Key Insights

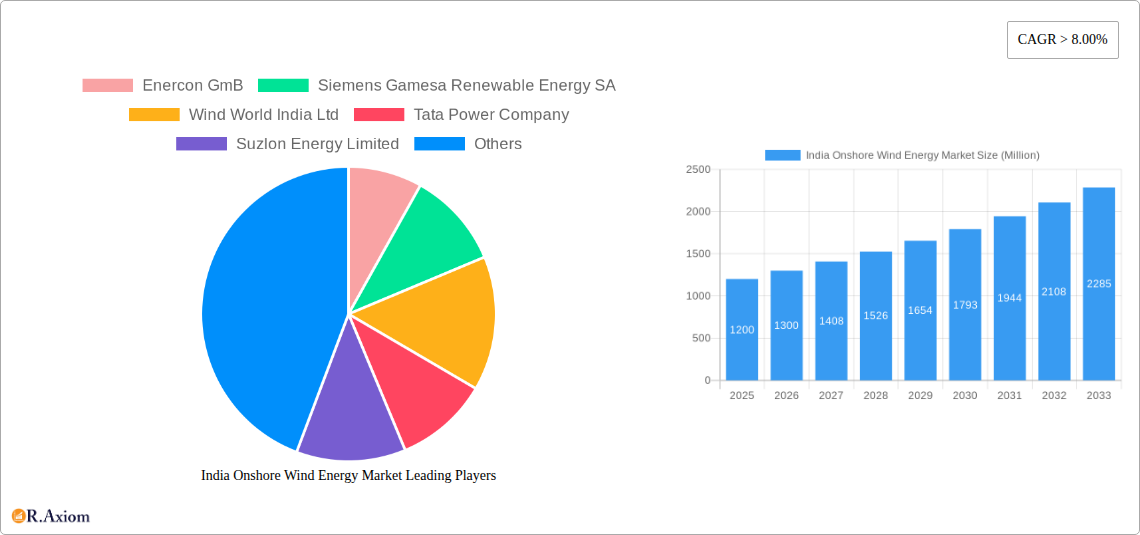

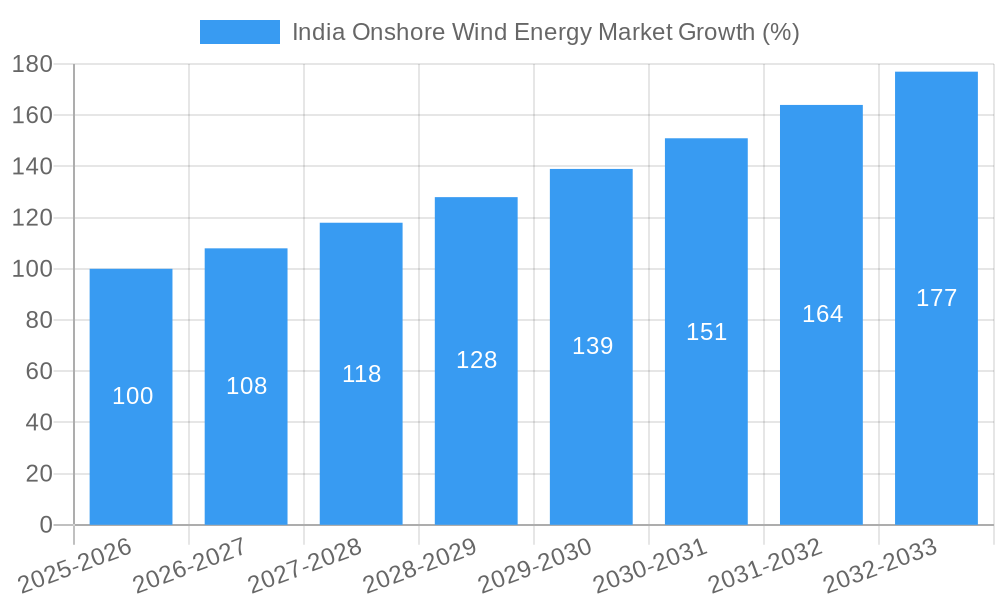

The India onshore wind energy market exhibits robust growth potential, driven by the government's ambitious renewable energy targets and the decreasing cost of wind turbine technology. With a current market size exceeding a billion USD (estimated based on a CAGR of >8% and the provided value unit of millions), the sector is poised for significant expansion over the forecast period (2025-2033). Key drivers include supportive government policies like the Production Linked Incentive (PLI) scheme, increasing demand for clean energy to meet the nation's power needs, and improving grid infrastructure. The market is segmented by turbine capacity, with the 2-3 MW segment currently holding a larger market share (55%) compared to the >3 MW segment (45%). This distribution reflects the ongoing transition towards larger, more efficient turbines, which are expected to gain significant market share in the coming years. However, challenges remain, including land acquisition complexities, grid integration issues in certain regions, and the intermittent nature of wind power. Despite these restraints, the long-term outlook for the India onshore wind energy market is positive, fueled by continuous technological advancements, favorable policy support, and growing investor interest. Leading players like Suzlon Energy, Tata Power, and others are actively contributing to the market's growth, further shaping its competitive landscape.

The Asia-Pacific region, particularly India, is a key focus area for the global onshore wind energy sector. India’s strategic location, abundant wind resources, and proactive government policies are significant advantages. The market's continued expansion is projected to attract further investment, leading to an increase in the deployment of wind energy projects across various states. While challenges related to project financing, regulatory approvals, and environmental concerns persist, the government's commitment to renewable energy integration is mitigating these obstacles. The ongoing emphasis on localization and the development of a domestic manufacturing base for wind turbines will further contribute to the market's growth and self-sufficiency. The sustained high CAGR demonstrates investor confidence and the enduring potential of this sector in meeting India's burgeoning energy demand while driving sustainability goals.

India Onshore Wind Energy Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the India Onshore Wind Energy Market, offering valuable insights for stakeholders across the value chain. The report covers the period from 2019 to 2033, with a focus on the base year 2025 and a forecast period spanning 2025-2033. Utilizing extensive market research and data analysis, this report delivers actionable intelligence for informed decision-making. The market is segmented by turbine capacity, with a detailed breakdown of the 2-3 MW and >3 MW segments. Key players such as Enercon GmB, Siemens Gamesa Renewable Energy SA, and Suzlon Energy Limited are analyzed, along with market trends, opportunities, and challenges. This report is essential reading for investors, industry professionals, and anyone seeking to understand the dynamics of this rapidly evolving market.

India Onshore Wind Energy Market Concentration & Innovation

The Indian onshore wind energy market exhibits a moderately concentrated structure, with a few major players holding significant market share. While precise market share figures for each company are xx, the competitive landscape is characterized by both established international players like Siemens Gamesa Renewable Energy SA and Vestas Wind Systems AS, and domestic giants such as Suzlon Energy Limited and Inox Wind limited. Innovation is driven by the need for cost reduction, improved efficiency, and the integration of smart technologies. Regulatory frameworks, while supportive of renewable energy, also present challenges regarding land acquisition and grid integration. Product substitutes, primarily solar power, exert competitive pressure, while end-user trends reflect a growing demand for sustainable energy solutions. M&A activity has been moderate, with deal values totaling xx Million in the last five years, primarily driven by consolidation within the industry. Examples include recent strategic partnerships focused on technology integration and market expansion.

- Market Concentration: Moderately concentrated, with a few dominant players.

- Innovation Drivers: Cost reduction, efficiency improvements, smart technology integration.

- Regulatory Framework: Supportive but presents challenges in land acquisition and grid connectivity.

- M&A Activity: Moderate activity with deal values totaling xx Million over the past five years.

India Onshore Wind Energy Market Industry Trends & Insights

The Indian onshore wind energy market is experiencing robust growth, driven by government policies promoting renewable energy adoption, increasing electricity demand, and decreasing wind turbine costs. The CAGR for the period 2019-2024 is estimated at xx%, with a projected CAGR of xx% during the forecast period (2025-2033). Market penetration is increasing steadily, driven by large-scale projects, supportive government initiatives, and corporate sustainability targets. Technological disruptions, such as advancements in turbine design and energy storage solutions, are enhancing the competitiveness of wind power. Consumer preferences are shifting towards environmentally friendly energy sources, further bolstering market growth. The competitive dynamics are characterized by intense competition among domestic and international players, leading to price pressures and continuous innovation. The market size is projected to reach xx Million by 2033.

Dominant Markets & Segments in India Onshore Wind Energy Market

The 2-3 MW turbine capacity segment currently holds a larger market share (55.0%) compared to the >3 MW segment (45.0%). This dominance can be attributed to several factors.

- Cost-Effectiveness: 2-3 MW turbines offer a balance between cost and power output, making them attractive for various project sizes.

- Infrastructure Suitability: Existing grid infrastructure in many regions is better suited for projects utilizing 2-3 MW turbines.

- Economies of Scale: The larger volume of 2-3 MW installations contributes to economies of scale, leading to lower costs.

However, the >3 MW segment is expected to witness significant growth in the coming years due to technological advancements and the increasing demand for larger-scale projects. The focus is shifting towards higher capacity turbines, which offer increased efficiency and reduced land requirements per MW, ultimately resulting in lower levelized cost of energy (LCOE). Certain regions, particularly those with favorable wind resources and supportive government policies, are driving this shift toward larger-scale installations.

India Onshore Wind Energy Market Product Developments

Recent product innovations focus on enhancing turbine efficiency, durability, and reducing the levelized cost of energy (LCOE). Advancements in blade design, tower technology, and control systems are improving energy capture and reducing operational costs. Hybrid Lattice Tubular (HLT) towers, as seen in recent Suzlon projects, showcase an example of this innovation. The market is also witnessing the integration of smart technologies, such as predictive maintenance and remote monitoring capabilities, optimizing performance and minimizing downtime. These advancements are improving the market fit of onshore wind turbines by enhancing their reliability, reducing overall costs and improving returns for project developers.

Report Scope & Segmentation Analysis

This report segments the Indian onshore wind energy market primarily by turbine capacity:

2-3 MW Segment: This segment currently holds a 55.0% market share and is expected to maintain a significant presence due to its cost-effectiveness and suitability for various project scales. The growth rate for this segment is projected at xx% during the forecast period.

>3 MW Segment: This segment holds a 45.0% market share and is poised for rapid growth driven by technological advancements and the increasing demand for large-scale wind farms. The growth rate for this segment is projected at xx% during the forecast period. Competitive dynamics within both segments are characterized by intense rivalry among domestic and international players.

Key Drivers of India Onshore Wind Energy Market Growth

Several factors are driving the expansion of the Indian onshore wind energy market: Government initiatives like the National Renewable Energy Policy aim to increase renewable energy capacity significantly. The decreasing cost of wind turbine technology makes wind power increasingly competitive with fossil fuels. India's substantial wind energy potential, coupled with supportive policies and regulatory frameworks, ensures continued growth. Corporate sustainability goals are also playing an important role, as businesses seek to reduce their carbon footprint and embrace renewable energy sources.

Challenges in the India Onshore Wind Energy Market Sector

The Indian onshore wind energy sector faces challenges, including land acquisition difficulties, which create delays and increase project costs. Intermittency of wind resources necessitates better energy storage solutions. Grid infrastructure limitations can hinder the seamless integration of large-scale wind farms. Supply chain disruptions and the availability of skilled labor present further constraints, impacting project timelines and costs. Finally, competition from other renewable energy sources, such as solar, necessitates continuous innovation to maintain competitiveness.

Emerging Opportunities in India Onshore Wind Energy Market

Significant opportunities exist in the development of hybrid wind-solar projects, harnessing the complementary nature of these resources. Technological advancements in wind turbine design and smart grid integration are opening new avenues for cost reduction and efficiency gains. Exploring offshore wind potential can significantly expand India's renewable energy capacity. Focus on rural electrification using small-scale wind projects can contribute to energy access in remote areas. Finally, partnerships between private sector and government initiatives foster market growth and innovation.

Leading Players in the India Onshore Wind Energy Market Market

- Enercon GmB

- Siemens Gamesa Renewable Energy SA

- Wind World India Ltd

- Tata Power Company

- Suzlon Energy Limited

- Envision Group

- Inox Wind limited

- Vestas Wind Systems AS

- General Electric Company

Key Developments in India Onshore Wind Energy Market Industry

- October 2022: Suzlon Group secured a 144.9 MW order for wind power projects in Gujarat and Madhya Pradesh, showcasing the ongoing demand for wind energy.

- May 2022: India announced plans for 30,000 MW of offshore wind power capacity, signaling a significant expansion of the renewable energy sector and future opportunities.

- October 2021: GE Renewable Energy secured an 810 MW order from JSW Energy Ltd, highlighting the substantial investments being made in onshore wind projects.

Strategic Outlook for India Onshore Wind Energy Market Market

The Indian onshore wind energy market is poised for sustained growth, driven by supportive government policies, increasing electricity demand, and technological advancements. The focus on cost reduction, efficiency improvements, and grid integration will be crucial for continued market expansion. The integration of smart technologies, along with exploring hybrid wind-solar and offshore wind potential, will unlock significant opportunities for industry stakeholders. The market’s future potential is immense, presenting attractive prospects for investors and businesses looking to participate in India's sustainable energy transition.

India Onshore Wind Energy Market Segmentation

- 1. Onshore

- 2. Offshore

India Onshore Wind Energy Market Segmentation By Geography

- 1. India

India Onshore Wind Energy Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 8.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Growing Vehicle Ownership4.; Government Initiatives

- 3.3. Market Restrains

- 3.3.1. 4.; Volatile Crude Oil Prices

- 3.4. Market Trends

- 3.4.1. Onshore Wind Energy is Expected to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Onshore Wind Energy Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Onshore

- 5.2. Market Analysis, Insights and Forecast - by Offshore

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by Onshore

- 6. China India Onshore Wind Energy Market Analysis, Insights and Forecast, 2019-2031

- 7. Japan India Onshore Wind Energy Market Analysis, Insights and Forecast, 2019-2031

- 8. India India Onshore Wind Energy Market Analysis, Insights and Forecast, 2019-2031

- 9. South Korea India Onshore Wind Energy Market Analysis, Insights and Forecast, 2019-2031

- 10. Taiwan India Onshore Wind Energy Market Analysis, Insights and Forecast, 2019-2031

- 11. Australia India Onshore Wind Energy Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Asia-Pacific India Onshore Wind Energy Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Enercon GmB

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Siemens Gamesa Renewable Energy SA

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Wind World India Ltd

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Tata Power Company

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Suzlon Energy Limited

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Envision Group

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Inox Wind limited

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Vestas Wind Systems AS

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 General Electric Company

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.1 Enercon GmB

List of Figures

- Figure 1: India Onshore Wind Energy Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: India Onshore Wind Energy Market Share (%) by Company 2024

List of Tables

- Table 1: India Onshore Wind Energy Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: India Onshore Wind Energy Market Volume Gigawatte Forecast, by Region 2019 & 2032

- Table 3: India Onshore Wind Energy Market Revenue Million Forecast, by Onshore 2019 & 2032

- Table 4: India Onshore Wind Energy Market Volume Gigawatte Forecast, by Onshore 2019 & 2032

- Table 5: India Onshore Wind Energy Market Revenue Million Forecast, by Offshore 2019 & 2032

- Table 6: India Onshore Wind Energy Market Volume Gigawatte Forecast, by Offshore 2019 & 2032

- Table 7: India Onshore Wind Energy Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: India Onshore Wind Energy Market Volume Gigawatte Forecast, by Region 2019 & 2032

- Table 9: India Onshore Wind Energy Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: India Onshore Wind Energy Market Volume Gigawatte Forecast, by Country 2019 & 2032

- Table 11: China India Onshore Wind Energy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: China India Onshore Wind Energy Market Volume (Gigawatte) Forecast, by Application 2019 & 2032

- Table 13: Japan India Onshore Wind Energy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Japan India Onshore Wind Energy Market Volume (Gigawatte) Forecast, by Application 2019 & 2032

- Table 15: India India Onshore Wind Energy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: India India Onshore Wind Energy Market Volume (Gigawatte) Forecast, by Application 2019 & 2032

- Table 17: South Korea India Onshore Wind Energy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: South Korea India Onshore Wind Energy Market Volume (Gigawatte) Forecast, by Application 2019 & 2032

- Table 19: Taiwan India Onshore Wind Energy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Taiwan India Onshore Wind Energy Market Volume (Gigawatte) Forecast, by Application 2019 & 2032

- Table 21: Australia India Onshore Wind Energy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Australia India Onshore Wind Energy Market Volume (Gigawatte) Forecast, by Application 2019 & 2032

- Table 23: Rest of Asia-Pacific India Onshore Wind Energy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Rest of Asia-Pacific India Onshore Wind Energy Market Volume (Gigawatte) Forecast, by Application 2019 & 2032

- Table 25: India Onshore Wind Energy Market Revenue Million Forecast, by Onshore 2019 & 2032

- Table 26: India Onshore Wind Energy Market Volume Gigawatte Forecast, by Onshore 2019 & 2032

- Table 27: India Onshore Wind Energy Market Revenue Million Forecast, by Offshore 2019 & 2032

- Table 28: India Onshore Wind Energy Market Volume Gigawatte Forecast, by Offshore 2019 & 2032

- Table 29: India Onshore Wind Energy Market Revenue Million Forecast, by Country 2019 & 2032

- Table 30: India Onshore Wind Energy Market Volume Gigawatte Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Onshore Wind Energy Market?

The projected CAGR is approximately > 8.00%.

2. Which companies are prominent players in the India Onshore Wind Energy Market?

Key companies in the market include Enercon GmB, Siemens Gamesa Renewable Energy SA, Wind World India Ltd, Tata Power Company, Suzlon Energy Limited, Envision Group, Inox Wind limited, Vestas Wind Systems AS, General Electric Company.

3. What are the main segments of the India Onshore Wind Energy Market?

The market segments include Onshore, Offshore.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Growing Vehicle Ownership4.; Government Initiatives.

6. What are the notable trends driving market growth?

Onshore Wind Energy is Expected to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Volatile Crude Oil Prices.

8. Can you provide examples of recent developments in the market?

October 2022: Suzlon Group secured new order to develop 144.9 MW wind power projects located at sites in Gujarat and Madhya Pradesh for the Aditya Birla Group. As a part of the contract, the company will install around 69 units of wind turbine generators (Wind Turbines) with a Hybrid Lattice Tubular (HLT) tower with a rated capacity of 2.1 MW each. It is expected to commence operations by the end of 2023.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Gigawatte.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Onshore Wind Energy Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Onshore Wind Energy Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Onshore Wind Energy Market?

To stay informed about further developments, trends, and reports in the India Onshore Wind Energy Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence