Key Insights

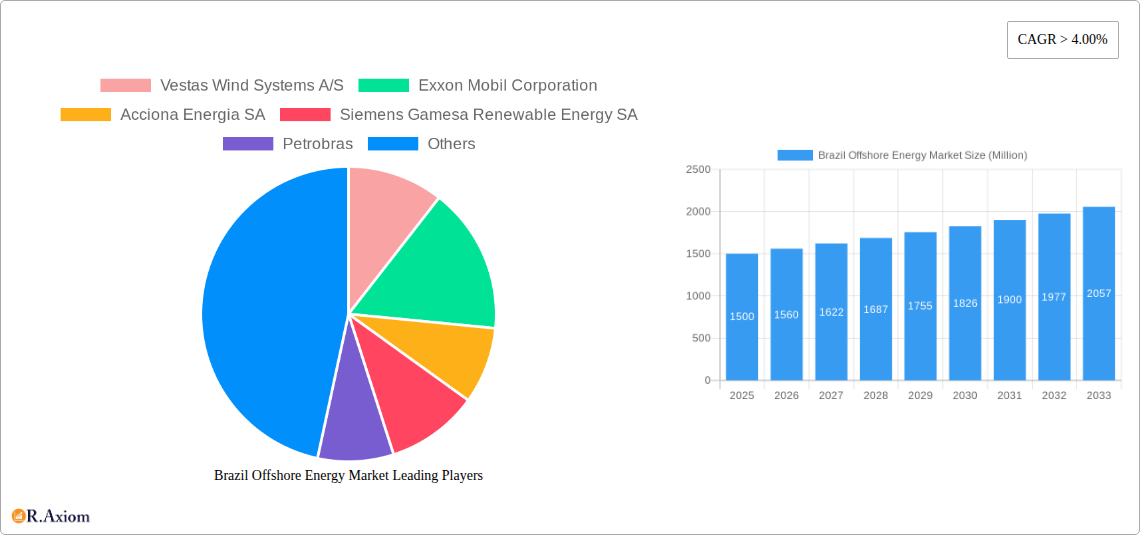

The Brazil offshore energy market, encompassing wind, oil & gas, and wave energy, presents a significant growth opportunity with a projected Compound Annual Growth Rate (CAGR) of 9.45%. Driven by Brazil's extensive coastline and abundant offshore resources, the market is poised for substantial expansion, particularly in offshore wind and deepwater oil & gas exploration. Government initiatives supporting renewable energy and energy independence further bolster this growth. Key market drivers include advancements in deepwater drilling technologies and increasing investments in offshore wind projects. However, challenges such as high initial capital expenditure, complex regulatory frameworks, and environmental considerations require strategic mitigation. The market is segmented by energy type: wind, oil & gas, and wave. While oil & gas currently dominates due to established infrastructure, offshore wind is anticipated to exhibit the fastest growth, supported by favorable policies and technological innovation.

Brazil Offshore Energy Market Market Size (In Billion)

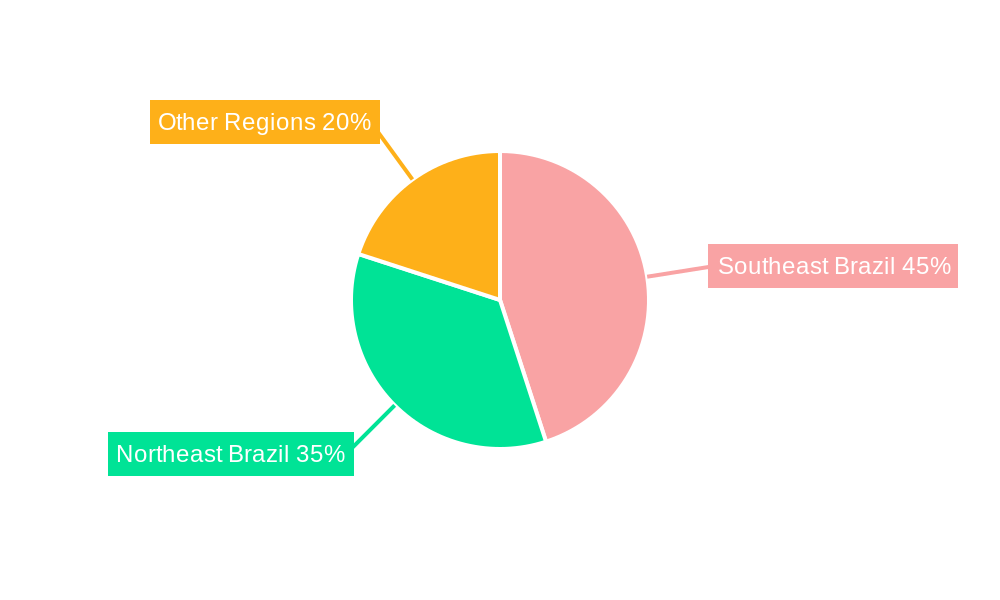

Geographic focus is concentrated in the Southeast and Northeast coastal regions, emphasizing the need for robust infrastructure, including port facilities, grid connectivity, and skilled labor. Major industry players are actively engaged, signaling strong market confidence. Sustained growth hinges on attracting foreign direct investment, fostering local expertise, effective risk management, technological advancement, and continued government support, ensuring a balance between economic development and environmental stewardship. The market size was valued at $1.6 billion in the base year of 2025.

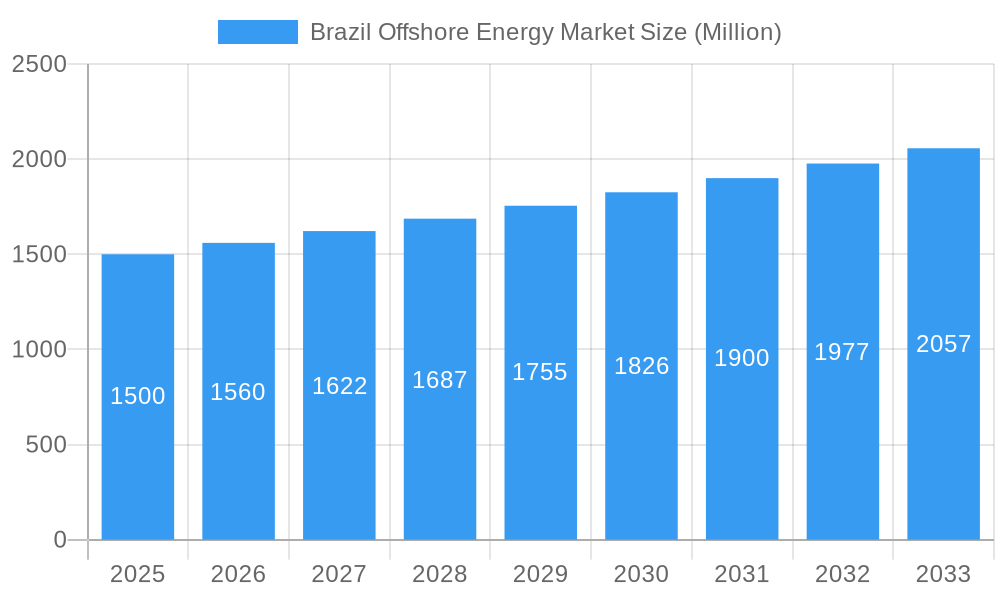

Brazil Offshore Energy Market Company Market Share

This comprehensive report analyzes the Brazil Offshore Energy Market from 2019 to 2033, with a specific focus on 2025. It provides critical insights into market dynamics, opportunities, and challenges for investors, industry stakeholders, and policymakers. The analysis covers market concentration, technological trends, regulatory environments, and competitive landscapes across wind, oil & gas, and wave energy segments.

Brazil Offshore Energy Market Concentration & Innovation

This section analyzes the competitive landscape of the Brazilian offshore energy market, exploring market concentration, innovation drivers, regulatory frameworks, product substitutes, end-user trends, and M&A activities. The market is characterized by a mix of international giants and domestic players, leading to a moderately concentrated market structure. While precise market share data for individual players remains proprietary, estimates suggest that Petrobras holds a significant share in the oil and gas sector, while international players like Vestas Wind Systems A/S and Siemens Gamesa Renewable Energy SA are increasingly active in the wind energy segment. The total M&A deal value in the sector between 2019-2024 is estimated at xx Million, with the majority of deals focused on consolidation within the oil and gas sector. Innovation is driven by the need for cost-effective and environmentally friendly solutions, leading to significant investments in floating offshore wind technology and enhanced oil recovery techniques. The regulatory framework, while evolving, presents both opportunities and challenges for market participants, with ongoing efforts to streamline permitting processes and encourage investment in renewable energy sources.

- Market Concentration: Moderately concentrated, with key players holding significant shares in specific segments.

- Innovation Drivers: Cost reduction, environmental sustainability, technological advancements.

- Regulatory Framework: Evolving, with ongoing changes impacting market access and investment.

- Product Substitutes: Limited substitutes exist for oil and gas in certain applications, but renewable energy sources are increasingly competing with fossil fuels.

- End-User Trends: Growing demand for cleaner energy sources and increasing energy security concerns are driving market growth.

- M&A Activities: Significant M&A activity, primarily in the oil and gas sector, with xx Million in deal value recorded between 2019 and 2024.

Brazil Offshore Energy Market Industry Trends & Insights

The Brazilian offshore energy market exhibits robust growth, driven by several key factors. The country's vast offshore resources, coupled with increasing energy demand and a growing focus on renewable energy, are propelling market expansion. Technological advancements, particularly in floating offshore wind technology, are overcoming geographical limitations. Government initiatives promoting renewable energy and energy independence are further boosting market growth. However, regulatory complexities and infrastructure limitations present challenges. The CAGR for the offshore energy market during the forecast period (2025-2033) is projected at xx%, with market penetration rates steadily increasing across different energy segments. The market is experiencing significant technological disruption, with emerging technologies like wave energy gradually gaining traction. Consumer preferences are shifting towards cleaner and more sustainable energy solutions, creating a favorable environment for renewable energy sources. Competitive dynamics are characterized by fierce competition among established players and the emergence of new entrants, leading to innovation and cost reductions.

Dominant Markets & Segments in Brazil Offshore Energy Market

The Brazilian offshore energy market is witnessing significant growth across all segments, with notable dominance in certain areas. The oil and gas sector, driven by Petrobras and international oil companies like Chevron Corporation and Exxon Mobil Corporation, continues to be a major contributor to the overall market. However, the offshore wind sector is experiencing rapid expansion, with projects like the proposed 5 GW Corio Generation development highlighting the potential. The wave energy sector remains relatively nascent but exhibits promising prospects given Brazil's extensive coastline.

Key Drivers:

- Oil & Gas: Abundant reserves, established infrastructure, and high energy demand.

- Wind: Favorable wind resources, government support for renewable energy, and technological advancements in floating offshore wind.

- Wave: Extensive coastline, increasing interest in wave energy technology, and potential for cost reductions.

Brazil Offshore Energy Market Product Developments

The Brazilian offshore energy market is witnessing continuous product innovations. Advancements in floating offshore wind technology, improved oil and gas extraction techniques, and the development of more efficient wave energy converters are key trends. These innovations enhance energy production efficiency, reduce environmental impact, and improve the overall economic viability of offshore energy projects. The focus is on developing cost-competitive and environmentally friendly solutions that cater to the specific needs of the Brazilian market.

Report Scope & Segmentation Analysis

This report segments the Brazil offshore energy market by type: Wind, Oil and Gas, and Wave.

Wind: The wind energy segment is projected to witness significant growth, driven by government policies and technological advancements. Market size in 2025 is estimated at xx Million, with a forecast of xx Million by 2033. Competitive dynamics are characterized by both international and domestic players.

Oil and Gas: The oil and gas segment remains a dominant player, benefiting from existing infrastructure and substantial reserves. The 2025 market size is estimated at xx Million, with a forecast of xx Million by 2033. Competition is intense, with both international and national oil companies vying for market share.

Wave: The wave energy segment is in its early stages of development, but offers considerable potential. Market size in 2025 is projected at xx Million, with forecast of xx Million by 2033. The sector is characterized by a smaller number of players, with companies like Eco Wave Power Global leading the innovation.

Key Drivers of Brazil Offshore Energy Market Growth

Several factors drive the growth of Brazil's offshore energy market. Government support for renewable energy, abundant offshore resources, increasing energy demand, and technological advancements in renewable energy technologies are key catalysts. Furthermore, the country's strategic location and growing economy create a favorable environment for investments in offshore energy infrastructure.

Challenges in the Brazil Offshore Energy Market Sector

The Brazilian offshore energy market faces several challenges. Regulatory complexities and permitting processes can delay project development. Infrastructure limitations, especially in deep-water areas, hinder the deployment of certain technologies. Furthermore, high initial investment costs and the need for specialized expertise represent significant barriers to entry for smaller companies. Fluctuations in global energy prices and environmental concerns also pose challenges.

Emerging Opportunities in Brazil Offshore Energy Market

The Brazilian offshore energy market presents significant opportunities. The growing demand for renewable energy sources opens doors for offshore wind and wave energy projects. Technological advancements, particularly in floating offshore wind technology, offer solutions for deep-water areas. The government's commitment to energy diversification creates a favorable environment for investment in new technologies and projects.

Leading Players in the Brazil Offshore Energy Market Market

Key Developments in Brazil Offshore Energy Market Industry

- June 2022: Corio Generation plans to develop five offshore wind projects in Brazil with a combined capacity of over 5 GW in partnership with Servtec.

- May 2022: Petrobras and Equinor evaluate the feasibility of a 4 GW offshore wind farm near Aracatu.

Strategic Outlook for Brazil Offshore Energy Market Market

The Brazilian offshore energy market is poised for significant growth, driven by supportive government policies, abundant resources, and technological advancements. The increasing demand for clean energy and the country's commitment to energy independence will fuel further investments in offshore wind, wave, and potentially other renewable energy sources. The market's future potential lies in leveraging technological innovations to unlock the vast offshore resources and achieve sustainable energy goals.

Brazil Offshore Energy Market Segmentation

-

1. Type

- 1.1. Wind

- 1.2. Oil and Gas

- 1.3. Wave

Brazil Offshore Energy Market Segmentation By Geography

- 1. Brazil

Brazil Offshore Energy Market Regional Market Share

Geographic Coverage of Brazil Offshore Energy Market

Brazil Offshore Energy Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.45% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Surge in Demand of Refined Petroleum Products4.; Need for Sustainable Refined Petroleum Products

- 3.3. Market Restrains

- 3.3.1. Increase in Adoption of Alternative Fuel Vehicles

- 3.4. Market Trends

- 3.4.1. The Oil and Gas Segment is Expected to Dominate the market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Brazil Offshore Energy Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Wind

- 5.1.2. Oil and Gas

- 5.1.3. Wave

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Brazil

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Vestas Wind Systems A/S

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Exxon Mobil Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Acciona Energia SA

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Siemens Gamesa Renewable Energy SA

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Petrobras

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Chevron Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Eco Wave Power Global

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Enel Green Power SpA

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Repsol SA

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 General Electric Company*List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Vestas Wind Systems A/S

List of Figures

- Figure 1: Brazil Offshore Energy Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Brazil Offshore Energy Market Share (%) by Company 2025

List of Tables

- Table 1: Brazil Offshore Energy Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Brazil Offshore Energy Market Volume gigawatts Forecast, by Type 2020 & 2033

- Table 3: Brazil Offshore Energy Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Brazil Offshore Energy Market Volume gigawatts Forecast, by Region 2020 & 2033

- Table 5: Brazil Offshore Energy Market Revenue billion Forecast, by Type 2020 & 2033

- Table 6: Brazil Offshore Energy Market Volume gigawatts Forecast, by Type 2020 & 2033

- Table 7: Brazil Offshore Energy Market Revenue billion Forecast, by Country 2020 & 2033

- Table 8: Brazil Offshore Energy Market Volume gigawatts Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Brazil Offshore Energy Market?

The projected CAGR is approximately 9.45%.

2. Which companies are prominent players in the Brazil Offshore Energy Market?

Key companies in the market include Vestas Wind Systems A/S, Exxon Mobil Corporation, Acciona Energia SA, Siemens Gamesa Renewable Energy SA, Petrobras, Chevron Corporation, Eco Wave Power Global, Enel Green Power SpA, Repsol SA, General Electric Company*List Not Exhaustive.

3. What are the main segments of the Brazil Offshore Energy Market?

The market segments include Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.6 billion as of 2022.

5. What are some drivers contributing to market growth?

Surge in Demand of Refined Petroleum Products4.; Need for Sustainable Refined Petroleum Products.

6. What are the notable trends driving market growth?

The Oil and Gas Segment is Expected to Dominate the market.

7. Are there any restraints impacting market growth?

Increase in Adoption of Alternative Fuel Vehicles.

8. Can you provide examples of recent developments in the market?

June 2022: Corio Generation intended to develop five offshore wind projects in Brazil with a combined capacity of more than 5 GW. Servtec, a Brazilian power generation company, will develop the five projects with Corio.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in gigawatts.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Brazil Offshore Energy Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Brazil Offshore Energy Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Brazil Offshore Energy Market?

To stay informed about further developments, trends, and reports in the Brazil Offshore Energy Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence