Key Insights

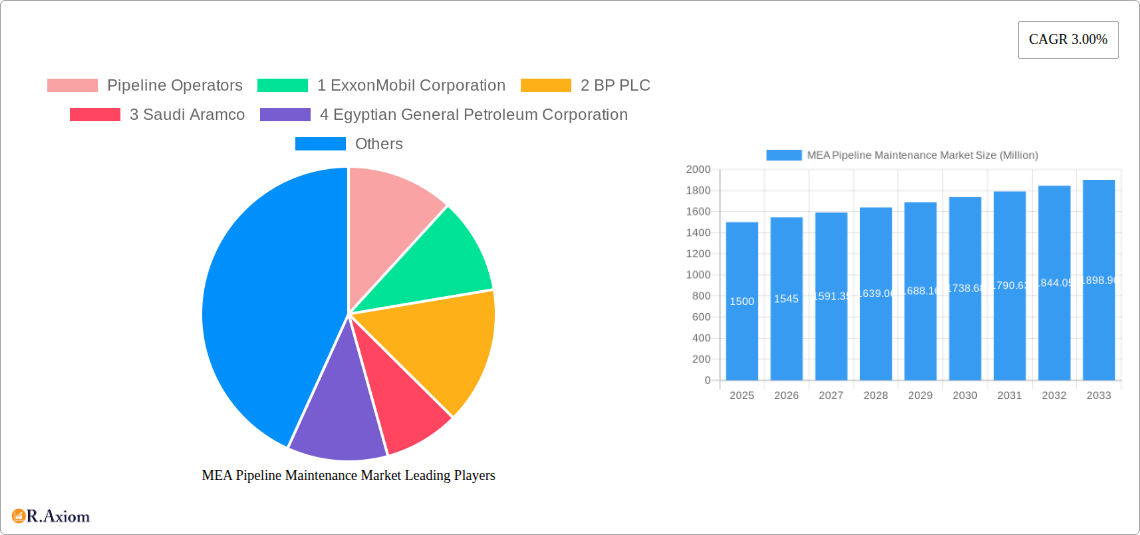

The Middle East and Africa (MEA) pipeline maintenance market is experiencing steady growth, driven by the region's significant investments in oil and gas infrastructure and the increasing demand for reliable energy transportation. The market's Compound Annual Growth Rate (CAGR) of 3.00% from 2019 to 2024 indicates a consistent expansion, projected to continue through 2033. Key drivers include aging pipeline networks requiring regular maintenance, stringent regulatory compliance mandates emphasizing safety and operational efficiency, and the ongoing development of new pipeline projects across the region. Furthermore, the rise of advanced technologies like smart pipelines and predictive maintenance strategies is contributing to market growth. Major players, including international oil companies (ExxonMobil, BP, Saudi Aramco) and specialized pipeline maintenance service providers (Arabian Pipes Company, Rezayat Group, Vallourec SA), are actively shaping the market landscape through strategic partnerships, technological innovation, and expansion into new regions within the MEA.

MEA Pipeline Maintenance Market Market Size (In Billion)

However, challenges remain. Fluctuations in oil and gas prices can impact investment in maintenance activities, while geopolitical instability and security concerns in certain regions may hinder project implementation and create operational risks. The skills gap in specialized pipeline maintenance expertise represents another hurdle to overcome. Despite these restraints, the long-term outlook for the MEA pipeline maintenance market remains positive, fueled by consistent energy demand and the need to optimize the performance and longevity of existing and new pipeline infrastructure. The focus on improving pipeline integrity management systems and adopting proactive maintenance strategies is expected to drive significant growth over the forecast period.

MEA Pipeline Maintenance Market Company Market Share

MEA Pipeline Maintenance Market: A Comprehensive Report (2019-2033)

This detailed report provides a comprehensive analysis of the MEA Pipeline Maintenance Market, offering actionable insights for industry stakeholders. Covering the period 2019-2033, with a base year of 2025 and a forecast period of 2025-2033, this report unveils the market's dynamics, growth drivers, challenges, and emerging opportunities. The study meticulously examines market concentration, innovation, trends, dominant segments, key players, and significant industry developments. The report is essential for pipeline operators, maintenance service providers, investors, and regulatory bodies seeking a deep understanding of this vital sector.

MEA Pipeline Maintenance Market Concentration & Innovation

This section analyzes the MEA pipeline maintenance market's competitive landscape, focusing on market concentration, innovation, regulatory frameworks, and market dynamics. The market exhibits a moderately concentrated structure, with a few major players holding significant market share. However, the presence of numerous smaller, specialized service providers fosters competition and innovation.

Market Concentration: While precise market share figures for individual companies are proprietary, ExxonMobil, BP PLC, Saudi Aramco, and other major pipeline operators exert significant influence on the market. The market share of the top five operators is estimated at xx%.

Innovation Drivers: Technological advancements in pipeline inspection, repair, and maintenance technologies, such as robotics, advanced materials, and data analytics, are major drivers of innovation. Stringent regulatory requirements regarding pipeline safety and environmental protection further stimulate the adoption of innovative solutions.

Regulatory Frameworks: Varying regulatory frameworks across MEA countries influence maintenance practices and compliance costs. Harmonization of regulations and increased enforcement contribute to market growth by improving safety and operational efficiency.

Product Substitutes: While direct substitutes for pipeline maintenance are limited, the increasing adoption of alternative energy sources may indirectly impact market demand over the long term.

End-User Trends: Growing demand for reliable energy transportation, coupled with aging pipeline infrastructure, fuels significant investments in pipeline maintenance. Increased focus on operational efficiency and safety are prominent end-user trends.

M&A Activities: The MEA region has witnessed several M&A activities in the pipeline sector, particularly involving the acquisition of smaller maintenance service providers by larger companies. The total value of M&A deals in the last five years is estimated to be around USD xx Billion. These activities have contributed to market consolidation and increased market concentration.

MEA Pipeline Maintenance Market Industry Trends & Insights

This section delves into the market's growth drivers, technological disruptions, and competitive dynamics. The MEA pipeline maintenance market is expected to witness robust growth driven by factors including expanding energy infrastructure, increasing investments in pipeline rehabilitation, and stringent safety regulations.

The CAGR for the forecast period (2025-2033) is projected to be xx%. Market penetration of advanced maintenance technologies, such as smart pigs and remote monitoring systems, is steadily increasing, reaching xx% in 2024, with expectations to exceed xx% by 2033. Technological disruptions, such as the adoption of advanced data analytics and AI-powered predictive maintenance, are transforming maintenance practices, leading to optimized resource allocation and reduced downtime. The market demonstrates intensified competitive dynamics, with major players continuously investing in new technologies and expanding their service offerings to gain a competitive edge. Growing awareness about environmental concerns and sustainability are also shaping industry trends.

Dominant Markets & Segments in MEA Pipeline Maintenance Market

This section identifies the leading regions, countries, and segments within the MEA pipeline maintenance market. While a precise ranking of dominance requires proprietary data analysis, the following observations are made based on industry knowledge:

Dominant Regions/Countries: Saudi Arabia and the UAE consistently rank high due to their substantial oil and gas reserves and extensive pipeline networks. Growth in other parts of the MEA, like Egypt and North African countries, also contribute significantly.

Key Drivers:

- Economic Policies: Government investments in energy infrastructure and supportive regulatory frameworks drive market growth.

- Infrastructure Development: Expansion of oil and gas pipelines and the rising need for maintenance fuel market demand.

- Geopolitical Factors: Regional stability and the continued importance of oil and gas in the region support market expansion.

The detailed analysis reveals that the dominance of certain countries or regions are primarily fueled by the level of oil and gas production and export activities as well as the age and condition of existing pipeline networks.

MEA Pipeline Maintenance Market Product Developments

Recent product innovations focus on improving pipeline inspection techniques, utilizing advanced non-destructive testing (NDT) methods like smart pigs and drones for enhanced efficiency and safety. The introduction of predictive maintenance solutions, leveraging data analytics and machine learning algorithms, optimizes maintenance schedules and minimizes downtime. These innovations lead to a significant competitive advantage, enabling companies to offer superior services and reduce operational costs for pipeline operators. Technological advancements continue to improve the accuracy, speed, and cost-effectiveness of pipeline maintenance.

Report Scope & Segmentation Analysis

This report segments the MEA pipeline maintenance market based on several key parameters.

By Pipeline Type: Crude oil pipelines, natural gas pipelines, and refined product pipelines represent distinct segments. Growth projections vary across these segments, reflecting differences in pipeline age, operating conditions, and regulatory requirements.

By Service Type: This includes inspection, repair, replacement, and other specialized maintenance services. Each service segment exhibits unique competitive dynamics and growth trajectories.

By Region: The report covers major MEA countries, analyzing their specific market characteristics, growth potential, and challenges.

Market sizes and growth projections are detailed for each segment, offering a comprehensive understanding of market segmentation.

Key Drivers of MEA Pipeline Maintenance Market Growth

Several factors drive the growth of the MEA pipeline maintenance market:

- Aging Infrastructure: A large portion of existing pipelines requires significant maintenance or replacement.

- Stringent Safety Regulations: Increased focus on safety and environmental protection necessitates higher maintenance standards.

- Technological Advancements: New technologies enable more efficient and cost-effective maintenance practices.

- Rising Energy Demand: Continued growth in energy consumption fuels the need for reliable pipeline infrastructure and maintenance.

Challenges in the MEA Pipeline Maintenance Market Sector

Several factors pose challenges to the MEA pipeline maintenance market:

- Security Concerns: Pipeline security and protection from vandalism or terrorism remain a crucial concern.

- Geopolitical Instability: Political instability in certain regions can disrupt maintenance activities.

- High Operational Costs: Maintaining extensive pipeline networks across diverse geographical terrains is expensive.

- Skill Gaps: A shortage of skilled technicians and engineers poses a significant challenge to efficient maintenance operations. The estimated cost impact due to skills shortage is projected to be USD xx Million per year.

Emerging Opportunities in MEA Pipeline Maintenance Market

Several opportunities exist in the MEA pipeline maintenance market:

- Digitalization: Adoption of digital technologies like IoT and big data analytics presents significant growth potential.

- Predictive Maintenance: Implementing predictive maintenance solutions through AI significantly optimizes maintenance schedules and cost-effectiveness.

- Green Technologies: Incorporating sustainable practices and environmentally friendly technologies improves sustainability and reduces environmental impact.

Leading Players in the MEA Pipeline Maintenance Market Market

- ExxonMobil Corporation

- BP PLC

- Saudi Aramco

- Egyptian General Petroleum Corporation

- East Mediterranean Gas Company

- Chevron Corporation

- West African Gas Pipeline Company

- SECO

- Arabian Pipes Company

- Rezayat Group

- Vallourec SA

- EEW Group

- Frontier Pipeline services

- OLEUM Process & Pipeline Services

- STATS Group

- Halliburton Company

- T D Williamson Inc

*List Not Exhaustive

Key Developments in MEA Pipeline Maintenance Market Industry

August 2022: Seplat Petroleum Development Company commenced commercial crude oil injection through the new Amukpe-Escravos Pipeline (67 km). This development improves the reliability and security of Seplat Energy's liquid export routes.

February 2022: Aramco signed a USD 15.5 Billion lease and leaseback deal for its gas pipeline network with a consortium comprising BlackRock Real Assets and Hassana Investment Company. This deal significantly impacts the market by attracting further private investment in the sector.

Strategic Outlook for MEA Pipeline Maintenance Market Market

The MEA pipeline maintenance market demonstrates significant growth potential driven by increasing energy demands, aging infrastructure, and the implementation of advanced technologies. Focus on enhancing safety, adopting sustainable practices, and optimizing operational efficiency will define future market success. Increased collaboration between pipeline operators and maintenance providers is essential for realizing this potential. The market's future growth depends significantly on regional political stability and continued investment in infrastructure development.

MEA Pipeline Maintenance Market Segmentation

-

1. Service Type

- 1.1. Pigging

- 1.2. Flushing & Chemical Cleaning

- 1.3. Pipeline Repair & Maintenance

- 1.4. Drying

- 1.5. Others

-

2. Location of Deployment

- 2.1. Onshore

- 2.2. Offshore

-

3. Geography

- 3.1. UAE

- 3.2. Algeria

- 3.3. Nigeria

- 3.4. Saudi Arabia

- 3.5. Rest of Middle East & Africa

MEA Pipeline Maintenance Market Segmentation By Geography

- 1. UAE

- 2. Algeria

- 3. Nigeria

- 4. Saudi Arabia

- 5. Rest of Middle East

MEA Pipeline Maintenance Market Regional Market Share

Geographic Coverage of MEA Pipeline Maintenance Market

MEA Pipeline Maintenance Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Pigging Segment to have a Significant Share in the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global MEA Pipeline Maintenance Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 5.1.1. Pigging

- 5.1.2. Flushing & Chemical Cleaning

- 5.1.3. Pipeline Repair & Maintenance

- 5.1.4. Drying

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Location of Deployment

- 5.2.1. Onshore

- 5.2.2. Offshore

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. UAE

- 5.3.2. Algeria

- 5.3.3. Nigeria

- 5.3.4. Saudi Arabia

- 5.3.5. Rest of Middle East & Africa

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. UAE

- 5.4.2. Algeria

- 5.4.3. Nigeria

- 5.4.4. Saudi Arabia

- 5.4.5. Rest of Middle East

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 6. UAE MEA Pipeline Maintenance Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Service Type

- 6.1.1. Pigging

- 6.1.2. Flushing & Chemical Cleaning

- 6.1.3. Pipeline Repair & Maintenance

- 6.1.4. Drying

- 6.1.5. Others

- 6.2. Market Analysis, Insights and Forecast - by Location of Deployment

- 6.2.1. Onshore

- 6.2.2. Offshore

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. UAE

- 6.3.2. Algeria

- 6.3.3. Nigeria

- 6.3.4. Saudi Arabia

- 6.3.5. Rest of Middle East & Africa

- 6.1. Market Analysis, Insights and Forecast - by Service Type

- 7. Algeria MEA Pipeline Maintenance Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Service Type

- 7.1.1. Pigging

- 7.1.2. Flushing & Chemical Cleaning

- 7.1.3. Pipeline Repair & Maintenance

- 7.1.4. Drying

- 7.1.5. Others

- 7.2. Market Analysis, Insights and Forecast - by Location of Deployment

- 7.2.1. Onshore

- 7.2.2. Offshore

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. UAE

- 7.3.2. Algeria

- 7.3.3. Nigeria

- 7.3.4. Saudi Arabia

- 7.3.5. Rest of Middle East & Africa

- 7.1. Market Analysis, Insights and Forecast - by Service Type

- 8. Nigeria MEA Pipeline Maintenance Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Service Type

- 8.1.1. Pigging

- 8.1.2. Flushing & Chemical Cleaning

- 8.1.3. Pipeline Repair & Maintenance

- 8.1.4. Drying

- 8.1.5. Others

- 8.2. Market Analysis, Insights and Forecast - by Location of Deployment

- 8.2.1. Onshore

- 8.2.2. Offshore

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. UAE

- 8.3.2. Algeria

- 8.3.3. Nigeria

- 8.3.4. Saudi Arabia

- 8.3.5. Rest of Middle East & Africa

- 8.1. Market Analysis, Insights and Forecast - by Service Type

- 9. Saudi Arabia MEA Pipeline Maintenance Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Service Type

- 9.1.1. Pigging

- 9.1.2. Flushing & Chemical Cleaning

- 9.1.3. Pipeline Repair & Maintenance

- 9.1.4. Drying

- 9.1.5. Others

- 9.2. Market Analysis, Insights and Forecast - by Location of Deployment

- 9.2.1. Onshore

- 9.2.2. Offshore

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. UAE

- 9.3.2. Algeria

- 9.3.3. Nigeria

- 9.3.4. Saudi Arabia

- 9.3.5. Rest of Middle East & Africa

- 9.1. Market Analysis, Insights and Forecast - by Service Type

- 10. Rest of Middle East MEA Pipeline Maintenance Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Service Type

- 10.1.1. Pigging

- 10.1.2. Flushing & Chemical Cleaning

- 10.1.3. Pipeline Repair & Maintenance

- 10.1.4. Drying

- 10.1.5. Others

- 10.2. Market Analysis, Insights and Forecast - by Location of Deployment

- 10.2.1. Onshore

- 10.2.2. Offshore

- 10.3. Market Analysis, Insights and Forecast - by Geography

- 10.3.1. UAE

- 10.3.2. Algeria

- 10.3.3. Nigeria

- 10.3.4. Saudi Arabia

- 10.3.5. Rest of Middle East & Africa

- 10.1. Market Analysis, Insights and Forecast - by Service Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Pipeline Operators

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 1 ExxonMobil Corporation

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 2 BP PLC

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 3 Saudi Aramco

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 4 Egyptian General Petroleum Corporation

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 5 East Mediterranean Gas Company

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 6 Chevron Corporation

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 7 West African Gas Pipeline Company

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 8 SECO

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Pipeline Maintenance Services Providers

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 1 Arabian Pipes Company

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 3 Rezayat Group

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 4 Vallourec SA

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 5 EEW Group

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 6 Frontier Pipeline services

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 7 OLEUM Process & Pipeline Services

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 8 STATS Group

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 9 Halliburton Company

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 10 T D Williamson Inc*List Not Exhaustive

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.1 Pipeline Operators

List of Figures

- Figure 1: Global MEA Pipeline Maintenance Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: UAE MEA Pipeline Maintenance Market Revenue (Million), by Service Type 2025 & 2033

- Figure 3: UAE MEA Pipeline Maintenance Market Revenue Share (%), by Service Type 2025 & 2033

- Figure 4: UAE MEA Pipeline Maintenance Market Revenue (Million), by Location of Deployment 2025 & 2033

- Figure 5: UAE MEA Pipeline Maintenance Market Revenue Share (%), by Location of Deployment 2025 & 2033

- Figure 6: UAE MEA Pipeline Maintenance Market Revenue (Million), by Geography 2025 & 2033

- Figure 7: UAE MEA Pipeline Maintenance Market Revenue Share (%), by Geography 2025 & 2033

- Figure 8: UAE MEA Pipeline Maintenance Market Revenue (Million), by Country 2025 & 2033

- Figure 9: UAE MEA Pipeline Maintenance Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Algeria MEA Pipeline Maintenance Market Revenue (Million), by Service Type 2025 & 2033

- Figure 11: Algeria MEA Pipeline Maintenance Market Revenue Share (%), by Service Type 2025 & 2033

- Figure 12: Algeria MEA Pipeline Maintenance Market Revenue (Million), by Location of Deployment 2025 & 2033

- Figure 13: Algeria MEA Pipeline Maintenance Market Revenue Share (%), by Location of Deployment 2025 & 2033

- Figure 14: Algeria MEA Pipeline Maintenance Market Revenue (Million), by Geography 2025 & 2033

- Figure 15: Algeria MEA Pipeline Maintenance Market Revenue Share (%), by Geography 2025 & 2033

- Figure 16: Algeria MEA Pipeline Maintenance Market Revenue (Million), by Country 2025 & 2033

- Figure 17: Algeria MEA Pipeline Maintenance Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Nigeria MEA Pipeline Maintenance Market Revenue (Million), by Service Type 2025 & 2033

- Figure 19: Nigeria MEA Pipeline Maintenance Market Revenue Share (%), by Service Type 2025 & 2033

- Figure 20: Nigeria MEA Pipeline Maintenance Market Revenue (Million), by Location of Deployment 2025 & 2033

- Figure 21: Nigeria MEA Pipeline Maintenance Market Revenue Share (%), by Location of Deployment 2025 & 2033

- Figure 22: Nigeria MEA Pipeline Maintenance Market Revenue (Million), by Geography 2025 & 2033

- Figure 23: Nigeria MEA Pipeline Maintenance Market Revenue Share (%), by Geography 2025 & 2033

- Figure 24: Nigeria MEA Pipeline Maintenance Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Nigeria MEA Pipeline Maintenance Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Saudi Arabia MEA Pipeline Maintenance Market Revenue (Million), by Service Type 2025 & 2033

- Figure 27: Saudi Arabia MEA Pipeline Maintenance Market Revenue Share (%), by Service Type 2025 & 2033

- Figure 28: Saudi Arabia MEA Pipeline Maintenance Market Revenue (Million), by Location of Deployment 2025 & 2033

- Figure 29: Saudi Arabia MEA Pipeline Maintenance Market Revenue Share (%), by Location of Deployment 2025 & 2033

- Figure 30: Saudi Arabia MEA Pipeline Maintenance Market Revenue (Million), by Geography 2025 & 2033

- Figure 31: Saudi Arabia MEA Pipeline Maintenance Market Revenue Share (%), by Geography 2025 & 2033

- Figure 32: Saudi Arabia MEA Pipeline Maintenance Market Revenue (Million), by Country 2025 & 2033

- Figure 33: Saudi Arabia MEA Pipeline Maintenance Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Rest of Middle East MEA Pipeline Maintenance Market Revenue (Million), by Service Type 2025 & 2033

- Figure 35: Rest of Middle East MEA Pipeline Maintenance Market Revenue Share (%), by Service Type 2025 & 2033

- Figure 36: Rest of Middle East MEA Pipeline Maintenance Market Revenue (Million), by Location of Deployment 2025 & 2033

- Figure 37: Rest of Middle East MEA Pipeline Maintenance Market Revenue Share (%), by Location of Deployment 2025 & 2033

- Figure 38: Rest of Middle East MEA Pipeline Maintenance Market Revenue (Million), by Geography 2025 & 2033

- Figure 39: Rest of Middle East MEA Pipeline Maintenance Market Revenue Share (%), by Geography 2025 & 2033

- Figure 40: Rest of Middle East MEA Pipeline Maintenance Market Revenue (Million), by Country 2025 & 2033

- Figure 41: Rest of Middle East MEA Pipeline Maintenance Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global MEA Pipeline Maintenance Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 2: Global MEA Pipeline Maintenance Market Revenue Million Forecast, by Location of Deployment 2020 & 2033

- Table 3: Global MEA Pipeline Maintenance Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 4: Global MEA Pipeline Maintenance Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global MEA Pipeline Maintenance Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 6: Global MEA Pipeline Maintenance Market Revenue Million Forecast, by Location of Deployment 2020 & 2033

- Table 7: Global MEA Pipeline Maintenance Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 8: Global MEA Pipeline Maintenance Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Global MEA Pipeline Maintenance Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 10: Global MEA Pipeline Maintenance Market Revenue Million Forecast, by Location of Deployment 2020 & 2033

- Table 11: Global MEA Pipeline Maintenance Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 12: Global MEA Pipeline Maintenance Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global MEA Pipeline Maintenance Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 14: Global MEA Pipeline Maintenance Market Revenue Million Forecast, by Location of Deployment 2020 & 2033

- Table 15: Global MEA Pipeline Maintenance Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 16: Global MEA Pipeline Maintenance Market Revenue Million Forecast, by Country 2020 & 2033

- Table 17: Global MEA Pipeline Maintenance Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 18: Global MEA Pipeline Maintenance Market Revenue Million Forecast, by Location of Deployment 2020 & 2033

- Table 19: Global MEA Pipeline Maintenance Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 20: Global MEA Pipeline Maintenance Market Revenue Million Forecast, by Country 2020 & 2033

- Table 21: Global MEA Pipeline Maintenance Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 22: Global MEA Pipeline Maintenance Market Revenue Million Forecast, by Location of Deployment 2020 & 2033

- Table 23: Global MEA Pipeline Maintenance Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 24: Global MEA Pipeline Maintenance Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the MEA Pipeline Maintenance Market?

The projected CAGR is approximately 3.00%.

2. Which companies are prominent players in the MEA Pipeline Maintenance Market?

Key companies in the market include Pipeline Operators, 1 ExxonMobil Corporation, 2 BP PLC, 3 Saudi Aramco, 4 Egyptian General Petroleum Corporation, 5 East Mediterranean Gas Company, 6 Chevron Corporation, 7 West African Gas Pipeline Company, 8 SECO, Pipeline Maintenance Services Providers, 1 Arabian Pipes Company, 3 Rezayat Group, 4 Vallourec SA, 5 EEW Group, 6 Frontier Pipeline services, 7 OLEUM Process & Pipeline Services, 8 STATS Group, 9 Halliburton Company, 10 T D Williamson Inc*List Not Exhaustive.

3. What are the main segments of the MEA Pipeline Maintenance Market?

The market segments include Service Type, Location of Deployment, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Pigging Segment to have a Significant Share in the Market.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

August 2022: Seplat Petroleum Development Company began commercial injection of crude oil through the new Amukpe-Escravos Pipeline. The 67-kilo-meter, mostly underground pipeline is expected to provide a more reliable and secure export route for liquids from Seplat Energy's major assets.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "MEA Pipeline Maintenance Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the MEA Pipeline Maintenance Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the MEA Pipeline Maintenance Market?

To stay informed about further developments, trends, and reports in the MEA Pipeline Maintenance Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence