Key Insights

The Mexican oil and gas industry, while historically significant, is currently undergoing a period of transition. The period from 2019-2024 witnessed a period of moderate growth, influenced by fluctuating global oil prices and government policy shifts. The energy reform initiated in 2013 aimed to increase private sector participation and investment, leading to a degree of initial growth. However, subsequent policy changes have created uncertainty, impacting investor confidence and potentially slowing growth compared to initial projections. Production levels, particularly in crude oil, have remained relatively stable but haven't achieved the substantial increases initially envisioned. Natural gas production has shown more consistent growth driven by increasing domestic demand and opportunities in the petrochemical sector. Challenges remain, including aging infrastructure requiring significant investment, environmental concerns regarding emissions, and the need for technological advancements to improve efficiency and access to reserves in more challenging geographical locations.

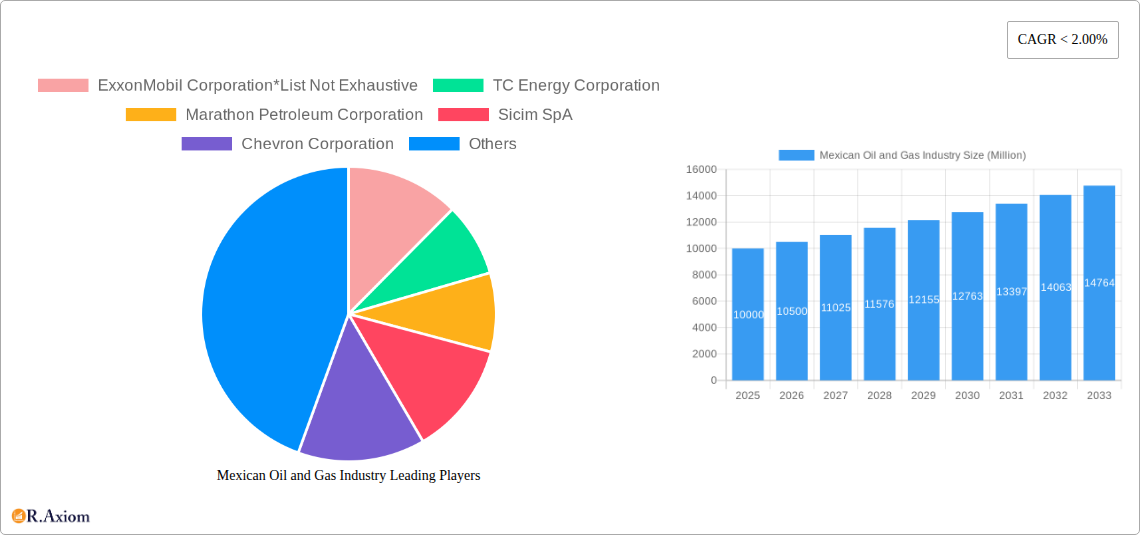

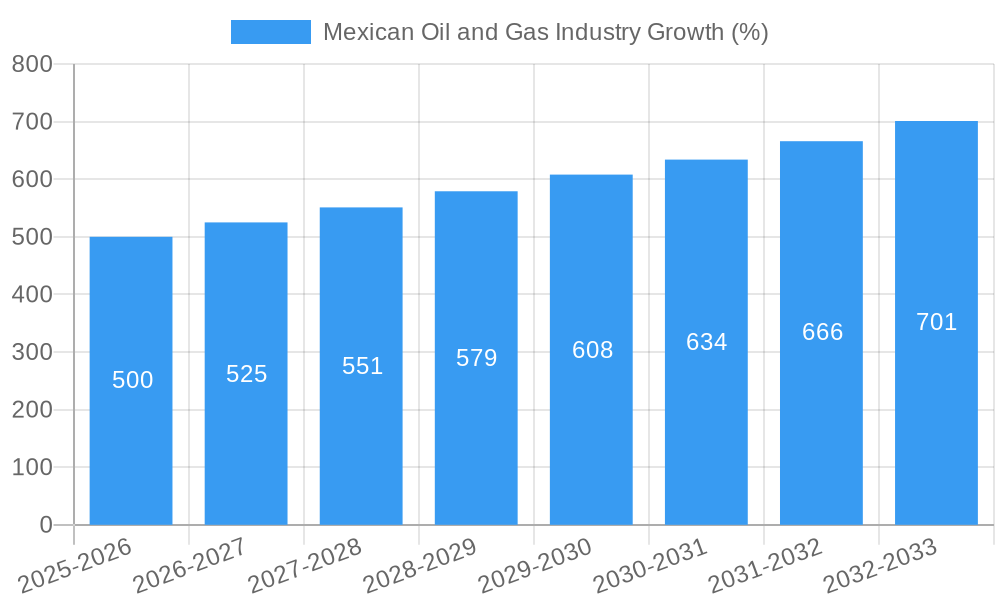

Looking forward to 2025-2033, moderate growth is projected, though the exact CAGR is difficult to definitively state without specific market size figures. Given the existing challenges and the need for substantial investment in infrastructure modernization and exploration, a conservative growth trajectory is anticipated. The success of future growth hinges on attracting further foreign investment, streamlining regulatory processes, and adopting sustainable practices to mitigate environmental impacts. The focus will likely be on enhancing natural gas production to meet rising domestic energy demands and leveraging existing infrastructure to support downstream activities. Furthermore, Mexico's geographical proximity to the US market offers a strategic advantage, provided that infrastructure and regulatory frameworks are adequately developed.

Mexican Oil and Gas Industry: A Comprehensive Market Report (2019-2033)

This detailed report provides a comprehensive analysis of the Mexican oil and gas industry, covering market dynamics, key players, and future growth prospects. The study period spans from 2019 to 2033, with a base year of 2025 and a forecast period from 2025 to 2033. This in-depth analysis is essential for industry stakeholders, investors, and strategic decision-makers seeking to understand the complexities and opportunities within this dynamic market. The report utilizes data from the historical period (2019-2024) to provide a robust foundation for future projections.

Mexican Oil and Gas Industry Market Concentration & Innovation

This section analyzes the competitive landscape of the Mexican oil and gas industry, examining market concentration, innovation drivers, regulatory frameworks, and recent mergers and acquisitions (M&A) activities. The report explores the impact of these factors on market dynamics and future growth.

Market Concentration: The Mexican oil and gas market exhibits a concentrated structure, with Pemex holding a significant market share, although the degree of concentration varies across upstream, midstream, and downstream segments. The report quantifies market share for key players and analyzes the level of competition within each segment. Data on market share for xx Million barrels of oil equivalent (Mboe) will be provided, showing Pemex's dominance and the relative positions of international players such as ExxonMobil and Chevron.

Innovation Drivers: Technological advancements such as enhanced oil recovery (EOR) techniques and the development of renewable energy sources are driving innovation. Government policies promoting energy diversification and environmental sustainability are also significant drivers. The report will detail specific examples of technological innovations impacting the industry.

Regulatory Framework: Mexico's regulatory framework significantly influences industry dynamics. The report assesses the impact of evolving regulations on investment decisions, production levels, and overall market competitiveness. Specific regulatory changes and their influence on M&A activities will be included. This will include a discussion on the impact of the Energy Reform.

Product Substitutes: The increasing adoption of renewable energy sources and the development of alternative fuels pose a challenge to traditional oil and gas products. The report assesses the impact of these substitutes on market demand and explores potential shifts in the industry.

End-User Trends: Changes in energy consumption patterns and evolving industrial demands will influence future growth in the sector. The report analyzes these trends and their implications for industry players.

M&A Activities: The report analyzes recent M&A activities in the Mexican oil and gas sector, including deal values (estimated at xx Million USD for the period) and their impact on market consolidation and competition. Key transactions will be detailed, including their strategic implications for involved companies.

Mexican Oil and Gas Industry Industry Trends & Insights

This section delves into the key trends shaping the Mexican oil and gas industry, focusing on market growth drivers, technological disruptions, consumer preferences, and competitive dynamics. The report will provide quantitative data to support its findings.

The Mexican oil and gas market is expected to experience a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is driven by factors such as increasing domestic energy demand, government initiatives to boost energy production, and ongoing investments in infrastructure development. The report details these market growth drivers in depth, assessing the contributions of each. The impact of government initiatives such as energy reform will be analyzed, along with their expected effect on market penetration of various segments and players. Technological disruptions, such as the adoption of automation and digitalization, will be studied. Further, changes in consumer preferences regarding sustainable energy sources will be considered. Finally, the report will assess the competitive dynamics between state-owned Pemex and private players, evaluating their market strategies.

Dominant Markets & Segments in Mexican Oil and Gas Industry

This section identifies the leading regions, countries, and segments within the Mexican oil and gas industry based on Type (Upstream, Midstream, Downstream) and Product (Crude Oil, Natural Gas, Petrochemicals). The analysis will highlight key factors contributing to the dominance of specific segments.

- Dominant Segment: The upstream segment is expected to remain the largest segment, contributing xx% of the total market value in 2025. However, this dominance might be challenged by government initiatives to develop infrastructure in the midstream and downstream sectors.

Key Drivers of Segment Dominance:

- Upstream: Significant hydrocarbon reserves, government investment in exploration and production activities.

- Midstream: Growing investment in pipeline infrastructure, increasing demand for natural gas transportation.

- Downstream: Expansion of refining capacity, growth in the petrochemical industry.

Dominant Product: Crude oil is expected to remain the dominant product, contributing xx% of the total market value. Natural gas will experience strong growth driven by increased domestic demand and export opportunities, while the petrochemical sector will continue to expand, driven by increased plastics production.

Mexican Oil and Gas Industry Product Developments

The Mexican oil and gas industry is witnessing significant product innovation, driven by technological advancements and evolving market needs. The focus is on improving efficiency, reducing environmental impact, and meeting growing demand for cleaner energy solutions. This includes advancements in Enhanced Oil Recovery (EOR) techniques to increase extraction from mature fields and the development of natural gas infrastructure.

Report Scope & Segmentation Analysis

This report segments the Mexican oil and gas market by Type (Upstream, Midstream, Downstream) and Product (Crude Oil, Natural Gas, Petrochemicals).

Upstream: This segment encompasses exploration, development, and production of crude oil and natural gas. Growth is projected to be xx% CAGR from 2025-2033, driven by investment in new exploration and production projects. Competition is mainly between Pemex and international oil companies.

Midstream: This segment involves the transportation, storage, and processing of oil and gas. Growth is projected to be xx% CAGR from 2025-2033, driven by expanding pipeline networks and gas processing facilities. Competition is relatively concentrated amongst a few major pipeline operators and storage companies.

Downstream: This segment includes refining, petrochemical production, and distribution of finished products. Growth is projected at xx% CAGR from 2025-2033, fueled by increased demand for refined products and petrochemicals. Competition is fierce, with a mix of state-owned and private refineries vying for market share.

Key Drivers of Mexican Oil and Gas Industry Growth

The growth of the Mexican oil and gas industry is fueled by several factors, including: increasing domestic energy demand, government support for exploration and production activities, and significant foreign direct investment (FDI) inflows. Further, technological advancements in enhanced oil recovery (EOR) techniques and the development of new infrastructure, including pipelines and refineries, are key contributors to market expansion. These factors are expected to drive growth over the forecast period.

Challenges in the Mexican Oil and Gas Industry Sector

The Mexican oil and gas industry faces several challenges, including infrastructure limitations which constrain production and transportation, high operational costs, and environmental concerns. Competition from renewable energy sources and regulatory uncertainty also pose significant risks. The decline in Pemex's production capacity is another major challenge and the impact of these factors on investment and economic activity needs further investigation.

Emerging Opportunities in Mexican Oil and Gas Industry

The Mexican oil and gas industry presents several emerging opportunities, including the development of unconventional resources like shale gas, growth in the petrochemical sector, and increased exports of natural gas. The rising demand for cleaner energy and the development of carbon capture and storage (CCS) technologies provide further growth avenues.

Leading Players in the Mexican Oil and Gas Industry Market

- ExxonMobil Corporation

- TC Energy Corporation

- Marathon Petroleum Corporation

- Sicim SpA

- Chevron Corporation

- Saipem SpA

- Citla Energy

- TotalEnergies SE

- Royal Dutch Shell PLC

- Petroleos Mexicanos (Pemex)

- BP PLC

- Sempra Energy

Key Developments in Mexican Oil and Gas Industry Industry

- January 2021: Braskem Idesa partially restored operations at the Etileno XXI petrochemical complex after a natural gas supply cut.

- August 2021: Mexico's state power utility partnered with TC Energy Corp. to develop a natural gas pipeline in the south.

Strategic Outlook for Mexican Oil and Gas Industry Market

The Mexican oil and gas industry is poised for continued growth, driven by increasing domestic demand, strategic investments in infrastructure development, and the potential for increased exports. However, navigating the challenges related to infrastructure, regulatory changes, and competition from renewable energy sources will be crucial for sustained success. The focus on technological innovation and diversification will be vital for players seeking to maintain competitiveness and capitalise on emerging opportunities in the market.

Mexican Oil and Gas Industry Segmentation

- 1. Upstream (Exploration and Production)

- 2. Midstream (Pipeline and LNG Terminals)

- 3. Downstre

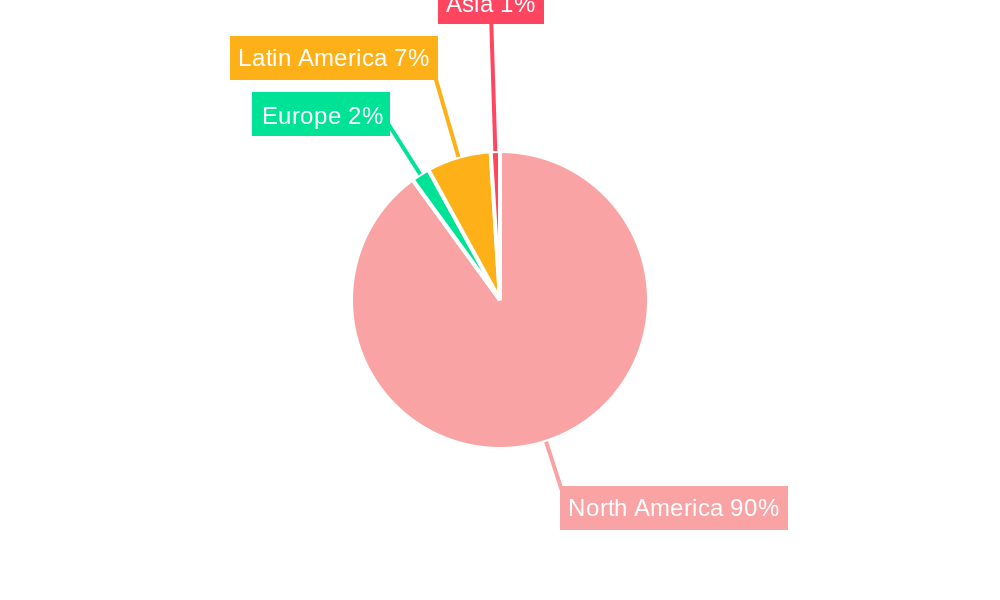

Mexican Oil and Gas Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Mexican Oil and Gas Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of < 2.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 4.; Recovering Number of Air Passengers

- 3.2.2 on Account of the Cheaper Airfare in Recent Times4.; Increasing Disposable Income of Population

- 3.3. Market Restrains

- 3.3.1. 4.; High Share of Fossil-Fuel-Based Aviation Fuels in South American Countries

- 3.4. Market Trends

- 3.4.1. Upstream Segment Expected to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Mexican Oil and Gas Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Upstream (Exploration and Production)

- 5.2. Market Analysis, Insights and Forecast - by Midstream (Pipeline and LNG Terminals)

- 5.3. Market Analysis, Insights and Forecast - by Downstre

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Upstream (Exploration and Production)

- 6. North America Mexican Oil and Gas Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Upstream (Exploration and Production)

- 6.2. Market Analysis, Insights and Forecast - by Midstream (Pipeline and LNG Terminals)

- 6.3. Market Analysis, Insights and Forecast - by Downstre

- 6.1. Market Analysis, Insights and Forecast - by Upstream (Exploration and Production)

- 7. South America Mexican Oil and Gas Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Upstream (Exploration and Production)

- 7.2. Market Analysis, Insights and Forecast - by Midstream (Pipeline and LNG Terminals)

- 7.3. Market Analysis, Insights and Forecast - by Downstre

- 7.1. Market Analysis, Insights and Forecast - by Upstream (Exploration and Production)

- 8. Europe Mexican Oil and Gas Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Upstream (Exploration and Production)

- 8.2. Market Analysis, Insights and Forecast - by Midstream (Pipeline and LNG Terminals)

- 8.3. Market Analysis, Insights and Forecast - by Downstre

- 8.1. Market Analysis, Insights and Forecast - by Upstream (Exploration and Production)

- 9. Middle East & Africa Mexican Oil and Gas Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Upstream (Exploration and Production)

- 9.2. Market Analysis, Insights and Forecast - by Midstream (Pipeline and LNG Terminals)

- 9.3. Market Analysis, Insights and Forecast - by Downstre

- 9.1. Market Analysis, Insights and Forecast - by Upstream (Exploration and Production)

- 10. Asia Pacific Mexican Oil and Gas Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Upstream (Exploration and Production)

- 10.2. Market Analysis, Insights and Forecast - by Midstream (Pipeline and LNG Terminals)

- 10.3. Market Analysis, Insights and Forecast - by Downstre

- 10.1. Market Analysis, Insights and Forecast - by Upstream (Exploration and Production)

- 11. Brazil Mexican Oil and Gas Industry Analysis, Insights and Forecast, 2019-2031

- 12. Argentina Mexican Oil and Gas Industry Analysis, Insights and Forecast, 2019-2031

- 13. Rest of South America Mexican Oil and Gas Industry Analysis, Insights and Forecast, 2019-2031

- 14. Competitive Analysis

- 14.1. Global Market Share Analysis 2024

- 14.2. Company Profiles

- 14.2.1 ExxonMobil Corporation*List Not Exhaustive

- 14.2.1.1. Overview

- 14.2.1.2. Products

- 14.2.1.3. SWOT Analysis

- 14.2.1.4. Recent Developments

- 14.2.1.5. Financials (Based on Availability)

- 14.2.2 TC Energy Corporation

- 14.2.2.1. Overview

- 14.2.2.2. Products

- 14.2.2.3. SWOT Analysis

- 14.2.2.4. Recent Developments

- 14.2.2.5. Financials (Based on Availability)

- 14.2.3 Marathon Petroleum Corporation

- 14.2.3.1. Overview

- 14.2.3.2. Products

- 14.2.3.3. SWOT Analysis

- 14.2.3.4. Recent Developments

- 14.2.3.5. Financials (Based on Availability)

- 14.2.4 Sicim SpA

- 14.2.4.1. Overview

- 14.2.4.2. Products

- 14.2.4.3. SWOT Analysis

- 14.2.4.4. Recent Developments

- 14.2.4.5. Financials (Based on Availability)

- 14.2.5 Chevron Corporation

- 14.2.5.1. Overview

- 14.2.5.2. Products

- 14.2.5.3. SWOT Analysis

- 14.2.5.4. Recent Developments

- 14.2.5.5. Financials (Based on Availability)

- 14.2.6 Saipem SpA

- 14.2.6.1. Overview

- 14.2.6.2. Products

- 14.2.6.3. SWOT Analysis

- 14.2.6.4. Recent Developments

- 14.2.6.5. Financials (Based on Availability)

- 14.2.7 Citla Energy

- 14.2.7.1. Overview

- 14.2.7.2. Products

- 14.2.7.3. SWOT Analysis

- 14.2.7.4. Recent Developments

- 14.2.7.5. Financials (Based on Availability)

- 14.2.8 TotalEnergies SE

- 14.2.8.1. Overview

- 14.2.8.2. Products

- 14.2.8.3. SWOT Analysis

- 14.2.8.4. Recent Developments

- 14.2.8.5. Financials (Based on Availability)

- 14.2.9 Royal Dutch Shell PLC

- 14.2.9.1. Overview

- 14.2.9.2. Products

- 14.2.9.3. SWOT Analysis

- 14.2.9.4. Recent Developments

- 14.2.9.5. Financials (Based on Availability)

- 14.2.10 Petroleos Mexicanos (Pemex)

- 14.2.10.1. Overview

- 14.2.10.2. Products

- 14.2.10.3. SWOT Analysis

- 14.2.10.4. Recent Developments

- 14.2.10.5. Financials (Based on Availability)

- 14.2.11 BP PLC

- 14.2.11.1. Overview

- 14.2.11.2. Products

- 14.2.11.3. SWOT Analysis

- 14.2.11.4. Recent Developments

- 14.2.11.5. Financials (Based on Availability)

- 14.2.12 Sempra Energy

- 14.2.12.1. Overview

- 14.2.12.2. Products

- 14.2.12.3. SWOT Analysis

- 14.2.12.4. Recent Developments

- 14.2.12.5. Financials (Based on Availability)

- 14.2.1 ExxonMobil Corporation*List Not Exhaustive

List of Figures

- Figure 1: Global Mexican Oil and Gas Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: South America Mexican Oil and Gas Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: South America Mexican Oil and Gas Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: North America Mexican Oil and Gas Industry Revenue (Million), by Upstream (Exploration and Production) 2024 & 2032

- Figure 5: North America Mexican Oil and Gas Industry Revenue Share (%), by Upstream (Exploration and Production) 2024 & 2032

- Figure 6: North America Mexican Oil and Gas Industry Revenue (Million), by Midstream (Pipeline and LNG Terminals) 2024 & 2032

- Figure 7: North America Mexican Oil and Gas Industry Revenue Share (%), by Midstream (Pipeline and LNG Terminals) 2024 & 2032

- Figure 8: North America Mexican Oil and Gas Industry Revenue (Million), by Downstre 2024 & 2032

- Figure 9: North America Mexican Oil and Gas Industry Revenue Share (%), by Downstre 2024 & 2032

- Figure 10: North America Mexican Oil and Gas Industry Revenue (Million), by Country 2024 & 2032

- Figure 11: North America Mexican Oil and Gas Industry Revenue Share (%), by Country 2024 & 2032

- Figure 12: South America Mexican Oil and Gas Industry Revenue (Million), by Upstream (Exploration and Production) 2024 & 2032

- Figure 13: South America Mexican Oil and Gas Industry Revenue Share (%), by Upstream (Exploration and Production) 2024 & 2032

- Figure 14: South America Mexican Oil and Gas Industry Revenue (Million), by Midstream (Pipeline and LNG Terminals) 2024 & 2032

- Figure 15: South America Mexican Oil and Gas Industry Revenue Share (%), by Midstream (Pipeline and LNG Terminals) 2024 & 2032

- Figure 16: South America Mexican Oil and Gas Industry Revenue (Million), by Downstre 2024 & 2032

- Figure 17: South America Mexican Oil and Gas Industry Revenue Share (%), by Downstre 2024 & 2032

- Figure 18: South America Mexican Oil and Gas Industry Revenue (Million), by Country 2024 & 2032

- Figure 19: South America Mexican Oil and Gas Industry Revenue Share (%), by Country 2024 & 2032

- Figure 20: Europe Mexican Oil and Gas Industry Revenue (Million), by Upstream (Exploration and Production) 2024 & 2032

- Figure 21: Europe Mexican Oil and Gas Industry Revenue Share (%), by Upstream (Exploration and Production) 2024 & 2032

- Figure 22: Europe Mexican Oil and Gas Industry Revenue (Million), by Midstream (Pipeline and LNG Terminals) 2024 & 2032

- Figure 23: Europe Mexican Oil and Gas Industry Revenue Share (%), by Midstream (Pipeline and LNG Terminals) 2024 & 2032

- Figure 24: Europe Mexican Oil and Gas Industry Revenue (Million), by Downstre 2024 & 2032

- Figure 25: Europe Mexican Oil and Gas Industry Revenue Share (%), by Downstre 2024 & 2032

- Figure 26: Europe Mexican Oil and Gas Industry Revenue (Million), by Country 2024 & 2032

- Figure 27: Europe Mexican Oil and Gas Industry Revenue Share (%), by Country 2024 & 2032

- Figure 28: Middle East & Africa Mexican Oil and Gas Industry Revenue (Million), by Upstream (Exploration and Production) 2024 & 2032

- Figure 29: Middle East & Africa Mexican Oil and Gas Industry Revenue Share (%), by Upstream (Exploration and Production) 2024 & 2032

- Figure 30: Middle East & Africa Mexican Oil and Gas Industry Revenue (Million), by Midstream (Pipeline and LNG Terminals) 2024 & 2032

- Figure 31: Middle East & Africa Mexican Oil and Gas Industry Revenue Share (%), by Midstream (Pipeline and LNG Terminals) 2024 & 2032

- Figure 32: Middle East & Africa Mexican Oil and Gas Industry Revenue (Million), by Downstre 2024 & 2032

- Figure 33: Middle East & Africa Mexican Oil and Gas Industry Revenue Share (%), by Downstre 2024 & 2032

- Figure 34: Middle East & Africa Mexican Oil and Gas Industry Revenue (Million), by Country 2024 & 2032

- Figure 35: Middle East & Africa Mexican Oil and Gas Industry Revenue Share (%), by Country 2024 & 2032

- Figure 36: Asia Pacific Mexican Oil and Gas Industry Revenue (Million), by Upstream (Exploration and Production) 2024 & 2032

- Figure 37: Asia Pacific Mexican Oil and Gas Industry Revenue Share (%), by Upstream (Exploration and Production) 2024 & 2032

- Figure 38: Asia Pacific Mexican Oil and Gas Industry Revenue (Million), by Midstream (Pipeline and LNG Terminals) 2024 & 2032

- Figure 39: Asia Pacific Mexican Oil and Gas Industry Revenue Share (%), by Midstream (Pipeline and LNG Terminals) 2024 & 2032

- Figure 40: Asia Pacific Mexican Oil and Gas Industry Revenue (Million), by Downstre 2024 & 2032

- Figure 41: Asia Pacific Mexican Oil and Gas Industry Revenue Share (%), by Downstre 2024 & 2032

- Figure 42: Asia Pacific Mexican Oil and Gas Industry Revenue (Million), by Country 2024 & 2032

- Figure 43: Asia Pacific Mexican Oil and Gas Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Mexican Oil and Gas Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Mexican Oil and Gas Industry Revenue Million Forecast, by Upstream (Exploration and Production) 2019 & 2032

- Table 3: Global Mexican Oil and Gas Industry Revenue Million Forecast, by Midstream (Pipeline and LNG Terminals) 2019 & 2032

- Table 4: Global Mexican Oil and Gas Industry Revenue Million Forecast, by Downstre 2019 & 2032

- Table 5: Global Mexican Oil and Gas Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Global Mexican Oil and Gas Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Brazil Mexican Oil and Gas Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Argentina Mexican Oil and Gas Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Rest of South America Mexican Oil and Gas Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Global Mexican Oil and Gas Industry Revenue Million Forecast, by Upstream (Exploration and Production) 2019 & 2032

- Table 11: Global Mexican Oil and Gas Industry Revenue Million Forecast, by Midstream (Pipeline and LNG Terminals) 2019 & 2032

- Table 12: Global Mexican Oil and Gas Industry Revenue Million Forecast, by Downstre 2019 & 2032

- Table 13: Global Mexican Oil and Gas Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 14: United States Mexican Oil and Gas Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Canada Mexican Oil and Gas Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Mexico Mexican Oil and Gas Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Global Mexican Oil and Gas Industry Revenue Million Forecast, by Upstream (Exploration and Production) 2019 & 2032

- Table 18: Global Mexican Oil and Gas Industry Revenue Million Forecast, by Midstream (Pipeline and LNG Terminals) 2019 & 2032

- Table 19: Global Mexican Oil and Gas Industry Revenue Million Forecast, by Downstre 2019 & 2032

- Table 20: Global Mexican Oil and Gas Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 21: Brazil Mexican Oil and Gas Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Argentina Mexican Oil and Gas Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Rest of South America Mexican Oil and Gas Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Global Mexican Oil and Gas Industry Revenue Million Forecast, by Upstream (Exploration and Production) 2019 & 2032

- Table 25: Global Mexican Oil and Gas Industry Revenue Million Forecast, by Midstream (Pipeline and LNG Terminals) 2019 & 2032

- Table 26: Global Mexican Oil and Gas Industry Revenue Million Forecast, by Downstre 2019 & 2032

- Table 27: Global Mexican Oil and Gas Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 28: United Kingdom Mexican Oil and Gas Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Germany Mexican Oil and Gas Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: France Mexican Oil and Gas Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Italy Mexican Oil and Gas Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Spain Mexican Oil and Gas Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Russia Mexican Oil and Gas Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Benelux Mexican Oil and Gas Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: Nordics Mexican Oil and Gas Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Rest of Europe Mexican Oil and Gas Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Global Mexican Oil and Gas Industry Revenue Million Forecast, by Upstream (Exploration and Production) 2019 & 2032

- Table 38: Global Mexican Oil and Gas Industry Revenue Million Forecast, by Midstream (Pipeline and LNG Terminals) 2019 & 2032

- Table 39: Global Mexican Oil and Gas Industry Revenue Million Forecast, by Downstre 2019 & 2032

- Table 40: Global Mexican Oil and Gas Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 41: Turkey Mexican Oil and Gas Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Israel Mexican Oil and Gas Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: GCC Mexican Oil and Gas Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: North Africa Mexican Oil and Gas Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: South Africa Mexican Oil and Gas Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Rest of Middle East & Africa Mexican Oil and Gas Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: Global Mexican Oil and Gas Industry Revenue Million Forecast, by Upstream (Exploration and Production) 2019 & 2032

- Table 48: Global Mexican Oil and Gas Industry Revenue Million Forecast, by Midstream (Pipeline and LNG Terminals) 2019 & 2032

- Table 49: Global Mexican Oil and Gas Industry Revenue Million Forecast, by Downstre 2019 & 2032

- Table 50: Global Mexican Oil and Gas Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 51: China Mexican Oil and Gas Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: India Mexican Oil and Gas Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 53: Japan Mexican Oil and Gas Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: South Korea Mexican Oil and Gas Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 55: ASEAN Mexican Oil and Gas Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 56: Oceania Mexican Oil and Gas Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 57: Rest of Asia Pacific Mexican Oil and Gas Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Mexican Oil and Gas Industry?

The projected CAGR is approximately < 2.00%.

2. Which companies are prominent players in the Mexican Oil and Gas Industry?

Key companies in the market include ExxonMobil Corporation*List Not Exhaustive, TC Energy Corporation, Marathon Petroleum Corporation, Sicim SpA, Chevron Corporation, Saipem SpA, Citla Energy, TotalEnergies SE, Royal Dutch Shell PLC, Petroleos Mexicanos (Pemex), BP PLC, Sempra Energy.

3. What are the main segments of the Mexican Oil and Gas Industry?

The market segments include Upstream (Exploration and Production), Midstream (Pipeline and LNG Terminals), Downstre.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Recovering Number of Air Passengers. on Account of the Cheaper Airfare in Recent Times4.; Increasing Disposable Income of Population.

6. What are the notable trends driving market growth?

Upstream Segment Expected to Witness Significant Growth.

7. Are there any restraints impacting market growth?

4.; High Share of Fossil-Fuel-Based Aviation Fuels in South American Countries.

8. Can you provide examples of recent developments in the market?

In January 2021, Braskem Idesa announced that it had partially restored the operations at Etileno XXI polyethylene petrochemical complex, which was shut down in December 2020 due to natural gas supply cut by Cengas, a major natural gas system operator of Mexico. Braskem further stated that it had restarted operations in an experimental business model, complying with all the safety standards to reduce the impact on Mexico's plastics industry supply chain.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Mexican Oil and Gas Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Mexican Oil and Gas Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Mexican Oil and Gas Industry?

To stay informed about further developments, trends, and reports in the Mexican Oil and Gas Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence