Key Insights

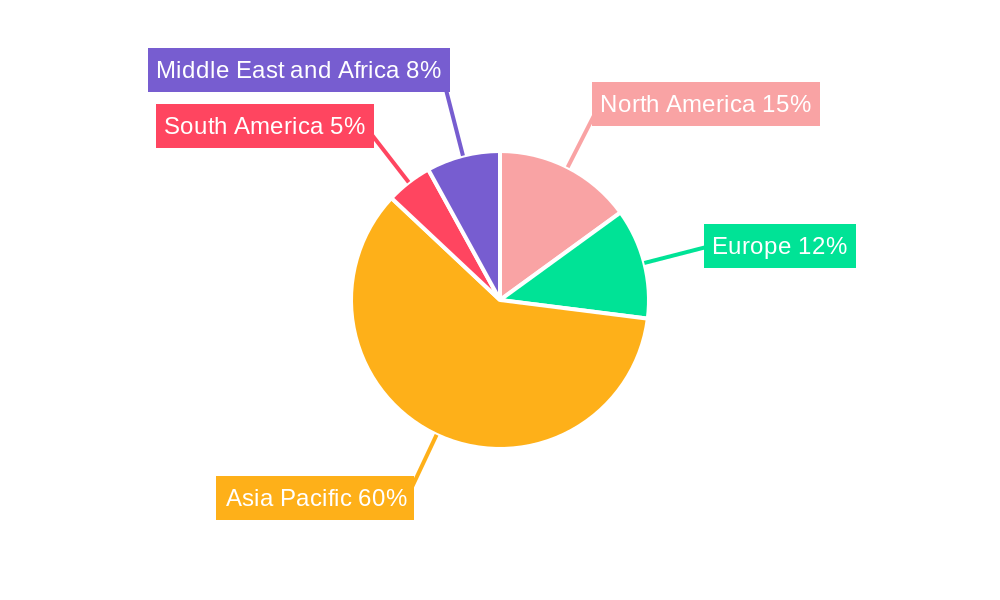

The global coal trading market, valued at $9.73 billion in 2025, is projected to experience robust growth, driven by sustained energy demand, particularly in developing economies with rapidly expanding industrial sectors and power generation needs. While the transition to renewable energy sources is underway, coal continues to play a significant role in the global energy mix, especially in regions with limited access to alternative energy options. The market's Compound Annual Growth Rate (CAGR) of 4.68% from 2025 to 2033 suggests a steady expansion, though this growth is likely to be influenced by fluctuating energy prices, geopolitical factors, and increasingly stringent environmental regulations. The steam coal segment dominates the market due to its extensive use in power generation. However, the coking coal segment is anticipated to exhibit faster growth due to its crucial role in the steel industry. Import and export activities are key drivers, with major players concentrated in regions with significant coal resources and high energy consumption. Geographic variations in market share are expected, with Asia-Pacific maintaining a leading position due to its large and rapidly developing economies. However, North America and Europe will continue to play a crucial role, although the rate of growth might be lower given their existing infrastructure and ongoing shift toward cleaner energy. Competition among major players, including Centennial Coal Company Limited, Glencore PLC, and Mercuria Energy Group, will remain intense, with companies focusing on optimizing supply chains, securing long-term contracts, and adapting to evolving regulatory landscapes.

Coal Trading Market Market Size (In Billion)

The restraints on market growth are primarily related to environmental concerns and governmental policies promoting renewable energy transitions. Carbon emission reduction targets are prompting a shift away from coal in many developed nations. Furthermore, fluctuations in global energy prices and geopolitical instability impacting coal supply chains can also influence market dynamics. Nevertheless, the continuing demand for electricity in emerging economies and the established infrastructure for coal utilization suggest sustained, albeit perhaps moderated, growth in the coal trading market over the forecast period. The strategic focus of market players will likely shift towards environmentally responsible coal mining practices, improved logistics, and exploring avenues for carbon capture and storage technologies to mitigate environmental impact and secure long-term market viability.

Coal Trading Market Company Market Share

Coal Trading Market: A Comprehensive Report (2019-2033)

This detailed report provides a comprehensive analysis of the global coal trading market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a focus on 2025 as the base and estimated year, this report examines market dynamics, key players, and future growth potential. The study period encompasses the historical period (2019-2024), the base year (2025), and the forecast period (2025-2033).

Coal Trading Market Concentration & Innovation

This section analyzes the competitive landscape of the coal trading market, assessing market concentration, innovation drivers, and regulatory influences. We examine the role of mergers and acquisitions (M&A) activity and its impact on market share. Key metrics such as market concentration ratios and M&A deal values are included. The analysis explores the influence of regulatory frameworks, the availability of product substitutes, evolving end-user trends (e.g., shift in energy sources), and the impact of technological advancements on market dynamics. The competitive intensity is evaluated considering factors such as pricing strategies, supply chain management, and brand reputation. Data on market share for leading players will be presented, along with an analysis of the factors driving innovation in areas such as coal transportation, processing, and trading efficiency. A detailed review of significant M&A activities, including deal values, will illustrate the evolving market structure. The report will estimate the average deal value for M&A transactions during the analyzed period to be approximately xx Million.

Coal Trading Market Industry Trends & Insights

This section delves into the key trends and insights shaping the coal trading market. We explore the factors driving market growth, such as increasing global energy demand (particularly in developing economies), and the challenges posed by technological disruptions, such as the rise of renewable energy sources and stricter environmental regulations. Consumer preferences regarding sustainable energy solutions are analyzed, along with their implications for coal demand. The competitive dynamics within the market are examined, with specific attention to pricing strategies, market share evolution, and the impact of major industry players. A detailed analysis of the Compound Annual Growth Rate (CAGR) and market penetration rate for different coal types and trader categories will be provided. We project the CAGR for the global coal trading market to be xx% during the forecast period (2025-2033). The market penetration of steam coal is estimated to be xx% in 2025, while coking coal penetration is projected at xx% in the same year.

Dominant Markets & Segments in Coal Trading Market

This section identifies the dominant regions, countries, and market segments within the coal trading market. We analyze the market share of different coal types (Steam Coal, Coaking Coal, Lignite) and trader types (Importer, Exporter). Dominant regions will be identified, highlighting the factors underpinning their leadership.

- Key Drivers for Dominant Segments:

- Steam Coal: High demand from power generation sector.

- Coking Coal: Essential for steel production.

- Lignite: Cost-effective option in specific regions.

- Importers: Strong demand in countries with limited domestic coal resources.

- Exporters: Abundance of coal reserves in exporting nations.

The dominance of specific regions and segments is analyzed, considering economic policies, infrastructure development, and geopolitical factors. We predict that Asia will remain the dominant region, with China and India leading as major consumers and traders.

Coal Trading Market Product Developments

This section focuses on recent product innovations, applications, and the competitive advantages they offer. Technological advancements in coal transportation, logistics, and trading platforms are highlighted. Emphasis is given to innovations that improve efficiency, reduce environmental impact, and enhance the overall competitiveness of players in the market. The market fit and acceptance of these new products and technologies are assessed, with an eye on future market trends.

Report Scope & Segmentation Analysis

This report segments the coal trading market by coal type (Steam Coal, Coaking Coal, Lignite) and trader type (Importer, Exporter). Each segment's growth projections, market size estimations for 2025, and competitive landscape are discussed.

- Coal Type: The report will individually analyze the market size and growth prospects for steam coal, coking coal, and lignite.

- Trader Type: The analysis will cover the market dynamics of importers and exporters separately, considering their unique challenges and opportunities.

Key Drivers of Coal Trading Market Growth

The growth of the coal trading market is propelled by several key factors:

- Rising Global Energy Demand: Growing industrialization and urbanization in developing economies fuel increased demand for energy, with coal playing a significant role.

- Infrastructure Development: Investments in power plants and transportation networks support coal trading expansion.

- Government Policies: Government policies supporting coal production and use in certain regions impact market growth.

Challenges in the Coal Trading Market Sector

Several challenges hinder the growth of the coal trading market:

- Environmental Concerns: Stringent environmental regulations and the push for cleaner energy sources pose significant threats.

- Price Volatility: Fluctuations in coal prices due to geopolitical factors and supply chain disruptions impact profitability.

- Competition from Renewables: The increasing competitiveness of renewable energy sources is reducing coal's market share.

Emerging Opportunities in Coal Trading Market

Emerging opportunities exist in the coal trading market:

- Technological Advancements: Innovations in coal mining, processing, and transportation enhance efficiency and sustainability.

- New Markets: Expanding demand in developing economies presents significant growth opportunities.

- Focus on Sustainability: Companies focusing on sustainable coal mining and trading practices can gain a competitive edge.

Leading Players in the Coal Trading Market

- Centennial Coal Company Limited

- Hind Energy and Coal Beneficiary India limited

- Mercuria Energy Group

- China Coal Energy Company Limited

- China Shenhua Energy Company Limited

- Glencore PLC

- Trafigura Group Pte Ltd

- Borneo Coal Trading

- Vitol Holding BV

- Mitsubishi Corporation RtM Japan Ltd

Key Developments in Coal Trading Market Industry

- February 2022: Russia and China announced an intergovernmental agreement for the supply of 100 Million tons of coal, highlighting the Asia-Pacific region's significant coal market until 2030.

- January 2022: Adani secured a contract to supply 1 Million tons of coal to NTPC, India's state-owned electricity generator.

Strategic Outlook for Coal Trading Market

The future of the coal trading market is complex, with growth catalysts and challenges intertwining. While environmental concerns and the rise of renewable energy sources pose threats, strong demand from developing nations, ongoing infrastructure development, and the potential for technological advancements offer opportunities for continued growth, albeit at a potentially slower pace than in previous decades. Successful players will need to adapt to stricter regulations, improve operational efficiency, and adopt sustainable practices to maintain a competitive edge.

Coal Trading Market Segmentation

-

1. Coal Type

- 1.1. Steam Coal

- 1.2. Coaking Coal

- 1.3. Lignite

-

2. Traders Type

- 2.1. Importer

- 2.2. Exporter

Coal Trading Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. France

- 2.3. United Kingdom

- 2.4. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. United Arab Emirates

- 5.3. South Africa

- 5.4. Rest of Middle East and Africa

Coal Trading Market Regional Market Share

Geographic Coverage of Coal Trading Market

Coal Trading Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.68% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 4.; Increasing Demand for Coal Based Power Generation Sector4.; Ease of Availability of Coal for Various Sectors

- 3.2.2 Such as Transport

- 3.2.3 Residential

- 3.2.4 Commercial and Others

- 3.3. Market Restrains

- 3.3.1. 4.; Increasing Adoption of Renewable Energy

- 3.4. Market Trends

- 3.4.1. Importer and Exporter to Maintain an Equal Share in the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Coal Trading Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Coal Type

- 5.1.1. Steam Coal

- 5.1.2. Coaking Coal

- 5.1.3. Lignite

- 5.2. Market Analysis, Insights and Forecast - by Traders Type

- 5.2.1. Importer

- 5.2.2. Exporter

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Coal Type

- 6. North America Coal Trading Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Coal Type

- 6.1.1. Steam Coal

- 6.1.2. Coaking Coal

- 6.1.3. Lignite

- 6.2. Market Analysis, Insights and Forecast - by Traders Type

- 6.2.1. Importer

- 6.2.2. Exporter

- 6.1. Market Analysis, Insights and Forecast - by Coal Type

- 7. Europe Coal Trading Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Coal Type

- 7.1.1. Steam Coal

- 7.1.2. Coaking Coal

- 7.1.3. Lignite

- 7.2. Market Analysis, Insights and Forecast - by Traders Type

- 7.2.1. Importer

- 7.2.2. Exporter

- 7.1. Market Analysis, Insights and Forecast - by Coal Type

- 8. Asia Pacific Coal Trading Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Coal Type

- 8.1.1. Steam Coal

- 8.1.2. Coaking Coal

- 8.1.3. Lignite

- 8.2. Market Analysis, Insights and Forecast - by Traders Type

- 8.2.1. Importer

- 8.2.2. Exporter

- 8.1. Market Analysis, Insights and Forecast - by Coal Type

- 9. South America Coal Trading Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Coal Type

- 9.1.1. Steam Coal

- 9.1.2. Coaking Coal

- 9.1.3. Lignite

- 9.2. Market Analysis, Insights and Forecast - by Traders Type

- 9.2.1. Importer

- 9.2.2. Exporter

- 9.1. Market Analysis, Insights and Forecast - by Coal Type

- 10. Middle East and Africa Coal Trading Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Coal Type

- 10.1.1. Steam Coal

- 10.1.2. Coaking Coal

- 10.1.3. Lignite

- 10.2. Market Analysis, Insights and Forecast - by Traders Type

- 10.2.1. Importer

- 10.2.2. Exporter

- 10.1. Market Analysis, Insights and Forecast - by Coal Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Centennial Coal Company Limited

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Hind Energy and Coal Beneficiary India limited

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Mercuria Energy Group

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 China Coal Energy Company Limited

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 China Shenhua Energy Company Limited

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Glencore PLC

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Trafigura Group Pte Ltd

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Borneo Coal Trading

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Vitol Holding BV

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Mitsubishi Corporation RtM Japan Ltd

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Centennial Coal Company Limited

List of Figures

- Figure 1: Global Coal Trading Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Coal Trading Market Revenue (Million), by Coal Type 2025 & 2033

- Figure 3: North America Coal Trading Market Revenue Share (%), by Coal Type 2025 & 2033

- Figure 4: North America Coal Trading Market Revenue (Million), by Traders Type 2025 & 2033

- Figure 5: North America Coal Trading Market Revenue Share (%), by Traders Type 2025 & 2033

- Figure 6: North America Coal Trading Market Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Coal Trading Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Coal Trading Market Revenue (Million), by Coal Type 2025 & 2033

- Figure 9: Europe Coal Trading Market Revenue Share (%), by Coal Type 2025 & 2033

- Figure 10: Europe Coal Trading Market Revenue (Million), by Traders Type 2025 & 2033

- Figure 11: Europe Coal Trading Market Revenue Share (%), by Traders Type 2025 & 2033

- Figure 12: Europe Coal Trading Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Coal Trading Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Coal Trading Market Revenue (Million), by Coal Type 2025 & 2033

- Figure 15: Asia Pacific Coal Trading Market Revenue Share (%), by Coal Type 2025 & 2033

- Figure 16: Asia Pacific Coal Trading Market Revenue (Million), by Traders Type 2025 & 2033

- Figure 17: Asia Pacific Coal Trading Market Revenue Share (%), by Traders Type 2025 & 2033

- Figure 18: Asia Pacific Coal Trading Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Coal Trading Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America Coal Trading Market Revenue (Million), by Coal Type 2025 & 2033

- Figure 21: South America Coal Trading Market Revenue Share (%), by Coal Type 2025 & 2033

- Figure 22: South America Coal Trading Market Revenue (Million), by Traders Type 2025 & 2033

- Figure 23: South America Coal Trading Market Revenue Share (%), by Traders Type 2025 & 2033

- Figure 24: South America Coal Trading Market Revenue (Million), by Country 2025 & 2033

- Figure 25: South America Coal Trading Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Coal Trading Market Revenue (Million), by Coal Type 2025 & 2033

- Figure 27: Middle East and Africa Coal Trading Market Revenue Share (%), by Coal Type 2025 & 2033

- Figure 28: Middle East and Africa Coal Trading Market Revenue (Million), by Traders Type 2025 & 2033

- Figure 29: Middle East and Africa Coal Trading Market Revenue Share (%), by Traders Type 2025 & 2033

- Figure 30: Middle East and Africa Coal Trading Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Middle East and Africa Coal Trading Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Coal Trading Market Revenue Million Forecast, by Coal Type 2020 & 2033

- Table 2: Global Coal Trading Market Revenue Million Forecast, by Traders Type 2020 & 2033

- Table 3: Global Coal Trading Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Coal Trading Market Revenue Million Forecast, by Coal Type 2020 & 2033

- Table 5: Global Coal Trading Market Revenue Million Forecast, by Traders Type 2020 & 2033

- Table 6: Global Coal Trading Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Coal Trading Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Coal Trading Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Rest of North America Coal Trading Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Global Coal Trading Market Revenue Million Forecast, by Coal Type 2020 & 2033

- Table 11: Global Coal Trading Market Revenue Million Forecast, by Traders Type 2020 & 2033

- Table 12: Global Coal Trading Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Germany Coal Trading Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: France Coal Trading Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: United Kingdom Coal Trading Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Rest of Europe Coal Trading Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Global Coal Trading Market Revenue Million Forecast, by Coal Type 2020 & 2033

- Table 18: Global Coal Trading Market Revenue Million Forecast, by Traders Type 2020 & 2033

- Table 19: Global Coal Trading Market Revenue Million Forecast, by Country 2020 & 2033

- Table 20: China Coal Trading Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: India Coal Trading Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Japan Coal Trading Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: South Korea Coal Trading Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Rest of Asia Pacific Coal Trading Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Global Coal Trading Market Revenue Million Forecast, by Coal Type 2020 & 2033

- Table 26: Global Coal Trading Market Revenue Million Forecast, by Traders Type 2020 & 2033

- Table 27: Global Coal Trading Market Revenue Million Forecast, by Country 2020 & 2033

- Table 28: Brazil Coal Trading Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Argentina Coal Trading Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Rest of South America Coal Trading Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Global Coal Trading Market Revenue Million Forecast, by Coal Type 2020 & 2033

- Table 32: Global Coal Trading Market Revenue Million Forecast, by Traders Type 2020 & 2033

- Table 33: Global Coal Trading Market Revenue Million Forecast, by Country 2020 & 2033

- Table 34: Saudi Arabia Coal Trading Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: United Arab Emirates Coal Trading Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: South Africa Coal Trading Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Rest of Middle East and Africa Coal Trading Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Coal Trading Market?

The projected CAGR is approximately 4.68%.

2. Which companies are prominent players in the Coal Trading Market?

Key companies in the market include Centennial Coal Company Limited, Hind Energy and Coal Beneficiary India limited, Mercuria Energy Group, China Coal Energy Company Limited, China Shenhua Energy Company Limited, Glencore PLC, Trafigura Group Pte Ltd, Borneo Coal Trading, Vitol Holding BV, Mitsubishi Corporation RtM Japan Ltd.

3. What are the main segments of the Coal Trading Market?

The market segments include Coal Type, Traders Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 9.73 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Demand for Coal Based Power Generation Sector4.; Ease of Availability of Coal for Various Sectors. Such as Transport. Residential. Commercial and Others.

6. What are the notable trends driving market growth?

Importer and Exporter to Maintain an Equal Share in the Market.

7. Are there any restraints impacting market growth?

4.; Increasing Adoption of Renewable Energy.

8. Can you provide examples of recent developments in the market?

February 2022: Russia and China announced the development of an intergovernmental agreement on the supply of coal in the amount of 100 million tons. According to the government of Russia, the Asia-Pacific region has a significant market for coal till 2030. The countries have started working on the agreement.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Coal Trading Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Coal Trading Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Coal Trading Market?

To stay informed about further developments, trends, and reports in the Coal Trading Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence