Key Insights

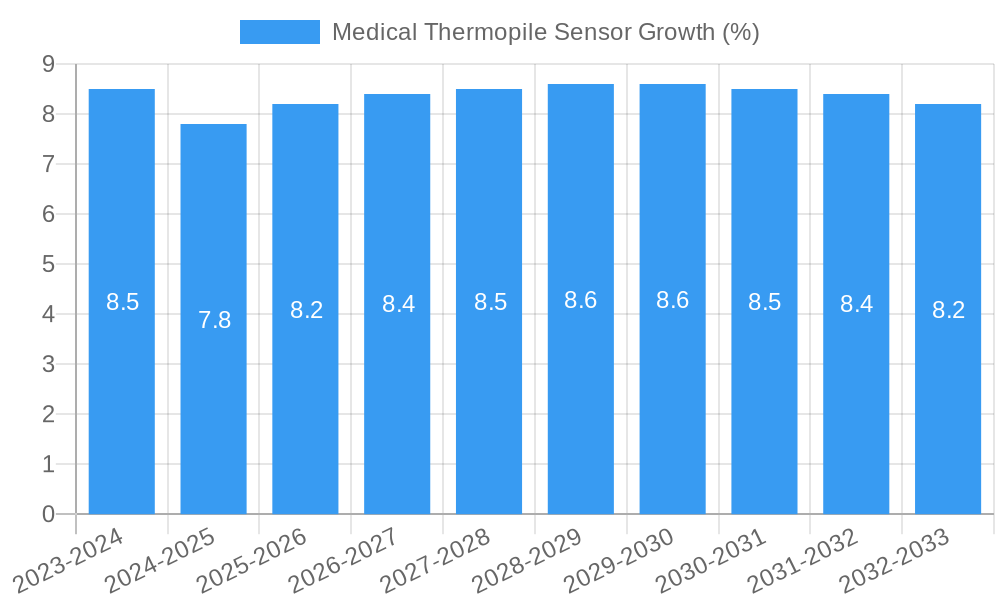

The global medical thermopile sensor market is poised for substantial growth, estimated at USD 550 million in 2025, with a projected Compound Annual Growth Rate (CAGR) of approximately 8.5% through 2033. This expansion is primarily fueled by the increasing demand for accurate and non-invasive temperature monitoring in healthcare settings, driven by an aging global population and the rising prevalence of chronic diseases requiring continuous health surveillance. The integration of advanced medical devices, such as smart thermometers and wearable health trackers, further propels market penetration. The COVID-19 pandemic significantly underscored the importance of rapid and reliable temperature detection, acting as a major catalyst for the adoption of thermopile sensors in both clinical and home-use scenarios. Emerging economies are also contributing to this growth, as healthcare infrastructure improves and awareness of the benefits of advanced diagnostic tools rises.

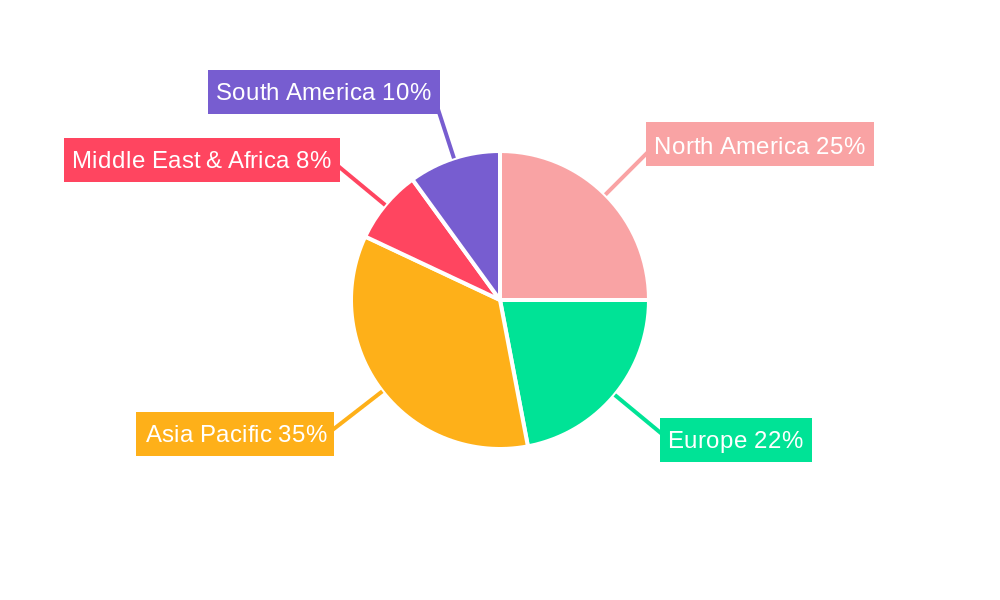

The market is segmented by application, with Forehead Thermometers and Ear Thermometers dominating the landscape due to their widespread use in consumer and professional settings. The "Others" segment, encompassing applications in medical imaging, patient monitoring systems, and drug delivery devices, is also expected to witness considerable expansion as innovation continues. In terms of technology, the Single Type Thermopile Sensor segment holds a larger share, attributed to its cost-effectiveness and suitability for a broad range of temperature sensing needs. However, the Dual Type Thermopile Sensor segment is gaining traction, offering enhanced accuracy and performance for more demanding medical applications. Geographically, Asia Pacific is projected to emerge as a key growth region, driven by burgeoning healthcare expenditure, rapid industrialization, and a large, health-conscious population, particularly in China and India. North America and Europe remain significant markets, characterized by established healthcare systems and high adoption rates of sophisticated medical technologies.

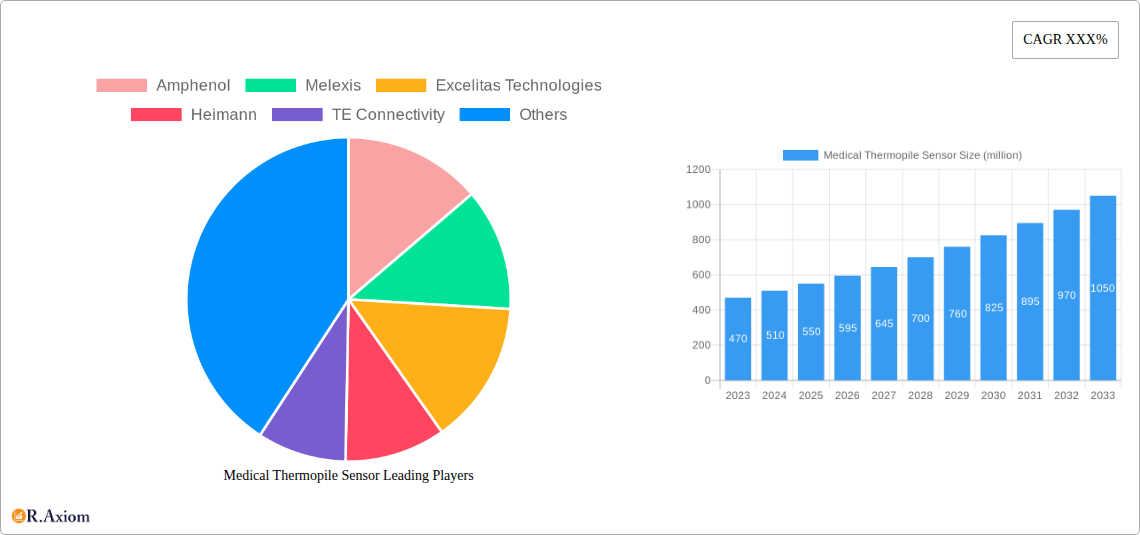

Medical Thermopile Sensor Market Concentration & Innovation

The medical thermopile sensor market, projected to reach $3,000 million by 2033, exhibits a moderate level of concentration. Leading players such as Amphenol, Melexis, Excelitas Technologies, Heimann, and TE Connectivity collectively hold significant market share, estimated at around 650 million. Innovation remains a crucial differentiator, driven by advancements in sensor accuracy, miniaturization, and energy efficiency. Key innovation drivers include the increasing demand for non-contact temperature measurement solutions in healthcare settings, fueled by the need for infection control and enhanced patient comfort. Regulatory frameworks, particularly those from bodies like the FDA and CE, play a pivotal role in shaping product development and market entry. Strict adherence to quality standards and performance benchmarks is paramount. Product substitutes, such as infrared thermometers without thermopile technology or alternative temperature sensing methods, exist but often lack the precision and reliability offered by thermopile sensors in medical applications. End-user trends strongly favor devices that are user-friendly, provide rapid and accurate readings, and are cost-effective. The COVID-19 pandemic significantly accelerated the adoption of contactless medical devices, boosting demand for thermopile sensors in fever screening applications. Mergers and acquisitions (M&A) activities are present, with an estimated M&A deal value of $500 million over the historical period, aimed at consolidating market presence and acquiring innovative technologies.

Medical Thermopile Sensor Industry Trends & Insights

The medical thermopile sensor industry is poised for robust growth, driven by an anticipated Compound Annual Growth Rate (CAGR) of 12.5% from 2025 to 2033. This significant expansion is underpinned by several key market growth drivers. The escalating global prevalence of infectious diseases and the subsequent emphasis on public health and hygiene have led to an unprecedented demand for accurate, non-contact temperature monitoring solutions. This surge is further amplified by an aging global population, which typically experiences a higher incidence of febrile conditions requiring regular temperature checks. Technological disruptions are continuously reshaping the landscape, with ongoing research and development focused on enhancing sensor sensitivity, reducing form factors for more discreet device integration, and improving power efficiency to enable longer battery life in portable medical devices. The development of sophisticated algorithms for ambient temperature compensation and advanced signal processing is also a critical area of innovation. Consumer preferences are increasingly leaning towards user-friendly, rapid, and accurate diagnostic tools that can be utilized both in clinical settings and for home healthcare monitoring. The convenience and safety of non-contact measurement are paramount, especially in the post-pandemic era. Competitive dynamics are characterized by a mix of established semiconductor manufacturers and specialized sensor providers vying for market share. Companies are investing heavily in R&D to differentiate their offerings through superior performance metrics, proprietary technologies, and competitive pricing. Market penetration is expected to deepen significantly, particularly in emerging economies where healthcare infrastructure is rapidly developing and there is a growing awareness of advanced diagnostic technologies. The integration of thermopile sensors into a wider array of medical devices, beyond traditional thermometers, is another significant trend contributing to market expansion.

Dominant Markets & Segments in Medical Thermopile Sensor

The medical thermopile sensor market is experiencing dominance in specific regions and application segments, driven by a confluence of economic policies, infrastructure development, and evolving healthcare needs. Geographically, North America and Europe currently represent the largest markets due to their well-established healthcare systems, high disposable incomes, and early adoption of advanced medical technologies. However, the Asia-Pacific region is emerging as a high-growth market, propelled by expanding healthcare expenditure, increasing prevalence of lifestyle-related diseases, and government initiatives to improve public health infrastructure. Within applications, the Forehead Thermometer segment is commanding a significant market share, estimated at $800 million in the base year 2025. This dominance is directly attributable to the widespread use of forehead thermometers in households, schools, and public spaces for rapid fever screening, a trend significantly accelerated by the global health crisis. The ease of use and non-invasive nature of forehead thermometers make them a preferred choice for general population screening.

- Key Drivers for Forehead Thermometer Dominance:

- Public Health Initiatives: Government campaigns promoting fever detection and early diagnosis.

- Consumer Convenience: Non-contact measurement offers superior hygiene and ease of use for individuals of all ages.

- Pandemic Preparedness: Increased demand for contactless temperature measurement solutions in public and private settings.

- Technological Advancements: Miniaturization and cost reduction of thermopile sensors enabling affordable consumer-grade devices.

The Ear Thermometer segment also holds a substantial market share, projected to reach $500 million by 2033. Ear thermometers are favored for their accuracy and speed in clinical settings, particularly for pediatric patients where accurate readings can be challenging.

- Key Drivers for Ear Thermometer Dominance:

- Clinical Accuracy: Historically recognized for providing reliable core body temperature readings.

- Pediatric Applications: Ease of use for infants and young children.

- Hospital and Clinic Adoption: Standard use in healthcare facilities for precise temperature monitoring.

The Others application segment, encompassing a range of devices like industrial thermometers, automotive sensors, and non-contact vital sign monitoring systems, is also witnessing steady growth, projected to reach $400 million by 2033.

- Key Drivers for 'Others' Segment Growth:

- Industrial Monitoring: Applications in manufacturing and process control requiring precise temperature measurement.

- Smart Home Integration: Incorporation into smart devices for environmental monitoring.

- Advanced Medical Devices: Use in non-contact patient monitoring systems and diagnostic equipment.

In terms of sensor type, the Single Type Thermopile Sensor segment currently dominates the market, estimated at $1,200 million in 2025. This is due to their widespread application in single-point temperature measurement devices like standard digital thermometers.

- Key Drivers for Single Type Dominance:

- Cost-Effectiveness: Generally less expensive to manufacture and integrate.

- Simplicity: Suitable for a broad range of basic temperature sensing applications.

- High Volume Production: Enables mass production of affordable consumer electronics.

The Dual Type Thermopile Sensor segment, while smaller, is exhibiting faster growth, projected to reach $900 million by 2033. These sensors are utilized in applications requiring more sophisticated temperature differential measurements or ambient temperature compensation, enhancing accuracy in complex environments.

- Key Drivers for Dual Type Growth:

- Enhanced Accuracy: Ability to compensate for ambient temperature variations.

- Advanced Medical Devices: Use in sophisticated diagnostic equipment and medical imaging.

- Growing R&D: Increased investment in higher-precision sensor technologies.

Medical Thermopile Sensor Product Developments

Recent product developments in the medical thermopile sensor market are centered on enhancing accuracy, miniaturization, and integration capabilities. Innovations include sensors with improved thermal resolution for detecting subtle temperature variations and advanced algorithms for real-time ambient temperature compensation, leading to more reliable readings in diverse conditions. Miniaturized sensor modules are enabling the development of smaller, more ergonomic medical devices, such as wearable health trackers and compact diagnostic tools. Furthermore, the integration of these sensors into smart medical devices, facilitating wireless data transmission and remote monitoring, is a significant trend. Competitive advantages are being achieved through higher signal-to-noise ratios, faster response times, and reduced power consumption, making these sensors ideal for battery-powered and portable healthcare solutions.

Report Scope & Segmentation Analysis

This report meticulously analyzes the global medical thermopile sensor market across its key segments. The Application segmentation includes Forehead Thermometer, Ear Thermometer, and Others. The Type segmentation covers Single Type Thermopile Sensor and Dual Type Thermopile Sensor.

The Forehead Thermometer segment is expected to witness substantial growth, driven by ongoing public health concerns and the demand for accessible fever screening tools, with projected market sizes reaching $1,500 million by 2033. Competitive dynamics are characterized by a focus on cost-effectiveness and ease of integration into consumer electronics.

The Ear Thermometer segment, a staple in clinical settings, is projected to reach $900 million by 2033. Its dominance is maintained by its reputation for accuracy, especially in pediatric care, with competition revolving around enhanced reliability and faster measurement times.

The Others segment, encompassing industrial and advanced medical applications, is forecasted to grow to $700 million by 2033. This segment's growth is fueled by diversification into new medical technologies and non-healthcare industrial uses, presenting opportunities for specialized, high-performance sensors.

For Single Type Thermopile Sensor, the market is estimated to reach $1,800 million by 2033. This segment benefits from its widespread application in established thermometer designs and its cost-effectiveness, leading to intense competition on volume and price.

The Dual Type Thermopile Sensor segment is projected to reach $1,300 million by 2033. Its growth is driven by the increasing demand for higher accuracy and advanced functionality in sophisticated medical devices, fostering innovation in sensor design and signal processing.

Key Drivers of Medical Thermopile Sensor Growth

The medical thermopile sensor market is propelled by a synergistic blend of technological advancements, economic imperatives, and evolving regulatory landscapes. The surging global demand for non-contact temperature measurement solutions, a direct consequence of heightened public health awareness and pandemic preparedness, is a primary growth catalyst. Technologically, the continuous miniaturization and improved accuracy of thermopile sensors are enabling their integration into an ever-wider array of medical devices, from consumer-grade thermometers to advanced diagnostic equipment. Economically, the increasing disposable incomes in emerging markets and government investments in healthcare infrastructure are expanding the accessibility of these sophisticated sensing technologies. Regulatory support for improved healthcare diagnostics and patient safety also plays a crucial role, encouraging manufacturers to develop and deploy high-performance thermopile sensors that meet stringent medical standards.

Challenges in the Medical Thermopile Sensor Sector

Despite its robust growth trajectory, the medical thermopile sensor sector faces several significant challenges. Intense price competition, particularly in the consumer electronics segment, can squeeze profit margins for manufacturers and necessitate continuous cost optimization strategies. Furthermore, the stringent regulatory approval processes for medical devices can lead to extended product development cycles and significant upfront investment. Supply chain disruptions, as experienced in recent years, can impact component availability and lead times, posing risks to consistent production and market responsiveness. The presence of alternative temperature sensing technologies, while often less precise, can also present a competitive hurdle in certain lower-end applications.

Emerging Opportunities in Medical Thermopile Sensor

The medical thermopile sensor market is ripe with emerging opportunities, particularly in the realm of advanced healthcare and smart devices. The burgeoning field of remote patient monitoring presents a significant avenue for growth, with thermopile sensors being integrated into wearable devices and home health hubs to track vital signs non-invasively. The expanding use of artificial intelligence (AI) in healthcare offers opportunities for AI-powered analysis of thermopile sensor data, enabling predictive diagnostics and personalized treatment. Furthermore, the increasing demand for contactless solutions in non-healthcare settings, such as food safety monitoring and industrial process control, opens up new market segments. The development of ultra-low-power thermopile sensors also creates opportunities for integration into battery-constrained IoT devices.

Leading Players in the Medical Thermopile Sensor Market

- Amphenol

- Melexis

- Excelitas Technologies

- Heimann

- TE Connectivity

- Semitec

- Hamamatsu Photonics

- Nicera

- Nippon Ceramic

- Micro-Hybrid Electronic

- Hanwei Electronics

- Winsen Electronics Technology

- Suzhou MEMSensing

Key Developments in Medical Thermopile Sensor Industry

- 2023: Launch of a new generation of ultra-sensitive thermopile sensors by Melexis, offering improved accuracy for non-contact medical thermometers.

- 2022: Excelitas Technologies announces an expansion of its thermopile sensor manufacturing capacity to meet surging demand.

- 2022: Hamamatsu Photonics introduces a compact, high-performance thermopile sensor array for advanced medical imaging applications.

- 2021: TE Connectivity acquires a specialized thermopile sensor company to bolster its presence in the healthcare market.

- 2020: Heimann releases an improved thermopile sensor with enhanced ambient temperature compensation for medical devices.

- 2019: Amphenol launches a new series of low-cost thermopile sensors optimized for high-volume consumer electronics, including fever thermometers.

Strategic Outlook for Medical Thermopile Sensor Market

The strategic outlook for the medical thermopile sensor market is overwhelmingly positive, driven by sustained demand for non-contact temperature measurement and the continuous innovation in sensor technology. Key growth catalysts include the expanding applications in remote patient monitoring, the integration with AI for advanced diagnostics, and the increasing penetration in emerging economies. Companies that focus on developing highly accurate, miniaturized, and energy-efficient thermopile sensors, while navigating regulatory landscapes and competitive pricing, are well-positioned for success. Strategic partnerships and R&D investments in next-generation sensing capabilities will be crucial for capturing market share and driving future growth.

Medical Thermopile Sensor Segmentation

-

1. Application

- 1.1. Forehead Thermometer

- 1.2. Ear Thermometer

- 1.3. Others

-

2. Type

- 2.1. Single Type Thermopile Sensor

- 2.2. Dual Type Thermopile Sensor

Medical Thermopile Sensor Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Medical Thermopile Sensor REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XXX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Medical Thermopile Sensor Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Forehead Thermometer

- 5.1.2. Ear Thermometer

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Single Type Thermopile Sensor

- 5.2.2. Dual Type Thermopile Sensor

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Medical Thermopile Sensor Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Forehead Thermometer

- 6.1.2. Ear Thermometer

- 6.1.3. Others

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Single Type Thermopile Sensor

- 6.2.2. Dual Type Thermopile Sensor

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Medical Thermopile Sensor Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Forehead Thermometer

- 7.1.2. Ear Thermometer

- 7.1.3. Others

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Single Type Thermopile Sensor

- 7.2.2. Dual Type Thermopile Sensor

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Medical Thermopile Sensor Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Forehead Thermometer

- 8.1.2. Ear Thermometer

- 8.1.3. Others

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Single Type Thermopile Sensor

- 8.2.2. Dual Type Thermopile Sensor

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Medical Thermopile Sensor Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Forehead Thermometer

- 9.1.2. Ear Thermometer

- 9.1.3. Others

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Single Type Thermopile Sensor

- 9.2.2. Dual Type Thermopile Sensor

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Medical Thermopile Sensor Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Forehead Thermometer

- 10.1.2. Ear Thermometer

- 10.1.3. Others

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Single Type Thermopile Sensor

- 10.2.2. Dual Type Thermopile Sensor

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Amphenol

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Melexis

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Excelitas Technologies

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Heimann

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 TE Connectivity

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Semitec

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Hamamatsu Photonics

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Nicera

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Nippon Ceramic

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Micro-Hybrid Electronic

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Hanwei Electronics

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Winsen Electronics Technology

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Suzhou MEMSensing

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.1 Amphenol

List of Figures

- Figure 1: Global Medical Thermopile Sensor Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Medical Thermopile Sensor Revenue (million), by Application 2024 & 2032

- Figure 3: North America Medical Thermopile Sensor Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Medical Thermopile Sensor Revenue (million), by Type 2024 & 2032

- Figure 5: North America Medical Thermopile Sensor Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Medical Thermopile Sensor Revenue (million), by Country 2024 & 2032

- Figure 7: North America Medical Thermopile Sensor Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Medical Thermopile Sensor Revenue (million), by Application 2024 & 2032

- Figure 9: South America Medical Thermopile Sensor Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Medical Thermopile Sensor Revenue (million), by Type 2024 & 2032

- Figure 11: South America Medical Thermopile Sensor Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America Medical Thermopile Sensor Revenue (million), by Country 2024 & 2032

- Figure 13: South America Medical Thermopile Sensor Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Medical Thermopile Sensor Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Medical Thermopile Sensor Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Medical Thermopile Sensor Revenue (million), by Type 2024 & 2032

- Figure 17: Europe Medical Thermopile Sensor Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Medical Thermopile Sensor Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Medical Thermopile Sensor Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Medical Thermopile Sensor Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Medical Thermopile Sensor Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Medical Thermopile Sensor Revenue (million), by Type 2024 & 2032

- Figure 23: Middle East & Africa Medical Thermopile Sensor Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa Medical Thermopile Sensor Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Medical Thermopile Sensor Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Medical Thermopile Sensor Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Medical Thermopile Sensor Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Medical Thermopile Sensor Revenue (million), by Type 2024 & 2032

- Figure 29: Asia Pacific Medical Thermopile Sensor Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific Medical Thermopile Sensor Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Medical Thermopile Sensor Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Medical Thermopile Sensor Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Medical Thermopile Sensor Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Medical Thermopile Sensor Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Medical Thermopile Sensor Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Medical Thermopile Sensor Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Medical Thermopile Sensor Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global Medical Thermopile Sensor Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Medical Thermopile Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Medical Thermopile Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Medical Thermopile Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Medical Thermopile Sensor Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Medical Thermopile Sensor Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global Medical Thermopile Sensor Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Medical Thermopile Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Medical Thermopile Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Medical Thermopile Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Medical Thermopile Sensor Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Medical Thermopile Sensor Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global Medical Thermopile Sensor Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Medical Thermopile Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Medical Thermopile Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Medical Thermopile Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Medical Thermopile Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Medical Thermopile Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Medical Thermopile Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Medical Thermopile Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Medical Thermopile Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Medical Thermopile Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Medical Thermopile Sensor Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Medical Thermopile Sensor Revenue million Forecast, by Type 2019 & 2032

- Table 31: Global Medical Thermopile Sensor Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Medical Thermopile Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Medical Thermopile Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Medical Thermopile Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Medical Thermopile Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Medical Thermopile Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Medical Thermopile Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Medical Thermopile Sensor Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Medical Thermopile Sensor Revenue million Forecast, by Type 2019 & 2032

- Table 40: Global Medical Thermopile Sensor Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Medical Thermopile Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Medical Thermopile Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Medical Thermopile Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Medical Thermopile Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Medical Thermopile Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Medical Thermopile Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Medical Thermopile Sensor Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Medical Thermopile Sensor?

The projected CAGR is approximately XXX%.

2. Which companies are prominent players in the Medical Thermopile Sensor?

Key companies in the market include Amphenol, Melexis, Excelitas Technologies, Heimann, TE Connectivity, Semitec, Hamamatsu Photonics, Nicera, Nippon Ceramic, Micro-Hybrid Electronic, Hanwei Electronics, Winsen Electronics Technology, Suzhou MEMSensing.

3. What are the main segments of the Medical Thermopile Sensor?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Medical Thermopile Sensor," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Medical Thermopile Sensor report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Medical Thermopile Sensor?

To stay informed about further developments, trends, and reports in the Medical Thermopile Sensor, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence