure, high adoption of advanced technologies, and substantial investments in healthcare IT.

Key Drivers for US Dominance:

- Robust healthcare infrastructure and substantial spending

- High adoption rate of advanced medical technologies

- Favorable regulatory environment encouraging innovation

- Strong presence of key market players

Segment Analysis:

- By Imaging Type: 3D and 4D imaging are experiencing faster growth than 2D imaging due to their superior diagnostic capabilities.

- By Application: Cardiology and oncology are the largest application segments, driven by the high prevalence of cardiovascular and cancer-related diseases.

- By Country: The United States accounts for a significantly larger market share than Canada.

North America Medical Imaging Software Market Product Developments

Recent product innovations center around AI-powered image analysis, cloud-based platforms for enhanced accessibility and collaboration, and integrated solutions that streamline workflows. These advancements offer competitive advantages by improving diagnostic accuracy, efficiency, and cost-effectiveness. The market sees a strong emphasis on user-friendly interfaces, integration with existing healthcare IT systems, and robust security features to meet evolving market needs and preferences.

Report Scope & Segmentation Analysis

This report segments the North American medical imaging software market in three key ways:

By Imaging Type: 2D, 3D, and 4D imaging systems each represent distinct market segments with varying growth rates and competitive landscapes. The 3D and 4D segments are projected to exhibit faster growth due to their enhanced diagnostic capabilities. Market sizes are expected to reach xx Million for 2D, xx Million for 3D, and xx Million for 4D by 2033.

By Application: Segments include dental, orthopedic, cardiology, obstetrics and gynecology, mammography, urology and nephrology, and other applications. Each application segment showcases unique growth trajectories and competitive dynamics. Cardiology and oncology are projected as the leading segments. Market size estimates for these and other segments will be detailed within the full report.

By Country: The market is analyzed for the United States and Canada, with the United States representing the significantly larger market. Growth projections for each country are included.

Key Drivers of North America Medical Imaging Software Market Growth

Several factors are driving the growth of the North American medical imaging software market. Technological advancements, particularly in AI and cloud computing, are improving diagnostic accuracy and workflow efficiency. The rising prevalence of chronic diseases necessitates advanced imaging techniques, fueling demand. Increasing healthcare expenditure and investments in healthcare IT infrastructure create a favorable environment for market expansion. Furthermore, supportive regulatory frameworks encourage innovation and adoption of new technologies.

Challenges in the North America Medical Imaging Software Market Sector

The market faces challenges including high implementation costs, concerns regarding data security and privacy, the need for skilled professionals to operate complex systems, and intense competition among vendors. Regulatory hurdles and evolving compliance requirements present ongoing challenges. Supply chain disruptions, though less pronounced than in other sectors, remain a potential risk to market growth.

Emerging Opportunities in North America Medical Imaging Software Market

Emerging opportunities lie in the integration of AI and machine learning for enhanced diagnostic accuracy, the development of cloud-based platforms for improved accessibility and collaboration, and the expansion into new applications and emerging markets. The growing adoption of telehealth and remote patient monitoring creates further opportunities for software solutions enabling remote diagnostics and consultations. Personalized medicine and the development of tailored imaging solutions are also promising areas for future growth.

Leading Players in the North America Medical Imaging Software Market Market

- McKesson

- QI Imaging

- Philips

- Siemens Healthineers

- MIM Software

- Brain Innovation

- Carestream Health

- VidiStar LLC

- Amirsys

- Toshiba

- Claron Technology

- Esaote

- Medviso

- General Electric Healthcare

- Riverain Technologies

Key Developments in North America Medical Imaging Software Market Industry

- January 2024: MIM Software acquired by GE HealthCare, expanding GE's portfolio in AI-powered imaging solutions.

- June 2023: Medviso receives FDA clearance for InterView FUSION and InterView XP software, enhancing nuclear medicine and molecular imaging workflows.

Strategic Outlook for North America Medical Imaging Software Market Market

The North American medical imaging software market holds significant growth potential driven by technological advancements, increasing healthcare expenditure, and a rising demand for improved diagnostic capabilities. The integration of AI, cloud computing, and advanced imaging modalities will continue to shape the market landscape. Strategic partnerships, acquisitions, and continuous innovation will be key to success in this dynamic and competitive market. The focus on user-friendly interfaces, seamless integration with existing systems, robust security features, and compliance with regulatory requirements will further determine the success of companies in this sector.

North America Medical Imaging Software Market Segmentation

-

1. Imaging Type

- 1.1. 2D Imaging

- 1.2. 3D Imaging

- 1.3. 4D Imaging

-

2. Application

- 2.1. Dental

- 2.2. Orthopedic

- 2.3. Cardiology

- 2.4. Obstetrics and Gynecology

- 2.5. Mammography

- 2.6. Urology and Nephrology

- 2.7. Other Applications

North America Medical Imaging Software Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Medical Imaging Software Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 8.79% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand for Medical Imaging Devices; Increasing Number of Players in Healthcare

- 3.3. Market Restrains

- 3.3.1. Security Issues

- 3.4. Market Trends

- 3.4.1. Dental Application Segment is Expected to Hold Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Medical Imaging Software Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Imaging Type

- 5.1.1. 2D Imaging

- 5.1.2. 3D Imaging

- 5.1.3. 4D Imaging

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Dental

- 5.2.2. Orthopedic

- 5.2.3. Cardiology

- 5.2.4. Obstetrics and Gynecology

- 5.2.5. Mammography

- 5.2.6. Urology and Nephrology

- 5.2.7. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Imaging Type

- 6. United States North America Medical Imaging Software Market Analysis, Insights and Forecast, 2019-2031

- 7. Canada North America Medical Imaging Software Market Analysis, Insights and Forecast, 2019-2031

- 8. Mexico North America Medical Imaging Software Market Analysis, Insights and Forecast, 2019-2031

- 9. Rest of North America North America Medical Imaging Software Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 McKesson

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 QI Imaging

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Philips

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Siemens Healthineers

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 MIM Software

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Brain Innovation

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Carestream Health

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 VidiStar LLC

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Amirsys

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Toshiba

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Claron Technology

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 Esaote*List Not Exhaustive

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.13 Medviso

- 10.2.13.1. Overview

- 10.2.13.2. Products

- 10.2.13.3. SWOT Analysis

- 10.2.13.4. Recent Developments

- 10.2.13.5. Financials (Based on Availability)

- 10.2.14 General Electric Healthcare

- 10.2.14.1. Overview

- 10.2.14.2. Products

- 10.2.14.3. SWOT Analysis

- 10.2.14.4. Recent Developments

- 10.2.14.5. Financials (Based on Availability)

- 10.2.15 Riverain Technologies

- 10.2.15.1. Overview

- 10.2.15.2. Products

- 10.2.15.3. SWOT Analysis

- 10.2.15.4. Recent Developments

- 10.2.15.5. Financials (Based on Availability)

- 10.2.1 McKesson

List of Figures

- Figure 1: North America Medical Imaging Software Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America Medical Imaging Software Market Share (%) by Company 2024

List of Tables

- Table 1: North America Medical Imaging Software Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America Medical Imaging Software Market Revenue Million Forecast, by Imaging Type 2019 & 2032

- Table 3: North America Medical Imaging Software Market Revenue Million Forecast, by Application 2019 & 2032

- Table 4: North America Medical Imaging Software Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: North America Medical Imaging Software Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: United States North America Medical Imaging Software Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Canada North America Medical Imaging Software Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Mexico North America Medical Imaging Software Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Rest of North America North America Medical Imaging Software Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: North America Medical Imaging Software Market Revenue Million Forecast, by Imaging Type 2019 & 2032

- Table 11: North America Medical Imaging Software Market Revenue Million Forecast, by Application 2019 & 2032

- Table 12: North America Medical Imaging Software Market Revenue Million Forecast, by Country 2019 & 2032

- Table 13: United States North America Medical Imaging Software Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Canada North America Medical Imaging Software Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Mexico North America Medical Imaging Software Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Medical Imaging Software Market?

The projected CAGR is approximately 8.79%.

2. Which companies are prominent players in the North America Medical Imaging Software Market?

Key companies in the market include McKesson, QI Imaging, Philips, Siemens Healthineers, MIM Software, Brain Innovation, Carestream Health, VidiStar LLC, Amirsys, Toshiba, Claron Technology, Esaote*List Not Exhaustive, Medviso, General Electric Healthcare, Riverain Technologies.

3. What are the main segments of the North America Medical Imaging Software Market?

The market segments include Imaging Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.63 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand for Medical Imaging Devices; Increasing Number of Players in Healthcare.

6. What are the notable trends driving market growth?

Dental Application Segment is Expected to Hold Significant Market Share.

7. Are there any restraints impacting market growth?

Security Issues.

8. Can you provide examples of recent developments in the market?

Januray 2024 - MIM Software has announced that into an agreement to be acquired by GE HealthCare, MIM Software, a leading imaging technology innovator, provides artificial intelligence (AI), imaging, automation, accessibility, and standardization solutions for Radiation Oncology, Molecular Radiotherapy, Nuclear Medicine, Diagnostic Imaging, Interventional Radiology, and Urology.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Medical Imaging Software Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Medical Imaging Software Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Medical Imaging Software Market?

To stay informed about further developments, trends, and reports in the North America Medical Imaging Software Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence