Key Insights

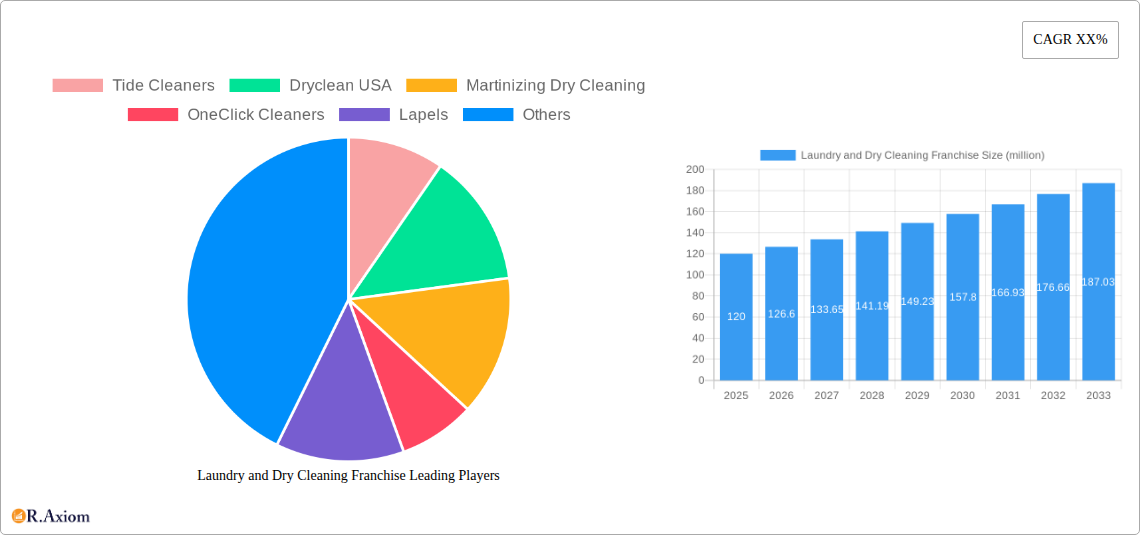

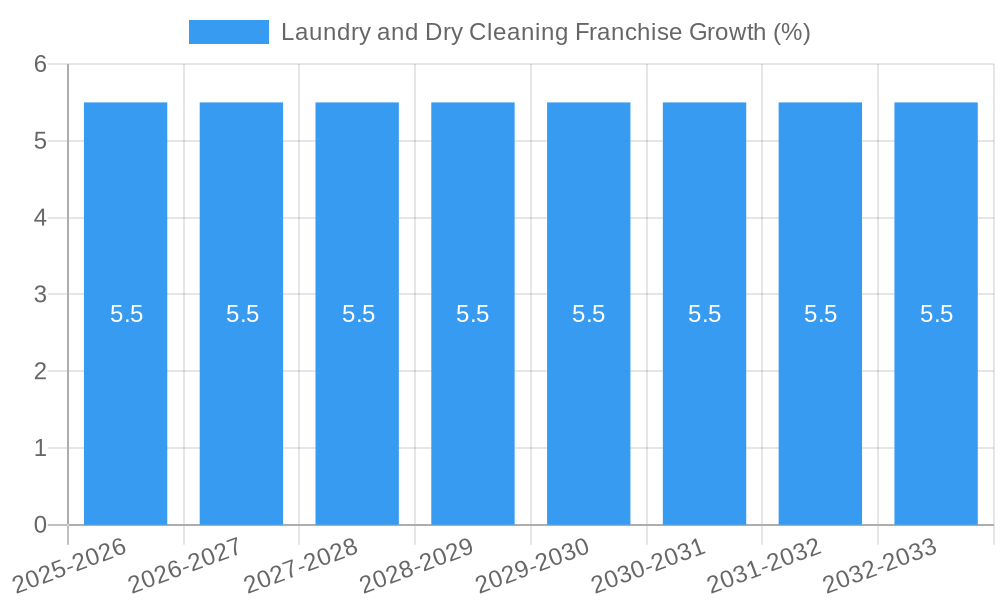

The global Laundry and Dry Cleaning Franchise market is poised for substantial growth, with an estimated market size of $120 million in 2025 and a projected Compound Annual Growth Rate (CAGR) of 5.5% through 2033. This expansion is fueled by increasingly busy lifestyles and a growing demand for convenient, professional garment care services. Consumers, particularly in urban and suburban areas, are prioritizing time-saving solutions, making the readily available and standardized services offered by franchises highly attractive. The market is segmented across various applications, with Personal Investment applications leading the charge due to individual consumer demand, closely followed by Corporate Investment driven by the need for uniform cleaning and employee perk programs. Key service types include Pickup and Delivery, which is experiencing significant traction due to its unparalleled convenience, and the traditional Plant with Retail Store model, which continues to be a strong performer. Emerging models like Satellite Stores and Laundromats integrated with dry cleaning services are also gaining prominence, catering to diverse consumer needs and locations.

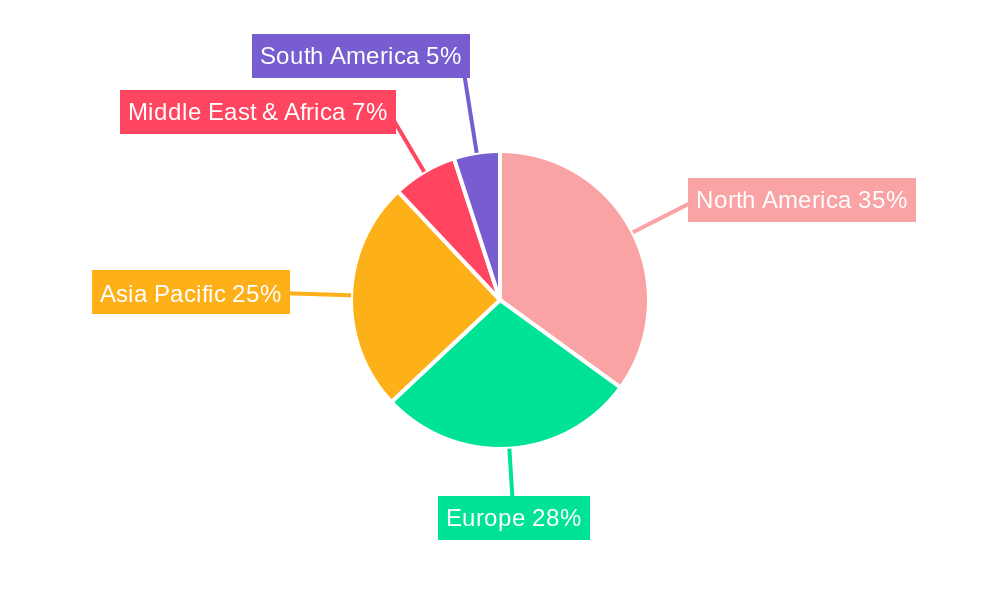

The competitive landscape features a mix of established players and innovative newcomers, including Tide Cleaners, ZIPS Dry Cleaners, and Mr Jeff, who are leveraging technology and customer-centric approaches to capture market share. Strategic expansions, particularly in the Asia Pacific region, driven by rapid urbanization and a burgeoning middle class, are expected to be a significant growth driver. While the market offers robust opportunities, certain restraints like high initial investment for franchisees and the rising cost of raw materials and labor could pose challenges. However, the persistent demand for efficient garment care, coupled with the convenience and perceived reliability of franchised operations, will likely outweigh these concerns, positioning the Laundry and Dry Cleaning Franchise market for sustained and dynamic growth over the forecast period. Innovations in eco-friendly cleaning processes and digital integration for booking and tracking services will further enhance customer satisfaction and market penetration.

Laundry and Dry Cleaning Franchise Market Concentration & Innovation

The laundry and dry cleaning franchise market exhibits a moderate to high level of concentration, with several key players like Tide Cleaners, Dryclean USA, and Martinizing Dry Cleaning holding significant market share. Innovation is a crucial differentiator, driven by the demand for convenience and sustainability. This includes advancements in eco-friendly cleaning technologies, contactless pickup and delivery systems, and integrated mobile applications that streamline customer experience. Regulatory frameworks, while varying by region, primarily focus on environmental protection, chemical usage, and labor practices. Product substitutes, such as at-home laundry solutions and wash-and-fold services, present a continuous challenge, necessitating franchises to emphasize their quality, efficiency, and specialized cleaning capabilities. End-user trends are strongly shifting towards on-demand services, with consumers increasingly seeking solutions that save time and effort. Mergers and acquisitions (M&A) activities are on the rise as established brands look to expand their footprint and smaller players seek strategic partnerships for survival and growth. For instance, M&A deals in the sector are projected to reach a combined value of over $500 million during the study period.

Laundry and Dry Cleaning Franchise Industry Trends & Insights

The laundry and dry cleaning franchise industry is poised for robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of approximately 8.5% from 2019 to 2033, with an estimated market size of over $35 billion by 2025. This expansion is fueled by several interconnected trends. Urbanization and busy lifestyles are driving demand for convenient laundry solutions, pushing the market penetration of pickup and delivery services significantly higher, reaching an estimated 40% of the total market by 2025. Technological disruptions are at the forefront, with the adoption of AI-powered scheduling, smart lockers for contactless drop-off and pick-up, and advanced eco-friendly cleaning machines. These innovations not only enhance operational efficiency but also appeal to environmentally conscious consumers, a segment that is projected to grow by over 15% annually. Consumer preferences are evolving rapidly, demanding faster turnaround times, personalized care for garments, and transparent pricing. The rise of the gig economy has also influenced the industry, with many franchises leveraging flexible delivery models. Competitive dynamics are intensifying, prompting established players like Lapels and ZIPS Dry Cleaners to invest heavily in digital transformation and customer loyalty programs. Furthermore, the increasing awareness about hygiene and sanitation, especially post-pandemic, has further boosted the demand for professional cleaning services, creating a fertile ground for new franchises and expansion of existing ones. The market penetration of specialized services, such as garment care for sensitive fabrics and stain removal expertise, is also expected to see a notable uptick.

Dominant Markets & Segments in Laundry and Dry Cleaning Franchise

The global laundry and dry cleaning franchise market demonstrates distinct regional and segmental dominance. North America, particularly the United States, currently holds the largest market share, estimated at over $15 billion in 2025, driven by a mature consumer market with a high disposable income and a strong demand for convenience services. The increasing adoption of technology and the presence of well-established franchise brands contribute significantly to this dominance.

Application:

- Personal Investment: This segment continues to be a strong driver, especially for individuals seeking entrepreneurship opportunities with relatively lower initial capital compared to large corporate ventures. The appeal lies in established business models and brand recognition provided by franchisors. The market size for personal investment-driven franchises is projected to reach over $10 billion by 2025.

- Corporate Investment: This segment is witnessing significant growth as larger corporations and private equity firms identify the lucrative potential and scalability of the laundry and dry cleaning sector. They often focus on acquiring multiple units or establishing large-scale operations, driving market consolidation and efficiency.

Types:

- Pickup and Delivery: This segment is experiencing the most rapid expansion, driven by the demand for convenience. With an estimated market size of over $8 billion in 2025, its dominance is attributable to the ability to serve a wider customer base without requiring physical store presence in every locality. Factors like advanced logistics software and efficient routing systems are key growth enablers.

- Plant with Retail Store: This traditional model remains a significant player, offering a comprehensive service at a central location. It provides a strong brand presence and allows for direct customer interaction. The market size for this segment is estimated to be around $7 billion in 2025.

- Laundromat: While a more commoditized segment, laundromats are adapting by integrating modern amenities like Wi-Fi, comfortable seating, and app-based payment systems to enhance customer experience. The market size for this segment is estimated at over $5 billion in 2025.

- Satellite Store: These smaller outlets typically serve as drop-off and pick-up points for larger processing plants, catering to high-traffic areas. Their market size is projected to be around $3 billion in 2025.

Laundry and Dry Cleaning Franchise Product Developments

Product developments in the laundry and dry cleaning franchise sector are heavily focused on enhancing sustainability and convenience. Innovations include the adoption of advanced, water-saving, and chemical-reducing cleaning technologies, such as ozone cleaning and advanced solvent recovery systems, significantly reducing environmental impact and operational costs. The integration of smart technology, including mobile apps for order placement, payment, and real-time tracking, alongside automated locker systems for contactless service, is revolutionizing customer experience. These developments offer competitive advantages by addressing evolving consumer demands for eco-friendly, efficient, and technologically advanced laundry solutions.

Report Scope & Segmentation Analysis

This report meticulously analyzes the laundry and dry cleaning franchise market across various segmentation dimensions, providing granular insights into market dynamics and growth projections.

- Application: The market is segmented into Personal Investment and Corporate Investment. The Personal Investment segment, driven by entrepreneurial aspirations, is estimated to reach a market size of over $10 billion by 2025. The Corporate Investment segment, characterized by strategic acquisitions and large-scale operations, is projected for substantial growth, contributing significantly to market consolidation.

- Types: Key operational models analyzed include Pickup and Delivery, estimated at over $8 billion in 2025, leading in growth due to convenience demand. Plant with Retail Store is a significant segment valued at approximately $7 billion in 2025, offering comprehensive services. Laundromat services, while traditional, are adapting to modern needs, with an estimated market size of over $5 billion in 2025. Satellite Store operations, serving as convenient drop-off/pick-up points, are projected at around $3 billion in 2025. Others, encompassing specialized services, also contribute to the market's diversity.

Key Drivers of Laundry and Dry Cleaning Franchise Growth

The laundry and dry cleaning franchise sector's growth is propelled by several critical drivers. Technological advancements, such as the widespread adoption of app-based ordering, contactless payment systems, and eco-friendly cleaning technologies like ozone and advanced solvent recovery, are enhancing operational efficiency and customer convenience. Economic factors, including rising disposable incomes and a growing demand for time-saving services in dual-income households and urban areas, significantly boost service utilization. Regulatory support, particularly in regions promoting green initiatives and sustainable business practices, further encourages investment and innovation. The increasing focus on hygiene and sanitation, amplified by global health concerns, has also created a sustained demand for professional cleaning services.

Challenges in the Laundry and Dry Cleaning Franchise Sector

Despite robust growth, the laundry and dry cleaning franchise sector faces several challenges. Intense competition from both established brands and independent operators necessitates continuous innovation and competitive pricing strategies. Regulatory hurdles, including evolving environmental compliance standards for chemical disposal and water usage, can increase operational costs and require significant capital investment for upgrades. Supply chain disruptions, particularly for specialized cleaning chemicals and equipment, can impact service delivery and lead to delays. Furthermore, the labor-intensive nature of the industry, coupled with a shortage of skilled workers, presents a persistent challenge in maintaining service quality and operational efficiency.

Emerging Opportunities in Laundry and Dry Cleaning Franchise

Emerging opportunities in the laundry and dry cleaning franchise market are abundant, driven by evolving consumer lifestyles and technological advancements. The expansion of on-demand and subscription-based laundry services caters to the growing demand for ultimate convenience. The increasing consumer preference for sustainable and eco-friendly cleaning methods presents a significant opportunity for franchises adopting green technologies and practices. Furthermore, the growth of e-commerce and the need for specialized cleaning of delicate and high-value garments, such as designer wear and luxury fabrics, opens new revenue streams. The integration of smart home technology and IoT devices for seamless laundry management also represents a promising avenue for innovation.

Leading Players in the Laundry and Dry Cleaning Franchise Market

The laundry and dry cleaning franchise market is characterized by a diverse range of leading players, including:

- Tide Cleaners

- Dryclean USA

- Martinizing Dry Cleaning

- OneClick Cleaners

- Lapels

- ZIPS Dry Cleaners

- OXXO Care Cleaners

- CD One Price Cleaners

- Comet Cleaners

- Pressed4Time

- Speed Queen

- WaveMax Laundry

- Eco Laundry Company

- Cleanz24

- Mr Jeff

- Manju Cleaners

- ChemDry

- Instawash

- Pressto

- DhobiLite

Key Developments in Laundry and Dry Cleaning Franchise Industry

- 2023: Tide Cleaners continues its aggressive expansion through strategic partnerships and acquisitions, increasing its market presence by over 20%.

- 2023: ZIPS Dry Cleaners launches a new mobile app featuring advanced AI-powered garment care advice and personalized service options.

- 2024: OXXO Care Cleaners introduces a fully automated, contactless garment cleaning system in select metropolitan areas.

- 2024: WaveMax Laundry invests heavily in expanding its network of self-service laundromats equipped with smart payment and machine monitoring technology.

- 2024: Eco Laundry Company receives significant funding to scale its operations, focusing on biodegradable cleaning solutions and water-saving technologies.

- 2024: Mr Jeff expands its franchise model into new international markets, targeting emerging economies with a focus on affordable and convenient laundry solutions.

- 2025: Industry analysts predict a surge in M&A activity as larger players seek to consolidate market share and acquire innovative technologies.

- 2025: Continued growth in the pickup and delivery segment is expected, with a focus on optimizing logistics and delivery speed.

Strategic Outlook for Laundry and Dry Cleaning Franchise Market

The strategic outlook for the laundry and dry cleaning franchise market is overwhelmingly positive, driven by persistent consumer demand for convenience, a growing emphasis on sustainability, and ongoing technological integration. Franchisors that prioritize customer-centric innovations, such as seamless digital experiences, eco-friendly practices, and flexible service models, will be best positioned for sustained growth. Investments in operational efficiency through automation and advanced logistics will be crucial for maintaining competitive pricing and expanding reach. The increasing disposable incomes and urbanization trends globally will continue to fuel demand, while strategic partnerships and potential consolidations will shape the competitive landscape. The market is ripe for those who can effectively adapt to evolving consumer preferences and leverage emerging technologies to deliver superior value.

Laundry and Dry Cleaning Franchise Segmentation

-

1. Application

- 1.1. Personal Investment

- 1.2. Corporate Investment

-

2. Types

- 2.1. Pickup and Delivery

- 2.2. Satellite Store

- 2.3. Plant with Retail Store

- 2.4. Laundromat

- 2.5. Others

Laundry and Dry Cleaning Franchise Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Laundry and Dry Cleaning Franchise REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Laundry and Dry Cleaning Franchise Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Personal Investment

- 5.1.2. Corporate Investment

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Pickup and Delivery

- 5.2.2. Satellite Store

- 5.2.3. Plant with Retail Store

- 5.2.4. Laundromat

- 5.2.5. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Laundry and Dry Cleaning Franchise Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Personal Investment

- 6.1.2. Corporate Investment

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Pickup and Delivery

- 6.2.2. Satellite Store

- 6.2.3. Plant with Retail Store

- 6.2.4. Laundromat

- 6.2.5. Others

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Laundry and Dry Cleaning Franchise Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Personal Investment

- 7.1.2. Corporate Investment

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Pickup and Delivery

- 7.2.2. Satellite Store

- 7.2.3. Plant with Retail Store

- 7.2.4. Laundromat

- 7.2.5. Others

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Laundry and Dry Cleaning Franchise Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Personal Investment

- 8.1.2. Corporate Investment

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Pickup and Delivery

- 8.2.2. Satellite Store

- 8.2.3. Plant with Retail Store

- 8.2.4. Laundromat

- 8.2.5. Others

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Laundry and Dry Cleaning Franchise Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Personal Investment

- 9.1.2. Corporate Investment

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Pickup and Delivery

- 9.2.2. Satellite Store

- 9.2.3. Plant with Retail Store

- 9.2.4. Laundromat

- 9.2.5. Others

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Laundry and Dry Cleaning Franchise Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Personal Investment

- 10.1.2. Corporate Investment

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Pickup and Delivery

- 10.2.2. Satellite Store

- 10.2.3. Plant with Retail Store

- 10.2.4. Laundromat

- 10.2.5. Others

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Tide Cleaners

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Dryclean USA

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Martinizing Dry Cleaning

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 OneClick Cleaners

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Lapels

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 ZIPS Dry Cleaners

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 OXXO Care Cleaners

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 CD One Price Cleaners

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Comet Cleaners

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Pressed4Time

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Speed Queen

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 WaveMax Laundry

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Eco Laundry Company

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Cleanz24

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Mr Jeff

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Manju Cleaners

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 ChemDry

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 Instawash

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 Pressto

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.20 DhobiLite

- 11.2.20.1. Overview

- 11.2.20.2. Products

- 11.2.20.3. SWOT Analysis

- 11.2.20.4. Recent Developments

- 11.2.20.5. Financials (Based on Availability)

- 11.2.1 Tide Cleaners

List of Figures

- Figure 1: Global Laundry and Dry Cleaning Franchise Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Laundry and Dry Cleaning Franchise Revenue (million), by Application 2024 & 2032

- Figure 3: North America Laundry and Dry Cleaning Franchise Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Laundry and Dry Cleaning Franchise Revenue (million), by Types 2024 & 2032

- Figure 5: North America Laundry and Dry Cleaning Franchise Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Laundry and Dry Cleaning Franchise Revenue (million), by Country 2024 & 2032

- Figure 7: North America Laundry and Dry Cleaning Franchise Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Laundry and Dry Cleaning Franchise Revenue (million), by Application 2024 & 2032

- Figure 9: South America Laundry and Dry Cleaning Franchise Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Laundry and Dry Cleaning Franchise Revenue (million), by Types 2024 & 2032

- Figure 11: South America Laundry and Dry Cleaning Franchise Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Laundry and Dry Cleaning Franchise Revenue (million), by Country 2024 & 2032

- Figure 13: South America Laundry and Dry Cleaning Franchise Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Laundry and Dry Cleaning Franchise Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Laundry and Dry Cleaning Franchise Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Laundry and Dry Cleaning Franchise Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Laundry and Dry Cleaning Franchise Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Laundry and Dry Cleaning Franchise Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Laundry and Dry Cleaning Franchise Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Laundry and Dry Cleaning Franchise Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Laundry and Dry Cleaning Franchise Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Laundry and Dry Cleaning Franchise Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Laundry and Dry Cleaning Franchise Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Laundry and Dry Cleaning Franchise Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Laundry and Dry Cleaning Franchise Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Laundry and Dry Cleaning Franchise Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Laundry and Dry Cleaning Franchise Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Laundry and Dry Cleaning Franchise Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Laundry and Dry Cleaning Franchise Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Laundry and Dry Cleaning Franchise Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Laundry and Dry Cleaning Franchise Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Laundry and Dry Cleaning Franchise Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Laundry and Dry Cleaning Franchise Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Laundry and Dry Cleaning Franchise Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Laundry and Dry Cleaning Franchise Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Laundry and Dry Cleaning Franchise Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Laundry and Dry Cleaning Franchise Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Laundry and Dry Cleaning Franchise Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Laundry and Dry Cleaning Franchise Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Laundry and Dry Cleaning Franchise Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Laundry and Dry Cleaning Franchise Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Laundry and Dry Cleaning Franchise Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Laundry and Dry Cleaning Franchise Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Laundry and Dry Cleaning Franchise Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Laundry and Dry Cleaning Franchise Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Laundry and Dry Cleaning Franchise Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Laundry and Dry Cleaning Franchise Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Laundry and Dry Cleaning Franchise Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Laundry and Dry Cleaning Franchise Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Laundry and Dry Cleaning Franchise Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Laundry and Dry Cleaning Franchise Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Laundry and Dry Cleaning Franchise Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Laundry and Dry Cleaning Franchise Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Laundry and Dry Cleaning Franchise Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Laundry and Dry Cleaning Franchise Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Laundry and Dry Cleaning Franchise Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Laundry and Dry Cleaning Franchise Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Laundry and Dry Cleaning Franchise Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Laundry and Dry Cleaning Franchise Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Laundry and Dry Cleaning Franchise Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Laundry and Dry Cleaning Franchise Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Laundry and Dry Cleaning Franchise Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Laundry and Dry Cleaning Franchise Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Laundry and Dry Cleaning Franchise Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Laundry and Dry Cleaning Franchise Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Laundry and Dry Cleaning Franchise Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Laundry and Dry Cleaning Franchise Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Laundry and Dry Cleaning Franchise Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Laundry and Dry Cleaning Franchise Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Laundry and Dry Cleaning Franchise Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Laundry and Dry Cleaning Franchise Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Laundry and Dry Cleaning Franchise Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Laundry and Dry Cleaning Franchise Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Laundry and Dry Cleaning Franchise Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Laundry and Dry Cleaning Franchise Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Laundry and Dry Cleaning Franchise Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Laundry and Dry Cleaning Franchise Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Laundry and Dry Cleaning Franchise Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Laundry and Dry Cleaning Franchise?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Laundry and Dry Cleaning Franchise?

Key companies in the market include Tide Cleaners, Dryclean USA, Martinizing Dry Cleaning, OneClick Cleaners, Lapels, ZIPS Dry Cleaners, OXXO Care Cleaners, CD One Price Cleaners, Comet Cleaners, Pressed4Time, Speed Queen, WaveMax Laundry, Eco Laundry Company, Cleanz24, Mr Jeff, Manju Cleaners, ChemDry, Instawash, Pressto, DhobiLite.

3. What are the main segments of the Laundry and Dry Cleaning Franchise?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3350.00, USD 5025.00, and USD 6700.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Laundry and Dry Cleaning Franchise," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Laundry and Dry Cleaning Franchise report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Laundry and Dry Cleaning Franchise?

To stay informed about further developments, trends, and reports in the Laundry and Dry Cleaning Franchise, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence