Key Insights

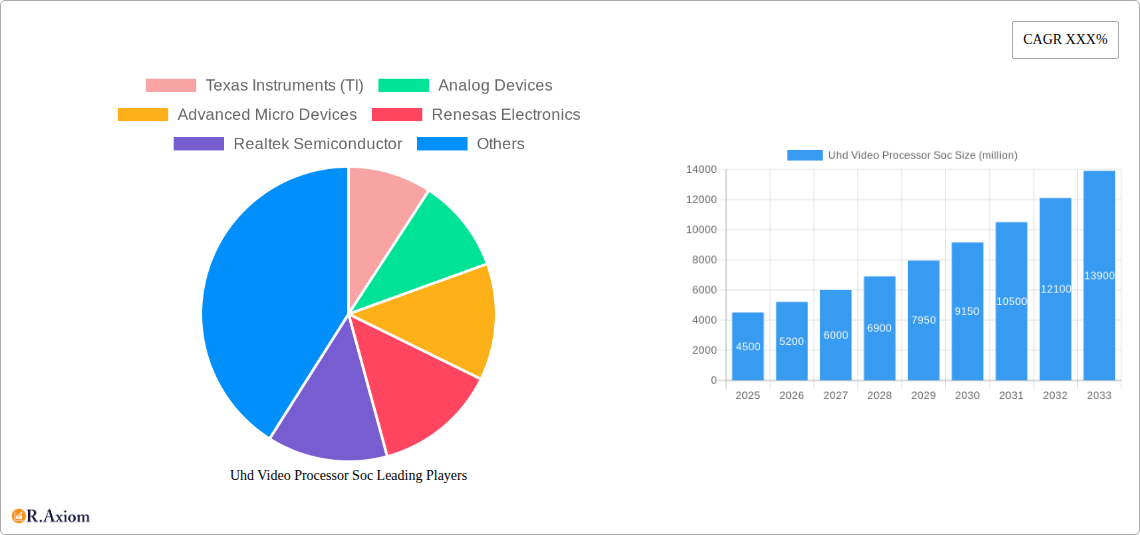

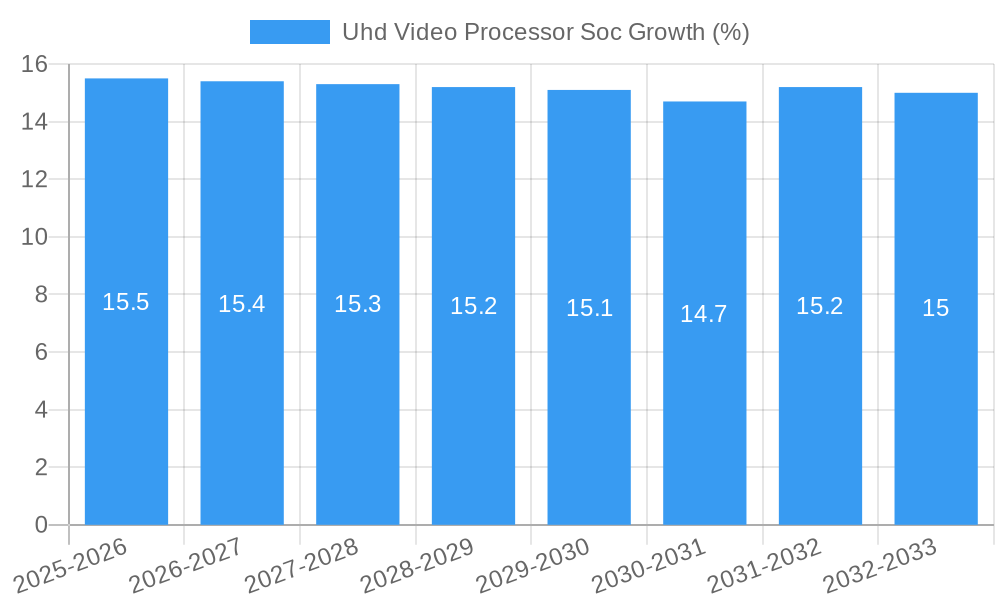

The UHD Video Processor SoC market is experiencing robust growth, projected to reach an estimated USD 4,500 million by the end of 2025. This expansion is fueled by an impressive Compound Annual Growth Rate (CAGR) of 15.5% between 2025 and 2033. This surge is primarily driven by the escalating demand for higher resolution content across various sectors, including broadcasting, entertainment, and security monitoring. The increasing adoption of 4K and 8K displays in consumer electronics, coupled with the burgeoning use of advanced video processing in industrial automation and smart transportation, are key growth catalysts. Furthermore, the proliferation of streaming services and the growing popularity of high-definition gaming are creating a significant appetite for sophisticated video processing capabilities. The medical sector also presents a substantial opportunity, with advancements in imaging technologies requiring higher fidelity and faster processing.

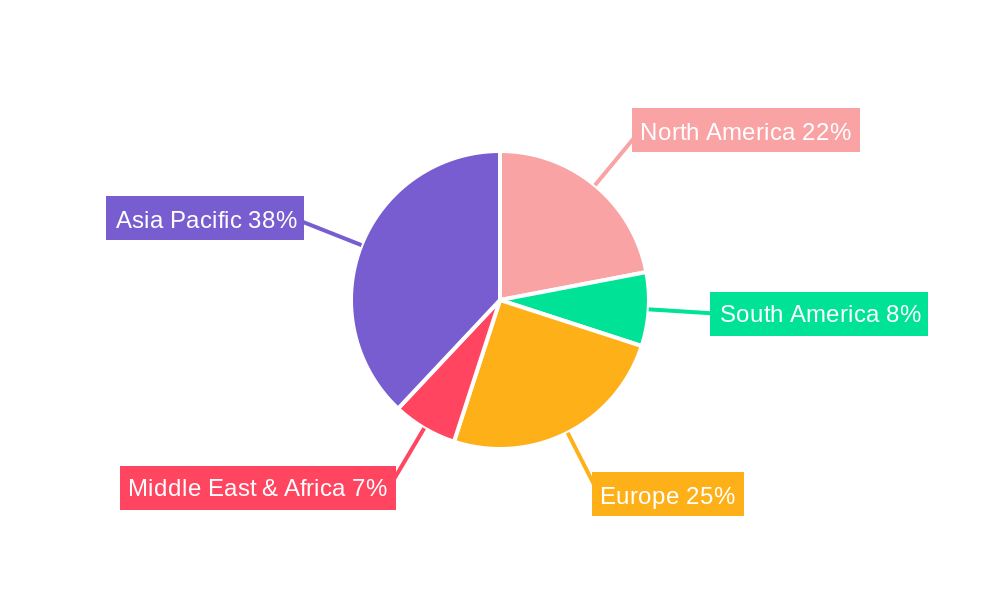

The market is segmented into 4K and 8K Video Processor ICs, with 4K solutions currently dominating due to wider adoption. However, the 8K segment is poised for rapid growth as display technology advances and content production for 8K becomes more mainstream. Major industry players like Texas Instruments, Analog Devices, and MediaTek are at the forefront, investing heavily in research and development to deliver more powerful, energy-efficient, and cost-effective UHD video processor SoCs. While the market is characterized by intense competition and rapid technological advancements, potential restraints include the high cost of implementing advanced processing for certain niche applications and the evolving standards for video compression and transmission. The Asia Pacific region, particularly China and Japan, is expected to lead market growth, driven by strong manufacturing capabilities and a large consumer base embracing new display technologies.

Certainly, here is an SEO-optimized, detailed report description for UHD Video Processor SoCs, designed for high search visibility and industry stakeholder engagement.

Title: UHD Video Processor SoC Market: Comprehensive Analysis and Forecast 2019-2033

Description: Dive deep into the dynamic UHD Video Processor SoC market with our definitive report. Covering advancements in 4K Video Processor ICs and 8K Video Processor ICs across Broadcasting, Education and Entertainment, Medical, Security Monitoring, Smart Transportation, and Industrial Manufacturing sectors. This report analyzes market concentration, innovation trends, dominant segments, growth drivers, challenges, and emerging opportunities from 2019 to 2033, with a base year of 2025. Featuring insights from industry leaders like Texas Instruments (TI), Analog Devices, Advanced Micro Devices, Renesas Electronics, Realtek Semiconductor, Lattice Semiconductor, MediaTek, Lontium, Goke Microelectronics, and comprehensive segmentation analysis. Essential for understanding the future of high-resolution video processing.

UHD Video Processor SoC Market Concentration & Innovation

The UHD Video Processor SoC market exhibits moderate concentration, with key players like Texas Instruments (TI), Analog Devices, and Advanced Micro Devices holding significant market share, estimated at over 60% combined. Innovation is a primary driver, fueled by the relentless demand for higher resolutions (4K and 8K), advanced AI capabilities for image enhancement, and increased power efficiency. Regulatory frameworks, particularly those concerning broadcast standards and medical device certifications, play a crucial role in shaping product development. Product substitutes, such as discrete chipsets or less integrated solutions, are gradually losing ground to comprehensive SoCs that offer superior performance and cost-effectiveness. End-user trends reveal a strong preference for seamless integration, reduced latency, and enhanced visual experiences, particularly in the Education and Entertainment and Broadcasting segments. Mergers and acquisitions (M&A) are ongoing, with recent deals valued in the hundreds of millions, indicating a strategic consolidation to enhance technological portfolios and market reach. For instance, a significant M&A event in 2023 involved a leading semiconductor manufacturer acquiring a specialized AI IP provider, valued at approximately $500 million, aimed at bolstering its AI processing capabilities for next-generation video SoCs.

UHD Video Processor SoC Industry Trends & Insights

The UHD Video Processor SoC industry is poised for substantial growth, driven by an accelerating Compound Annual Growth Rate (CAGR) estimated at approximately 15% throughout the forecast period of 2025–2033. This robust expansion is underpinned by several interconnected trends. The increasing adoption of 4K and nascent 8K displays across consumer electronics, professional broadcasting equipment, and medical imaging devices is creating an insatiable demand for sophisticated video processing capabilities. Technological disruptions are predominantly centered around AI and machine learning integration, enabling real-time image upscaling, noise reduction, object recognition, and advanced video analytics. This is particularly impacting the Security Monitoring and Smart Transportation segments, where AI-powered video processing is becoming indispensable for intelligent surveillance and autonomous systems. Consumer preferences are evolving towards more immersive and interactive visual experiences, pushing manufacturers to deliver SoCs that support higher frame rates, wider color gamuts, and HDR (High Dynamic Range) technologies. The competitive dynamics are intensifying, with companies fiercely vying for market share through product differentiation, strategic partnerships, and continuous innovation. Market penetration of UHD video processors is projected to reach over 70% in the consumer electronics segment by 2028, and over 50% in the industrial and medical sectors. The historical period (2019-2024) saw significant advancements in 4K processing, with 8K solutions beginning to gain traction. The base year of 2025 marks a critical inflection point, with 8K adoption accelerating and AI integration becoming a standard feature. The estimated year of 2025 also signifies a robust recovery and sustained growth trajectory following global supply chain adjustments. The overall market size is projected to exceed several billion dollars, with the forecast period indicating a doubling of the market value. The interplay of evolving consumer demands, rapid technological advancements, and increasing digital content creation are key factors propelling this market forward. The shift towards cloud-based video processing and edge computing also presents new avenues for SoC development and deployment, further diversifying application potential.

Dominant Markets & Segments in Uhd Video Processor Soc

The UHD Video Processor SoC market demonstrates distinct regional and segment dominance, driven by a confluence of technological adoption, economic development, and specific industry needs.

Leading Region:

- Asia-Pacific stands as the dominant region, accounting for an estimated 45% of the global market share in 2025. This leadership is propelled by the presence of major consumer electronics manufacturing hubs in countries like China, South Korea, and Taiwan, which are significant producers and consumers of UHD displays and devices. Favorable government initiatives promoting technological advancement and digital infrastructure development further bolster this dominance. The region’s rapidly growing middle class and increasing disposable income fuel the demand for premium entertainment and advanced consumer electronics.

Dominant Application Segments:

- Broadcasting: This segment represents a substantial market, driven by the transition to digital broadcasting standards, the proliferation of 4K content, and the ongoing development of 8K broadcasting infrastructure. Investments in advanced broadcast equipment, including cameras, switchers, and display technologies, necessitate high-performance UHD video processor SoCs. The demand for seamless content delivery and superior viewing experiences for a global audience ensures consistent market growth, projected to contribute over 25% to the total market revenue.

- Education and Entertainment: This is a rapidly expanding segment, fueled by the widespread adoption of smart classrooms, advanced display technologies in educational institutions, and the surging demand for immersive gaming and home entertainment systems. The increasing availability of 4K and 8K streaming content and the growth of VR/AR applications are significant growth catalysts. The segment is expected to witness a CAGR of approximately 18% over the forecast period, driven by consumer upgrade cycles and increasing investments in digital learning platforms.

Dominant Product Types:

- 4K Video Processor ICs: Currently, 4K Video Processor ICs hold the largest market share, estimated at around 75% in 2025. This dominance is attributed to the widespread availability of 4K displays, the mature ecosystem of 4K content, and their integration into a vast array of devices, from televisions and monitors to professional cameras and signage. The affordability and established performance of 4K solutions make them the go-to choice for most applications.

- 8K Video Processor ICs: While smaller in market share, 8K Video Processor ICs are experiencing the fastest growth, with a projected CAGR exceeding 25% during the forecast period. The increasing development of 8K content, the introduction of high-end 8K televisions, and the demand for ultra-high definition in professional applications like broadcast production and large-format displays are driving this surge. Countries with advanced technological infrastructure and a focus on cutting-edge consumer electronics, such as South Korea and Japan, are leading the adoption of 8K solutions.

Key drivers for dominance in these segments include substantial government investment in digital transformation initiatives, robust economic policies supporting semiconductor manufacturing and R&D, and the rapid deployment of high-speed internet infrastructure essential for streaming and transmitting high-resolution video.

UHD Video Processor SoC Product Developments

Recent product developments in the UHD Video Processor SoC market focus on enhanced AI capabilities for intelligent image processing, improved power efficiency for mobile and edge devices, and support for emerging video standards like HDR10+ and Dolby Vision. Companies are integrating neural processing units (NPUs) directly onto SoCs to accelerate AI tasks such as real-time upscaling, object detection, and scene analysis. This offers a significant competitive advantage by enabling smarter features without relying on external processors. The development of scalable architectures that support both 4K and 8K resolutions on a single platform is also a key trend, providing flexibility and cost-effectiveness for manufacturers. These innovations are directly addressing the market’s demand for more immersive, intelligent, and energy-efficient video solutions.

Report Scope & Segmentation Analysis

This report offers a comprehensive analysis of the UHD Video Processor SoC market, meticulously segmented by application and product type.

- Broadcasting: This segment encompasses SoCs used in broadcast equipment, including cameras, encoders, decoders, and broadcast infrastructure. The market is driven by the transition to higher broadcast standards and the demand for high-quality content delivery. Growth projections for this segment are robust, with an estimated market size of over $1.5 billion by 2028.

- Education and Entertainment: This segment covers SoCs for consumer electronics like smart TVs, gaming consoles, projectors, and advanced display systems for educational purposes. The expanding digital content landscape and the increasing adoption of smart displays in homes and educational institutions fuel its growth. Expected to witness significant expansion with a projected market size exceeding $2 billion by 2028.

- Medical: SoCs for medical imaging devices, such as ultrasound, MRI, and endoscopy systems, are included. The demand for higher resolution and greater diagnostic accuracy drives innovation in this segment. The market size is estimated to reach over $800 million by 2028, with a steady growth rate.

- Security Monitoring: This segment focuses on SoCs for surveillance cameras, video analytics systems, and network video recorders (NVRs). The increasing need for intelligent surveillance and advanced threat detection propels its growth. Projected market size of over $1 billion by 2028.

- Smart Transportation: SoCs for automotive infotainment systems, advanced driver-assistance systems (ADAS), and in-vehicle display solutions are covered. The rising adoption of connected and autonomous vehicles drives demand for sophisticated video processing. Expected market size of over $600 million by 2028.

- Industrial Manufacturing: This segment includes SoCs for industrial automation, machine vision, and inspection systems. The need for high-precision visual inspection and quality control contributes to its growth. Projected market size of over $500 million by 2028.

- 4K Video Processor ICs: These are foundational to the current market, supporting a wide range of devices. They offer a balance of performance and cost.

- 8K Video Processor ICs: Representing the cutting edge, these ICs are crucial for applications demanding the highest visual fidelity and are experiencing rapid adoption.

Key Drivers of Uhd Video Processor Soc Growth

The growth of the UHD Video Processor SoC market is propelled by several key factors. Technologically, the escalating demand for higher resolution content (4K and 8K) and the increasing adoption of technologies like HDR (High Dynamic Range) and wider color gamuts are creating a significant need for advanced processing power. Economically, the expanding consumer electronics market, particularly in emerging economies, and the continuous decline in the cost of UHD display technologies are making these solutions more accessible. Regulatory frameworks promoting digital broadcasting standards and the increasing use of video in critical applications like security and healthcare also act as significant catalysts. The proliferation of 5G networks is further enabling higher bandwidth for streaming and real-time video applications, indirectly boosting the demand for capable processors.

Challenges in the Uhd Video Processor Soc Sector

Despite its strong growth trajectory, the UHD Video Processor SoC sector faces several challenges. Supply chain volatility, as demonstrated by recent global shortages of essential components, continues to pose a risk to production volumes and lead times, potentially impacting market growth by up to 10%. The high cost of developing and manufacturing cutting-edge 8K processors, coupled with the still-developing ecosystem of 8K content, can slow down widespread adoption. Intense competitive pressure among major semiconductor manufacturers leads to a constant need for innovation and price adjustments, which can affect profit margins. Furthermore, stringent certification requirements in sectors like medical and automotive can add significant development time and cost. The increasing complexity of SoC designs also necessitates specialized expertise, creating a talent acquisition challenge for many companies.

Emerging Opportunities in Uhd Video Processor Soc

Emerging opportunities in the UHD Video Processor SoC market are diverse and promising. The rapid expansion of the metaverse and virtual reality (VR)/augmented reality (AR) technologies presents a significant demand for SoCs capable of delivering highly immersive and realistic visual experiences. The integration of AI and machine learning directly into SoCs for edge computing applications, particularly in areas like autonomous driving and smart city infrastructure, offers substantial growth potential. The increasing demand for high-performance video processing in professional drone applications and industrial automation also opens new avenues. Furthermore, the development of energy-efficient SoCs for portable and battery-powered devices is a key trend, catering to the growing market for mobile UHD content consumption and creation.

Leading Players in the Uhd Video Processor Soc Market

- Texas Instruments (TI)

- Analog Devices

- Advanced Micro Devices

- Renesas Electronics

- Realtek Semiconductor

- Lattice Semiconductor

- MediaTek

- Lontium

- Goke Microelectronics

Key Developments in Uhd Video Processor Soc Industry

- 2023 March: Texas Instruments (TI) launched a new family of high-performance processors optimized for 8K video processing, featuring advanced AI acceleration capabilities.

- 2023 July: MediaTek announced its next-generation SoC designed for premium 4K smart TVs, focusing on enhanced HDR processing and energy efficiency.

- 2023 September: Advanced Micro Devices (AMD) unveiled a new series of graphics processing units (GPUs) with integrated video encode/decode engines, supporting the latest 4K and emerging 8K standards, catering to the gaming and professional content creation markets.

- 2024 February: Analog Devices acquired a specialized AI chip startup, signaling a strong commitment to integrating advanced AI functionalities into its future UHD video processing solutions.

- 2024 April: Renesas Electronics introduced a new automotive-grade SoC with advanced video processing for ADAS and infotainment systems, emphasizing safety and immersive user experiences.

- 2024 June: Realtek Semiconductor showcased its latest advancements in Wi-Fi 7 integrated SoCs that support high-bandwidth video streaming, crucial for seamless 4K/8K content delivery in smart home environments.

- 2024 August: Lontium Semiconductor announced a new series of display interface controllers designed to support higher resolutions and refresh rates for future UHD monitor and display applications.

- 2024 October: Goke Microelectronics revealed a new platform for smart security cameras, leveraging UHD processing for advanced object detection and facial recognition, enhancing surveillance capabilities.

- 2025 January: Lattice Semiconductor introduced new FPGAs with enhanced video processing capabilities, designed for flexible and scalable solutions in broadcasting and industrial vision applications.

Strategic Outlook for Uhd Video Processor Soc Market

The strategic outlook for the UHD Video Processor SoC market is exceptionally positive, characterized by sustained innovation and expanding application frontiers. The ongoing evolution towards higher resolutions like 8K, coupled with the integration of AI for intelligent video analysis, will continue to be a primary growth catalyst. The increasing demand for immersive experiences in entertainment, education, and emerging metaverse applications will drive the need for SoCs with superior graphical and processing capabilities. Furthermore, the growing adoption of UHD video in critical sectors such as automotive, medical imaging, and industrial automation presents significant long-term growth opportunities. Companies that can effectively deliver powerful, energy-efficient, and cost-effective UHD video processing solutions, particularly those with robust AI integration, will be well-positioned to capture market share and lead the industry’s advancement. Strategic partnerships and acquisitions aimed at bolstering technological portfolios, especially in AI and advanced display technologies, will remain a key strategy for market players.

Uhd Video Processor Soc Segmentation

-

1. Application

- 1.1. Broadcasting

- 1.2. Education and Entertainment

- 1.3. Medical

- 1.4. Security Monitoring

- 1.5. Smart Transportation

- 1.6. Industrial Manufacturing

-

2. Type

- 2.1. 4K Video Processor ICs

- 2.2. 8K Video Processor ICs

Uhd Video Processor Soc Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Uhd Video Processor Soc REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XXX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Uhd Video Processor Soc Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Broadcasting

- 5.1.2. Education and Entertainment

- 5.1.3. Medical

- 5.1.4. Security Monitoring

- 5.1.5. Smart Transportation

- 5.1.6. Industrial Manufacturing

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. 4K Video Processor ICs

- 5.2.2. 8K Video Processor ICs

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Uhd Video Processor Soc Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Broadcasting

- 6.1.2. Education and Entertainment

- 6.1.3. Medical

- 6.1.4. Security Monitoring

- 6.1.5. Smart Transportation

- 6.1.6. Industrial Manufacturing

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. 4K Video Processor ICs

- 6.2.2. 8K Video Processor ICs

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Uhd Video Processor Soc Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Broadcasting

- 7.1.2. Education and Entertainment

- 7.1.3. Medical

- 7.1.4. Security Monitoring

- 7.1.5. Smart Transportation

- 7.1.6. Industrial Manufacturing

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. 4K Video Processor ICs

- 7.2.2. 8K Video Processor ICs

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Uhd Video Processor Soc Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Broadcasting

- 8.1.2. Education and Entertainment

- 8.1.3. Medical

- 8.1.4. Security Monitoring

- 8.1.5. Smart Transportation

- 8.1.6. Industrial Manufacturing

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. 4K Video Processor ICs

- 8.2.2. 8K Video Processor ICs

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Uhd Video Processor Soc Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Broadcasting

- 9.1.2. Education and Entertainment

- 9.1.3. Medical

- 9.1.4. Security Monitoring

- 9.1.5. Smart Transportation

- 9.1.6. Industrial Manufacturing

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. 4K Video Processor ICs

- 9.2.2. 8K Video Processor ICs

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Uhd Video Processor Soc Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Broadcasting

- 10.1.2. Education and Entertainment

- 10.1.3. Medical

- 10.1.4. Security Monitoring

- 10.1.5. Smart Transportation

- 10.1.6. Industrial Manufacturing

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. 4K Video Processor ICs

- 10.2.2. 8K Video Processor ICs

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Texas Instruments (TI)

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Analog Devices

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Advanced Micro Devices

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Renesas Electronics

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Realtek Semiconductor

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Lattice Semiconductor

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 MediaTek

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Lontium

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Goke Microelectronics

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.1 Texas Instruments (TI)

List of Figures

- Figure 1: Global Uhd Video Processor Soc Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: Global Uhd Video Processor Soc Volume Breakdown (K, %) by Region 2024 & 2032

- Figure 3: North America Uhd Video Processor Soc Revenue (million), by Application 2024 & 2032

- Figure 4: North America Uhd Video Processor Soc Volume (K), by Application 2024 & 2032

- Figure 5: North America Uhd Video Processor Soc Revenue Share (%), by Application 2024 & 2032

- Figure 6: North America Uhd Video Processor Soc Volume Share (%), by Application 2024 & 2032

- Figure 7: North America Uhd Video Processor Soc Revenue (million), by Type 2024 & 2032

- Figure 8: North America Uhd Video Processor Soc Volume (K), by Type 2024 & 2032

- Figure 9: North America Uhd Video Processor Soc Revenue Share (%), by Type 2024 & 2032

- Figure 10: North America Uhd Video Processor Soc Volume Share (%), by Type 2024 & 2032

- Figure 11: North America Uhd Video Processor Soc Revenue (million), by Country 2024 & 2032

- Figure 12: North America Uhd Video Processor Soc Volume (K), by Country 2024 & 2032

- Figure 13: North America Uhd Video Processor Soc Revenue Share (%), by Country 2024 & 2032

- Figure 14: North America Uhd Video Processor Soc Volume Share (%), by Country 2024 & 2032

- Figure 15: South America Uhd Video Processor Soc Revenue (million), by Application 2024 & 2032

- Figure 16: South America Uhd Video Processor Soc Volume (K), by Application 2024 & 2032

- Figure 17: South America Uhd Video Processor Soc Revenue Share (%), by Application 2024 & 2032

- Figure 18: South America Uhd Video Processor Soc Volume Share (%), by Application 2024 & 2032

- Figure 19: South America Uhd Video Processor Soc Revenue (million), by Type 2024 & 2032

- Figure 20: South America Uhd Video Processor Soc Volume (K), by Type 2024 & 2032

- Figure 21: South America Uhd Video Processor Soc Revenue Share (%), by Type 2024 & 2032

- Figure 22: South America Uhd Video Processor Soc Volume Share (%), by Type 2024 & 2032

- Figure 23: South America Uhd Video Processor Soc Revenue (million), by Country 2024 & 2032

- Figure 24: South America Uhd Video Processor Soc Volume (K), by Country 2024 & 2032

- Figure 25: South America Uhd Video Processor Soc Revenue Share (%), by Country 2024 & 2032

- Figure 26: South America Uhd Video Processor Soc Volume Share (%), by Country 2024 & 2032

- Figure 27: Europe Uhd Video Processor Soc Revenue (million), by Application 2024 & 2032

- Figure 28: Europe Uhd Video Processor Soc Volume (K), by Application 2024 & 2032

- Figure 29: Europe Uhd Video Processor Soc Revenue Share (%), by Application 2024 & 2032

- Figure 30: Europe Uhd Video Processor Soc Volume Share (%), by Application 2024 & 2032

- Figure 31: Europe Uhd Video Processor Soc Revenue (million), by Type 2024 & 2032

- Figure 32: Europe Uhd Video Processor Soc Volume (K), by Type 2024 & 2032

- Figure 33: Europe Uhd Video Processor Soc Revenue Share (%), by Type 2024 & 2032

- Figure 34: Europe Uhd Video Processor Soc Volume Share (%), by Type 2024 & 2032

- Figure 35: Europe Uhd Video Processor Soc Revenue (million), by Country 2024 & 2032

- Figure 36: Europe Uhd Video Processor Soc Volume (K), by Country 2024 & 2032

- Figure 37: Europe Uhd Video Processor Soc Revenue Share (%), by Country 2024 & 2032

- Figure 38: Europe Uhd Video Processor Soc Volume Share (%), by Country 2024 & 2032

- Figure 39: Middle East & Africa Uhd Video Processor Soc Revenue (million), by Application 2024 & 2032

- Figure 40: Middle East & Africa Uhd Video Processor Soc Volume (K), by Application 2024 & 2032

- Figure 41: Middle East & Africa Uhd Video Processor Soc Revenue Share (%), by Application 2024 & 2032

- Figure 42: Middle East & Africa Uhd Video Processor Soc Volume Share (%), by Application 2024 & 2032

- Figure 43: Middle East & Africa Uhd Video Processor Soc Revenue (million), by Type 2024 & 2032

- Figure 44: Middle East & Africa Uhd Video Processor Soc Volume (K), by Type 2024 & 2032

- Figure 45: Middle East & Africa Uhd Video Processor Soc Revenue Share (%), by Type 2024 & 2032

- Figure 46: Middle East & Africa Uhd Video Processor Soc Volume Share (%), by Type 2024 & 2032

- Figure 47: Middle East & Africa Uhd Video Processor Soc Revenue (million), by Country 2024 & 2032

- Figure 48: Middle East & Africa Uhd Video Processor Soc Volume (K), by Country 2024 & 2032

- Figure 49: Middle East & Africa Uhd Video Processor Soc Revenue Share (%), by Country 2024 & 2032

- Figure 50: Middle East & Africa Uhd Video Processor Soc Volume Share (%), by Country 2024 & 2032

- Figure 51: Asia Pacific Uhd Video Processor Soc Revenue (million), by Application 2024 & 2032

- Figure 52: Asia Pacific Uhd Video Processor Soc Volume (K), by Application 2024 & 2032

- Figure 53: Asia Pacific Uhd Video Processor Soc Revenue Share (%), by Application 2024 & 2032

- Figure 54: Asia Pacific Uhd Video Processor Soc Volume Share (%), by Application 2024 & 2032

- Figure 55: Asia Pacific Uhd Video Processor Soc Revenue (million), by Type 2024 & 2032

- Figure 56: Asia Pacific Uhd Video Processor Soc Volume (K), by Type 2024 & 2032

- Figure 57: Asia Pacific Uhd Video Processor Soc Revenue Share (%), by Type 2024 & 2032

- Figure 58: Asia Pacific Uhd Video Processor Soc Volume Share (%), by Type 2024 & 2032

- Figure 59: Asia Pacific Uhd Video Processor Soc Revenue (million), by Country 2024 & 2032

- Figure 60: Asia Pacific Uhd Video Processor Soc Volume (K), by Country 2024 & 2032

- Figure 61: Asia Pacific Uhd Video Processor Soc Revenue Share (%), by Country 2024 & 2032

- Figure 62: Asia Pacific Uhd Video Processor Soc Volume Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Uhd Video Processor Soc Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Uhd Video Processor Soc Volume K Forecast, by Region 2019 & 2032

- Table 3: Global Uhd Video Processor Soc Revenue million Forecast, by Application 2019 & 2032

- Table 4: Global Uhd Video Processor Soc Volume K Forecast, by Application 2019 & 2032

- Table 5: Global Uhd Video Processor Soc Revenue million Forecast, by Type 2019 & 2032

- Table 6: Global Uhd Video Processor Soc Volume K Forecast, by Type 2019 & 2032

- Table 7: Global Uhd Video Processor Soc Revenue million Forecast, by Region 2019 & 2032

- Table 8: Global Uhd Video Processor Soc Volume K Forecast, by Region 2019 & 2032

- Table 9: Global Uhd Video Processor Soc Revenue million Forecast, by Application 2019 & 2032

- Table 10: Global Uhd Video Processor Soc Volume K Forecast, by Application 2019 & 2032

- Table 11: Global Uhd Video Processor Soc Revenue million Forecast, by Type 2019 & 2032

- Table 12: Global Uhd Video Processor Soc Volume K Forecast, by Type 2019 & 2032

- Table 13: Global Uhd Video Processor Soc Revenue million Forecast, by Country 2019 & 2032

- Table 14: Global Uhd Video Processor Soc Volume K Forecast, by Country 2019 & 2032

- Table 15: United States Uhd Video Processor Soc Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: United States Uhd Video Processor Soc Volume (K) Forecast, by Application 2019 & 2032

- Table 17: Canada Uhd Video Processor Soc Revenue (million) Forecast, by Application 2019 & 2032

- Table 18: Canada Uhd Video Processor Soc Volume (K) Forecast, by Application 2019 & 2032

- Table 19: Mexico Uhd Video Processor Soc Revenue (million) Forecast, by Application 2019 & 2032

- Table 20: Mexico Uhd Video Processor Soc Volume (K) Forecast, by Application 2019 & 2032

- Table 21: Global Uhd Video Processor Soc Revenue million Forecast, by Application 2019 & 2032

- Table 22: Global Uhd Video Processor Soc Volume K Forecast, by Application 2019 & 2032

- Table 23: Global Uhd Video Processor Soc Revenue million Forecast, by Type 2019 & 2032

- Table 24: Global Uhd Video Processor Soc Volume K Forecast, by Type 2019 & 2032

- Table 25: Global Uhd Video Processor Soc Revenue million Forecast, by Country 2019 & 2032

- Table 26: Global Uhd Video Processor Soc Volume K Forecast, by Country 2019 & 2032

- Table 27: Brazil Uhd Video Processor Soc Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Brazil Uhd Video Processor Soc Volume (K) Forecast, by Application 2019 & 2032

- Table 29: Argentina Uhd Video Processor Soc Revenue (million) Forecast, by Application 2019 & 2032

- Table 30: Argentina Uhd Video Processor Soc Volume (K) Forecast, by Application 2019 & 2032

- Table 31: Rest of South America Uhd Video Processor Soc Revenue (million) Forecast, by Application 2019 & 2032

- Table 32: Rest of South America Uhd Video Processor Soc Volume (K) Forecast, by Application 2019 & 2032

- Table 33: Global Uhd Video Processor Soc Revenue million Forecast, by Application 2019 & 2032

- Table 34: Global Uhd Video Processor Soc Volume K Forecast, by Application 2019 & 2032

- Table 35: Global Uhd Video Processor Soc Revenue million Forecast, by Type 2019 & 2032

- Table 36: Global Uhd Video Processor Soc Volume K Forecast, by Type 2019 & 2032

- Table 37: Global Uhd Video Processor Soc Revenue million Forecast, by Country 2019 & 2032

- Table 38: Global Uhd Video Processor Soc Volume K Forecast, by Country 2019 & 2032

- Table 39: United Kingdom Uhd Video Processor Soc Revenue (million) Forecast, by Application 2019 & 2032

- Table 40: United Kingdom Uhd Video Processor Soc Volume (K) Forecast, by Application 2019 & 2032

- Table 41: Germany Uhd Video Processor Soc Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: Germany Uhd Video Processor Soc Volume (K) Forecast, by Application 2019 & 2032

- Table 43: France Uhd Video Processor Soc Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: France Uhd Video Processor Soc Volume (K) Forecast, by Application 2019 & 2032

- Table 45: Italy Uhd Video Processor Soc Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Italy Uhd Video Processor Soc Volume (K) Forecast, by Application 2019 & 2032

- Table 47: Spain Uhd Video Processor Soc Revenue (million) Forecast, by Application 2019 & 2032

- Table 48: Spain Uhd Video Processor Soc Volume (K) Forecast, by Application 2019 & 2032

- Table 49: Russia Uhd Video Processor Soc Revenue (million) Forecast, by Application 2019 & 2032

- Table 50: Russia Uhd Video Processor Soc Volume (K) Forecast, by Application 2019 & 2032

- Table 51: Benelux Uhd Video Processor Soc Revenue (million) Forecast, by Application 2019 & 2032

- Table 52: Benelux Uhd Video Processor Soc Volume (K) Forecast, by Application 2019 & 2032

- Table 53: Nordics Uhd Video Processor Soc Revenue (million) Forecast, by Application 2019 & 2032

- Table 54: Nordics Uhd Video Processor Soc Volume (K) Forecast, by Application 2019 & 2032

- Table 55: Rest of Europe Uhd Video Processor Soc Revenue (million) Forecast, by Application 2019 & 2032

- Table 56: Rest of Europe Uhd Video Processor Soc Volume (K) Forecast, by Application 2019 & 2032

- Table 57: Global Uhd Video Processor Soc Revenue million Forecast, by Application 2019 & 2032

- Table 58: Global Uhd Video Processor Soc Volume K Forecast, by Application 2019 & 2032

- Table 59: Global Uhd Video Processor Soc Revenue million Forecast, by Type 2019 & 2032

- Table 60: Global Uhd Video Processor Soc Volume K Forecast, by Type 2019 & 2032

- Table 61: Global Uhd Video Processor Soc Revenue million Forecast, by Country 2019 & 2032

- Table 62: Global Uhd Video Processor Soc Volume K Forecast, by Country 2019 & 2032

- Table 63: Turkey Uhd Video Processor Soc Revenue (million) Forecast, by Application 2019 & 2032

- Table 64: Turkey Uhd Video Processor Soc Volume (K) Forecast, by Application 2019 & 2032

- Table 65: Israel Uhd Video Processor Soc Revenue (million) Forecast, by Application 2019 & 2032

- Table 66: Israel Uhd Video Processor Soc Volume (K) Forecast, by Application 2019 & 2032

- Table 67: GCC Uhd Video Processor Soc Revenue (million) Forecast, by Application 2019 & 2032

- Table 68: GCC Uhd Video Processor Soc Volume (K) Forecast, by Application 2019 & 2032

- Table 69: North Africa Uhd Video Processor Soc Revenue (million) Forecast, by Application 2019 & 2032

- Table 70: North Africa Uhd Video Processor Soc Volume (K) Forecast, by Application 2019 & 2032

- Table 71: South Africa Uhd Video Processor Soc Revenue (million) Forecast, by Application 2019 & 2032

- Table 72: South Africa Uhd Video Processor Soc Volume (K) Forecast, by Application 2019 & 2032

- Table 73: Rest of Middle East & Africa Uhd Video Processor Soc Revenue (million) Forecast, by Application 2019 & 2032

- Table 74: Rest of Middle East & Africa Uhd Video Processor Soc Volume (K) Forecast, by Application 2019 & 2032

- Table 75: Global Uhd Video Processor Soc Revenue million Forecast, by Application 2019 & 2032

- Table 76: Global Uhd Video Processor Soc Volume K Forecast, by Application 2019 & 2032

- Table 77: Global Uhd Video Processor Soc Revenue million Forecast, by Type 2019 & 2032

- Table 78: Global Uhd Video Processor Soc Volume K Forecast, by Type 2019 & 2032

- Table 79: Global Uhd Video Processor Soc Revenue million Forecast, by Country 2019 & 2032

- Table 80: Global Uhd Video Processor Soc Volume K Forecast, by Country 2019 & 2032

- Table 81: China Uhd Video Processor Soc Revenue (million) Forecast, by Application 2019 & 2032

- Table 82: China Uhd Video Processor Soc Volume (K) Forecast, by Application 2019 & 2032

- Table 83: India Uhd Video Processor Soc Revenue (million) Forecast, by Application 2019 & 2032

- Table 84: India Uhd Video Processor Soc Volume (K) Forecast, by Application 2019 & 2032

- Table 85: Japan Uhd Video Processor Soc Revenue (million) Forecast, by Application 2019 & 2032

- Table 86: Japan Uhd Video Processor Soc Volume (K) Forecast, by Application 2019 & 2032

- Table 87: South Korea Uhd Video Processor Soc Revenue (million) Forecast, by Application 2019 & 2032

- Table 88: South Korea Uhd Video Processor Soc Volume (K) Forecast, by Application 2019 & 2032

- Table 89: ASEAN Uhd Video Processor Soc Revenue (million) Forecast, by Application 2019 & 2032

- Table 90: ASEAN Uhd Video Processor Soc Volume (K) Forecast, by Application 2019 & 2032

- Table 91: Oceania Uhd Video Processor Soc Revenue (million) Forecast, by Application 2019 & 2032

- Table 92: Oceania Uhd Video Processor Soc Volume (K) Forecast, by Application 2019 & 2032

- Table 93: Rest of Asia Pacific Uhd Video Processor Soc Revenue (million) Forecast, by Application 2019 & 2032

- Table 94: Rest of Asia Pacific Uhd Video Processor Soc Volume (K) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Uhd Video Processor Soc?

The projected CAGR is approximately XXX%.

2. Which companies are prominent players in the Uhd Video Processor Soc?

Key companies in the market include Texas Instruments (TI), Analog Devices, Advanced Micro Devices, Renesas Electronics, Realtek Semiconductor, Lattice Semiconductor, MediaTek, Lontium, Goke Microelectronics.

3. What are the main segments of the Uhd Video Processor Soc?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3950.00, USD 5925.00, and USD 7900.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in K.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Uhd Video Processor Soc," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Uhd Video Processor Soc report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Uhd Video Processor Soc?

To stay informed about further developments, trends, and reports in the Uhd Video Processor Soc, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence