Key Insights

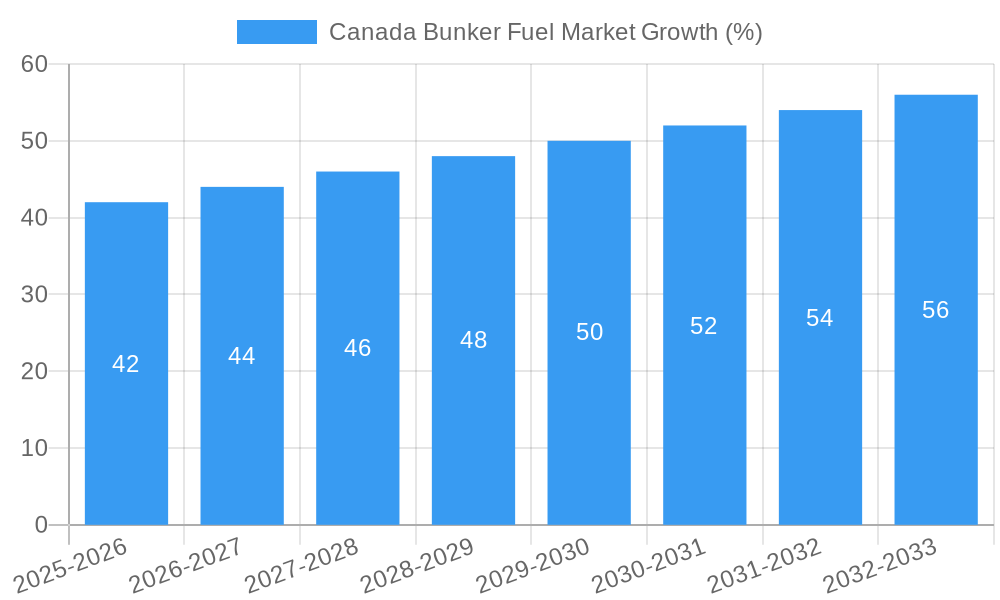

The Canada Bunker Fuel market, valued at $1.42 billion in 2025, is projected to experience robust growth, driven by increasing maritime trade activity and a rising demand for efficient and low-sulfur fuels. The market's Compound Annual Growth Rate (CAGR) exceeding 2.93% from 2025 to 2033 indicates a significant expansion. This growth is fueled by several factors including the expansion of the Canadian port infrastructure, growing global trade volumes necessitating increased bunker fuel consumption, and stricter environmental regulations pushing adoption of cleaner fuels. Major players like PetroChina, TotalEnergies, and World Fuel Services are key suppliers, while Cosco Shipping Lines, OOCL, and other major shipping companies are significant consumers. While a comprehensive regional breakdown is unavailable, the Canadian market's growth is expected to be largely influenced by activity in major port cities and along key shipping lanes within Canada and neighboring regions. Potential restraints could include price volatility in crude oil markets impacting bunker fuel costs, and the implementation of additional environmental regulations that may necessitate further fuel technology advancements and potentially influence pricing. The market segmentation (likely including fuel type, vessel size, and geographic location) will further shape the competitive landscape and growth trajectory.

The forecast period (2025-2033) suggests a continued upward trend in market value, with growth likely accelerating based on anticipated increases in shipping activity and the continued adoption of environmentally compliant fuels. The historical period (2019-2024) provides a baseline for understanding past market performance and informing future predictions. Analyzing this data in conjunction with global trends in shipping, environmental regulations, and fuel prices will provide a more comprehensive understanding of the nuanced dynamics driving the Canadian bunker fuel market's growth and its implications for stakeholders across the supply chain.

Canada Bunker Fuel Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Canada Bunker Fuel Market, covering the period from 2019 to 2033. With a focus on market dynamics, competitive landscapes, and future growth opportunities, this study is an essential resource for industry stakeholders, investors, and strategic decision-makers. The report utilizes data from the historical period (2019-2024), base year (2025), and estimated year (2025), to project the market forecast (2025-2033).

Canada Bunker Fuel Market Concentration & Innovation

This section analyzes the concentration of the Canadian bunker fuel market, exploring innovation drivers, regulatory frameworks, product substitutes, end-user trends, and mergers and acquisitions (M&A) activities. The market exhibits a moderately concentrated structure, with a few major players holding significant market share.

Market Concentration: The top five fuel suppliers (PetroChina Company Limited, TotalEnergies SE, Peninsula Petroleum Ltd, A P Møller – Mærsk AS, and World Fuel Services Corporation) collectively hold an estimated xx% market share in 2025. The ship-owning segment is similarly concentrated, with Cosco Shipping Lines Co Ltd, Orient Overseas Container Line (OOCL), Mediterranean Shipping Company, Ocean Network Express, and CMA CGM Group accounting for a substantial portion of the demand. A detailed breakdown of market share for each company is included in the full report.

Innovation Drivers: The drive towards environmental sustainability is a major catalyst for innovation, with increasing adoption of cleaner fuels like LNG and biofuels. Technological advancements in fuel efficiency and emission reduction technologies are also shaping market trends.

Regulatory Framework: Government regulations aimed at reducing greenhouse gas emissions from shipping are driving the transition towards cleaner bunker fuels. These regulations impact fuel choices and investment in emission-reducing technologies. Further analysis of specific regulations and their impact is detailed within the report.

Product Substitutes: The emergence of alternative fuels, such as LNG and biofuels, presents both opportunities and challenges for traditional bunker fuel suppliers. The report analyzes the competitive landscape created by these substitutes and their potential market penetration.

End-User Trends: Growing demand from container shipping, bulk shipping, and cruise lines, coupled with fluctuating global fuel prices, significantly influence the market. The full report explores these trends and their impact on future demand.

M&A Activities: The report documents recent M&A activity within the Canadian bunker fuel market, including the value of completed deals and their implications for market consolidation. The impact of Cryopeak LNG Solutions and Ferus Natural Gas Fuels' merger is specifically examined. For example, this merger may lead to an increase in the xx Million CAD market share of the combined entity by 2033.

Canada Bunker Fuel Market Industry Trends & Insights

This section explores the key trends and insights shaping the Canadian bunker fuel market. The market is experiencing robust growth, driven by several factors. The CAGR for the forecast period (2025-2033) is projected to be xx%, indicating a substantial increase in market size.

The report details the influence of factors like increasing global trade, the expansion of the Canadian shipping industry, and the rising demand for energy-efficient shipping solutions. Furthermore, the analysis covers technological disruptions, shifting consumer preferences towards sustainable fuels, and the competitive dynamics among market players, including price competition and strategic alliances. Market penetration of LNG and biofuels is also analyzed, providing a comprehensive picture of the evolving market landscape.

Dominant Markets & Segments in Canada Bunker Fuel Market

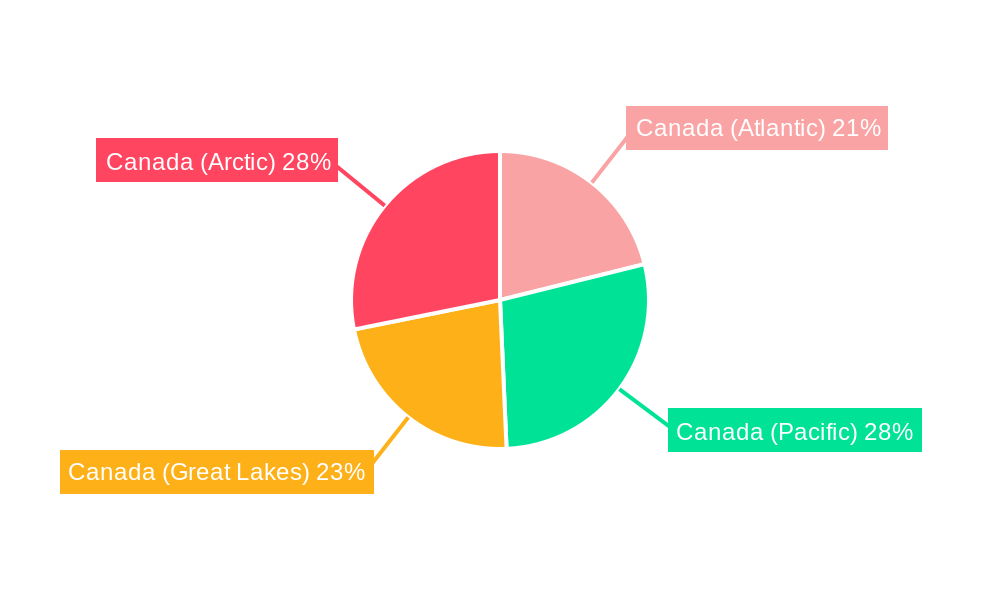

This section identifies the leading regions, countries, and segments within the Canadian bunker fuel market. The report highlights the dominance of specific ports, based on their shipping activity and bunker fuel consumption.

- Key Drivers of Dominance:

- Strategic Port Locations: Proximity to major shipping lanes and access to infrastructure contribute significantly to regional dominance.

- Economic Policies: Government incentives and regulations related to fuel usage affect the regional market.

- Infrastructure: The availability of adequate storage facilities, bunkering infrastructure, and efficient logistics networks plays a vital role.

The detailed analysis in the full report includes a comprehensive discussion of these factors, providing insights into the reasons behind market leadership and variations across different regions.

Canada Bunker Fuel Market Product Developments

Recent product developments in the Canadian bunker fuel market emphasize the shift towards cleaner and more sustainable fuel options. This includes the growing adoption of LNG and biofuels, driven by environmental regulations and the desire for reduced carbon emissions. The development of innovative fuel blends and the improvement of fuel efficiency technologies are also key areas of focus for industry players. These advancements provide competitive advantages by enhancing cost-effectiveness and environmental performance.

Report Scope & Segmentation Analysis

This report segments the Canadian bunker fuel market based on several key parameters. The detailed analysis covers fuel type (e.g., heavy fuel oil, LNG, biofuels), vessel type (e.g., container ships, bulk carriers, tankers), and region (e.g., East Coast, West Coast). Each segment's growth projections, market size, and competitive dynamics are explored. For example, the LNG segment is projected to experience significant growth during the forecast period, driven by environmental concerns and technological advancements in LNG bunkering infrastructure. The report provides a detailed assessment of market size and growth projections for each segment.

Key Drivers of Canada Bunker Fuel Market Growth

The growth of the Canadian bunker fuel market is driven by several factors. The continued expansion of global trade and increasing shipping activity contribute significantly. Moreover, government regulations promoting the adoption of cleaner fuels and technological innovations in fuel efficiency are vital catalysts. These developments create opportunities for companies offering sustainable fuel solutions and energy-efficient technologies.

Challenges in the Canada Bunker Fuel Market Sector

The Canadian bunker fuel market faces several challenges. Stricter environmental regulations can increase compliance costs for fuel suppliers. Fluctuations in global fuel prices and potential supply chain disruptions pose risks to market stability. Intense competition among fuel suppliers necessitates innovative strategies to maintain market share and profitability. These challenges significantly impact market dynamics and require strategic adaptation from market players.

Emerging Opportunities in Canada Bunker Fuel Market

Several emerging opportunities exist within the Canadian bunker fuel market. The growing demand for cleaner fuels like LNG and biofuels creates significant market potential for suppliers specializing in these products. Furthermore, technological advancements in fuel efficiency and emission reduction offer substantial opportunities for innovation and cost savings. The development of advanced bunkering infrastructure and expansion into new markets can also generate significant growth opportunities.

Leading Players in the Canada Bunker Fuel Market Market

- PetroChina Company Limited

- TotalEnergies SE

- Peninsula Petroleum Ltd

- A P Møller – Mærsk AS

- World Fuel Services Corporation

- Cosco Shipping Lines Co Ltd

- Orient Overseas Container Line (OOCL)

- Mediterranean Shipping Company

- Ocean Network Express

- CMA CGM Group

- List of Other Prominent Companies (Detailed list available in the full report)

Market ranking and share analysis are provided in the full report.

Key Developments in Canada Bunker Fuel Market Industry

- May 2024: CSL Group's revival of its biofuel initiative using B100 biodiesel highlights the growing adoption of sustainable fuels within the Canadian shipping industry. This signals a shift towards environmentally friendly practices and could influence other companies to adopt similar initiatives.

- February 2024: The merger of Cryopeak LNG Solutions and Ferus Natural Gas Fuels signifies a significant consolidation within the LNG sector, potentially leading to increased LNG production and distribution across Canada, and further market share consolidation.

Strategic Outlook for Canada Bunker Fuel Market Market

The future of the Canadian bunker fuel market appears positive, driven by continued growth in global trade and increasing demand for efficient and sustainable fuel solutions. The transition towards cleaner fuels presents significant opportunities for innovation and investment. The strategic focus should be on adopting sustainable practices, investing in advanced technologies, and securing long-term supply contracts to maintain a competitive edge. The market is poised for substantial growth and transformation in the coming years.

Canada Bunker Fuel Market Segmentation

-

1. Fuel Type

- 1.1. High Sulfur Fuel Oil (HSFO)

- 1.2. Very-low Sulfur Fuel Oil (VLSFO)

- 1.3. Marine Gas Oil (MGO)

- 1.4. Liquefied Natural Gas (LNG)

- 1.5. Other Fuel Types

-

2. Vessel Type

- 2.1. Containers

- 2.2. Tankers

- 2.3. General Cargo

- 2.4. Bulk Carrier

- 2.5. Other Vessel Types

Canada Bunker Fuel Market Segmentation By Geography

- 1. Canada

Canada Bunker Fuel Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 2.93% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Rising LNG Trade4.; Surge in Marine Transportation

- 3.3. Market Restrains

- 3.3.1. 4.; Rising LNG Trade4.; Surge in Marine Transportation

- 3.4. Market Trends

- 3.4.1. The Very Low Sulphur Fuel Oil (VLSFO) Segment is to Witness Significant Growth During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Canada Bunker Fuel Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Fuel Type

- 5.1.1. High Sulfur Fuel Oil (HSFO)

- 5.1.2. Very-low Sulfur Fuel Oil (VLSFO)

- 5.1.3. Marine Gas Oil (MGO)

- 5.1.4. Liquefied Natural Gas (LNG)

- 5.1.5. Other Fuel Types

- 5.2. Market Analysis, Insights and Forecast - by Vessel Type

- 5.2.1. Containers

- 5.2.2. Tankers

- 5.2.3. General Cargo

- 5.2.4. Bulk Carrier

- 5.2.5. Other Vessel Types

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Canada

- 5.1. Market Analysis, Insights and Forecast - by Fuel Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Fuel Suppliers

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 1 PetroChina Company Limited

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 2 TotalEnergies SE

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 3 Peninsula Petroleum Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 4 A P Møller – Mærsk AS

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 5 World Fuel Services Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Ship Owners

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 1 Cosco Shipping Lines Co Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 2 Orient Overseas Container Line (OOCL)

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 3 Mediterranean Shipping Company

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 4 Ocean Network Express

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 5 CMA CGM Group*List Not Exhaustive 6 4 List of Other Prominent Companies6 5 Market Ranking/ Share Analysi

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Fuel Suppliers

List of Figures

- Figure 1: Canada Bunker Fuel Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Canada Bunker Fuel Market Share (%) by Company 2024

List of Tables

- Table 1: Canada Bunker Fuel Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Canada Bunker Fuel Market Volume Billion Forecast, by Region 2019 & 2032

- Table 3: Canada Bunker Fuel Market Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 4: Canada Bunker Fuel Market Volume Billion Forecast, by Fuel Type 2019 & 2032

- Table 5: Canada Bunker Fuel Market Revenue Million Forecast, by Vessel Type 2019 & 2032

- Table 6: Canada Bunker Fuel Market Volume Billion Forecast, by Vessel Type 2019 & 2032

- Table 7: Canada Bunker Fuel Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Canada Bunker Fuel Market Volume Billion Forecast, by Region 2019 & 2032

- Table 9: Canada Bunker Fuel Market Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 10: Canada Bunker Fuel Market Volume Billion Forecast, by Fuel Type 2019 & 2032

- Table 11: Canada Bunker Fuel Market Revenue Million Forecast, by Vessel Type 2019 & 2032

- Table 12: Canada Bunker Fuel Market Volume Billion Forecast, by Vessel Type 2019 & 2032

- Table 13: Canada Bunker Fuel Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Canada Bunker Fuel Market Volume Billion Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Canada Bunker Fuel Market?

The projected CAGR is approximately > 2.93%.

2. Which companies are prominent players in the Canada Bunker Fuel Market?

Key companies in the market include Fuel Suppliers, 1 PetroChina Company Limited, 2 TotalEnergies SE, 3 Peninsula Petroleum Ltd, 4 A P Møller – Mærsk AS, 5 World Fuel Services Corporation, Ship Owners, 1 Cosco Shipping Lines Co Ltd, 2 Orient Overseas Container Line (OOCL), 3 Mediterranean Shipping Company, 4 Ocean Network Express, 5 CMA CGM Group*List Not Exhaustive 6 4 List of Other Prominent Companies6 5 Market Ranking/ Share Analysi.

3. What are the main segments of the Canada Bunker Fuel Market?

The market segments include Fuel Type, Vessel Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.42 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Rising LNG Trade4.; Surge in Marine Transportation.

6. What are the notable trends driving market growth?

The Very Low Sulphur Fuel Oil (VLSFO) Segment is to Witness Significant Growth During the Forecast Period.

7. Are there any restraints impacting market growth?

4.; Rising LNG Trade4.; Surge in Marine Transportation.

8. Can you provide examples of recent developments in the market?

May 2024: CSL Group, a Canadian company, announced that its gearless bulk carrier, CSL Welland, will once again operate on B100 biodiesel for the upcoming season, signaling the revival of its biofuel initiative. In collaboration with Canada Clean Fuels Inc., the company is fueling eight of its vessels with B100 biodiesel sourced from North America and produced from waste plant materials.February 2024: Cryopeak LNG Solutions signed an agreement to merge operations with Ferus Natural Gas Fuels to develop a new liquefied natural gas (LNG) production and distribution organization across Canada. The company also manages three LNG production facilities through this expansion in Western Canada and operates the country's most significant LNG transportation.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Canada Bunker Fuel Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Canada Bunker Fuel Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Canada Bunker Fuel Market?

To stay informed about further developments, trends, and reports in the Canada Bunker Fuel Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence