Key Insights

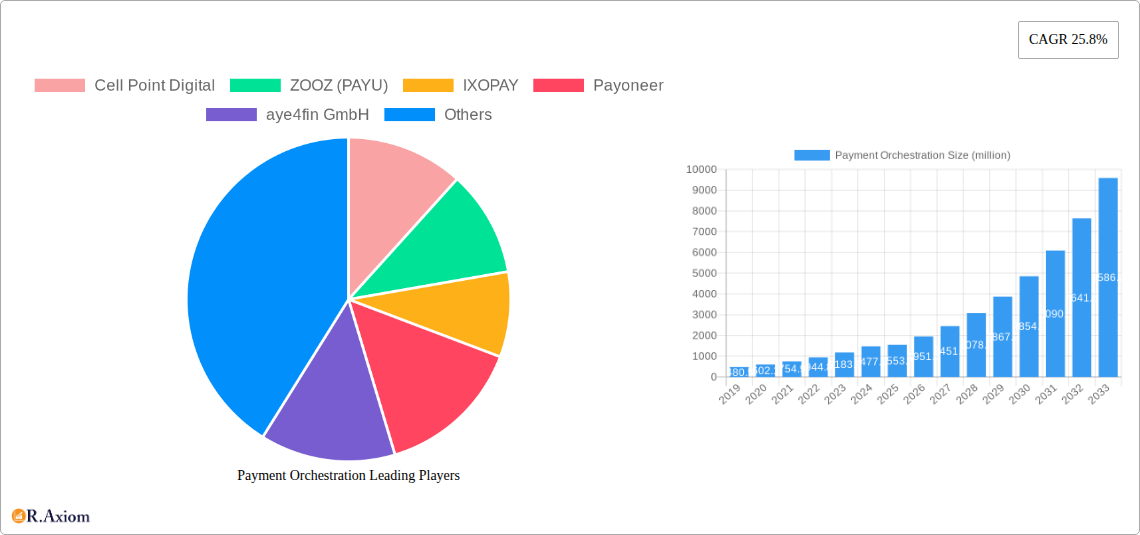

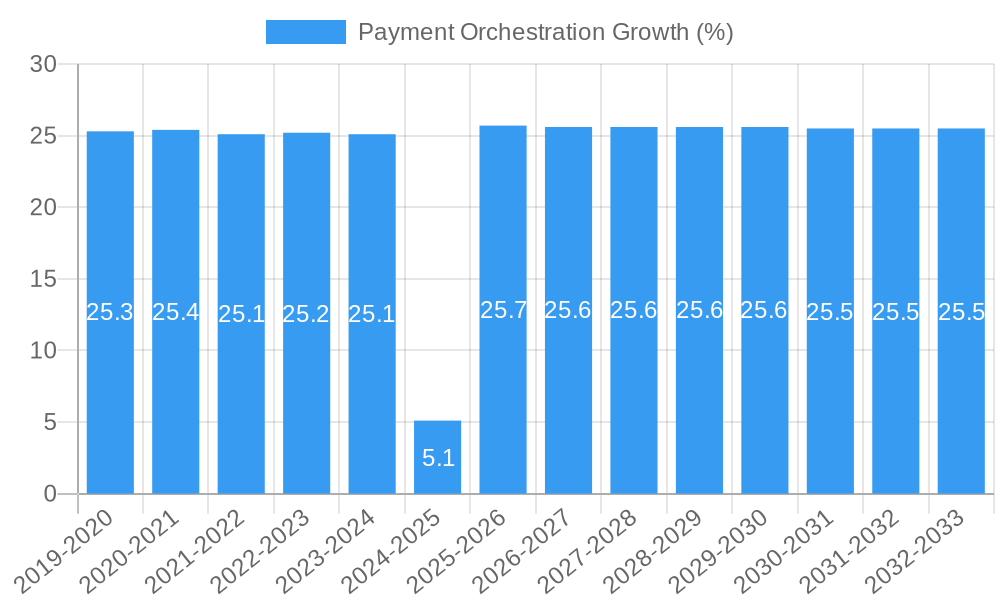

The Payment Orchestration market is poised for explosive growth, projected to reach $1553.3 million by 2025 and sustain a remarkable Compound Annual Growth Rate (CAGR) of 25.8% through 2033. This surge is fueled by the increasing complexity of digital payment ecosystems, the rising demand for seamless cross-border transactions, and the critical need for businesses to optimize their payment processing efficiency and security. As e-commerce continues its global dominance and industries like BFSI, Healthcare, and EdTech increasingly rely on sophisticated payment solutions, payment orchestration platforms become indispensable tools for managing multiple payment gateways, reducing transaction costs, preventing fraud, and enhancing the customer experience. The market's robust expansion is also propelled by the growing adoption of advanced technologies such as AI and machine learning for intelligent payment routing and fraud detection, as well as the push for greater regulatory compliance across diverse payment landscapes.

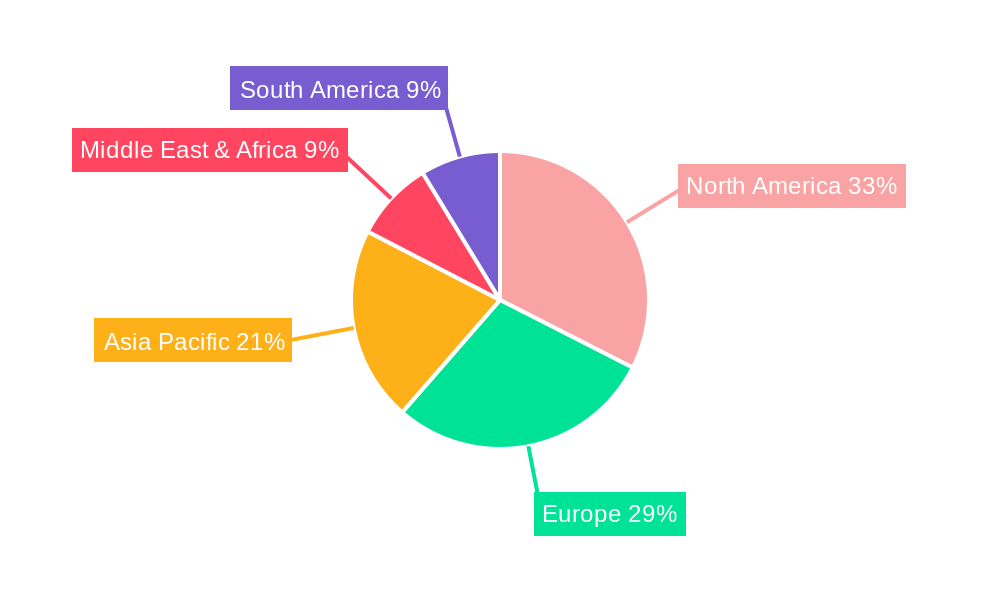

The market is segmented by both application and type, reflecting its broad applicability and diverse user base. Key application segments like BFSI, E-commerce, Travel and Hospitality, EdTech, Gaming and Entertainment, and Healthcare Industry are driving significant demand. The B2C, B2B, and C2C segments further highlight the pervasive nature of payment orchestration needs across all levels of commerce. Geographically, North America and Europe are leading the adoption, benefiting from established digital payment infrastructures and high consumer trust. However, the Asia Pacific region is expected to witness the fastest growth, driven by its burgeoning digital economies, increasing smartphone penetration, and a rapidly expanding online consumer base. The competitive landscape features prominent players such as Cell Point Digital, ZOOZ (PAYU), IXOPAY, Payoneer, and Worldline, all actively innovating to capture market share by offering comprehensive, scalable, and secure payment orchestration solutions.

This in-depth report delivers a thorough analysis of the global Payment Orchestration market, providing critical insights for stakeholders navigating this dynamic sector. Covering a comprehensive study period from 2019 to 2033, with a base year of 2025 and a forecast period from 2025 to 2033, this report offers invaluable data and strategic guidance. The market is projected to reach over 1,000 million by 2025, with an estimated CAGR of 15.XX% during the forecast period. Historical data from 2019-2024 is meticulously analyzed to provide a robust foundation.

Payment Orchestration Market Concentration & Innovation

The Payment Orchestration market exhibits moderate to high concentration, with several key players vying for dominance. Innovation is a primary driver, fueled by the increasing demand for seamless, secure, and flexible payment processing across diverse industries. Regulatory frameworks, such as PSD2 and emerging data privacy laws, are shaping product development and market strategies, ensuring compliance and fostering trust. Product substitutes, including traditional payment gateways and integrated payment solutions, are present but lack the comprehensive flexibility offered by true orchestration platforms. End-user trends indicate a strong preference for embedded payments, localized payment methods, and enhanced fraud prevention capabilities. Mergers and acquisitions (M&A) activity is significant, with an estimated 100 million in M&A deal values observed during the historical period, indicating consolidation and strategic expansion. Leading companies are actively acquiring smaller innovators to expand their service portfolios and market reach.

- Market Share Metrics: Companies like Cell Point Digital and ZOOZ (PAYU) hold substantial market shares, estimated in the range of 10-15% each.

- M&A Deal Values: Significant investment in acquiring innovative technologies and customer bases. Recent deals have involved valuations in the tens of millions of dollars.

Payment Orchestration Industry Trends & Insights

The Payment Orchestration industry is experiencing robust growth, driven by several interconnected trends and evolving consumer preferences. The insatiable demand for frictionless digital experiences across all sectors is a primary growth catalyst. Businesses are increasingly recognizing the strategic importance of a unified payment layer that can connect disparate payment methods, gateways, and acquirers. This enables them to optimize transaction success rates, reduce costs, and enhance customer satisfaction. Technological advancements, particularly in APIs, AI-powered fraud detection, and real-time data analytics, are profoundly impacting the industry. These technologies empower payment orchestration platforms to offer sophisticated functionalities such as intelligent routing, dynamic currency conversion, and personalized payment experiences.

Consumer preferences are shifting towards greater flexibility and convenience. Shoppers expect to pay using their preferred methods, whether it's a local e-wallet, buy now, pay later (BNPL) option, or traditional card schemes. Payment orchestration platforms address this by providing a single point of integration for a vast array of payment options. Furthermore, the rise of cross-border e-commerce necessitates sophisticated solutions that can handle multiple currencies, local regulations, and varying payment preferences across different geographies. The competitive landscape is intensifying, with established payment providers, fintech startups, and technology giants all vying for market share. This competition fosters continuous innovation and drives down costs, benefiting end-users. The estimated market penetration for advanced payment orchestration solutions is still in its early stages, presenting a significant opportunity for growth. The projected CAGR of 15.XX% reflects this substantial untapped potential. Companies are investing heavily in R&D to develop more intelligent and adaptable payment infrastructures. The ongoing digital transformation across industries, from BFSI to Travel and Hospitality, further fuels the adoption of these comprehensive payment solutions. The market is expected to witness continued innovation in areas like embedded finance, ensuring payments are an integral part of the user journey rather than a separate step.

Dominant Markets & Segments in Payment Orchestration

The Payment Orchestration market exhibits a clear dominance in certain regions and industry segments, driven by specific economic policies, technological infrastructure, and regulatory environments.

Leading Region Analysis: North America currently holds a leading position, driven by its mature e-commerce ecosystem, high disposable income, and early adoption of digital payment technologies. The region benefits from a robust regulatory framework that encourages innovation while prioritizing consumer protection.

Dominant Segments by Application:

- E-commerce: This segment is the largest contributor to the payment orchestration market. The surge in online shopping, particularly post-pandemic, has created an immense need for scalable, secure, and diverse payment processing capabilities. Businesses require solutions that can handle high transaction volumes, prevent fraud, and offer localized payment options to cater to a global customer base. The economic policies supporting digital commerce and readily available internet infrastructure further solidify e-commerce's dominance.

- BFSI (Banking, Financial Services, and Insurance): This sector is a significant adopter due to the complex regulatory landscape, the need for secure transaction processing, and the drive for digital transformation. Payment orchestration enables BFSI institutions to streamline internal processes, offer innovative digital payment services to their customers, and enhance fraud detection mechanisms. Investments in advanced fintech solutions and a strong focus on cybersecurity are key drivers here.

- Travel and Hospitality Industry: This industry relies heavily on seamless payment experiences for bookings, reservations, and in-service transactions. Payment orchestration allows for dynamic pricing, flexible payment options (including BNPL for larger bookings), and efficient handling of international transactions. The recovery and continued growth of global travel are directly impacting the demand for these solutions.

Dominant Segments by Type:

- B2C (Business-to-Consumer): This segment represents the largest share of the payment orchestration market. The overwhelming majority of consumer transactions occur in a B2C context, whether online or in-store. The demand for intuitive, fast, and secure payment experiences by individual consumers is the primary driver.

- B2B (Business-to-Business): While smaller than B2C, the B2B segment is experiencing significant growth. Businesses are increasingly adopting digital payment solutions for procurement, invoicing, and supplier payments. Payment orchestration offers B2B companies efficiency gains through automated reconciliation, improved cash flow management, and access to a wider range of payment methods suitable for business transactions. The increasing complexity of B2B supply chains and the drive for operational efficiency are key factors.

Payment Orchestration Product Developments

Product developments in payment orchestration are rapidly advancing, focusing on intelligence, flexibility, and comprehensive functionality. Key innovations include AI-powered fraud detection engines that proactively identify and prevent fraudulent transactions with unparalleled accuracy. Real-time analytics dashboards provide businesses with deep insights into transaction performance, customer behavior, and operational efficiency. The integration of advanced routing capabilities optimizes transaction success rates by intelligently selecting the best payment gateway or acquirer for each transaction based on cost, success rate, and region. Emphasis is also placed on supporting a wider array of payment methods, including digital wallets, cryptocurrencies, and BNPL options, to cater to evolving consumer preferences. These developments offer significant competitive advantages by enabling businesses to reduce costs, improve customer experience, and expand their market reach.

Report Scope & Segmentation Analysis

This report offers a detailed segmentation of the Payment Orchestration market across key Application and Type categories. The analysis provides granular insights into the market dynamics, growth projections, and competitive landscapes within each segment.

- BFSI: This segment is projected to witness substantial growth, with market sizes estimated to reach over 200 million by 2025. Growth is driven by digital transformation initiatives and the need for robust fraud prevention.

- E-commerce: Expected to remain the largest segment, with market sizes exceeding 300 million by 2025. Key drivers include the expansion of online retail and the demand for seamless checkout experiences.

- Travel and Hospitality Industry: This segment, estimated at over 100 million by 2025, benefits from the recovery of global travel and the increasing adoption of digital booking and payment solutions.

- EdTech: A growing segment, projected to reach over 50 million by 2025, driven by the increasing demand for online learning platforms and subscription services.

- Gaming and Entertainment: This segment, estimated at over 70 million by 2025, is fueled by in-game purchases and digital content consumption, requiring flexible and secure payment options.

- Healthcare Industry: Expected to grow to over 60 million by 2025, driven by the adoption of telemedicine and digital health services.

- Others: Encompassing various emerging sectors, this segment is projected to reach over 40 million by 2025.

- B2C: Dominating the market, with an estimated size of over 500 million by 2025, driven by widespread consumer adoption of digital payments.

- B2B: Experiencing strong growth, projected to exceed 150 million by 2025, as businesses increasingly digitize their payment processes.

- C2C: While a smaller segment, estimated at over 20 million by 2025, it is influenced by the growth of peer-to-peer payment platforms.

Key Drivers of Payment Orchestration Growth

The growth of the Payment Orchestration market is propelled by several interconnected factors.

- Technological Advancements: The rapid evolution of APIs, cloud computing, and artificial intelligence has enabled the development of more sophisticated and flexible payment solutions.

- Digital Transformation: Across all industries, businesses are undergoing digital transformation, leading to an increased reliance on digital payment processing.

- E-commerce Expansion: The continuous growth of online retail globally necessitates robust and scalable payment infrastructure.

- Cross-Border Commerce: The increasing volume of international transactions drives the demand for solutions that can handle multiple currencies, regulations, and payment preferences.

- Customer Experience Enhancement: Businesses are prioritizing seamless and personalized payment experiences to improve customer satisfaction and loyalty.

- Regulatory Compliance: Evolving payment regulations (e.g., data privacy, security standards) mandate the use of advanced payment solutions.

Challenges in the Payment Orchestration Sector

Despite its growth potential, the Payment Orchestration sector faces several challenges.

- Regulatory Complexity: Navigating diverse and ever-changing global payment regulations can be a significant hurdle for businesses and solution providers.

- Integration Challenges: Integrating multiple payment gateways, acquirers, and services can be technically complex and time-consuming.

- Security and Fraud Prevention: Maintaining robust security measures and effectively combating sophisticated fraud schemes requires continuous investment and adaptation.

- Talent Shortage: A lack of skilled professionals with expertise in payment technologies, cybersecurity, and data analytics can hinder development and implementation.

- Market Fragmentation: The presence of numerous vendors and solutions can lead to market fragmentation and difficulty in selecting the optimal orchestration platform.

Emerging Opportunities in Payment Orchestration

The Payment Orchestration market is ripe with emerging opportunities.

- Embedded Finance: The integration of payment functionalities directly into non-financial applications and platforms presents a significant growth area.

- BNPL Expansion: The continued growth of Buy Now, Pay Later solutions offers a compelling opportunity for orchestration platforms to facilitate these payment methods.

- Cryptocurrency Integration: As cryptocurrencies gain mainstream acceptance, the ability to seamlessly integrate them into payment flows will become increasingly valuable.

- AI and Machine Learning: Further advancements in AI and ML for fraud detection, personalized payment offers, and predictive analytics will unlock new capabilities.

- Emerging Markets: The growing digital adoption in developing economies presents a substantial opportunity for payment orchestration solutions tailored to local needs.

Leading Players in the Payment Orchestration Market

- Cell Point Digital

- ZOOZ (PAYU)

- IXOPAY

- Payoneer

- aye4fin GmbH

- Bridge

- Amadeus IT Group

- Worldline

- APEXX Fintech

- Rebilly

- Spreedly

- ModoPayments

Key Developments in Payment Orchestration Industry

- 2024 Q1: Spreedly announces a significant expansion of its payment gateway integrations, adding over 50 new options to its platform.

- 2024 Q2: Cell Point Digital acquires a leading fraud detection startup, enhancing its security capabilities.

- 2024 Q3: IXOPAY launches a new suite of tools for merchants in the Travel and Hospitality sector, focusing on dynamic pricing and payment flexibility.

- 2024 Q4: ZOOZ (PAYU) announces strategic partnerships with several major e-commerce platforms to streamline checkout experiences.

- 2025 Q1: Worldline introduces an AI-powered payment routing engine designed to optimize transaction success rates globally.

- 2025 Q2: APEXX Fintech secures substantial funding to accelerate its global expansion and product development in B2B payments.

Strategic Outlook for Payment Orchestration Market

- 2024 Q1: Spreedly announces a significant expansion of its payment gateway integrations, adding over 50 new options to its platform.

- 2024 Q2: Cell Point Digital acquires a leading fraud detection startup, enhancing its security capabilities.

- 2024 Q3: IXOPAY launches a new suite of tools for merchants in the Travel and Hospitality sector, focusing on dynamic pricing and payment flexibility.

- 2024 Q4: ZOOZ (PAYU) announces strategic partnerships with several major e-commerce platforms to streamline checkout experiences.

- 2025 Q1: Worldline introduces an AI-powered payment routing engine designed to optimize transaction success rates globally.

- 2025 Q2: APEXX Fintech secures substantial funding to accelerate its global expansion and product development in B2B payments.

Strategic Outlook for Payment Orchestration Market

The strategic outlook for the Payment Orchestration market is exceptionally positive, driven by the persistent global shift towards digital commerce and the increasing complexity of payment ecosystems. Future growth will be catalyzed by the continued demand for frictionless customer experiences, the necessity for advanced fraud prevention, and the imperative for businesses to optimize transaction costs and success rates. Companies that can effectively leverage AI, offer a comprehensive range of payment options, and ensure seamless integration will be well-positioned for success. The ongoing expansion into emerging markets and the increasing adoption of embedded finance present significant untapped potential, promising sustained innovation and market growth throughout the forecast period.

Payment Orchestration Segmentation

-

1. Application

- 1.1. BFSI

- 1.2. E-commerce

- 1.3. Travel and Hospitality Industry

- 1.4. EdTech

- 1.5. Gaming and Entertainment

- 1.6. Healthcare Industry

- 1.7. Others

-

2. Types

- 2.1. B2C

- 2.2. B2B

- 2.3. C2C

Payment Orchestration Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Payment Orchestration REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 25.8% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Payment Orchestration Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. BFSI

- 5.1.2. E-commerce

- 5.1.3. Travel and Hospitality Industry

- 5.1.4. EdTech

- 5.1.5. Gaming and Entertainment

- 5.1.6. Healthcare Industry

- 5.1.7. Others

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. B2C

- 5.2.2. B2B

- 5.2.3. C2C

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Payment Orchestration Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. BFSI

- 6.1.2. E-commerce

- 6.1.3. Travel and Hospitality Industry

- 6.1.4. EdTech

- 6.1.5. Gaming and Entertainment

- 6.1.6. Healthcare Industry

- 6.1.7. Others

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. B2C

- 6.2.2. B2B

- 6.2.3. C2C

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Payment Orchestration Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. BFSI

- 7.1.2. E-commerce

- 7.1.3. Travel and Hospitality Industry

- 7.1.4. EdTech

- 7.1.5. Gaming and Entertainment

- 7.1.6. Healthcare Industry

- 7.1.7. Others

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. B2C

- 7.2.2. B2B

- 7.2.3. C2C

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Payment Orchestration Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. BFSI

- 8.1.2. E-commerce

- 8.1.3. Travel and Hospitality Industry

- 8.1.4. EdTech

- 8.1.5. Gaming and Entertainment

- 8.1.6. Healthcare Industry

- 8.1.7. Others

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. B2C

- 8.2.2. B2B

- 8.2.3. C2C

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Payment Orchestration Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. BFSI

- 9.1.2. E-commerce

- 9.1.3. Travel and Hospitality Industry

- 9.1.4. EdTech

- 9.1.5. Gaming and Entertainment

- 9.1.6. Healthcare Industry

- 9.1.7. Others

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. B2C

- 9.2.2. B2B

- 9.2.3. C2C

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Payment Orchestration Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. BFSI

- 10.1.2. E-commerce

- 10.1.3. Travel and Hospitality Industry

- 10.1.4. EdTech

- 10.1.5. Gaming and Entertainment

- 10.1.6. Healthcare Industry

- 10.1.7. Others

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. B2C

- 10.2.2. B2B

- 10.2.3. C2C

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Cell Point Digital

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 ZOOZ (PAYU)

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 IXOPAY

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Payoneer

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 aye4fin GmbH

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Bridge

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Amadeus IT Group

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Worldline

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 APEXX Fintech

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Rebilly

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Spreedly

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 ModoPayments

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Cell Point Digital

List of Figures

- Figure 1: Global Payment Orchestration Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Payment Orchestration Revenue (million), by Application 2024 & 2032

- Figure 3: North America Payment Orchestration Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Payment Orchestration Revenue (million), by Types 2024 & 2032

- Figure 5: North America Payment Orchestration Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Payment Orchestration Revenue (million), by Country 2024 & 2032

- Figure 7: North America Payment Orchestration Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Payment Orchestration Revenue (million), by Application 2024 & 2032

- Figure 9: South America Payment Orchestration Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Payment Orchestration Revenue (million), by Types 2024 & 2032

- Figure 11: South America Payment Orchestration Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Payment Orchestration Revenue (million), by Country 2024 & 2032

- Figure 13: South America Payment Orchestration Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Payment Orchestration Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Payment Orchestration Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Payment Orchestration Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Payment Orchestration Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Payment Orchestration Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Payment Orchestration Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Payment Orchestration Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Payment Orchestration Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Payment Orchestration Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Payment Orchestration Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Payment Orchestration Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Payment Orchestration Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Payment Orchestration Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Payment Orchestration Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Payment Orchestration Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Payment Orchestration Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Payment Orchestration Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Payment Orchestration Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Payment Orchestration Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Payment Orchestration Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Payment Orchestration Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Payment Orchestration Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Payment Orchestration Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Payment Orchestration Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Payment Orchestration Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Payment Orchestration Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Payment Orchestration Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Payment Orchestration Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Payment Orchestration Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Payment Orchestration Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Payment Orchestration Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Payment Orchestration Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Payment Orchestration Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Payment Orchestration Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Payment Orchestration Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Payment Orchestration Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Payment Orchestration Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Payment Orchestration Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Payment Orchestration Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Payment Orchestration Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Payment Orchestration Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Payment Orchestration Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Payment Orchestration Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Payment Orchestration Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Payment Orchestration Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Payment Orchestration Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Payment Orchestration Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Payment Orchestration Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Payment Orchestration Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Payment Orchestration Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Payment Orchestration Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Payment Orchestration Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Payment Orchestration Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Payment Orchestration Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Payment Orchestration Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Payment Orchestration Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Payment Orchestration Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Payment Orchestration Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Payment Orchestration Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Payment Orchestration Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Payment Orchestration Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Payment Orchestration Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Payment Orchestration Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Payment Orchestration Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Payment Orchestration Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Payment Orchestration?

The projected CAGR is approximately 25.8%.

2. Which companies are prominent players in the Payment Orchestration?

Key companies in the market include Cell Point Digital, ZOOZ (PAYU), IXOPAY, Payoneer, aye4fin GmbH, Bridge, Amadeus IT Group, Worldline, APEXX Fintech, Rebilly, Spreedly, ModoPayments.

3. What are the main segments of the Payment Orchestration?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD 1553.3 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3950.00, USD 5925.00, and USD 7900.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Payment Orchestration," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Payment Orchestration report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Payment Orchestration?

To stay informed about further developments, trends, and reports in the Payment Orchestration, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence