Key Insights

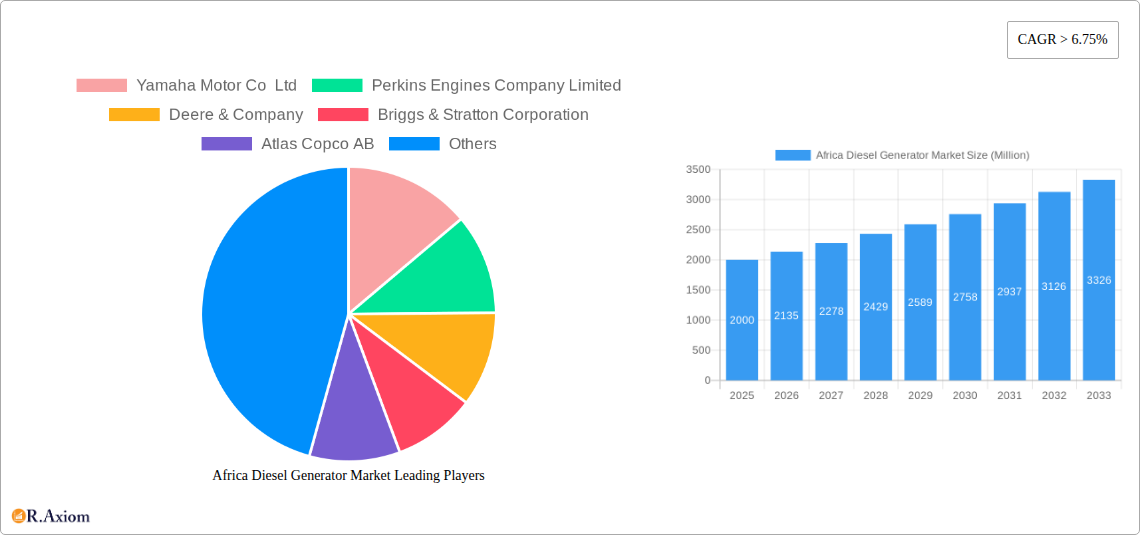

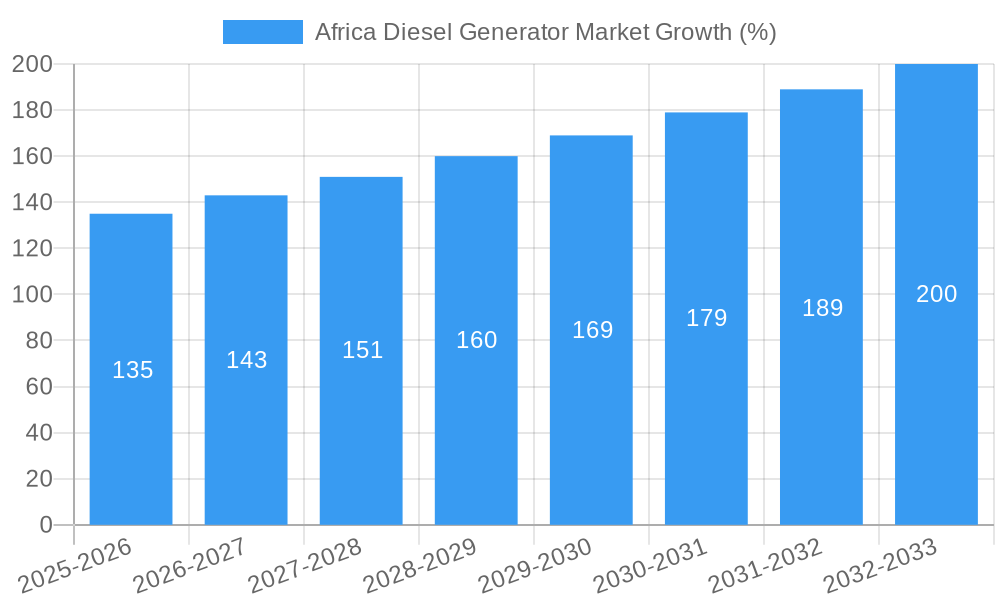

The Africa diesel generator market, valued at approximately $XX million in 2025, is projected to experience robust growth, exceeding a compound annual growth rate (CAGR) of 6.75% from 2025 to 2033. This expansion is fueled by several key factors. Firstly, increasing urbanization and industrialization across the continent drive a significant demand for reliable power solutions, particularly in regions with underdeveloped or unreliable grid infrastructure. Secondly, the growth of various sectors, including telecommunications, healthcare, and manufacturing, necessitates consistent power supply, making diesel generators a critical investment. Furthermore, the rising adoption of backup power systems to mitigate frequent power outages further boosts market growth. The market segmentation reveals a strong demand across various power capacities, with the 75-375 kVA segment potentially leading the charge due to its suitability for a wide range of applications. Prime power applications are anticipated to dominate, but the backup and peak-shaving segments will also witness substantial growth, driven by the need for power resilience and cost-effective power management. Key players, including Yamaha Motor Co Ltd, Perkins Engines Company Limited, and Cummins Inc., are actively expanding their presence in the African market to capitalize on these growth opportunities. However, challenges such as fluctuating fuel prices and stringent emission regulations pose potential restraints on market growth.

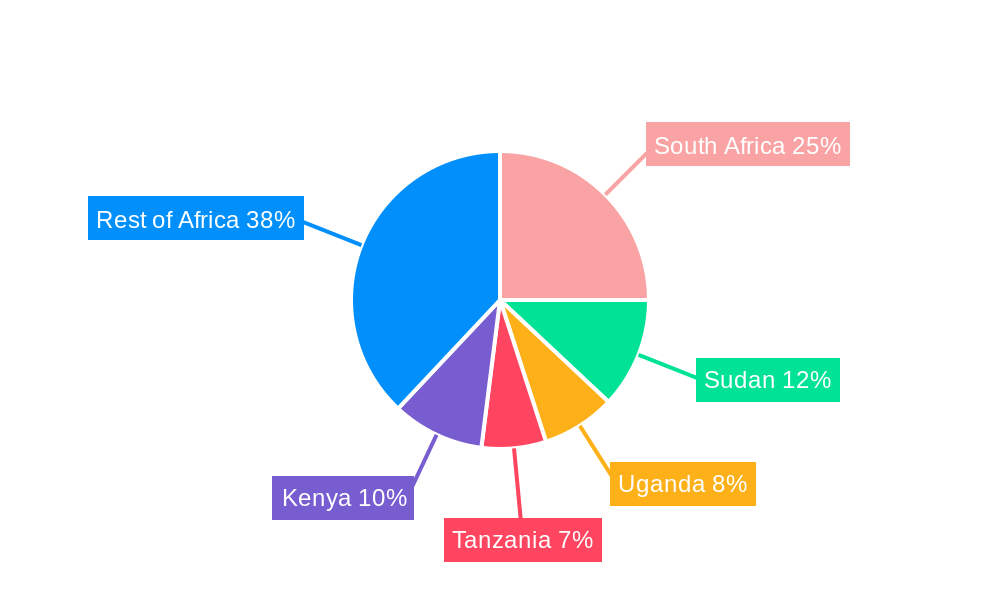

The market's regional distribution shows significant potential across diverse African nations. South Africa, Sudan, Uganda, Tanzania, and Kenya represent key markets, owing to their relatively developed economies and substantial infrastructure projects. However, untapped potential exists in the "Rest of Africa" segment, as electrification initiatives and infrastructural development continue across the continent. The forecast period of 2025-2033 presents considerable opportunities for market players to penetrate new markets, forge strategic partnerships, and introduce innovative products tailored to the specific needs of the African market. Addressing the challenges through technological advancements, such as the development of more fuel-efficient and environmentally friendly diesel generators, will be crucial for sustainable market growth.

Africa Diesel Generator Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Africa Diesel Generator Market, offering valuable insights for industry stakeholders, investors, and businesses seeking to capitalize on the region's dynamic energy landscape. The report covers the period from 2019 to 2033, with a focus on the forecast period of 2025-2033 and a base year of 2025. The study incorporates extensive data analysis, market segmentation, and competitive landscape assessment. Key market players, such as Yamaha Motor Co Ltd, Perkins Engines Company Limited, Deere & Company, Briggs & Stratton Corporation, Atlas Copco AB, Caterpillar Inc, Kirloskar Oil Engines Limited, Honda Siel Power Products Limited, Cummins Inc, Yanmar Holdings Co Ltd, and Mitsubishi Heavy Industries Ltd, are thoroughly examined. The market is segmented by rating (0-75 kVA, 75-375 kVA, Above 375 kVA) and application (Prime Power, Backup Power, Peak Shaving).

Africa Diesel Generator Market Market Concentration & Innovation

The Africa diesel generator market exhibits a moderately concentrated landscape, with a few dominant players controlling a significant portion of the market share. However, the presence of numerous smaller, regional players fosters competition and innovation. The market is characterized by ongoing product development, driven by the need for enhanced efficiency, reliability, and reduced emissions. Stringent environmental regulations in certain African countries are also prompting manufacturers to invest in cleaner technologies. The market has witnessed several M&A activities in recent years, with deal values ranging from xx Million to xx Million, aimed at expanding market reach and portfolio diversification. Market share data reveals that the top 5 players collectively hold approximately xx% of the market, indicating significant consolidation. Future growth is expected to be driven by the ongoing integration of digital technologies, such as smart monitoring and remote diagnostics, as well as the adoption of alternative fuels. Regulatory frameworks vary across African nations, presenting both challenges and opportunities for market players. Product substitutes, including solar and wind power, are gaining traction, particularly in off-grid areas, impacting diesel generator adoption. End-user trends are leaning toward more reliable and environmentally friendly solutions, with higher efficiency and lower noise levels becoming increasingly important.

Africa Diesel Generator Market Industry Trends & Insights

The Africa diesel generator market is experiencing robust growth, driven by factors such as rising electricity demand, particularly in the rapidly expanding industrial and commercial sectors. Infrastructure development initiatives across various African nations are further fueling market expansion. The market is poised for a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). Technological disruptions, primarily in the form of advanced engine technologies, improved fuel efficiency, and integrated digital solutions, are shaping market dynamics. Consumer preferences are shifting towards environmentally sustainable options with lower emissions, encouraging manufacturers to prioritize cleaner fuel technologies. Competitive dynamics are intense, with major players focusing on product differentiation, technological advancements, and strategic partnerships to maintain their market positions. Market penetration varies across different regions and segments. The high initial investment cost remains a significant barrier for wider adoption in some rural areas, however, the increase in leasing options is reducing this barrier.

Dominant Markets & Segments in Africa Diesel Generator Market

- Leading Region: [Insert the name of leading region with supporting data] Due to factors such as strong economic growth, substantial infrastructure development projects, and increasing industrialization.

- Leading Country: [Insert the name of the leading country with supporting data] Its rapid urbanization, expanding industrial sector, and inadequate electricity infrastructure drive higher demand.

- Dominant Segment (Rating): The 75-375 kVA segment currently dominates, driven by its suitability for a wide range of applications across various industries. The 0-75 kVA segment caters to smaller businesses and households, while the segment above 375 kVA caters to large industries and power plants. This segment's growth is expected to be more moderate than that of 75-375kVA.

- Dominant Segment (Application): Backup power generation holds the largest market share due to frequent power outages across many African countries. Prime power applications are also experiencing substantial growth driven by industrial expansion and rising energy demands. Peak shaving applications are gaining traction as companies and industries seek to optimize their energy consumption and reduce costs.

The dominance of specific regions and segments is primarily influenced by economic policies promoting industrial development, infrastructure investments, population growth and urbanization, and the reliability of existing power grids. These factors create significant demand for reliable backup power, fueling the growth of the diesel generator market within these regions and segments.

Africa Diesel Generator Market Product Developments

Recent product innovations focus on enhancing fuel efficiency, lowering noise pollution, and improving overall reliability. Manufacturers are incorporating advanced engine technologies, such as electronically controlled fuel injection systems and turbocharging, to optimize performance and reduce emissions. The integration of smart technologies, such as remote monitoring and diagnostics, enables predictive maintenance, minimizing downtime and maximizing operational efficiency. These developments cater to the growing need for reliable, efficient, and environmentally friendly power solutions in various applications across the African market. The market is seeing a push towards hybrid systems that combine diesel generators with renewable energy sources.

Report Scope & Segmentation Analysis

This report segments the Africa diesel generator market based on rating (0-75 kVA, 75-375 kVA, Above 375 kVA) and application (Prime Power, Backup Power, Peak Shaving). Each segment's growth projections, market sizes, and competitive dynamics are thoroughly analyzed. The 75-375 kVA segment is projected to witness significant growth due to its versatility across diverse applications. Backup power applications dominate the market due to the unreliable electricity grids in many African countries. The report provides a detailed analysis of each segment's market size, growth rate, key players, and market trends.

Key Drivers of Africa Diesel Generator Market Growth

The Africa diesel generator market's growth is fueled by several key factors: rapid industrialization and urbanization leading to increased energy demand; unreliable electricity infrastructure causing frequent power outages; government initiatives promoting infrastructure development and rural electrification; and increasing adoption of diesel generators across diverse sectors, including healthcare, telecommunications, and manufacturing. The rising adoption of backup power solutions in residential and commercial sectors further contributes to this market's expansion.

Challenges in the Africa Diesel Generator Market Sector

The market faces challenges such as high initial investment costs, stringent environmental regulations pushing for cleaner technologies, volatility in fuel prices, and the emergence of alternative power sources like solar and wind power. Supply chain disruptions and logistical issues in certain regions can also impact market growth. These factors can create significant barriers to entry for new players and influence the market's overall growth trajectory. The lack of skilled technicians and maintenance facilities in some regions is also a challenge.

Emerging Opportunities in Africa Diesel Generator Market

Emerging opportunities lie in the adoption of hybrid systems combining diesel generators with renewable energy sources, providing a more sustainable and cost-effective power solution. The growing demand for higher efficiency and lower emission generators creates openings for technologically advanced products. Government initiatives promoting rural electrification present significant market potential. The increasing use of leasing options and finance schemes opens the market up to a larger customer base.

Leading Players in the Africa Diesel Generator Market Market

- Yamaha Motor Co Ltd

- Perkins Engines Company Limited

- Deere & Company

- Briggs & Stratton Corporation

- Atlas Copco AB

- Caterpillar Inc

- Kirloskar Oil Engines Limited

- Honda Siel Power Products Limited

- Cummins Inc

- Yanmar Holdings Co Ltd

- Mitsubishi Heavy Industries Ltd

Key Developments in Africa Diesel Generator Market Industry

- June 2023: A 150 kVA Pramac Perkins Silent Diesel Generator and a 200 Amp Automatic Transfer Switch were sent to Ghana, showcasing the demand for reliable backup power solutions in the commercial sector.

- January 2023: The African Development Bank's USD 610 million investment in Nigeria's transmission project highlights the government's commitment to improving electricity infrastructure, indirectly impacting the diesel generator market by potentially reducing the need for backup power in some areas, while simultaneously increasing demand for generators in areas not covered by the expansion.

Strategic Outlook for Africa Diesel Generator Market Market

The Africa diesel generator market is poised for sustained growth driven by increasing energy demand, infrastructure development, and the persistent need for reliable backup power. Opportunities exist for manufacturers who can offer efficient, environmentally friendly, and technologically advanced solutions. Strategic partnerships with local distributors and service providers will be crucial for success in this market. The market will likely see further consolidation through mergers and acquisitions, with major players focusing on expanding their market share and product portfolios.

Africa Diesel Generator Market Segmentation

-

1. Ratings

- 1.1. 0 - 75 kVA

- 1.2. 75 - 375 kVA

- 1.3. Above 375 kVA

-

2. Application

- 2.1. Prime Power

- 2.2. Backup Power

- 2.3. Peak Shaving

-

3. Geography

- 3.1. Nigeria

- 3.2. Angola

- 3.3. South Africa

- 3.4. Rest of Africa

Africa Diesel Generator Market Segmentation By Geography

- 1. Nigeria

- 2. Angola

- 3. South Africa

- 4. Rest of Africa

Africa Diesel Generator Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 6.75% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increased Demand for Uninterrupted and Reliable Power Supply4.; The Rise In the Industrial Sector

- 3.3. Market Restrains

- 3.3.1. 4.; Advancements In Battery Technologies

- 3.4. Market Trends

- 3.4.1. Backup Generators to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Africa Diesel Generator Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Ratings

- 5.1.1. 0 - 75 kVA

- 5.1.2. 75 - 375 kVA

- 5.1.3. Above 375 kVA

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Prime Power

- 5.2.2. Backup Power

- 5.2.3. Peak Shaving

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Nigeria

- 5.3.2. Angola

- 5.3.3. South Africa

- 5.3.4. Rest of Africa

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Nigeria

- 5.4.2. Angola

- 5.4.3. South Africa

- 5.4.4. Rest of Africa

- 5.1. Market Analysis, Insights and Forecast - by Ratings

- 6. Nigeria Africa Diesel Generator Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Ratings

- 6.1.1. 0 - 75 kVA

- 6.1.2. 75 - 375 kVA

- 6.1.3. Above 375 kVA

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Prime Power

- 6.2.2. Backup Power

- 6.2.3. Peak Shaving

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. Nigeria

- 6.3.2. Angola

- 6.3.3. South Africa

- 6.3.4. Rest of Africa

- 6.1. Market Analysis, Insights and Forecast - by Ratings

- 7. Angola Africa Diesel Generator Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Ratings

- 7.1.1. 0 - 75 kVA

- 7.1.2. 75 - 375 kVA

- 7.1.3. Above 375 kVA

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Prime Power

- 7.2.2. Backup Power

- 7.2.3. Peak Shaving

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. Nigeria

- 7.3.2. Angola

- 7.3.3. South Africa

- 7.3.4. Rest of Africa

- 7.1. Market Analysis, Insights and Forecast - by Ratings

- 8. South Africa Africa Diesel Generator Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Ratings

- 8.1.1. 0 - 75 kVA

- 8.1.2. 75 - 375 kVA

- 8.1.3. Above 375 kVA

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Prime Power

- 8.2.2. Backup Power

- 8.2.3. Peak Shaving

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. Nigeria

- 8.3.2. Angola

- 8.3.3. South Africa

- 8.3.4. Rest of Africa

- 8.1. Market Analysis, Insights and Forecast - by Ratings

- 9. Rest of Africa Africa Diesel Generator Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Ratings

- 9.1.1. 0 - 75 kVA

- 9.1.2. 75 - 375 kVA

- 9.1.3. Above 375 kVA

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Prime Power

- 9.2.2. Backup Power

- 9.2.3. Peak Shaving

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. Nigeria

- 9.3.2. Angola

- 9.3.3. South Africa

- 9.3.4. Rest of Africa

- 9.1. Market Analysis, Insights and Forecast - by Ratings

- 10. South Africa Africa Diesel Generator Market Analysis, Insights and Forecast, 2019-2031

- 11. Sudan Africa Diesel Generator Market Analysis, Insights and Forecast, 2019-2031

- 12. Uganda Africa Diesel Generator Market Analysis, Insights and Forecast, 2019-2031

- 13. Tanzania Africa Diesel Generator Market Analysis, Insights and Forecast, 2019-2031

- 14. Kenya Africa Diesel Generator Market Analysis, Insights and Forecast, 2019-2031

- 15. Rest of Africa Africa Diesel Generator Market Analysis, Insights and Forecast, 2019-2031

- 16. Competitive Analysis

- 16.1. Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Yamaha Motor Co Ltd

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Perkins Engines Company Limited

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Deere & Company

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Briggs & Stratton Corporation

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Atlas Copco AB

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Caterpillar Inc

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Kirloskar Oil Engines Limited

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Honda Siel Power Products Limited*List Not Exhaustive

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Cummins Inc

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 Yanmar Holdings Co Ltd

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.11 Mitsubishi Heavy Industries Ltd

- 16.2.11.1. Overview

- 16.2.11.2. Products

- 16.2.11.3. SWOT Analysis

- 16.2.11.4. Recent Developments

- 16.2.11.5. Financials (Based on Availability)

- 16.2.1 Yamaha Motor Co Ltd

List of Figures

- Figure 1: Africa Diesel Generator Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Africa Diesel Generator Market Share (%) by Company 2024

List of Tables

- Table 1: Africa Diesel Generator Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Africa Diesel Generator Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: Africa Diesel Generator Market Revenue Million Forecast, by Ratings 2019 & 2032

- Table 4: Africa Diesel Generator Market Volume K Unit Forecast, by Ratings 2019 & 2032

- Table 5: Africa Diesel Generator Market Revenue Million Forecast, by Application 2019 & 2032

- Table 6: Africa Diesel Generator Market Volume K Unit Forecast, by Application 2019 & 2032

- Table 7: Africa Diesel Generator Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 8: Africa Diesel Generator Market Volume K Unit Forecast, by Geography 2019 & 2032

- Table 9: Africa Diesel Generator Market Revenue Million Forecast, by Region 2019 & 2032

- Table 10: Africa Diesel Generator Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 11: Africa Diesel Generator Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Africa Diesel Generator Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 13: South Africa Africa Diesel Generator Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: South Africa Africa Diesel Generator Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 15: Sudan Africa Diesel Generator Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Sudan Africa Diesel Generator Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 17: Uganda Africa Diesel Generator Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Uganda Africa Diesel Generator Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 19: Tanzania Africa Diesel Generator Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Tanzania Africa Diesel Generator Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 21: Kenya Africa Diesel Generator Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Kenya Africa Diesel Generator Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 23: Rest of Africa Africa Diesel Generator Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Rest of Africa Africa Diesel Generator Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 25: Africa Diesel Generator Market Revenue Million Forecast, by Ratings 2019 & 2032

- Table 26: Africa Diesel Generator Market Volume K Unit Forecast, by Ratings 2019 & 2032

- Table 27: Africa Diesel Generator Market Revenue Million Forecast, by Application 2019 & 2032

- Table 28: Africa Diesel Generator Market Volume K Unit Forecast, by Application 2019 & 2032

- Table 29: Africa Diesel Generator Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 30: Africa Diesel Generator Market Volume K Unit Forecast, by Geography 2019 & 2032

- Table 31: Africa Diesel Generator Market Revenue Million Forecast, by Country 2019 & 2032

- Table 32: Africa Diesel Generator Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 33: Africa Diesel Generator Market Revenue Million Forecast, by Ratings 2019 & 2032

- Table 34: Africa Diesel Generator Market Volume K Unit Forecast, by Ratings 2019 & 2032

- Table 35: Africa Diesel Generator Market Revenue Million Forecast, by Application 2019 & 2032

- Table 36: Africa Diesel Generator Market Volume K Unit Forecast, by Application 2019 & 2032

- Table 37: Africa Diesel Generator Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 38: Africa Diesel Generator Market Volume K Unit Forecast, by Geography 2019 & 2032

- Table 39: Africa Diesel Generator Market Revenue Million Forecast, by Country 2019 & 2032

- Table 40: Africa Diesel Generator Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 41: Africa Diesel Generator Market Revenue Million Forecast, by Ratings 2019 & 2032

- Table 42: Africa Diesel Generator Market Volume K Unit Forecast, by Ratings 2019 & 2032

- Table 43: Africa Diesel Generator Market Revenue Million Forecast, by Application 2019 & 2032

- Table 44: Africa Diesel Generator Market Volume K Unit Forecast, by Application 2019 & 2032

- Table 45: Africa Diesel Generator Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 46: Africa Diesel Generator Market Volume K Unit Forecast, by Geography 2019 & 2032

- Table 47: Africa Diesel Generator Market Revenue Million Forecast, by Country 2019 & 2032

- Table 48: Africa Diesel Generator Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 49: Africa Diesel Generator Market Revenue Million Forecast, by Ratings 2019 & 2032

- Table 50: Africa Diesel Generator Market Volume K Unit Forecast, by Ratings 2019 & 2032

- Table 51: Africa Diesel Generator Market Revenue Million Forecast, by Application 2019 & 2032

- Table 52: Africa Diesel Generator Market Volume K Unit Forecast, by Application 2019 & 2032

- Table 53: Africa Diesel Generator Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 54: Africa Diesel Generator Market Volume K Unit Forecast, by Geography 2019 & 2032

- Table 55: Africa Diesel Generator Market Revenue Million Forecast, by Country 2019 & 2032

- Table 56: Africa Diesel Generator Market Volume K Unit Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Africa Diesel Generator Market?

The projected CAGR is approximately > 6.75%.

2. Which companies are prominent players in the Africa Diesel Generator Market?

Key companies in the market include Yamaha Motor Co Ltd, Perkins Engines Company Limited, Deere & Company, Briggs & Stratton Corporation, Atlas Copco AB, Caterpillar Inc, Kirloskar Oil Engines Limited, Honda Siel Power Products Limited*List Not Exhaustive, Cummins Inc, Yanmar Holdings Co Ltd, Mitsubishi Heavy Industries Ltd.

3. What are the main segments of the Africa Diesel Generator Market?

The market segments include Ratings, Application, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increased Demand for Uninterrupted and Reliable Power Supply4.; The Rise In the Industrial Sector.

6. What are the notable trends driving market growth?

Backup Generators to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Advancements In Battery Technologies.

8. Can you provide examples of recent developments in the market?

June 2023: A 150 kVA Pramac Perkins Silent Diesel Generator and a 200 Amp Automatic Transfer Switch were sent to Ghana, Africa. The full standby power solution will likely provide backup electricity to a large Accra building materials supplier's offices and warehouse.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Africa Diesel Generator Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Africa Diesel Generator Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Africa Diesel Generator Market?

To stay informed about further developments, trends, and reports in the Africa Diesel Generator Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence