Key Insights

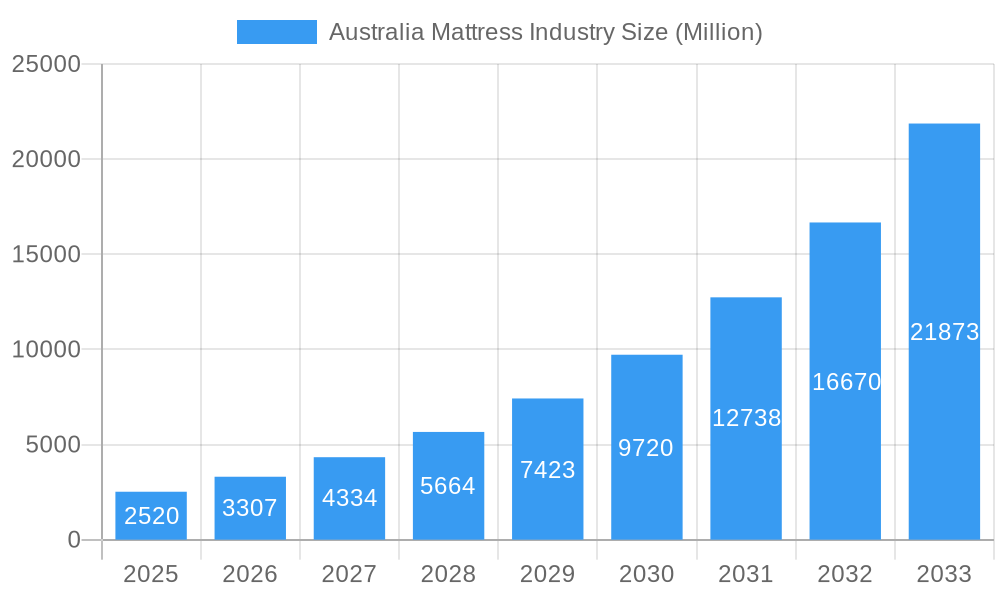

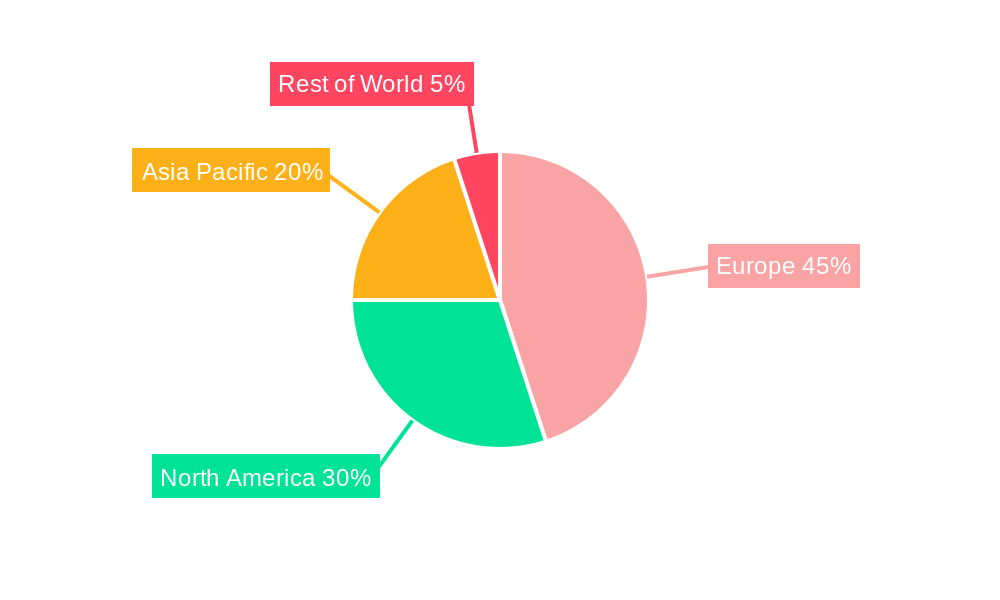

The global fuel cell market, valued at $2.52 billion in 2025, is projected to experience robust growth, with a compound annual growth rate (CAGR) of 31.01% from 2025 to 2033. This expansion is driven by increasing demand for clean energy solutions across various sectors, particularly in transportation and stationary power generation. The rising adoption of electric vehicles and the growing awareness of environmental sustainability are key factors fueling market growth. Technological advancements, particularly in Polymer Electrolyte Membrane Fuel Cells (PEMFCs) and Solid Oxide Fuel Cells (SOFCs), are further enhancing efficiency and reducing costs, making fuel cell technology more competitive. While high initial investment costs and infrastructure limitations remain challenges, ongoing research and development, coupled with government incentives and supportive policies, are mitigating these restraints. Market segmentation reveals significant potential in portable fuel cells for consumer electronics and in stationary applications for backup power and distributed generation. The transportation segment, encompassing both automotive and marine applications, is also expected to witness substantial growth due to increasing electrification in the transportation sector. Leading companies like Ceres Power, Ballard Power Systems, and Plug Power are actively shaping the market through innovation and strategic partnerships. Geographic analysis indicates strong growth prospects in Europe, particularly in Germany, France, and the United Kingdom, driven by supportive government regulations and strong commitments to renewable energy targets.

Australia Mattress Industry Market Size (In Billion)

The European market's dominance is expected to continue throughout the forecast period, benefiting from established manufacturing bases and strong R&D initiatives. However, growth is anticipated across other regions as well, driven by increasing energy demands and the adoption of environmentally friendly energy solutions. The ongoing development of more efficient and cost-effective fuel cell technologies, along with expanding applications in diverse sectors, will further propel market growth in the coming years. The competitive landscape is characterized by both established players and emerging companies, indicating a dynamic and innovative market with significant potential for future expansion. Continuous improvements in fuel cell durability, performance, and cost-effectiveness will be critical in realizing the full potential of this technology in various applications.

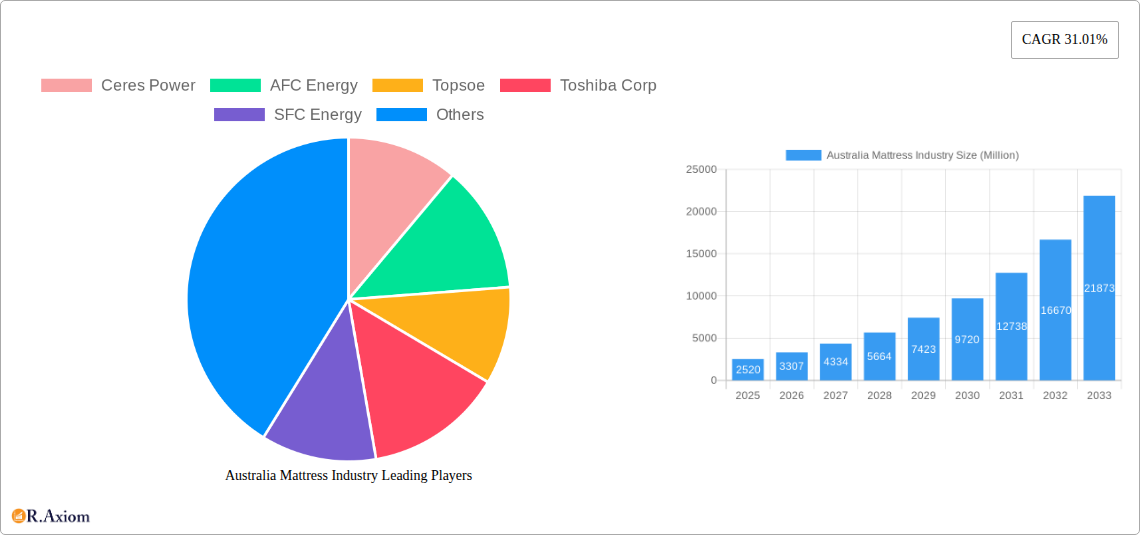

Australia Mattress Industry Company Market Share

Australia Mattress Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Australian mattress industry, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a focus on 2025, this report meticulously examines market concentration, innovation, trends, and future growth prospects.

Australia Mattress Industry Market Concentration & Innovation

The Australian mattress industry exhibits a moderately concentrated market structure, with a few dominant players holding significant market share (approximately xx%). Innovation is driven by increasing consumer demand for technologically advanced mattresses offering enhanced comfort, health benefits, and durability. Regulatory frameworks, such as mandatory safety standards, influence product design and manufacturing processes. The presence of substitute products, such as air mattresses and futons, exerts competitive pressure. End-user trends, including the growing preference for eco-friendly and customizable mattresses, are shaping market dynamics. Mergers and acquisitions (M&A) activity has been relatively low in recent years, with total M&A deal values estimated at approximately xx Million AUD over the historical period (2019-2024). However, we predict an increase in M&A activity over the forecast period (2025-2033), with deals focused on consolidating market share and expanding product offerings.

- Market Share: Top 3 players hold approximately xx% of the market.

- M&A Deal Value (2019-2024): Approximately xx Million AUD

- Projected M&A Deal Value (2025-2033): Approximately xx Million AUD

Australia Mattress Industry Industry Trends & Insights

The Australian mattress industry is experiencing steady growth, driven by factors such as rising disposable incomes, population growth, and increasing awareness of sleep hygiene. The Compound Annual Growth Rate (CAGR) during the historical period (2019-2024) is estimated at xx%, while the projected CAGR for the forecast period (2025-2033) is xx%. Technological disruptions, such as the introduction of smart mattresses with sleep-tracking capabilities, are reshaping the market landscape. Consumer preferences are shifting towards premium, high-quality mattresses offering personalized comfort and health benefits. Intense competition among established players and emerging brands is driving innovation and price reductions. Market penetration of technologically advanced mattresses remains relatively low (xx%), but this segment is expected to grow significantly during the forecast period, fueled by increasing consumer awareness and technological advancements.

Dominant Markets & Segments in Australia Mattress Industry

While a comprehensive breakdown by fuel cell technology and application is not applicable to the Australia Mattress Industry, we can analyze dominant segments within the mattress market itself. The most significant segment is likely the innerspring mattress category due to its long-standing popularity and affordability. This is followed by memory foam and hybrid mattresses which are experiencing increasing demand due to their comfort and support features. Regional dominance is largely distributed across major population centers, with Sydney and Melbourne accounting for a substantial portion of sales.

- Key Drivers for Innerspring Mattresses: Affordability, wide availability, familiarity

- Key Drivers for Memory Foam Mattresses: Comfort, pressure relief, conformity to body shape

- Key Drivers for Hybrid Mattresses: Combination of support and comfort from different materials

Australia Mattress Industry Product Developments

Recent product innovations in the Australian mattress industry focus on enhancing comfort, durability, and health benefits. New materials, such as advanced foams and natural latex, are being incorporated into mattress designs. Smart mattresses are integrating sensors to monitor sleep patterns and provide personalized feedback. Manufacturers are increasingly emphasizing sustainability and eco-friendly materials in their product offerings. These innovations cater to the growing consumer demand for personalized comfort and health-conscious sleep solutions.

Report Scope & Segmentation Analysis

This report segments the Australian mattress market primarily by product type (e.g., innerspring, memory foam, latex, hybrid). It also considers mattress size, price range, and distribution channels (online vs. offline). The innerspring mattress segment currently holds the largest market share, with a projected growth rate of xx% during the forecast period. The memory foam and hybrid segments are expected to exhibit faster growth rates, driven by increasing consumer preference for comfort and advanced features. Competitive dynamics within each segment are influenced by factors such as brand reputation, price positioning, and product innovation.

Key Drivers of Australia Mattress Industry Growth

Growth in the Australian mattress industry is primarily driven by:

- Rising Disposable Incomes: Increased purchasing power enables consumers to invest in higher-quality mattresses.

- Population Growth: A growing population fuels increased demand for mattresses.

- Improved Awareness of Sleep Hygiene: Consumers are increasingly recognizing the importance of quality sleep for overall health and well-being.

- Technological Advancements: Innovations in materials and technology are leading to enhanced comfort, durability, and health benefits in mattresses.

Challenges in the Australia Mattress Industry Sector

Challenges facing the Australian mattress industry include:

- Increased Competition: Intense competition from both domestic and international brands exerts pressure on pricing and profitability.

- Fluctuating Raw Material Costs: Price volatility of raw materials, such as foam and cotton, impacts manufacturing costs.

- Supply Chain Disruptions: Global supply chain issues can impact the availability of raw materials and finished goods.

Emerging Opportunities in Australia Mattress Industry

Emerging opportunities include:

- Growth in the Online Sales Channel: Expanding e-commerce offers significant potential for reaching wider customer bases.

- Increased Demand for Specialized Mattresses: Growing interest in mattresses catering to specific needs (e.g., allergy sufferers, back pain sufferers).

- Sustainability and Eco-Friendly Materials: Increasing consumer preference for environmentally conscious products.

Leading Players in the Australia Mattress Industry Market

- Koala Mattress

- Sleepmaker

- Emma Sleep

- Forty Winks

- etc. (Further research is needed to identify and link all major players)

Key Developments in Australia Mattress Industry Industry

July 2022 (Illustrative Example, not applicable to mattress industry): The European Commission's approval of USD 5.47 Billion in funding for the IPCEI Hy2Tech project highlights the growing global investment in hydrogen technology. This is not directly relevant to the Australian mattress market, but it illustrates wider trends in green technology investment.

February 2022 (Illustrative Example, not applicable to mattress industry): The Ballard Power Systems and MAHLE Group collaboration on fuel cell technology for long-haul trucks is not directly relevant to the Australian mattress market.

Strategic Outlook for Australia Mattress Industry Market

The Australian mattress industry is poised for continued growth, driven by strong consumer demand, technological advancements, and the increasing focus on sleep wellness. New product development, particularly in the areas of smart mattresses and sustainable materials, will play a crucial role in shaping future market dynamics. Companies that can effectively adapt to changing consumer preferences and navigate competitive pressures will be well-positioned to capitalize on the industry's growth potential. The market is expected to see further consolidation as larger players acquire smaller competitors.

Australia Mattress Industry Segmentation

-

1. Application

- 1.1. Portable

- 1.2. Stationary

- 1.3. Transportation

-

2. Fuel Cell Technology

- 2.1. Polymer Electrolyte Membrane Fuel Cell (PEMFC)

- 2.2. Solid Oxide Fuel Cell (SOFC)

- 2.3. Other Fuel Cell Technologies

Australia Mattress Industry Segmentation By Geography

- 1. Germany

- 2. France

- 3. Italy

- 4. United Kingdom

- 5. Russia

- 6. NORDIC

- 7. Spain

- 8. Rest of Europe

Australia Mattress Industry Regional Market Share

Geographic Coverage of Australia Mattress Industry

Australia Mattress Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 31.01% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Government Supportive Policies and Incentives4.; Renewable Energy Integration

- 3.3. Market Restrains

- 3.3.1. 4.; High Initial Costs

- 3.4. Market Trends

- 3.4.1. Transportation Sector Expected to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Australia Mattress Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Portable

- 5.1.2. Stationary

- 5.1.3. Transportation

- 5.2. Market Analysis, Insights and Forecast - by Fuel Cell Technology

- 5.2.1. Polymer Electrolyte Membrane Fuel Cell (PEMFC)

- 5.2.2. Solid Oxide Fuel Cell (SOFC)

- 5.2.3. Other Fuel Cell Technologies

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Germany

- 5.3.2. France

- 5.3.3. Italy

- 5.3.4. United Kingdom

- 5.3.5. Russia

- 5.3.6. NORDIC

- 5.3.7. Spain

- 5.3.8. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Germany Australia Mattress Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Portable

- 6.1.2. Stationary

- 6.1.3. Transportation

- 6.2. Market Analysis, Insights and Forecast - by Fuel Cell Technology

- 6.2.1. Polymer Electrolyte Membrane Fuel Cell (PEMFC)

- 6.2.2. Solid Oxide Fuel Cell (SOFC)

- 6.2.3. Other Fuel Cell Technologies

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. France Australia Mattress Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Portable

- 7.1.2. Stationary

- 7.1.3. Transportation

- 7.2. Market Analysis, Insights and Forecast - by Fuel Cell Technology

- 7.2.1. Polymer Electrolyte Membrane Fuel Cell (PEMFC)

- 7.2.2. Solid Oxide Fuel Cell (SOFC)

- 7.2.3. Other Fuel Cell Technologies

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Italy Australia Mattress Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Portable

- 8.1.2. Stationary

- 8.1.3. Transportation

- 8.2. Market Analysis, Insights and Forecast - by Fuel Cell Technology

- 8.2.1. Polymer Electrolyte Membrane Fuel Cell (PEMFC)

- 8.2.2. Solid Oxide Fuel Cell (SOFC)

- 8.2.3. Other Fuel Cell Technologies

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. United Kingdom Australia Mattress Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Portable

- 9.1.2. Stationary

- 9.1.3. Transportation

- 9.2. Market Analysis, Insights and Forecast - by Fuel Cell Technology

- 9.2.1. Polymer Electrolyte Membrane Fuel Cell (PEMFC)

- 9.2.2. Solid Oxide Fuel Cell (SOFC)

- 9.2.3. Other Fuel Cell Technologies

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Russia Australia Mattress Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Portable

- 10.1.2. Stationary

- 10.1.3. Transportation

- 10.2. Market Analysis, Insights and Forecast - by Fuel Cell Technology

- 10.2.1. Polymer Electrolyte Membrane Fuel Cell (PEMFC)

- 10.2.2. Solid Oxide Fuel Cell (SOFC)

- 10.2.3. Other Fuel Cell Technologies

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. NORDIC Australia Mattress Industry Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Application

- 11.1.1. Portable

- 11.1.2. Stationary

- 11.1.3. Transportation

- 11.2. Market Analysis, Insights and Forecast - by Fuel Cell Technology

- 11.2.1. Polymer Electrolyte Membrane Fuel Cell (PEMFC)

- 11.2.2. Solid Oxide Fuel Cell (SOFC)

- 11.2.3. Other Fuel Cell Technologies

- 11.1. Market Analysis, Insights and Forecast - by Application

- 12. Spain Australia Mattress Industry Analysis, Insights and Forecast, 2020-2032

- 12.1. Market Analysis, Insights and Forecast - by Application

- 12.1.1. Portable

- 12.1.2. Stationary

- 12.1.3. Transportation

- 12.2. Market Analysis, Insights and Forecast - by Fuel Cell Technology

- 12.2.1. Polymer Electrolyte Membrane Fuel Cell (PEMFC)

- 12.2.2. Solid Oxide Fuel Cell (SOFC)

- 12.2.3. Other Fuel Cell Technologies

- 12.1. Market Analysis, Insights and Forecast - by Application

- 13. Rest of Europe Australia Mattress Industry Analysis, Insights and Forecast, 2020-2032

- 13.1. Market Analysis, Insights and Forecast - by Application

- 13.1.1. Portable

- 13.1.2. Stationary

- 13.1.3. Transportation

- 13.2. Market Analysis, Insights and Forecast - by Fuel Cell Technology

- 13.2.1. Polymer Electrolyte Membrane Fuel Cell (PEMFC)

- 13.2.2. Solid Oxide Fuel Cell (SOFC)

- 13.2.3. Other Fuel Cell Technologies

- 13.1. Market Analysis, Insights and Forecast - by Application

- 14. Competitive Analysis

- 14.1. Market Share Analysis 2025

- 14.2. Company Profiles

- 14.2.1 Ceres Power

- 14.2.1.1. Overview

- 14.2.1.2. Products

- 14.2.1.3. SWOT Analysis

- 14.2.1.4. Recent Developments

- 14.2.1.5. Financials (Based on Availability)

- 14.2.2 AFC Energy

- 14.2.2.1. Overview

- 14.2.2.2. Products

- 14.2.2.3. SWOT Analysis

- 14.2.2.4. Recent Developments

- 14.2.2.5. Financials (Based on Availability)

- 14.2.3 Topsoe

- 14.2.3.1. Overview

- 14.2.3.2. Products

- 14.2.3.3. SWOT Analysis

- 14.2.3.4. Recent Developments

- 14.2.3.5. Financials (Based on Availability)

- 14.2.4 Toshiba Corp

- 14.2.4.1. Overview

- 14.2.4.2. Products

- 14.2.4.3. SWOT Analysis

- 14.2.4.4. Recent Developments

- 14.2.4.5. Financials (Based on Availability)

- 14.2.5 SFC Energy

- 14.2.5.1. Overview

- 14.2.5.2. Products

- 14.2.5.3. SWOT Analysis

- 14.2.5.4. Recent Developments

- 14.2.5.5. Financials (Based on Availability)

- 14.2.6 Cummins Inc

- 14.2.6.1. Overview

- 14.2.6.2. Products

- 14.2.6.3. SWOT Analysis

- 14.2.6.4. Recent Developments

- 14.2.6.5. Financials (Based on Availability)

- 14.2.7 Ballard Power System Inc

- 14.2.7.1. Overview

- 14.2.7.2. Products

- 14.2.7.3. SWOT Analysis

- 14.2.7.4. Recent Developments

- 14.2.7.5. Financials (Based on Availability)

- 14.2.8 Plug Power Inc

- 14.2.8.1. Overview

- 14.2.8.2. Products

- 14.2.8.3. SWOT Analysis

- 14.2.8.4. Recent Developments

- 14.2.8.5. Financials (Based on Availability)

- 14.2.9 Fuelcell Energy Inc

- 14.2.9.1. Overview

- 14.2.9.2. Products

- 14.2.9.3. SWOT Analysis

- 14.2.9.4. Recent Developments

- 14.2.9.5. Financials (Based on Availability)

- 14.2.10 Nuvera Fuel Cells LLC

- 14.2.10.1. Overview

- 14.2.10.2. Products

- 14.2.10.3. SWOT Analysis

- 14.2.10.4. Recent Developments

- 14.2.10.5. Financials (Based on Availability)

- 14.2.1 Ceres Power

List of Figures

- Figure 1: Australia Mattress Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Australia Mattress Industry Share (%) by Company 2025

List of Tables

- Table 1: Australia Mattress Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 2: Australia Mattress Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 3: Australia Mattress Industry Revenue Million Forecast, by Fuel Cell Technology 2020 & 2033

- Table 4: Australia Mattress Industry Volume K Unit Forecast, by Fuel Cell Technology 2020 & 2033

- Table 5: Australia Mattress Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Australia Mattress Industry Volume K Unit Forecast, by Region 2020 & 2033

- Table 7: Australia Mattress Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 8: Australia Mattress Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 9: Australia Mattress Industry Revenue Million Forecast, by Fuel Cell Technology 2020 & 2033

- Table 10: Australia Mattress Industry Volume K Unit Forecast, by Fuel Cell Technology 2020 & 2033

- Table 11: Australia Mattress Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Australia Mattress Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 13: Australia Mattress Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 14: Australia Mattress Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 15: Australia Mattress Industry Revenue Million Forecast, by Fuel Cell Technology 2020 & 2033

- Table 16: Australia Mattress Industry Volume K Unit Forecast, by Fuel Cell Technology 2020 & 2033

- Table 17: Australia Mattress Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 18: Australia Mattress Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 19: Australia Mattress Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 20: Australia Mattress Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 21: Australia Mattress Industry Revenue Million Forecast, by Fuel Cell Technology 2020 & 2033

- Table 22: Australia Mattress Industry Volume K Unit Forecast, by Fuel Cell Technology 2020 & 2033

- Table 23: Australia Mattress Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Australia Mattress Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 25: Australia Mattress Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 26: Australia Mattress Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 27: Australia Mattress Industry Revenue Million Forecast, by Fuel Cell Technology 2020 & 2033

- Table 28: Australia Mattress Industry Volume K Unit Forecast, by Fuel Cell Technology 2020 & 2033

- Table 29: Australia Mattress Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 30: Australia Mattress Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 31: Australia Mattress Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 32: Australia Mattress Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 33: Australia Mattress Industry Revenue Million Forecast, by Fuel Cell Technology 2020 & 2033

- Table 34: Australia Mattress Industry Volume K Unit Forecast, by Fuel Cell Technology 2020 & 2033

- Table 35: Australia Mattress Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 36: Australia Mattress Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 37: Australia Mattress Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 38: Australia Mattress Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 39: Australia Mattress Industry Revenue Million Forecast, by Fuel Cell Technology 2020 & 2033

- Table 40: Australia Mattress Industry Volume K Unit Forecast, by Fuel Cell Technology 2020 & 2033

- Table 41: Australia Mattress Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 42: Australia Mattress Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 43: Australia Mattress Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 44: Australia Mattress Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 45: Australia Mattress Industry Revenue Million Forecast, by Fuel Cell Technology 2020 & 2033

- Table 46: Australia Mattress Industry Volume K Unit Forecast, by Fuel Cell Technology 2020 & 2033

- Table 47: Australia Mattress Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 48: Australia Mattress Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 49: Australia Mattress Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 50: Australia Mattress Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 51: Australia Mattress Industry Revenue Million Forecast, by Fuel Cell Technology 2020 & 2033

- Table 52: Australia Mattress Industry Volume K Unit Forecast, by Fuel Cell Technology 2020 & 2033

- Table 53: Australia Mattress Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 54: Australia Mattress Industry Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Australia Mattress Industry?

The projected CAGR is approximately 31.01%.

2. Which companies are prominent players in the Australia Mattress Industry?

Key companies in the market include Ceres Power, AFC Energy, Topsoe, Toshiba Corp, SFC Energy, Cummins Inc , Ballard Power System Inc, Plug Power Inc, Fuelcell Energy Inc, Nuvera Fuel Cells LLC.

3. What are the main segments of the Australia Mattress Industry?

The market segments include Application, Fuel Cell Technology.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.52 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Government Supportive Policies and Incentives4.; Renewable Energy Integration.

6. What are the notable trends driving market growth?

Transportation Sector Expected to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; High Initial Costs.

8. Can you provide examples of recent developments in the market?

July 2022: the European Commission approved USD 5.47 billion in public funding for the IPCEI Hy2Tech project was jointly prepared and notified by fifteen Member States to support research, innovation, and the first industrial development in the hydrogen technology value chain. Hydrogen was expected to become one of the leading options for power generation, further expected to drive the fuel cell market.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Australia Mattress Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Australia Mattress Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Australia Mattress Industry?

To stay informed about further developments, trends, and reports in the Australia Mattress Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence