Key Insights

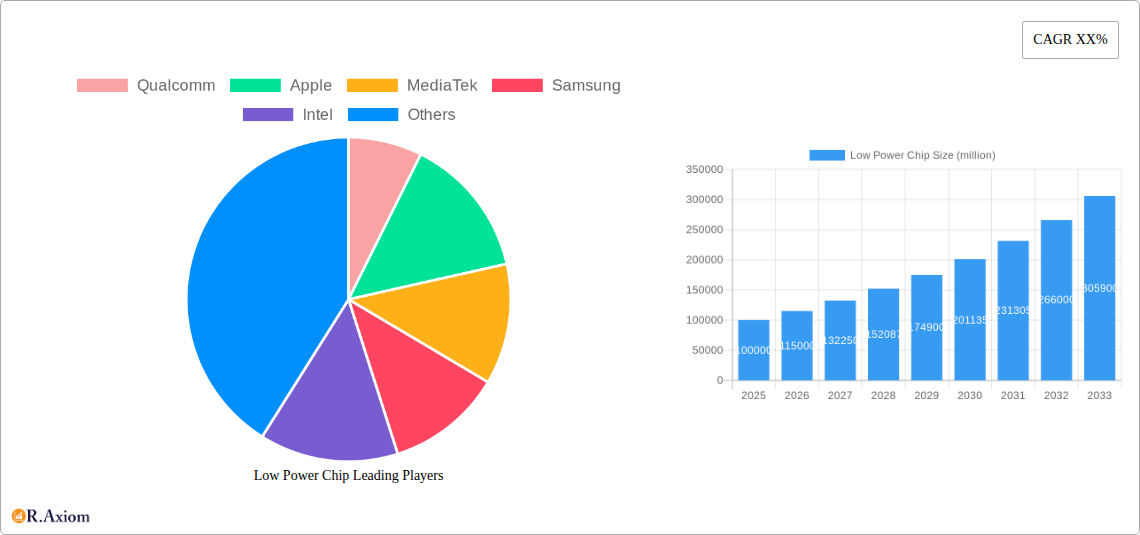

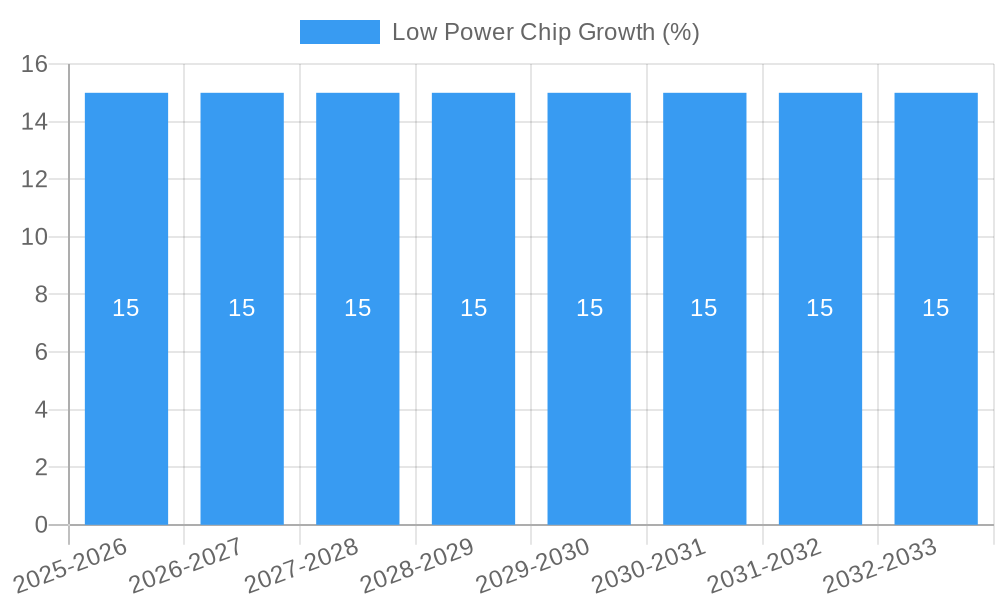

The global Low Power Chip market is projected to witness substantial growth, reaching an estimated market size of approximately USD 100,000 million by 2025, with a projected Compound Annual Growth Rate (CAGR) of 15% through 2033. This robust expansion is fueled by the escalating demand for energy-efficient solutions across a multitude of electronic devices. Key drivers include the burgeoning adoption of IoT devices, the increasing prevalence of wearable technology, and the stringent regulatory push for reduced power consumption in consumer electronics and automotive applications. The proliferation of smartphones, tablets, and advanced computing systems, all of which prioritize battery life and thermal management, further propels the market forward. Innovations in semiconductor technology, focusing on miniaturization, reduced voltage operation, and optimized power management integrated circuits (PMICs), are continuously enhancing the capabilities of low power chips.

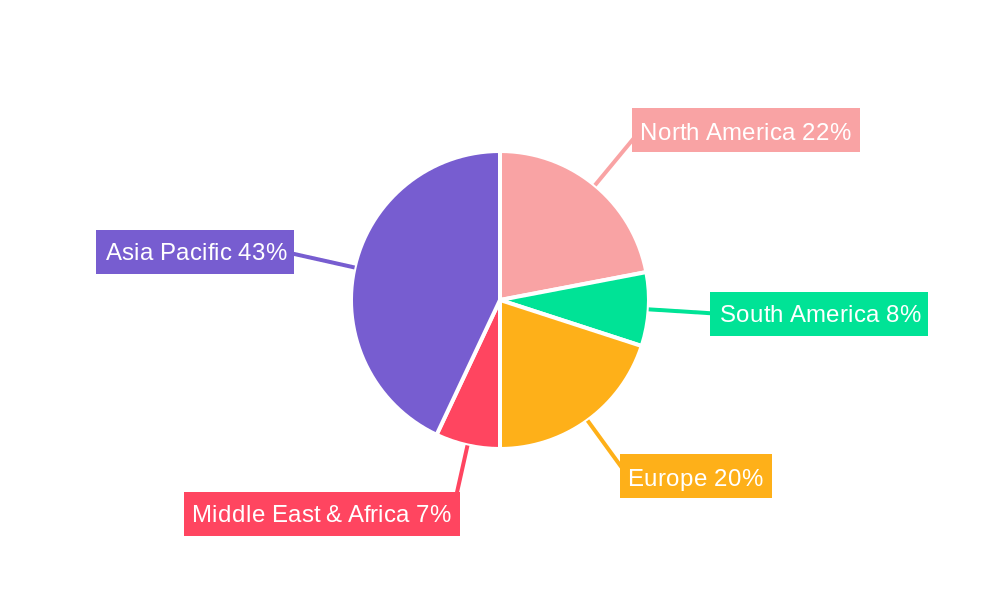

The market is segmented by type, with Dynamic Power Consumption chips expected to dominate due to their adaptability in varying operational states, followed by Static Power and Surge Power solutions. By application, the Computer and Phone segments are major revenue generators, with the Automotive sector showing significant growth potential driven by the electrification of vehicles and the demand for power-efficient in-car electronics. Emerging economies, particularly in the Asia Pacific region, are anticipated to be the fastest-growing markets, owing to rapid industrialization, increasing disposable incomes, and a strong manufacturing base for electronics. However, the market faces restraints such as the high research and development costs associated with advanced low-power technologies and the potential for commoditization of certain low-end chip categories. Despite these challenges, the overarching trend towards sustainability and the continuous evolution of smart devices ensure a bright future for the low power chip industry.

This in-depth report provides an exhaustive analysis of the global Low Power Chip market, encompassing historical data, current trends, and future projections. With an estimated market size reaching hundreds of millions by 2025 and projected to grow at a CAGR of xx% during the forecast period of 2025-2033, this study is an essential resource for stakeholders seeking to understand market dynamics, identify growth opportunities, and navigate the competitive landscape. The report covers a comprehensive study period from 2019 to 2033, with a base year of 2025 and an estimated year also set for 2025, followed by a robust forecast period.

Low Power Chip Market Concentration & Innovation

The Low Power Chip market exhibits moderate concentration, with major players like Qualcomm, Apple, MediaTek, Samsung, and Intel holding significant market shares. Levetop, Taolink Technologies, Ainstec, Rivai Technologies, Haitusense, Cva Chip, Nanjing Houmo Intelligent Technology, Suzhou XiongLi Technology, Hefei Aichuang Microelectronics Technology, Wuhan Ruinajie Semiconductor, Beijing Qingwei Intelligent Technology, Fengjia Microelectronics (Shanghai), and Shanghai Taisi Microelectronics are also emerging as key contributors, particularly in specialized segments and geographic regions. Innovation is a primary driver, fueled by the relentless demand for extended battery life in mobile devices, enhanced efficiency in automotive electronics, and reduced energy consumption in computing. Advancements in fabrication technologies, novel material science, and sophisticated power management techniques are at the forefront of this innovation. Regulatory frameworks, such as energy efficiency standards and environmental regulations, also play a crucial role in shaping product development and market adoption. The availability of product substitutes, while present in broader semiconductor categories, is limited for highly specialized low-power solutions. End-user trends strongly favor devices with longer operational durations and reduced thermal footprints. Mergers and acquisition (M&A) activities, valued in the millions of dollars, are expected to continue as companies seek to acquire complementary technologies and expand their market reach. For instance, strategic acquisitions in advanced semiconductor design and power management IP are anticipated to reshape the competitive landscape.

Low Power Chip Industry Trends & Insights

The global Low Power Chip market is experiencing robust growth, projected to reach a market size of hundreds of millions by 2025, with continued expansion driven by a CAGR of xx% during the forecast period of 2025-2033. This upward trajectory is propelled by several interconnected trends. Firstly, the ever-increasing demand for portable and connected devices across consumer electronics, automotive, and industrial sectors necessitates highly efficient power management solutions. The proliferation of the Internet of Things (IoT) is a significant catalyst, with billions of connected devices requiring minimal power to operate for extended periods, often in remote or battery-dependent environments. Technological disruptions are continuously pushing the boundaries of what's possible. Advances in sub-micron fabrication processes, such as xx nm and below, enable the creation of transistors with significantly reduced leakage current and dynamic power consumption. The development of novel architectures, including heterogeneous computing, multi-core processors optimized for low-power states, and specialized accelerators for AI and machine learning tasks, are further enhancing energy efficiency. Furthermore, the integration of advanced power management integrated circuits (PMICs) and sophisticated sleep modes is becoming standard. Consumer preferences are increasingly aligning with energy-conscious products. Users expect longer battery life, reduced heat generation, and a smaller environmental footprint from their devices. This has created a strong market pull for low-power chip solutions. Competitive dynamics are intensifying, with established players like Qualcomm, Apple, and MediaTek fiercely vying for market share by offering differentiated products. Simultaneously, emerging players are carving out niches through specialization in specific applications or by leveraging innovative technologies. The market penetration of low-power chips is expanding beyond traditional mobile devices into areas like wearables, smart home appliances, and increasingly, automotive applications where power efficiency is critical for electric vehicle range and autonomous driving systems. The continuous pursuit of higher performance at lower power envelopes is a defining characteristic of the industry.

Dominant Markets & Segments in Low Power Chip

The global Low Power Chip market is characterized by dominant segments that are driving significant growth and innovation.

Application Segments

- Phone: This segment remains a cornerstone of the low-power chip market. The relentless demand for longer battery life, thinner and lighter devices, and enhanced mobile computing power directly translates into a massive need for sophisticated low-power processors, modems, and application-specific integrated circuits (ASICs). The presence of major smartphone manufacturers like Apple, Samsung, and the strong influence of Qualcomm and MediaTek in supplying chipsets for a vast array of Android devices solidifies this segment's dominance. Economic policies that encourage consumer spending on smartphones and infrastructure development that supports ubiquitous mobile connectivity further bolster this segment.

- Automotive: This is a rapidly expanding segment, fueled by the electrification of vehicles and the increasing complexity of automotive electronics. Low-power chips are crucial for electric vehicle (EV) powertrains, battery management systems (BMS), infotainment systems, Advanced Driver-Assistance Systems (ADAS), and the burgeoning autonomous driving technologies. The drive for greater EV range, reduced energy consumption for onboard systems, and the integration of sophisticated sensors and processors necessitate highly efficient and reliable low-power solutions. Regulatory frameworks mandating stricter emissions standards and promoting EV adoption are significant growth drivers. Infrastructure development for charging stations and the widespread adoption of connected car technologies further accelerate this segment's growth.

- Computer: While desktop computers may not be the primary focus, the low-power chip market in computing is significantly driven by laptops, ultrabooks, and embedded systems. The demand for portable computing with extended battery life is a constant, pushing for energy-efficient CPUs, GPUs, and chipsets. The growth of cloud computing and data centers also indirectly benefits from low-power chip advancements, as energy efficiency translates to lower operational costs and reduced environmental impact.

- Others: This broad category encompasses a diverse range of applications, including wearables, IoT devices, smart home appliances, industrial automation, medical devices, and telecommunications equipment. The sheer volume and projected growth of the IoT ecosystem, with billions of sensors and connected devices requiring long battery life and minimal power consumption, make this segment a crucial contributor to the overall low-power chip market. The miniaturization trend across all electronic devices also favors low-power solutions.

Type Segments

- Dynamic Power Consumption: This segment is paramount as it directly relates to the power consumed when the chip is actively processing data. Innovations in reducing switching frequencies, optimizing transistor designs for lower operating voltages, and implementing dynamic voltage and frequency scaling (DVFS) are key to minimizing dynamic power. The continuous push for higher performance within strict power budgets drives innovation in this area.

- Static Power: Also known as leakage power, this refers to the power consumed when the chip is idle or in low-power states. Minimizing static power is crucial for extending battery life, especially in devices that spend a significant amount of time in standby mode. Advanced fabrication techniques, such as high-k metal-gate technology and multi-threshold CMOS, are employed to reduce leakage currents.

- Surge Power: This segment addresses the transient power spikes that occur during rapid changes in operational states, such as device startup or sudden bursts of processing activity. Efficient management of surge power is important for system stability and preventing premature battery depletion. Advanced power gating techniques and optimized power delivery networks are critical here.

Low Power Chip Product Developments

The low-power chip sector is abuzz with product innovation, driven by the insatiable demand for energy efficiency across diverse applications. Companies are actively developing advanced System-on-Chips (SoCs) with integrated power management units (PMUs), heterogeneous processing architectures that leverage specialized low-power cores for specific tasks, and novel semiconductor materials that exhibit reduced leakage currents. These advancements translate into extended battery life for smartphones, increased range for electric vehicles, and more efficient operation of IoT devices. Competitive advantages are being forged through superior power-performance ratios, reduced thermal footprints, and enhanced integration of functionalities, allowing for smaller and more cost-effective end products.

Report Scope & Segmentation Analysis

This report meticulously segments the Low Power Chip market across key dimensions to provide granular insights.

Application Segments: The Phone application segment is projected to maintain its leading position with an estimated market size of hundreds of millions in 2025, driven by the consistent demand for premium mobile experiences and the ongoing innovation in smartphone technology. The Automotive segment is anticipated to witness the highest growth rate, expanding to hundreds of millions by 2025, as the automotive industry accelerates its transition towards electrification and autonomous driving. The Computer segment, encompassing laptops and embedded systems, is expected to reach hundreds of millions, supported by the growing trend of portable computing. The Others segment, including IoT and wearables, presents substantial growth opportunities, with projections reaching hundreds of millions as the connected ecosystem continues to expand exponentially.

Type Segments: In terms of chip types, Dynamic Power Consumption represents the largest segment, estimated at hundreds of millions in 2025, due to its direct impact on active device performance. Static Power consumption, critical for battery longevity, is also a significant segment, projected to reach hundreds of millions, as manufacturers prioritize extended standby times. Surge Power management, while a smaller segment, is crucial for system reliability and is expected to grow to hundreds of millions as devices become more complex.

Key Drivers of Low Power Chip Growth

The growth of the Low Power Chip market is propelled by a confluence of factors. Technological advancements, particularly in semiconductor fabrication processes (e.g., xx nm nodes) and novel materials, are enabling lower power consumption. The burgeoning Internet of Things (IoT) ecosystem, with its demand for long-lasting, battery-powered devices, is a primary growth engine. The rapid adoption of electric vehicles (EVs), where power efficiency directly impacts range, is creating substantial demand in the automotive sector. Stringent government regulations and environmental initiatives mandating energy efficiency further incentivize the development and adoption of low-power solutions. Economic factors, such as increasing consumer demand for portable electronics and the growing penetration of smart technologies in homes and industries, also play a crucial role.

Challenges in the Low Power Chip Sector

Despite its promising outlook, the Low Power Chip sector faces several challenges. The increasing complexity of chip designs to achieve higher performance at lower power can lead to higher research and development costs, estimated in the millions of dollars. Supply chain disruptions, particularly in the semiconductor industry, can impact production and lead times, affecting market availability. Intense competition among established and emerging players can exert downward pressure on pricing. Furthermore, the evolving regulatory landscape, while a driver, can also present compliance challenges and require significant investment in redesigns. Developing cost-effective solutions for highly specialized niche applications remains a persistent challenge.

Emerging Opportunities in Low Power Chip

The Low Power Chip market is ripe with emerging opportunities. The exponential growth of the Internet of Things (IoT) continues to fuel demand for ultra-low-power microcontrollers and sensors. The expansion of 5G networks and the increasing adoption of edge computing will require highly efficient chipsets for base stations and edge devices. The automotive sector's transition to autonomous driving and electrification presents a significant opportunity for advanced power management solutions. Furthermore, the growing demand for sustainable and energy-efficient electronics across all sectors creates a continuous market for innovation in low-power technologies. The development of AI and machine learning accelerators optimized for low-power operation is another key emerging area.

Leading Players in the Low Power Chip Market

- Qualcomm

- Apple

- MediaTek

- Samsung

- Intel

- Levetop

- Taolink Technologies

- Ainstec

- Rivai Technologies

- Haitusense

- Cva Chip

- Nanjing Houmo Intelligent Technology

- Suzhou XiongLi Technology

- Hefei Aichuang Microelectronics Technology

- Wuhan Ruinajie Semiconductor

- Beijing Qingwei Intelligent Technology

- Fengjia Microelectronics (Shanghai)

- Shanghai Taisi Microelectronics

Key Developments in Low Power Chip Industry

- 2023 March: Apple launches M2 Pro and M2 Max chips, showcasing significant advancements in performance-per-watt for Mac computers.

- 2023 January: Qualcomm introduces the Snapdragon X75 modem-RFTM, offering enhanced power efficiency for 5G connectivity.

- 2022 December: MediaTek announces its new Dimensity 9200+ chipset, emphasizing improved power efficiency for flagship smartphones.

- 2022 November: Samsung unveils its latest Exynos processors, highlighting architectural improvements for reduced power consumption.

- 2022 October: Intel showcases its next-generation mobile processors with a focus on extending battery life for laptops.

- 2022 September: An industry consortium announces standardization efforts for ultra-low-power wireless communication protocols, impacting the IoT segment.

- 2022 August: Several startups announce breakthroughs in novel materials for next-generation low-power transistors.

- 2022 July: Major automotive chip manufacturers report increased R&D investments in power management solutions for EVs and autonomous driving.

Strategic Outlook for Low Power Chip Market

- 2023 March: Apple launches M2 Pro and M2 Max chips, showcasing significant advancements in performance-per-watt for Mac computers.

- 2023 January: Qualcomm introduces the Snapdragon X75 modem-RFTM, offering enhanced power efficiency for 5G connectivity.

- 2022 December: MediaTek announces its new Dimensity 9200+ chipset, emphasizing improved power efficiency for flagship smartphones.

- 2022 November: Samsung unveils its latest Exynos processors, highlighting architectural improvements for reduced power consumption.

- 2022 October: Intel showcases its next-generation mobile processors with a focus on extending battery life for laptops.

- 2022 September: An industry consortium announces standardization efforts for ultra-low-power wireless communication protocols, impacting the IoT segment.

- 2022 August: Several startups announce breakthroughs in novel materials for next-generation low-power transistors.

- 2022 July: Major automotive chip manufacturers report increased R&D investments in power management solutions for EVs and autonomous driving.

Strategic Outlook for Low Power Chip Market

The strategic outlook for the Low Power Chip market remains exceptionally bright, driven by persistent global trends towards electrification, digitalization, and sustainability. The continuous pursuit of longer battery life, reduced energy consumption, and higher performance-per-watt across all electronic devices will ensure sustained demand. Key growth catalysts include the ongoing expansion of the IoT ecosystem, the maturation of electric vehicle technology, and the increasing integration of AI and machine learning at the edge. Companies that focus on innovation in advanced semiconductor architectures, novel materials, and efficient power management techniques, while adeptly navigating supply chain complexities and regulatory landscapes, are well-positioned for significant success in this dynamic and expanding market.

Low Power Chip Segmentation

-

1. Application

- 1.1. Automotive

- 1.2. Computer

- 1.3. Phone

- 1.4. Others

-

2. Types

- 2.1. Dynamic Power Consumption

- 2.2. Static Power

- 2.3. Surge Power

Low Power Chip Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Low Power Chip REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Low Power Chip Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Automotive

- 5.1.2. Computer

- 5.1.3. Phone

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Dynamic Power Consumption

- 5.2.2. Static Power

- 5.2.3. Surge Power

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Low Power Chip Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Automotive

- 6.1.2. Computer

- 6.1.3. Phone

- 6.1.4. Others

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Dynamic Power Consumption

- 6.2.2. Static Power

- 6.2.3. Surge Power

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Low Power Chip Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Automotive

- 7.1.2. Computer

- 7.1.3. Phone

- 7.1.4. Others

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Dynamic Power Consumption

- 7.2.2. Static Power

- 7.2.3. Surge Power

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Low Power Chip Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Automotive

- 8.1.2. Computer

- 8.1.3. Phone

- 8.1.4. Others

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Dynamic Power Consumption

- 8.2.2. Static Power

- 8.2.3. Surge Power

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Low Power Chip Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Automotive

- 9.1.2. Computer

- 9.1.3. Phone

- 9.1.4. Others

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Dynamic Power Consumption

- 9.2.2. Static Power

- 9.2.3. Surge Power

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Low Power Chip Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Automotive

- 10.1.2. Computer

- 10.1.3. Phone

- 10.1.4. Others

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Dynamic Power Consumption

- 10.2.2. Static Power

- 10.2.3. Surge Power

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Qualcomm

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Apple

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 MediaTek

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Samsung

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Intel

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Levetop

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Taolink Technologies

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Ainstec

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Rivai Technologies

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Haitusense

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Cva Chip

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Nanjing Houmo Intelligent Technology

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Suzhou XiongLi Technology

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Hefei Aichuang Microelectronics Technology

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Wuhan Ruinajie Semiconductor

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Beijing Qingwei Intelligent Technology

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Fengjia Microelectronics (Shanghai)

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 Shanghai Taisi Microelectronics

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.1 Qualcomm

List of Figures

- Figure 1: Global Low Power Chip Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Low Power Chip Revenue (million), by Application 2024 & 2032

- Figure 3: North America Low Power Chip Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Low Power Chip Revenue (million), by Types 2024 & 2032

- Figure 5: North America Low Power Chip Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Low Power Chip Revenue (million), by Country 2024 & 2032

- Figure 7: North America Low Power Chip Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Low Power Chip Revenue (million), by Application 2024 & 2032

- Figure 9: South America Low Power Chip Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Low Power Chip Revenue (million), by Types 2024 & 2032

- Figure 11: South America Low Power Chip Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Low Power Chip Revenue (million), by Country 2024 & 2032

- Figure 13: South America Low Power Chip Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Low Power Chip Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Low Power Chip Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Low Power Chip Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Low Power Chip Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Low Power Chip Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Low Power Chip Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Low Power Chip Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Low Power Chip Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Low Power Chip Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Low Power Chip Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Low Power Chip Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Low Power Chip Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Low Power Chip Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Low Power Chip Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Low Power Chip Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Low Power Chip Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Low Power Chip Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Low Power Chip Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Low Power Chip Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Low Power Chip Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Low Power Chip Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Low Power Chip Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Low Power Chip Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Low Power Chip Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Low Power Chip Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Low Power Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Low Power Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Low Power Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Low Power Chip Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Low Power Chip Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Low Power Chip Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Low Power Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Low Power Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Low Power Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Low Power Chip Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Low Power Chip Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Low Power Chip Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Low Power Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Low Power Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Low Power Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Low Power Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Low Power Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Low Power Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Low Power Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Low Power Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Low Power Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Low Power Chip Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Low Power Chip Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Low Power Chip Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Low Power Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Low Power Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Low Power Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Low Power Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Low Power Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Low Power Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Low Power Chip Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Low Power Chip Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Low Power Chip Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Low Power Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Low Power Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Low Power Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Low Power Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Low Power Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Low Power Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Low Power Chip Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Low Power Chip?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Low Power Chip?

Key companies in the market include Qualcomm, Apple, MediaTek, Samsung, Intel, Levetop, Taolink Technologies, Ainstec, Rivai Technologies, Haitusense, Cva Chip, Nanjing Houmo Intelligent Technology, Suzhou XiongLi Technology, Hefei Aichuang Microelectronics Technology, Wuhan Ruinajie Semiconductor, Beijing Qingwei Intelligent Technology, Fengjia Microelectronics (Shanghai), Shanghai Taisi Microelectronics.

3. What are the main segments of the Low Power Chip?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Low Power Chip," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Low Power Chip report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Low Power Chip?

To stay informed about further developments, trends, and reports in the Low Power Chip, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence