Key Insights

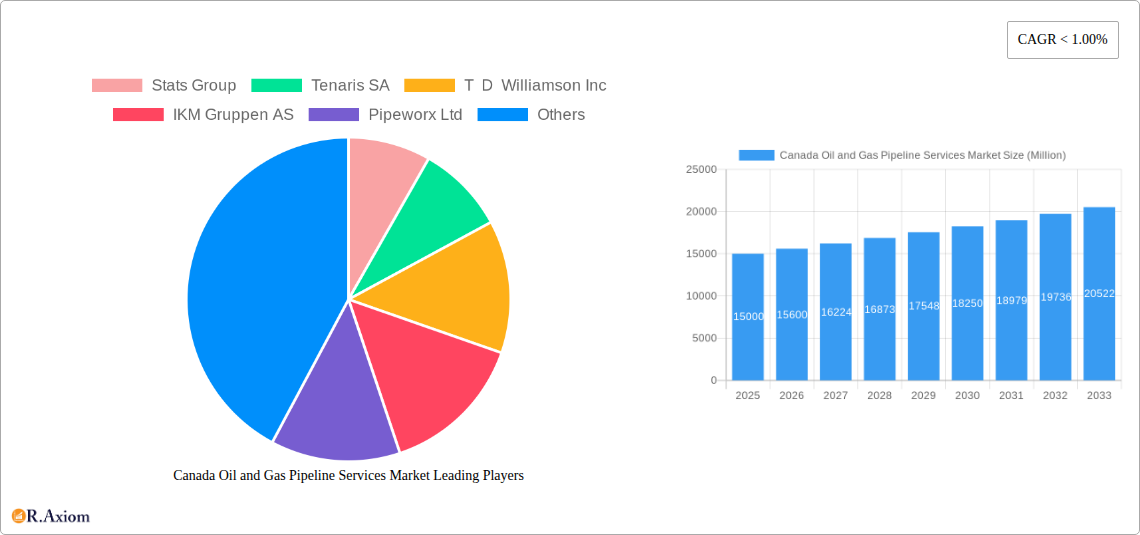

The Canadian oil and gas pipeline services market is experiencing robust growth, driven by increasing domestic energy production and the ongoing need for efficient transportation infrastructure. The period between 2019 and 2024 witnessed a significant expansion, laying a solid foundation for continued progress. While precise market size figures for past years are unavailable, industry analysis suggests a substantial market value in 2025, estimated at $15 billion CAD, reflecting the sustained demand for pipeline construction, maintenance, and repair services. This growth is fueled by several factors, including government initiatives promoting energy infrastructure development, increasing cross-border energy trade, and the ongoing need for pipeline upgrades to enhance safety and operational efficiency. The market is also witnessing technological advancements such as the implementation of smart pipelines and improved leak detection systems, boosting efficiency and minimizing environmental impact. This technological integration is likely to further contribute to market expansion throughout the forecast period.

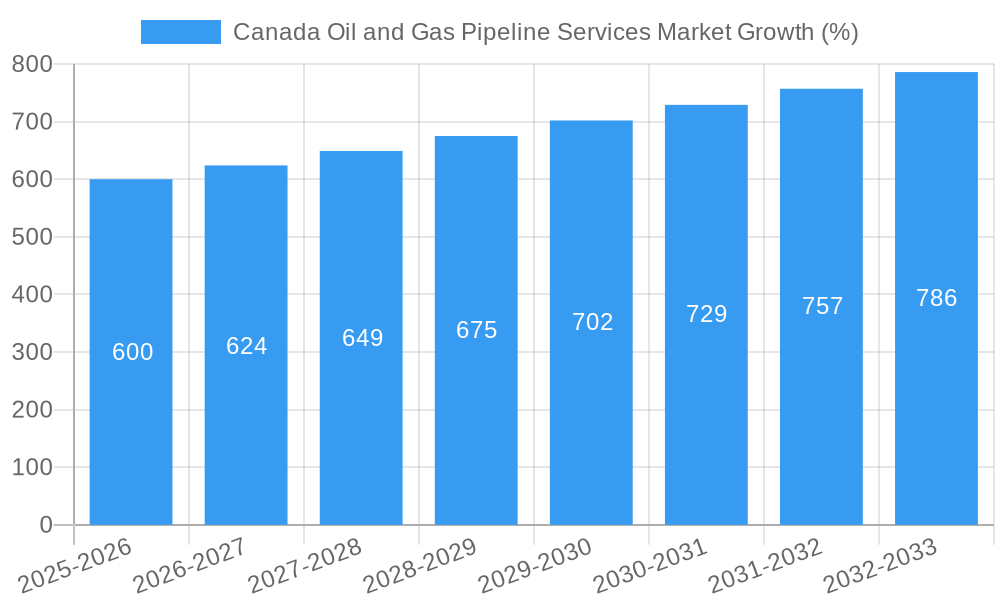

Looking forward to 2033, the Canadian oil and gas pipeline services market is projected to maintain a healthy Compound Annual Growth Rate (CAGR). Assuming a conservative CAGR of 4% based on industry trends and government investment projections, the market is expected to surpass $22 billion CAD by 2033. This continued growth will be influenced by several factors, including potential increases in oil and gas production, expansion of existing pipeline networks to accommodate rising demand, and the ongoing need for maintenance and modernization of aging pipelines. However, regulatory changes and environmental concerns will pose challenges, potentially impacting the rate of expansion. The market will likely see increased competition among service providers, leading to innovation and price optimization within the sector.

Canada Oil and Gas Pipeline Services Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Canada Oil and Gas Pipeline Services market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. The study covers the period from 2019 to 2033, with 2025 serving as the base and estimated year. The report meticulously examines market size, segmentation, growth drivers, challenges, opportunities, and key players. It leverages extensive primary and secondary research to deliver an accurate and insightful assessment of the Canadian oil and gas pipeline services landscape.

Canada Oil and Gas Pipeline Services Market Market Concentration & Innovation

The Canadian oil and gas pipeline services market exhibits a moderately concentrated structure, with several large multinational corporations and regional players dominating specific segments. Market share analysis reveals that the top five players hold approximately xx% of the market in 2025, with a notable concentration in the Upstream sector. Innovation is driven by the need for enhanced efficiency, safety, and environmental compliance. Technological advancements in pipeline inspection, maintenance, and repair are key drivers.

- Market Concentration: Top 5 players hold approximately xx% market share in 2025.

- Innovation Drivers: Improved efficiency, safety regulations, environmental concerns.

- Regulatory Framework: Stringent environmental regulations and safety standards influence service providers.

- Product Substitutes: Technological advancements are introducing alternative pipeline materials and maintenance techniques.

- End-User Trends: Increasing demand for efficient and environmentally friendly pipeline services.

- M&A Activities: The past five years have witnessed xx M&A deals, with a total value of approximately $xx Million, mainly driven by consolidation and expansion strategies.

Canada Oil and Gas Pipeline Services Market Industry Trends & Insights

The Canadian oil and gas pipeline services market is projected to experience a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is primarily fueled by increasing oil and gas production, expanding pipeline networks, and stringent regulations mandating regular maintenance and inspection. Technological disruptions, such as the adoption of advanced inspection technologies and robotics, are enhancing efficiency and reducing operational costs. However, fluctuating oil prices and environmental concerns pose challenges to market growth. Market penetration of advanced inspection technologies is estimated at xx% in 2025, projected to reach xx% by 2033.

Dominant Markets & Segments in Canada Oil and Gas Pipeline Services Market

The Upstream sector currently dominates the Canadian oil and gas pipeline services market, accounting for approximately xx% of the total market revenue in 2025. This dominance is attributed to the higher density of pipelines and increased activity in oil and gas extraction. Within service types, Pigging and Cleaning Services and Inspection Services (excluding pigging) constitute major segments.

- Dominant Sector: Upstream (xx% market share in 2025)

- Key Drivers for Upstream Dominance: High oil and gas production, extensive pipeline networks.

- Dominant Service Type: Pigging and Cleaning Services and Inspection Services (excluding pigging)

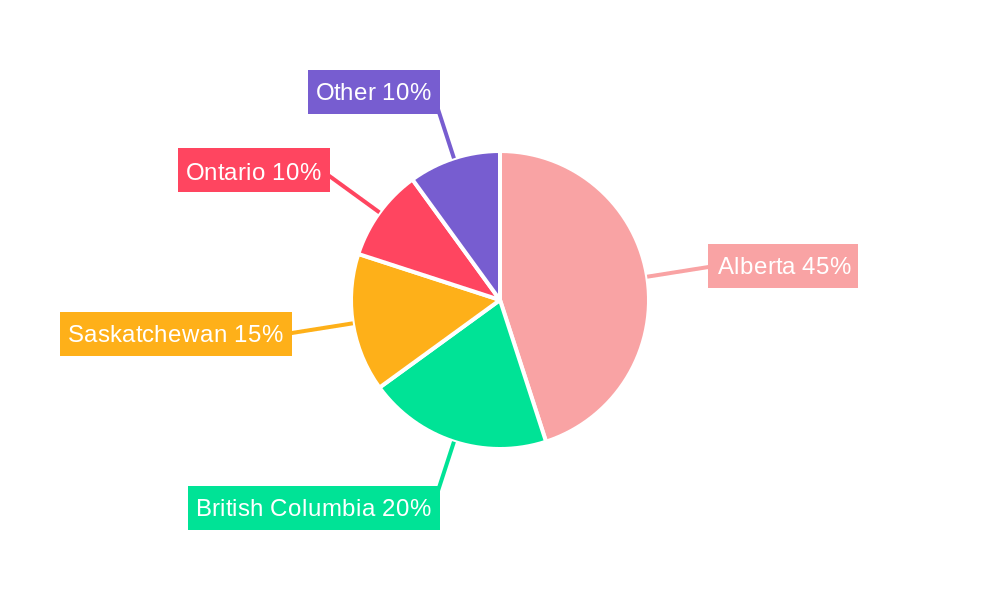

- Geographic Dominance: Alberta and British Columbia account for a significant share of market activity, driven by robust oil sands production and pipeline infrastructure.

- Key Drivers for Geographic Dominance: Oil sands development, pipeline infrastructure.

The Midstream and Downstream sectors are also experiencing growth driven by expansion projects and upgrading infrastructure. Repair services (Vacuum drying and other repair services, including decommissioning) are experiencing notable growth due to the aging pipeline infrastructure.

Canada Oil and Gas Pipeline Services Market Product Developments

Recent product developments focus on advanced inspection technologies like smart pigs, drones, and robotic solutions for pipeline maintenance and repair. These innovations deliver improved accuracy, reduced downtime, and enhanced safety. The market is also witnessing the adoption of environmentally friendly cleaning and drying techniques.

Report Scope & Segmentation Analysis

This report segments the Canadian oil and gas pipeline services market based on service type (Pre-commissioning & Commissioning, Pigging & Cleaning, Mechanical Cleaning - Inspection, Other Inspection - Flushing & Chemical Cleaning, Drying), repair services (Vacuum Drying, Other Repair Services), and sector (Upstream, Midstream, Downstream). Each segment's growth projections, market size (in Million), and competitive dynamics are analyzed in detail. For example, the Pigging & Cleaning services segment is projected to grow at a CAGR of xx% from 2025-2033, driven by increasing pipeline throughput and stringent regulatory compliance.

Key Drivers of Canada Oil and Gas Pipeline Services Market Growth

Growth in the Canadian oil and gas pipeline services market is driven by several factors: increasing oil and gas production, expansion of pipeline networks to support new projects, stringent regulations requiring regular pipeline maintenance and inspections, and the adoption of advanced technologies that improve efficiency and safety. Government initiatives supporting infrastructure development further contribute to the market’s growth.

Challenges in the Canada Oil and Gas Pipeline Services Market Sector

The market faces challenges such as fluctuating oil prices, which directly impact investment in pipeline projects and maintenance activities. Environmental concerns and regulations create pressure for environmentally friendly solutions, increasing operational costs. Competition from both domestic and international companies can also impact profitability.

Emerging Opportunities in Canada Oil and Gas Pipeline Services Market

Emerging opportunities lie in adopting advanced technologies like AI and machine learning for predictive maintenance, reducing operational costs and improving safety. Growing focus on environmental sustainability presents an opportunity for companies offering eco-friendly pipeline services. Expansion into new regions with developing oil and gas infrastructure also holds significant potential.

Leading Players in the Canada Oil and Gas Pipeline Services Market Market

- Stats Group

- Tenaris SA

- T D Williamson Inc

- IKM Gruppen AS

- Pipeworx Ltd

- Mistras Group Inc

- Trican Well Service Ltd

- Ledcor Group of Companies

- Baker Hughes a GE Co

- Tetra Tech Inc

Key Developments in Canada Oil and Gas Pipeline Services Market Industry

- 2023: Company X acquired Company Y, expanding its service portfolio in the Alberta region.

- 2022: Introduction of a new pipeline inspection technology by Company Z, leading to increased efficiency and safety.

- 2021: Government announcement of increased funding for pipeline infrastructure upgrades.

Strategic Outlook for Canada Oil and Gas Pipeline Services Market Market

The Canadian oil and gas pipeline services market holds significant long-term growth potential, driven by ongoing investments in pipeline infrastructure, stringent regulatory requirements, and the increasing adoption of advanced technologies. Companies focusing on innovation, sustainability, and efficient service delivery are well-positioned to capitalize on these opportunities and achieve significant market share gains.

Canada Oil and Gas Pipeline Services Market Segmentation

-

1. Service Type

- 1.1. Pre-commissioning and Commissioning Services

-

1.2. Pigging and Cleaning Services

- 1.2.1. Intelligent Pigging

- 1.2.2. Caliper Pigging

- 1.2.3. Mechanical Cleaning

-

1.3. Inspection Services (Excluding Pigging)

- 1.3.1. Hydro Testing

- 1.3.2. Other Inspection Services

-

1.4. Flushing and Chemical Cleaning Services

- 1.4.1. Chemical Inhibitors

- 1.4.2. Other Flushing and Chemical Cleaning Services

-

1.5. Drying Services

- 1.5.1. Air Drying

- 1.5.2. Nitrogen

- 1.5.3. Vacuum Drying

-

1.6. Repair Services

- 1.6.1. Hot Tapping

- 1.6.2. Other Repair Services

- 1.7. Decommissioning Services

-

2. Sector

- 2.1. Upstream

- 2.2. Midstream

- 2.3. Downstream

-

3. Geography

- 3.1. Western Canada

- 3.2. Eastern Canada

Canada Oil and Gas Pipeline Services Market Segmentation By Geography

- 1. Western Canada

- 2. Eastern Canada

Canada Oil and Gas Pipeline Services Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of < 1.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; The Rise in Oil and Gas Drilling Activities4.; Increased Shale Gas Exploration

- 3.3. Market Restrains

- 3.3.1. 4.; Increasing Share of Renewable Energy

- 3.4. Market Trends

- 3.4.1. Increasing Demand for Repair Services

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Canada Oil and Gas Pipeline Services Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 5.1.1. Pre-commissioning and Commissioning Services

- 5.1.2. Pigging and Cleaning Services

- 5.1.2.1. Intelligent Pigging

- 5.1.2.2. Caliper Pigging

- 5.1.2.3. Mechanical Cleaning

- 5.1.3. Inspection Services (Excluding Pigging)

- 5.1.3.1. Hydro Testing

- 5.1.3.2. Other Inspection Services

- 5.1.4. Flushing and Chemical Cleaning Services

- 5.1.4.1. Chemical Inhibitors

- 5.1.4.2. Other Flushing and Chemical Cleaning Services

- 5.1.5. Drying Services

- 5.1.5.1. Air Drying

- 5.1.5.2. Nitrogen

- 5.1.5.3. Vacuum Drying

- 5.1.6. Repair Services

- 5.1.6.1. Hot Tapping

- 5.1.6.2. Other Repair Services

- 5.1.7. Decommissioning Services

- 5.2. Market Analysis, Insights and Forecast - by Sector

- 5.2.1. Upstream

- 5.2.2. Midstream

- 5.2.3. Downstream

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Western Canada

- 5.3.2. Eastern Canada

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Western Canada

- 5.4.2. Eastern Canada

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 6. Western Canada Canada Oil and Gas Pipeline Services Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Service Type

- 6.1.1. Pre-commissioning and Commissioning Services

- 6.1.2. Pigging and Cleaning Services

- 6.1.2.1. Intelligent Pigging

- 6.1.2.2. Caliper Pigging

- 6.1.2.3. Mechanical Cleaning

- 6.1.3. Inspection Services (Excluding Pigging)

- 6.1.3.1. Hydro Testing

- 6.1.3.2. Other Inspection Services

- 6.1.4. Flushing and Chemical Cleaning Services

- 6.1.4.1. Chemical Inhibitors

- 6.1.4.2. Other Flushing and Chemical Cleaning Services

- 6.1.5. Drying Services

- 6.1.5.1. Air Drying

- 6.1.5.2. Nitrogen

- 6.1.5.3. Vacuum Drying

- 6.1.6. Repair Services

- 6.1.6.1. Hot Tapping

- 6.1.6.2. Other Repair Services

- 6.1.7. Decommissioning Services

- 6.2. Market Analysis, Insights and Forecast - by Sector

- 6.2.1. Upstream

- 6.2.2. Midstream

- 6.2.3. Downstream

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. Western Canada

- 6.3.2. Eastern Canada

- 6.1. Market Analysis, Insights and Forecast - by Service Type

- 7. Eastern Canada Canada Oil and Gas Pipeline Services Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Service Type

- 7.1.1. Pre-commissioning and Commissioning Services

- 7.1.2. Pigging and Cleaning Services

- 7.1.2.1. Intelligent Pigging

- 7.1.2.2. Caliper Pigging

- 7.1.2.3. Mechanical Cleaning

- 7.1.3. Inspection Services (Excluding Pigging)

- 7.1.3.1. Hydro Testing

- 7.1.3.2. Other Inspection Services

- 7.1.4. Flushing and Chemical Cleaning Services

- 7.1.4.1. Chemical Inhibitors

- 7.1.4.2. Other Flushing and Chemical Cleaning Services

- 7.1.5. Drying Services

- 7.1.5.1. Air Drying

- 7.1.5.2. Nitrogen

- 7.1.5.3. Vacuum Drying

- 7.1.6. Repair Services

- 7.1.6.1. Hot Tapping

- 7.1.6.2. Other Repair Services

- 7.1.7. Decommissioning Services

- 7.2. Market Analysis, Insights and Forecast - by Sector

- 7.2.1. Upstream

- 7.2.2. Midstream

- 7.2.3. Downstream

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. Western Canada

- 7.3.2. Eastern Canada

- 7.1. Market Analysis, Insights and Forecast - by Service Type

- 8. Eastern Canada Canada Oil and Gas Pipeline Services Market Analysis, Insights and Forecast, 2019-2031

- 9. Western Canada Canada Oil and Gas Pipeline Services Market Analysis, Insights and Forecast, 2019-2031

- 10. Central Canada Canada Oil and Gas Pipeline Services Market Analysis, Insights and Forecast, 2019-2031

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Stats Group

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Tenaris SA

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 T D Williamson Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 IKM Gruppen AS

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Pipeworx Ltd

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Mistras Group Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Trican Well Service Ltd*List Not Exhaustive

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Ledcor Group of Companies

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Baker Hughes a GE Co

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Tetra Tech Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Stats Group

List of Figures

- Figure 1: Canada Oil and Gas Pipeline Services Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Canada Oil and Gas Pipeline Services Market Share (%) by Company 2024

List of Tables

- Table 1: Canada Oil and Gas Pipeline Services Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Canada Oil and Gas Pipeline Services Market Revenue Million Forecast, by Service Type 2019 & 2032

- Table 3: Canada Oil and Gas Pipeline Services Market Revenue Million Forecast, by Sector 2019 & 2032

- Table 4: Canada Oil and Gas Pipeline Services Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 5: Canada Oil and Gas Pipeline Services Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Canada Oil and Gas Pipeline Services Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Eastern Canada Canada Oil and Gas Pipeline Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Western Canada Canada Oil and Gas Pipeline Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Central Canada Canada Oil and Gas Pipeline Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Canada Oil and Gas Pipeline Services Market Revenue Million Forecast, by Service Type 2019 & 2032

- Table 11: Canada Oil and Gas Pipeline Services Market Revenue Million Forecast, by Sector 2019 & 2032

- Table 12: Canada Oil and Gas Pipeline Services Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 13: Canada Oil and Gas Pipeline Services Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Canada Oil and Gas Pipeline Services Market Revenue Million Forecast, by Service Type 2019 & 2032

- Table 15: Canada Oil and Gas Pipeline Services Market Revenue Million Forecast, by Sector 2019 & 2032

- Table 16: Canada Oil and Gas Pipeline Services Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 17: Canada Oil and Gas Pipeline Services Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Canada Oil and Gas Pipeline Services Market?

The projected CAGR is approximately < 1.00%.

2. Which companies are prominent players in the Canada Oil and Gas Pipeline Services Market?

Key companies in the market include Stats Group, Tenaris SA, T D Williamson Inc, IKM Gruppen AS, Pipeworx Ltd, Mistras Group Inc, Trican Well Service Ltd*List Not Exhaustive, Ledcor Group of Companies, Baker Hughes a GE Co, Tetra Tech Inc.

3. What are the main segments of the Canada Oil and Gas Pipeline Services Market?

The market segments include Service Type, Sector, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; The Rise in Oil and Gas Drilling Activities4.; Increased Shale Gas Exploration.

6. What are the notable trends driving market growth?

Increasing Demand for Repair Services.

7. Are there any restraints impacting market growth?

4.; Increasing Share of Renewable Energy.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Canada Oil and Gas Pipeline Services Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Canada Oil and Gas Pipeline Services Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Canada Oil and Gas Pipeline Services Market?

To stay informed about further developments, trends, and reports in the Canada Oil and Gas Pipeline Services Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence