Key Insights

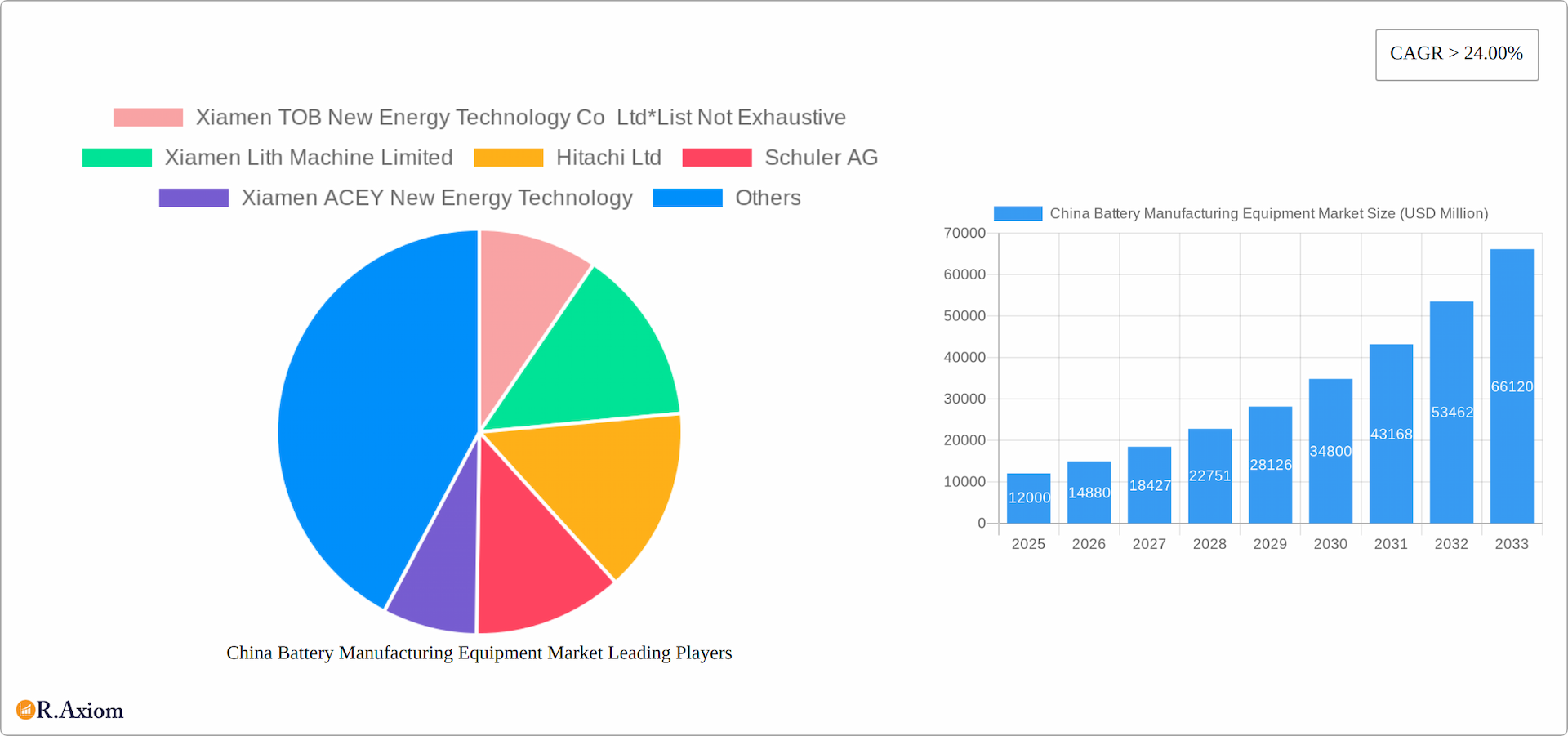

The China battery manufacturing equipment market is experiencing robust growth, projected to reach a substantial size driven by the booming electric vehicle (EV) sector and the nation's aggressive push for renewable energy adoption. With a current market size of USD 12,000 million in 2025 and a Compound Annual Growth Rate (CAGR) exceeding 24%, the market is poised for significant expansion through 2033. Key drivers include increasing EV production, government incentives promoting domestic battery manufacturing, and the continuous improvement of battery technology demanding sophisticated equipment. The market is segmented by machine type, encompassing coating & drying, calendaring, slitting, mixing, electrode stacking, assembly & handling, and formation & testing machines, each contributing to the overall growth trajectory. Similarly, the end-user segment comprises automotive, industrial, and other applications, with automotive dominating due to the surge in EV demand. Leading companies such as Xiamen TOB, Xiamen Lith Machine, Hitachi, Schuler, and Durr are actively competing in this dynamic landscape, constantly innovating to meet the evolving technological needs of battery manufacturers.

China Battery Manufacturing Equipment Market Market Size (In Billion)

The considerable growth potential is further amplified by continuous technological advancements in battery manufacturing processes, leading to increased automation and efficiency. While certain challenges such as supply chain constraints and potential raw material price fluctuations might present temporary headwinds, the overall market outlook remains positive. The sustained focus on sustainability and the escalating demand for high-performance batteries are expected to fuel further investments in advanced manufacturing equipment, consolidating China's position as a global hub for battery production and technology. The significant market share held by China in this sector indicates a strong domestic demand and a robust ecosystem supporting its growth. The forecast period suggests substantial future growth for all segments and continued dominance of key players that invest in R&D and adapt quickly to emerging technological changes.

China Battery Manufacturing Equipment Market Company Market Share

China Battery Manufacturing Equipment Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the China Battery Manufacturing Equipment market, offering invaluable insights for stakeholders across the value chain. The report covers the period 2019-2033, with 2025 as the base year and a forecast period spanning 2025-2033. The USD Million is used as the unit for all market values. Discover key trends, growth drivers, challenges, and opportunities shaping this dynamic market.

China Battery Manufacturing Equipment Market Concentration & Innovation

The China Battery Manufacturing Equipment market exhibits a moderately concentrated landscape, with a few dominant players and a significant number of smaller, specialized firms. Market share analysis reveals a top 5 players holding approximately xx% of the market in 2025, indicating moderate consolidation. Innovation is a key driver, fueled by the relentless pursuit of higher efficiency, lower costs, and improved battery performance. Stringent environmental regulations further incentivize the development of sustainable manufacturing processes and equipment. Product substitution is currently limited, with the focus primarily on incremental improvements within existing technologies. However, emerging technologies like solid-state batteries could disrupt the market in the long term.

Key aspects analyzed:

- Market concentration ratio (CR5, CR10)

- R&D investments by key players

- Patent filings and technological advancements

- Regulatory landscape and its impact

- Mergers & acquisitions (M&A) activity: The report analyzes significant M&A deals in the historical period (2019-2024), providing deal values and strategic implications. For example, the xx acquisition of yy in 202x for USD xx million significantly impacted market share.

- End-user trends in battery technology adoption, shifting demand towards higher energy density and faster charging capabilities.

China Battery Manufacturing Equipment Market Industry Trends & Insights

The China Battery Manufacturing Equipment market is experiencing explosive growth, fueled by the rapid expansion of the electric vehicle (EV) industry and the surging demand for energy storage solutions (ESS) across various sectors. This market is projected to exhibit a significant Compound Annual Growth Rate (CAGR) of [Insert Updated CAGR Percentage]% during the forecast period (2025-2033), exceeding previous projections due to [Insert Specific Reason for Increased Growth, e.g., government initiatives, technological breakthroughs, increased investment]. Technological advancements, particularly in automation, artificial intelligence (AI)-powered process optimization, and advanced materials science, are revolutionizing manufacturing efficiency and output. Consumer preferences for sustainable and affordable products are driving demand for eco-friendly and cost-effective equipment. The competitive landscape is fiercely dynamic, with both established domestic and international players vying for market share, resulting in continuous innovation and price optimization that benefits end-users. Market penetration of cutting-edge technologies such as high-speed coating, automated assembly lines, and advanced process control systems is expected to reach [Insert Updated Percentage]% by 2033.

Dominant Markets & Segments in China Battery Manufacturing Equipment Market

The automotive sector remains the dominant end-user market, currently accounting for approximately [Insert Updated Percentage]% of total demand in 2025. This is largely attributed to the phenomenal growth of China's EV industry and the government's continued support for its expansion. Within the equipment segment, electrode stacking, assembly & handling, and formation & testing machines continue to represent the largest market shares, but [Mention if any other segment is gaining significant traction].

Key Drivers by Segment:

- Automotive: Strengthened government incentives for EV adoption, increasing consumer preference for EVs, substantial expansion of charging infrastructure, and the rising demand for higher energy density batteries.

- Industrial: Widespread adoption of battery energy storage systems (BESS) for grid-scale energy storage, renewable energy integration, and industrial applications, driven by the need for reliable and efficient power management.

- Other End Users: Continued growth in portable electronics, consumer electronics, and specialized applications such as medical devices and aerospace, demanding advanced battery technologies and manufacturing processes.

- Coating & Dryer: Increasing demand for high-quality, consistent, and efficient electrode coatings to enhance battery performance and lifespan.

- Calendaring: Continued importance in ensuring precise electrode thickness and density for optimal battery cell performance.

- Slitting: Maintaining its critical role in ensuring accurate electrode dimensions for optimal battery pack assembly and functionality.

- Mixing: Advancements in mixing technologies to achieve precise slurry consistency and enhanced electrode properties are driving growth.

- Electrode Stacking: Automation and high-precision stacking systems are improving efficiency and consistency, leading to higher battery quality and yield.

- Assembly & Handling: Highly automated systems are increasing speed and precision in battery pack assembly, reducing production times and costs.

- Formation & Testing: Sophisticated testing methodologies and advanced equipment are critical for quality control, performance validation, and ensuring the safety and reliability of final products.

The geographically dominant regions remain concentrated in China's coastal provinces, leveraging established industrial clusters and proximity to major battery manufacturers. Continued regional dominance is driven by robust infrastructure, access to a skilled workforce, government support policies, and efficient supply chain networks.

China Battery Manufacturing Equipment Market Product Developments

Recent innovations are focused on enhancing automation, precision, throughput, and sustainability. Advanced robotic systems, AI-powered quality control, high-speed coating technologies, and the integration of Industry 4.0 principles are improving efficiency, reducing manufacturing costs, and enhancing the overall quality of produced batteries. The market is witnessing a strong shift towards modular and flexible manufacturing systems to accommodate diverse battery chemistries (e.g., LFP, NMC, Solid-State), formats (e.g., prismatic, cylindrical, pouch), and evolving customer demands. [Add specific examples of recent innovative product developments, e.g., new types of coating machines, advanced automation solutions]. This focus on adaptability ensures that manufacturers can swiftly respond to the evolving needs of the battery market and maintain a competitive edge.

Report Scope & Segmentation Analysis

This report segments the China Battery Manufacturing Equipment market based on machine type (Coating & Dryer, Calendaring, Slitting, Mixing, Electrode Stacking, Assembly & Handling Machines, Formation & Testing Machines) and end-user (Automotive, Industrial, Other End Users). Each segment’s growth projections, market size (in USD million) for the historical and forecast periods, and competitive landscape are thoroughly analyzed. For example, the Assembly & Handling Machines segment is projected to exhibit a CAGR of xx% driven by automation trends. The automotive end-user segment is expected to maintain its dominance with a market size of USD xx million by 2033, driven by EV growth.

Key Drivers of China Battery Manufacturing Equipment Market Growth

The market's growth is propelled by several factors: the surge in EV adoption fueled by government policies supporting electric mobility, the increasing demand for energy storage solutions, technological advancements leading to higher efficiency and reduced costs, and the expansion of battery manufacturing facilities in China. The significant investments in battery gigafactories like the USD 1.561 billion investment by GAC in Guangzhou further underscore the market's dynamism.

Challenges in the China Battery Manufacturing Equipment Sector

The market faces challenges such as intense competition, price pressures, supply chain disruptions, and the need for continuous technological upgrades. The complex regulatory environment and environmental concerns also pose significant hurdles. These challenges are estimated to impact market growth by approximately xx% annually in the short term.

Emerging Opportunities in China Battery Manufacturing Equipment Market

Opportunities exist in the development of advanced automation technologies, specialized equipment for next-generation battery chemistries (solid-state, etc.), and customized solutions for specific battery applications. Expanding into niche markets like BESS and other industrial applications also presents significant potential. The increasing focus on sustainability presents an opportunity for manufacturers offering eco-friendly solutions.

Leading Players in the China Battery Manufacturing Equipment Market

- Xiamen TOB New Energy Technology Co Ltd

- Xiamen Lith Machine Limited

- Hitachi Ltd

- Schuler AG

- Xiamen ACEY New Energy Technology

- Durr AG

- Wuxi Lead Intelligent Equipment Co Ltd

- Andritz AG

- Xiamen Tmax Battery Equipments Limited

- Manz AG

Key Developments in China Battery Manufacturing Equipment Industry

- December 2022: GAC announces USD 1.561 billion investment in a new 6 GWh battery production facility in Guangzhou, scheduled to operate in March 2024.

- November 2022: BYD announces expansion of battery production capacity with a new 20 GWh plant in Wenzhou, Zhejiang province, scheduled to start production in 2024.

These developments signal a significant increase in demand for battery manufacturing equipment and drive market growth.

Strategic Outlook for China Battery Manufacturing Equipment Market

The China Battery Manufacturing Equipment market is poised for sustained growth, driven by the continued expansion of the EV and energy storage sectors. Strategic partnerships, technological innovation, and a focus on sustainability will be crucial for success. The market's future is bright, with immense potential for growth and innovation in the coming years.

China Battery Manufacturing Equipment Market Segmentation

-

1. Machine Type

- 1.1. Coating & Dryer

- 1.2. Calendaring

- 1.3. Slitting

- 1.4. Mixing

- 1.5. Electrode Stacking

- 1.6. Assembly & Handling Machines

- 1.7. Formation & Testing Machines

-

2. End User

- 2.1. Automotive

- 2.2. Industrial

- 2.3. Other End Users

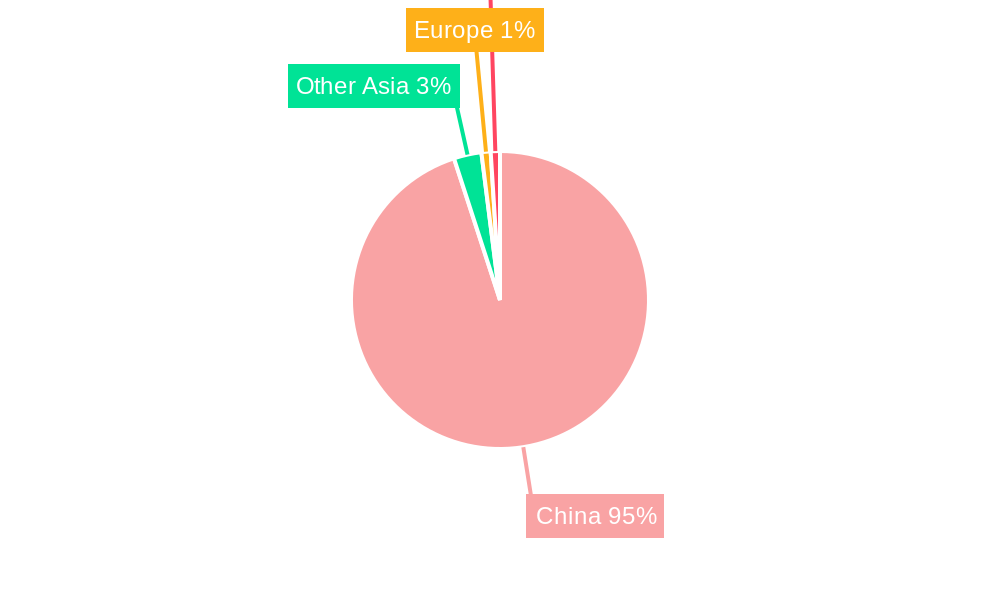

China Battery Manufacturing Equipment Market Segmentation By Geography

- 1. China

China Battery Manufacturing Equipment Market Regional Market Share

Geographic Coverage of China Battery Manufacturing Equipment Market

China Battery Manufacturing Equipment Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 24.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Declining Cost of Lithium Batteries4.; Increased Adoption of Renewable Energy

- 3.3. Market Restrains

- 3.3.1. 4.; Mismatch in Demand and Supply of Raw Materials for Battery Manufacturing

- 3.4. Market Trends

- 3.4.1. Automotive Segment to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Battery Manufacturing Equipment Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Machine Type

- 5.1.1. Coating & Dryer

- 5.1.2. Calendaring

- 5.1.3. Slitting

- 5.1.4. Mixing

- 5.1.5. Electrode Stacking

- 5.1.6. Assembly & Handling Machines

- 5.1.7. Formation & Testing Machines

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Automotive

- 5.2.2. Industrial

- 5.2.3. Other End Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. China

- 5.1. Market Analysis, Insights and Forecast - by Machine Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Xiamen TOB New Energy Technology Co Ltd*List Not Exhaustive

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Xiamen Lith Machine Limited

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Hitachi Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Schuler AG

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Xiamen ACEY New Energy Technology

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Durr AG

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Wuxi Lead Intelligent Equipment Co Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Andritz AG

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Xiamen Tmax Battery Equipments Limited

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Manz AG

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Xiamen TOB New Energy Technology Co Ltd*List Not Exhaustive

List of Figures

- Figure 1: China Battery Manufacturing Equipment Market Revenue Breakdown (USD Million, %) by Product 2025 & 2033

- Figure 2: China Battery Manufacturing Equipment Market Share (%) by Company 2025

List of Tables

- Table 1: China Battery Manufacturing Equipment Market Revenue USD Million Forecast, by Machine Type 2020 & 2033

- Table 2: China Battery Manufacturing Equipment Market Volume Gigawatt Forecast, by Machine Type 2020 & 2033

- Table 3: China Battery Manufacturing Equipment Market Revenue USD Million Forecast, by End User 2020 & 2033

- Table 4: China Battery Manufacturing Equipment Market Volume Gigawatt Forecast, by End User 2020 & 2033

- Table 5: China Battery Manufacturing Equipment Market Revenue USD Million Forecast, by Region 2020 & 2033

- Table 6: China Battery Manufacturing Equipment Market Volume Gigawatt Forecast, by Region 2020 & 2033

- Table 7: China Battery Manufacturing Equipment Market Revenue USD Million Forecast, by Machine Type 2020 & 2033

- Table 8: China Battery Manufacturing Equipment Market Volume Gigawatt Forecast, by Machine Type 2020 & 2033

- Table 9: China Battery Manufacturing Equipment Market Revenue USD Million Forecast, by End User 2020 & 2033

- Table 10: China Battery Manufacturing Equipment Market Volume Gigawatt Forecast, by End User 2020 & 2033

- Table 11: China Battery Manufacturing Equipment Market Revenue USD Million Forecast, by Country 2020 & 2033

- Table 12: China Battery Manufacturing Equipment Market Volume Gigawatt Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Battery Manufacturing Equipment Market?

The projected CAGR is approximately > 24.00%.

2. Which companies are prominent players in the China Battery Manufacturing Equipment Market?

Key companies in the market include Xiamen TOB New Energy Technology Co Ltd*List Not Exhaustive, Xiamen Lith Machine Limited, Hitachi Ltd, Schuler AG, Xiamen ACEY New Energy Technology, Durr AG, Wuxi Lead Intelligent Equipment Co Ltd, Andritz AG, Xiamen Tmax Battery Equipments Limited, Manz AG.

3. What are the main segments of the China Battery Manufacturing Equipment Market?

The market segments include Machine Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 12000 USD Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Declining Cost of Lithium Batteries4.; Increased Adoption of Renewable Energy.

6. What are the notable trends driving market growth?

Automotive Segment to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Mismatch in Demand and Supply of Raw Materials for Battery Manufacturing.

8. Can you provide examples of recent developments in the market?

In December 2022, the Chinese car company GAC announced that they had started building a production facility for electric car batteries in Guangzhou. With a total investment of USD 1.561 billion, the new factory is scheduled to operate in March 2024 with an annual production capacity of 6 GWh.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in USD Million and volume, measured in Gigawatt.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Battery Manufacturing Equipment Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Battery Manufacturing Equipment Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Battery Manufacturing Equipment Market?

To stay informed about further developments, trends, and reports in the China Battery Manufacturing Equipment Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence