Key Insights

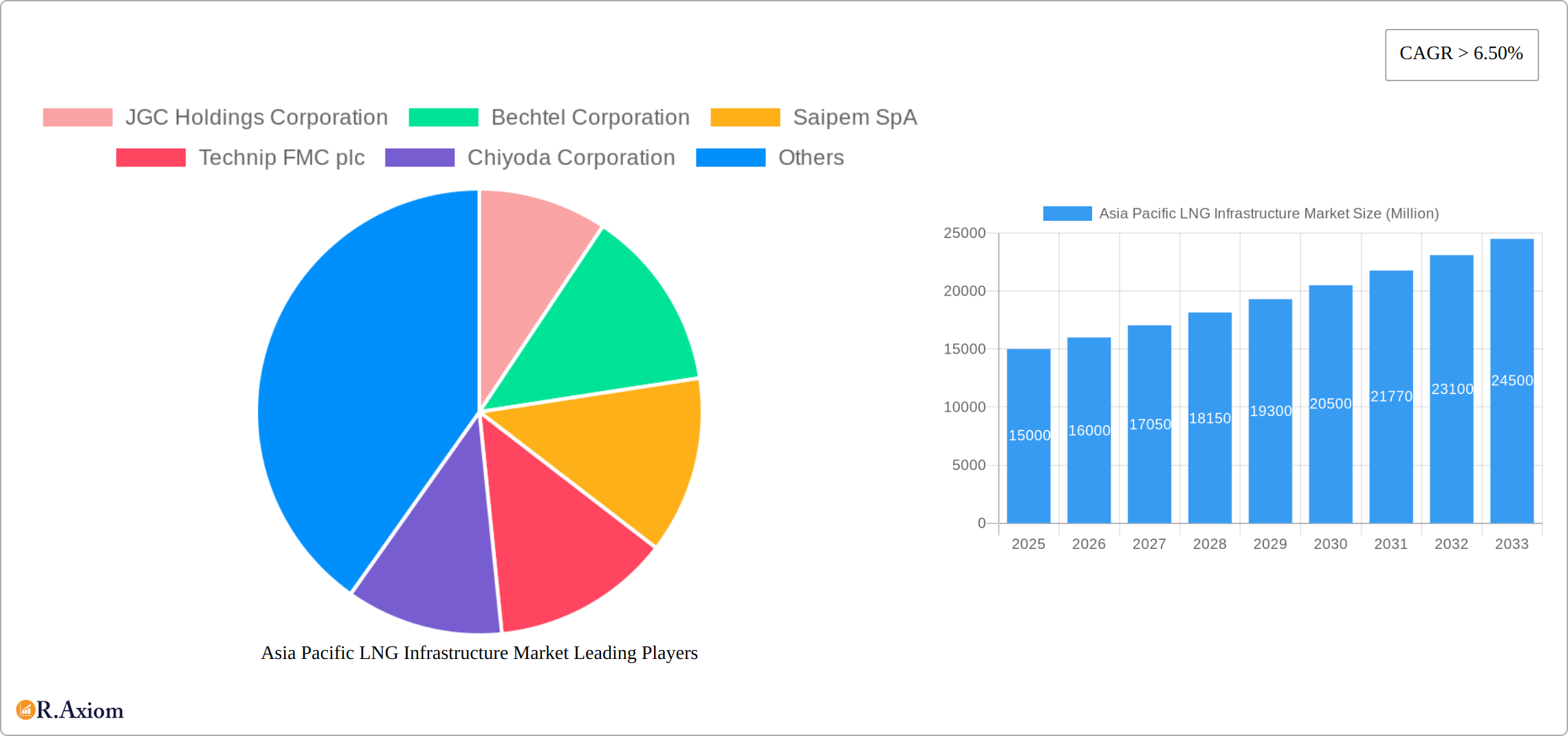

The Asia Pacific LNG Infrastructure market is experiencing robust growth, driven by increasing energy demand, particularly in rapidly developing economies like China, India, and South Korea. The region's reliance on imported LNG necessitates significant investment in regasification and liquefaction terminals to ensure a reliable and efficient energy supply. This market, valued at approximately $XX million in 2025, is projected to experience a Compound Annual Growth Rate (CAGR) exceeding 6.50% from 2025 to 2033, reaching an estimated value of $[Calculate estimated 2033 value based on 2025 value and CAGR] million by 2033. Key drivers include government initiatives promoting cleaner energy sources, stringent environmental regulations pushing for a shift away from coal, and rising industrialization across the region. Furthermore, the expansion of existing infrastructure and construction of new LNG terminals are major factors contributing to market growth. While increasing construction costs and geopolitical uncertainties pose some restraints, the long-term outlook remains positive given the region's considerable energy needs and commitment to diversifying its energy portfolio. The market is segmented into regasification and liquefaction terminals, with both segments witnessing significant expansion. Major players like JGC Holdings Corporation, Bechtel Corporation, and Saipem SpA are leading this growth, leveraging their expertise in engineering, procurement, and construction (EPC) to secure lucrative projects.

The Asia-Pacific LNG infrastructure market's growth is fueled by the substantial increase in LNG imports, necessitated by the region's burgeoning energy requirements. This growth is further supported by supportive government policies aimed at promoting energy security and environmental sustainability. While challenges remain, such as the inherent volatility of global LNG prices and potential regulatory hurdles, the market is poised for sustained expansion over the forecast period. The focus is shifting towards enhancing efficiency, reducing environmental impact through technology upgrades and exploring opportunities in emerging markets within the Asia Pacific region. This dynamic environment presents significant opportunities for established players and new entrants alike, particularly those capable of delivering innovative solutions that address the unique challenges and opportunities presented by each individual market within the region. The competitive landscape features both established international EPC contractors and regional players, leading to increased competition and a focus on providing cost-effective and efficient solutions.

This in-depth report provides a comprehensive analysis of the Asia Pacific LNG infrastructure market, encompassing historical data (2019-2024), the base year (2025), and a detailed forecast (2025-2033). It offers invaluable insights for industry stakeholders, investors, and businesses seeking to understand the market's dynamics, opportunities, and challenges. The report utilizes rigorous research methodologies and incorporates data from various reliable sources to present accurate and actionable intelligence.

Asia Pacific LNG Infrastructure Market Market Concentration & Innovation

The Asia Pacific LNG infrastructure market presents a dynamic interplay of concentration, innovation, and evolving regulatory landscapes. While a few major players, including JGC Holdings Corporation, Bechtel Corporation, Saipem SpA, Technip FMC plc, Chiyoda Corporation, Fluor Corporation, McDermott International Inc, and Chevron Corporation, hold significant market share (estimated at xx% collectively, with individual shares at xx% respectively), a considerable number of smaller companies contribute to a competitive market environment. Innovation is a key driver, fueled by advancements in liquefaction and regasification technologies focused on enhancing efficiency, minimizing emissions, and reducing costs. This includes the development of smaller, modular LNG facilities, enabling greater accessibility and flexibility. The average M&A deal value over the past five years has been approximately $xx million, reflecting substantial investment in market expansion and consolidation.

Several key factors shape the market:

- Regulatory Frameworks: Stringent environmental regulations are accelerating the adoption of cleaner technologies and sustainable practices throughout the LNG value chain, influencing project design and operation.

- Product Substitutes: Competition from renewable energy sources and other alternative fuels presents a challenge, requiring the LNG industry to continuously demonstrate its value proposition in terms of reliability, affordability, and emissions reduction.

- End-User Trends: The burgeoning energy demand in rapidly developing Asian economies is a primary driver of market expansion, particularly in sectors such as power generation, industrial processes, and transportation.

- M&A Activities: Strategic mergers and acquisitions are reshaping the competitive landscape, leading to greater economies of scale and enhanced technological capabilities.

Asia Pacific LNG Infrastructure Market Industry Trends & Insights

The Asia Pacific LNG infrastructure market is experiencing robust growth, projected at a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This expansion is fueled by a confluence of factors including rising energy demand, accelerating industrialization across the region, and supportive government policies promoting LNG as a transition fuel. Market penetration of LNG infrastructure projects is anticipated to increase significantly, from xx% in 2025 to xx% by 2033. Technological disruptions, exemplified by the aforementioned modular LNG facilities, are reshaping market dynamics, enabling greater flexibility and reducing deployment times. The growing consumer preference for cleaner energy sources further strengthens the demand for LNG infrastructure, creating substantial opportunities for innovation and investment.

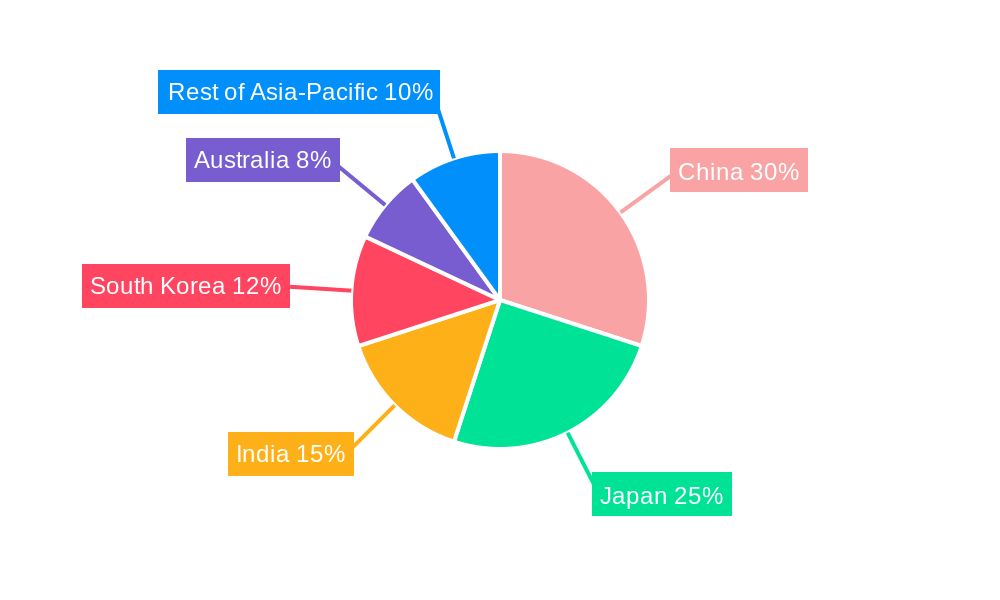

Dominant Markets & Segments in Asia Pacific LNG Infrastructure Market

The Asia Pacific region dominates the global LNG infrastructure market, with significant growth driven by countries like China, India, Japan, South Korea, and Australia. Within the region, China and India are the leading markets for LNG infrastructure owing to their large energy demands and ongoing infrastructure developments.

Dominant Segments:

- Regasification Terminals: This segment is expected to maintain significant dominance due to the high demand for imported LNG. Key drivers include:

- Growing energy demand in several Asian countries.

- Government initiatives supporting LNG infrastructure development.

- Strategic geographic locations facilitating efficient LNG supply chains.

- Liquefaction Terminals: This segment experiences considerable growth driven by increasing domestic LNG production in countries like Australia and potential expansion in other countries. Key drivers include:

- Abundant natural gas reserves in certain regions.

- Investments in liquefaction facilities and associated infrastructure.

- Government incentives for LNG production and export.

Both segments are characterized by intense competition, technological innovation, and fluctuating LNG prices.

Asia Pacific LNG Infrastructure Market Product Developments

Recent product innovations are centered around enhancing the efficiency, safety, and environmental performance of LNG terminals and related infrastructure. Significant advancements in liquefaction and regasification technologies are leading to smaller, more modular, and environmentally friendly facilities. The focus on cost reduction and environmental sustainability is crucial in positioning LNG infrastructure as a responsible and competitive energy solution, aligning with global efforts towards decarbonization. The strong market fit stems from the growing need for reliable, efficient, and increasingly sustainable energy solutions.

Report Scope & Segmentation Analysis

This report segments the Asia Pacific LNG infrastructure market by type: Regasification Terminals and Liquefaction Terminals.

Regasification Terminals: This segment encompasses the infrastructure for receiving, storing, and regasifying imported LNG. The market size in 2025 is estimated at $xx Million, projected to reach $xx Million by 2033. Competition is intense, with a mix of large multinational companies and specialized regional players.

Liquefaction Terminals: This segment covers the infrastructure for liquefying natural gas for storage and transportation. The market size in 2025 is projected at $xx Million, expected to grow to $xx Million by 2033, driven by growing domestic LNG production.

Key Drivers of Asia Pacific LNG Infrastructure Market Growth

The Asia Pacific LNG infrastructure market's growth is propelled by several key factors:

- Rising Energy Demand: Rapid industrialization and population growth in several Asian countries are driving up energy demand.

- Government Support: Governments across the region are actively promoting LNG as a cleaner fuel source, providing financial incentives and supportive regulatory frameworks.

- Technological Advancements: Innovations in liquefaction and regasification technologies are leading to increased efficiency and reduced costs.

Challenges in the Asia Pacific LNG Infrastructure Market Sector

Despite the significant growth potential, several key challenges persist within the Asia Pacific LNG infrastructure market:

- High Capital Expenditure: The substantial initial investment required for building LNG infrastructure remains a major barrier to entry for new players and can limit market participation.

- Geopolitical Risks: Regional political instability, trade disputes, and potential disruptions to global supply chains pose significant risks to project development and long-term market stability.

- Environmental Concerns: Growing environmental concerns surrounding methane emissions, carbon footprint, and the overall lifecycle impact of LNG are leading to stricter regulations and necessitate ongoing efforts towards emissions reduction and sustainability.

- Infrastructure Development complexities: Securing necessary permits, land acquisition, and navigating complex regulatory processes adds to the challenges of project development and timely deployment.

Emerging Opportunities in Asia Pacific LNG Infrastructure Market

The market presents several emerging opportunities:

- Small-Scale LNG: The growing demand for LNG in remote areas is creating opportunities for small-scale LNG facilities.

- LNG as a Transportation Fuel: The adoption of LNG as a marine and road transport fuel presents significant growth potential.

- Technological Innovation: Advancements in LNG technologies offer opportunities for developing more efficient and sustainable solutions.

Leading Players in the Asia Pacific LNG Infrastructure Market Market

- JGC Holdings Corporation

- Bechtel Corporation

- Saipem SpA

- Technip FMC plc

- Chiyoda Corporation

- Fluor Corporation

- McDermott International Inc

- Chevron corporation

Key Developments in Asia Pacific LNG Infrastructure Market Industry

- June 2022: NOVATEK signed small-scale LNG cooperation agreements, aiming to expand LNG use as motor fuel and for off-grid customers in Russia. This signifies a potential market shift towards smaller-scale LNG infrastructure.

- April 2021: INOXCVA and Mitsui & Co. signed an MOU to establish a virtual pipeline in India, highlighting the growing importance of small-scale LNG infrastructure for last-mile delivery.

Strategic Outlook for Asia Pacific LNG Infrastructure Market Market

The Asia Pacific LNG infrastructure market is projected for substantial growth over the coming years, driven by the increasing energy demand, supportive government policies, and continuous technological advancements. Significant opportunities exist in the development of small-scale LNG infrastructure to cater to diverse and geographically dispersed markets, expanding LNG applications in transportation sectors (maritime and trucking), and adopting innovative technologies that enhance efficiency, sustainability, and overall cost-effectiveness. Strategic investments in infrastructure development coupled with a strong focus on technological innovation will be pivotal in capturing market share and achieving sustainable, long-term growth within this dynamic market.

Asia Pacific LNG Infrastructure Market Segmentation

-

1. Type

- 1.1. Regasification Terminal

- 1.2. Liquefication Terminal

-

2. Geography

- 2.1. India

- 2.2. China

- 2.3. Japan

- 2.4. Australia

- 2.5. South Korea

- 2.6. Rest of Asia Pacific

Asia Pacific LNG Infrastructure Market Segmentation By Geography

- 1. India

- 2. China

- 3. Japan

- 4. Australia

- 5. South Korea

- 6. Rest of Asia Pacific

Asia Pacific LNG Infrastructure Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 6.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Growing Vehicle Ownership4.; Government Initiatives

- 3.3. Market Restrains

- 3.3.1. 4.; Volatile Crude Oil Prices

- 3.4. Market Trends

- 3.4.1. Regasification terminal Segment to have a Significant Share in the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia Pacific LNG Infrastructure Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Regasification Terminal

- 5.1.2. Liquefication Terminal

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. India

- 5.2.2. China

- 5.2.3. Japan

- 5.2.4. Australia

- 5.2.5. South Korea

- 5.2.6. Rest of Asia Pacific

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.3.2. China

- 5.3.3. Japan

- 5.3.4. Australia

- 5.3.5. South Korea

- 5.3.6. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. India Asia Pacific LNG Infrastructure Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Regasification Terminal

- 6.1.2. Liquefication Terminal

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. India

- 6.2.2. China

- 6.2.3. Japan

- 6.2.4. Australia

- 6.2.5. South Korea

- 6.2.6. Rest of Asia Pacific

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. China Asia Pacific LNG Infrastructure Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Regasification Terminal

- 7.1.2. Liquefication Terminal

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. India

- 7.2.2. China

- 7.2.3. Japan

- 7.2.4. Australia

- 7.2.5. South Korea

- 7.2.6. Rest of Asia Pacific

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Japan Asia Pacific LNG Infrastructure Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Regasification Terminal

- 8.1.2. Liquefication Terminal

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. India

- 8.2.2. China

- 8.2.3. Japan

- 8.2.4. Australia

- 8.2.5. South Korea

- 8.2.6. Rest of Asia Pacific

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Australia Asia Pacific LNG Infrastructure Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Regasification Terminal

- 9.1.2. Liquefication Terminal

- 9.2. Market Analysis, Insights and Forecast - by Geography

- 9.2.1. India

- 9.2.2. China

- 9.2.3. Japan

- 9.2.4. Australia

- 9.2.5. South Korea

- 9.2.6. Rest of Asia Pacific

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. South Korea Asia Pacific LNG Infrastructure Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Regasification Terminal

- 10.1.2. Liquefication Terminal

- 10.2. Market Analysis, Insights and Forecast - by Geography

- 10.2.1. India

- 10.2.2. China

- 10.2.3. Japan

- 10.2.4. Australia

- 10.2.5. South Korea

- 10.2.6. Rest of Asia Pacific

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Rest of Asia Pacific Asia Pacific LNG Infrastructure Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - by Type

- 11.1.1. Regasification Terminal

- 11.1.2. Liquefication Terminal

- 11.2. Market Analysis, Insights and Forecast - by Geography

- 11.2.1. India

- 11.2.2. China

- 11.2.3. Japan

- 11.2.4. Australia

- 11.2.5. South Korea

- 11.2.6. Rest of Asia Pacific

- 11.1. Market Analysis, Insights and Forecast - by Type

- 12. China Asia Pacific LNG Infrastructure Market Analysis, Insights and Forecast, 2019-2031

- 13. Japan Asia Pacific LNG Infrastructure Market Analysis, Insights and Forecast, 2019-2031

- 14. India Asia Pacific LNG Infrastructure Market Analysis, Insights and Forecast, 2019-2031

- 15. South Korea Asia Pacific LNG Infrastructure Market Analysis, Insights and Forecast, 2019-2031

- 16. Taiwan Asia Pacific LNG Infrastructure Market Analysis, Insights and Forecast, 2019-2031

- 17. Australia Asia Pacific LNG Infrastructure Market Analysis, Insights and Forecast, 2019-2031

- 18. Rest of Asia-Pacific Asia Pacific LNG Infrastructure Market Analysis, Insights and Forecast, 2019-2031

- 19. Competitive Analysis

- 19.1. Market Share Analysis 2024

- 19.2. Company Profiles

- 19.2.1 JGC Holdings Corporation

- 19.2.1.1. Overview

- 19.2.1.2. Products

- 19.2.1.3. SWOT Analysis

- 19.2.1.4. Recent Developments

- 19.2.1.5. Financials (Based on Availability)

- 19.2.2 Bechtel Corporation

- 19.2.2.1. Overview

- 19.2.2.2. Products

- 19.2.2.3. SWOT Analysis

- 19.2.2.4. Recent Developments

- 19.2.2.5. Financials (Based on Availability)

- 19.2.3 Saipem SpA

- 19.2.3.1. Overview

- 19.2.3.2. Products

- 19.2.3.3. SWOT Analysis

- 19.2.3.4. Recent Developments

- 19.2.3.5. Financials (Based on Availability)

- 19.2.4 Technip FMC plc

- 19.2.4.1. Overview

- 19.2.4.2. Products

- 19.2.4.3. SWOT Analysis

- 19.2.4.4. Recent Developments

- 19.2.4.5. Financials (Based on Availability)

- 19.2.5 Chiyoda Corporation

- 19.2.5.1. Overview

- 19.2.5.2. Products

- 19.2.5.3. SWOT Analysis

- 19.2.5.4. Recent Developments

- 19.2.5.5. Financials (Based on Availability)

- 19.2.6 Fluor Corporation

- 19.2.6.1. Overview

- 19.2.6.2. Products

- 19.2.6.3. SWOT Analysis

- 19.2.6.4. Recent Developments

- 19.2.6.5. Financials (Based on Availability)

- 19.2.7 McDermott International Inc

- 19.2.7.1. Overview

- 19.2.7.2. Products

- 19.2.7.3. SWOT Analysis

- 19.2.7.4. Recent Developments

- 19.2.7.5. Financials (Based on Availability)

- 19.2.8 Chevron corporation

- 19.2.8.1. Overview

- 19.2.8.2. Products

- 19.2.8.3. SWOT Analysis

- 19.2.8.4. Recent Developments

- 19.2.8.5. Financials (Based on Availability)

- 19.2.1 JGC Holdings Corporation

List of Figures

- Figure 1: Asia Pacific LNG Infrastructure Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Asia Pacific LNG Infrastructure Market Share (%) by Company 2024

List of Tables

- Table 1: Asia Pacific LNG Infrastructure Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Asia Pacific LNG Infrastructure Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Asia Pacific LNG Infrastructure Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 4: Asia Pacific LNG Infrastructure Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Asia Pacific LNG Infrastructure Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: China Asia Pacific LNG Infrastructure Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Japan Asia Pacific LNG Infrastructure Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: India Asia Pacific LNG Infrastructure Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: South Korea Asia Pacific LNG Infrastructure Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Taiwan Asia Pacific LNG Infrastructure Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Australia Asia Pacific LNG Infrastructure Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Asia-Pacific Asia Pacific LNG Infrastructure Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Asia Pacific LNG Infrastructure Market Revenue Million Forecast, by Type 2019 & 2032

- Table 14: Asia Pacific LNG Infrastructure Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 15: Asia Pacific LNG Infrastructure Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Asia Pacific LNG Infrastructure Market Revenue Million Forecast, by Type 2019 & 2032

- Table 17: Asia Pacific LNG Infrastructure Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 18: Asia Pacific LNG Infrastructure Market Revenue Million Forecast, by Country 2019 & 2032

- Table 19: Asia Pacific LNG Infrastructure Market Revenue Million Forecast, by Type 2019 & 2032

- Table 20: Asia Pacific LNG Infrastructure Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 21: Asia Pacific LNG Infrastructure Market Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Asia Pacific LNG Infrastructure Market Revenue Million Forecast, by Type 2019 & 2032

- Table 23: Asia Pacific LNG Infrastructure Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 24: Asia Pacific LNG Infrastructure Market Revenue Million Forecast, by Country 2019 & 2032

- Table 25: Asia Pacific LNG Infrastructure Market Revenue Million Forecast, by Type 2019 & 2032

- Table 26: Asia Pacific LNG Infrastructure Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 27: Asia Pacific LNG Infrastructure Market Revenue Million Forecast, by Country 2019 & 2032

- Table 28: Asia Pacific LNG Infrastructure Market Revenue Million Forecast, by Type 2019 & 2032

- Table 29: Asia Pacific LNG Infrastructure Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 30: Asia Pacific LNG Infrastructure Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia Pacific LNG Infrastructure Market?

The projected CAGR is approximately > 6.50%.

2. Which companies are prominent players in the Asia Pacific LNG Infrastructure Market?

Key companies in the market include JGC Holdings Corporation, Bechtel Corporation, Saipem SpA, Technip FMC plc, Chiyoda Corporation, Fluor Corporation, McDermott International Inc, Chevron corporation.

3. What are the main segments of the Asia Pacific LNG Infrastructure Market?

The market segments include Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Growing Vehicle Ownership4.; Government Initiatives.

6. What are the notable trends driving market growth?

Regasification terminal Segment to have a Significant Share in the Market.

7. Are there any restraints impacting market growth?

4.; Volatile Crude Oil Prices.

8. Can you provide examples of recent developments in the market?

In June 2022, NOVATEK signed small-scale LNG cooperation agreements with the Moscow and Samara region's government, as part of the St. Petersburg International Economic Forum. The parties are looking to expand the use of LNG as motor fuel and for gas supply to off-grid customers, including the construction of small-scale LNG plants and relevant sales infrastructure.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia Pacific LNG Infrastructure Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia Pacific LNG Infrastructure Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia Pacific LNG Infrastructure Market?

To stay informed about further developments, trends, and reports in the Asia Pacific LNG Infrastructure Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence