Key Insights

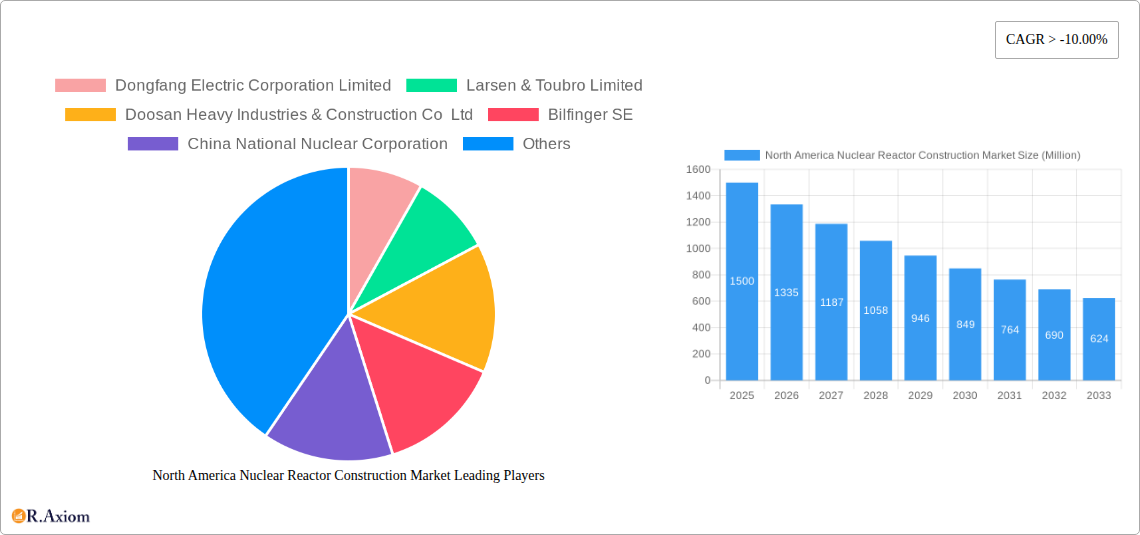

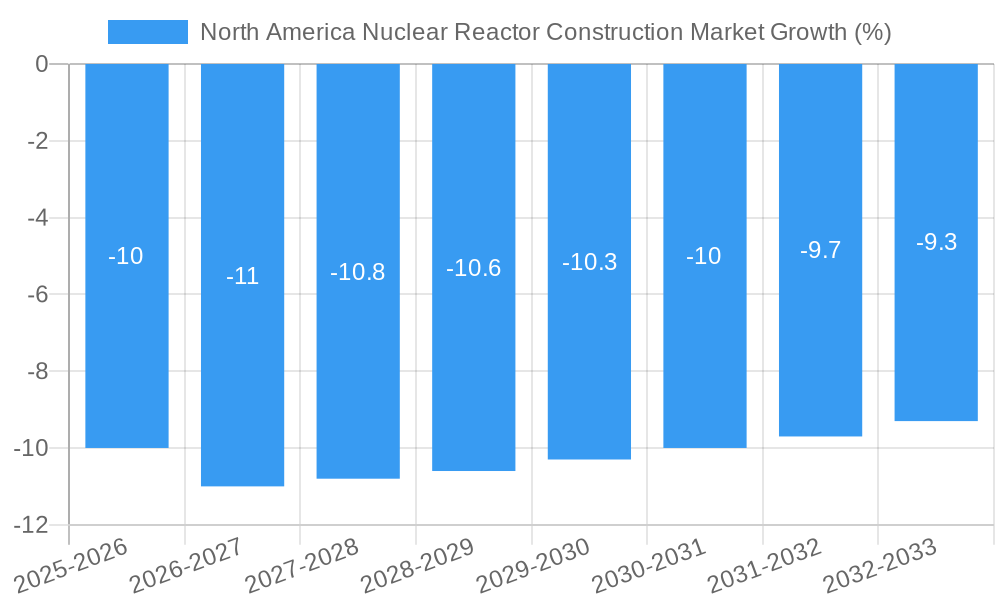

The North American nuclear reactor construction market, while facing a negative CAGR of over 10%, presents a complex landscape with both challenges and opportunities. The decline, observed between 2019 and 2024, is likely attributable to factors such as high initial investment costs, stringent regulatory hurdles, and public perception concerns surrounding nuclear safety. However, several drivers are poised to influence future growth. These include increasing concerns about energy security and climate change, leading to a renewed focus on carbon-free energy sources. Furthermore, advancements in reactor technology, such as Small Modular Reactors (SMRs), offer improved safety features, reduced construction times, and potentially lower costs, making nuclear power a more attractive proposition. The segment breakdown reveals a diversified market, with Pressurized Water Reactors (PWRs) likely maintaining a significant share due to their established technology and widespread adoption. However, other reactor types, including Pressurized Heavy Water Reactors (PHWRs) and potentially SMRs, are expected to gain traction in the coming years, driven by technological advancements and specific regional needs. Key players like Westinghouse, GE-Hitachi, and others are strategically positioned to benefit from these evolving market dynamics, focusing on innovation, regulatory compliance, and project management capabilities.

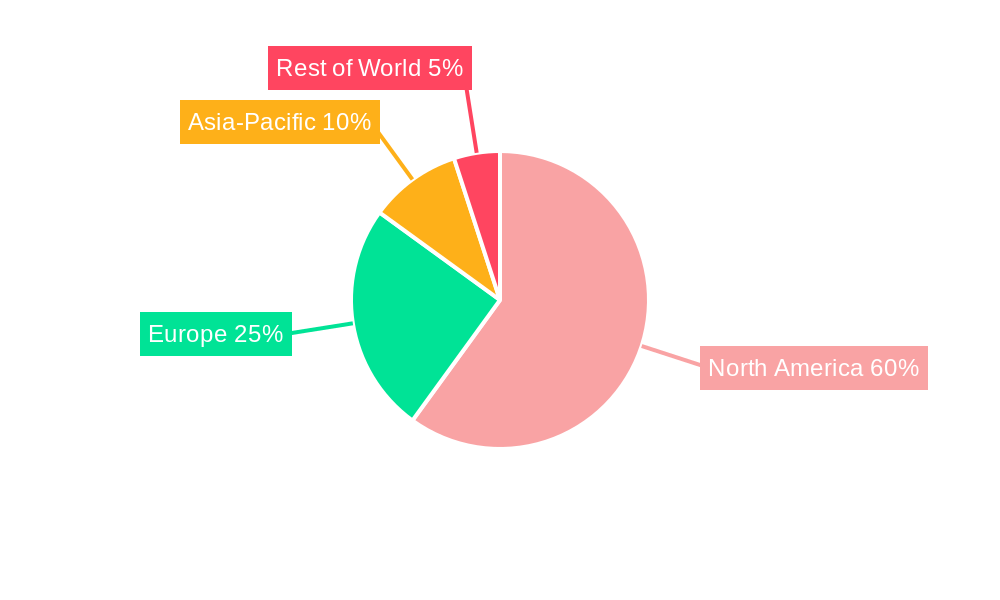

Despite the negative CAGR, the market is not entirely stagnant. The long-term outlook remains contingent on government policies supporting nuclear energy, successful deployment of advanced reactor designs, and overcoming public perception challenges. While the overall market size in 2025 may be smaller than in previous years (let's assume, for illustrative purposes, a market size of $1.5 billion based on a projected decline), strategic investments in SMR technology and supportive regulations could significantly shift the trajectory towards positive growth in the latter half of the forecast period (2025-2033). The competition among major players remains intense, with companies focusing on developing cost-effective and safe reactor technologies to capture market share. North America, with its established nuclear infrastructure and potential for SMR deployment, is expected to retain a significant portion of the regional market share, even within a contracting overall market.

North America Nuclear Reactor Construction Market: A Comprehensive Report (2019-2033)

This detailed report provides an in-depth analysis of the North America nuclear reactor construction market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033, this report meticulously examines market dynamics, segmentation, competitive landscape, and future growth potential.

North America Nuclear Reactor Construction Market Concentration & Innovation

This section analyzes the market concentration, innovation drivers, regulatory frameworks, product substitutes, end-user trends, and M&A activities within the North American nuclear reactor construction market. The market exhibits a moderately concentrated structure, with a few key players holding significant market share. The leading companies, including Electricite de France SA (EDF), Westinghouse Electric Company LLC (Toshiba), and GE-Hitachi Nuclear Energy Inc, compete based on technological advancements, project execution capabilities, and regulatory compliance. Market share analysis reveals that EDF holds approximately xx% of the market, Westinghouse xx%, and GE-Hitachi xx%, while other players collectively account for the remaining xx%.

Innovation is driven by the need for safer, more efficient, and cost-effective reactor designs. Regulatory frameworks, particularly those concerning safety and environmental impact, significantly influence technological advancements and market entry. The ongoing development of Small Modular Reactors (SMRs) represents a key area of innovation, promising improved safety and reduced capital costs. The lack of viable substitutes for nuclear energy in large-scale power generation reinforces the market’s long-term growth potential. Recent M&A activities, with a total estimated value of $xx Million over the past five years, reflects consolidation among industry players seeking to enhance their market position and technological capabilities. Key mergers include [mention specific M&A deals if available with estimated values]. End-user trends show a growing preference for advanced reactor designs that improve operational efficiency and reduce waste generation.

North America Nuclear Reactor Construction Market Industry Trends & Insights

The North American nuclear reactor construction market is experiencing a period of moderate growth, driven by factors such as increasing energy demand, concerns over climate change, and the need for reliable baseload power. The market is expected to witness a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is propelled by government initiatives promoting nuclear energy as a clean energy source, coupled with advancements in reactor technology. Technological disruptions, such as the development of SMRs and advanced reactor designs, are reshaping the market landscape and creating new opportunities. Market penetration of advanced reactor designs is currently at xx%, but is projected to increase to xx% by 2033. Competitive dynamics are characterized by intense competition among established players and the emergence of new entrants offering innovative solutions. Consumer preferences are shifting toward environmentally friendly energy sources, increasing the demand for safer and more sustainable nuclear power plants.

Dominant Markets & Segments in North America Nuclear Reactor Construction Market

The United States is the dominant market within North America for nuclear reactor construction, owing to its large energy demand, existing nuclear infrastructure, and government support for nuclear energy.

Key Drivers for U.S. Dominance:

- Favorable government policies and regulatory frameworks.

- Extensive existing nuclear infrastructure and expertise.

- Strong demand for reliable baseload power.

- Significant investments in research and development.

Segment Analysis:

- Service: Equipment segment holds a larger market share compared to the installation segment, primarily due to the high capital expenditure required for reactor construction and continuous maintenance. The equipment segment is projected to grow at a CAGR of xx% during the forecast period.

- Reactor Type: Pressurized Water Reactors (PWRs) currently dominate the market, followed by Boiling Water Reactors (BWRs). However, the market share of SMRs, including PWR and BWR designs, is expected to increase significantly due to their enhanced safety features and reduced capital costs. The adoption of other reactor types such as PHWRs, HTGRs, and LMFBRs is currently limited, but the future may see increased adoption. The PWR segment is anticipated to experience a CAGR of xx% over the forecast period.

North America Nuclear Reactor Construction Market Product Developments

Recent advancements in reactor technology focus on improving safety, efficiency, and reducing waste generation. Key innovations include the development of SMRs, advanced fuel cycles, and passive safety systems. These improvements enhance the market competitiveness of nuclear power, addressing past concerns related to safety and waste disposal. The growing emphasis on cost reduction and operational simplicity makes advanced reactor designs attractive to utilities and governments alike.

Report Scope & Segmentation Analysis

This report segments the North American nuclear reactor construction market based on service (equipment and installation) and reactor type (PWR, PHWR, BWR, HTGR, LMFBR). Each segment is analyzed based on historical data, current market trends, and growth projections. The report estimates the market size for each segment, offering detailed competitive analysis, including market share, key players, and their strategies. Growth projections for each segment are provided for the forecast period, 2025-2033. The competitive dynamics are analyzed considering aspects like pricing strategies, technological advancements, and regulatory changes.

Key Drivers of North America Nuclear Reactor Construction Market Growth

The growth of the North American nuclear reactor construction market is fueled by several key factors: the increasing need for baseload power, escalating concerns about climate change and greenhouse gas emissions, and proactive governmental support for nuclear energy development as a cleaner alternative. Furthermore, technological advancements in reactor designs, such as SMRs, have enhanced safety and reduced construction costs, significantly impacting market expansion. Lastly, the stable and predictable regulatory landscape, especially in the United States, fosters investments in new nuclear power plant projects.

Challenges in the North America Nuclear Reactor Construction Market Sector

The North American nuclear reactor construction market faces significant challenges including stringent regulatory approvals, extended project timelines, and high capital costs associated with construction and operation. Supply chain vulnerabilities, particularly regarding specialized materials and components, pose another considerable hurdle. Moreover, the intense competition among established and emerging players further complicates market entry and expansion. These factors collectively impact project profitability and slow down market growth. The regulatory hurdles alone add an estimated xx% to the total project cost.

Emerging Opportunities in North America Nuclear Reactor Construction Market

Emerging opportunities in the North American nuclear reactor construction market center around the growing interest in SMR technology. The potential for SMR deployment in remote areas with limited grid connectivity opens new avenues for market expansion. Furthermore, the integration of nuclear energy within broader energy systems, alongside renewable sources, presents significant potential. Advancements in nuclear waste management technologies and improved public perception of nuclear energy also offer promising growth pathways.

Leading Players in the North America Nuclear Reactor Construction Market Market

- Dongfang Electric Corporation Limited

- Larsen & Toubro Limited

- Doosan Heavy Industries & Construction Co Ltd

- Bilfinger SE

- China National Nuclear Corporation

- Electricite de France SA (EDF)

- Westinghouse Electric Company LLC (Toshiba)

- Shanghai Electric Group Company Limited

- Rosatom State Nuclear Energy Corporation

- Mitsubishi Heavy Industries Ltd

- GE-Hitachi Nuclear Energy Inc

Key Developments in North America Nuclear Reactor Construction Market Industry

- 2022-Q4: Westinghouse secures a contract for the supply of nuclear fuel to a US power plant.

- 2023-Q1: EDF announces a new SMR development project.

- 2023-Q3: GE-Hitachi successfully completes testing of a new reactor component.

- [Add more developments with year/month and impact]

Strategic Outlook for North America Nuclear Reactor Construction Market Market

The future of the North American nuclear reactor construction market appears promising, driven by increasing energy demands, environmental concerns, and technological advancements. The growth of SMRs, coupled with supportive government policies, is poised to unlock significant market expansion. Strategic partnerships and collaborations among industry players will be crucial for accelerating innovation and market penetration. The focus on enhancing safety, reducing costs, and improving public perception of nuclear energy will shape future market developments.

North America Nuclear Reactor Construction Market Segmentation

-

1. Service

- 1.1. Equipment

- 1.2. Installation

-

2. Reactor Type

- 2.1. Pressurized Water Reactor

- 2.2. Pressurized Heavy Water Reactor

- 2.3. Boiling Water Reactor

- 2.4. High-temperature Gas Cooled Reactor

- 2.5. Liquid Metal Fast Breeder Reactor

-

3. Geography

- 3.1. United States

- 3.2. Canada

- 3.3. Rest of North America

North America Nuclear Reactor Construction Market Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Rest of North America

North America Nuclear Reactor Construction Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > -10.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Growing Demand for Renewable Energy4.; Upcoming Investments in the Energy Sector and Supportive Renewable Energy Policies

- 3.3. Market Restrains

- 3.3.1. 4.; High Initial Investment Cost and Long Investment Return Period on Projects

- 3.4. Market Trends

- 3.4.1. Pressurized Water Reactor to dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Nuclear Reactor Construction Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Service

- 5.1.1. Equipment

- 5.1.2. Installation

- 5.2. Market Analysis, Insights and Forecast - by Reactor Type

- 5.2.1. Pressurized Water Reactor

- 5.2.2. Pressurized Heavy Water Reactor

- 5.2.3. Boiling Water Reactor

- 5.2.4. High-temperature Gas Cooled Reactor

- 5.2.5. Liquid Metal Fast Breeder Reactor

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. United States

- 5.3.2. Canada

- 5.3.3. Rest of North America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.4.2. Canada

- 5.4.3. Rest of North America

- 5.1. Market Analysis, Insights and Forecast - by Service

- 6. United States North America Nuclear Reactor Construction Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Service

- 6.1.1. Equipment

- 6.1.2. Installation

- 6.2. Market Analysis, Insights and Forecast - by Reactor Type

- 6.2.1. Pressurized Water Reactor

- 6.2.2. Pressurized Heavy Water Reactor

- 6.2.3. Boiling Water Reactor

- 6.2.4. High-temperature Gas Cooled Reactor

- 6.2.5. Liquid Metal Fast Breeder Reactor

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. United States

- 6.3.2. Canada

- 6.3.3. Rest of North America

- 6.1. Market Analysis, Insights and Forecast - by Service

- 7. Canada North America Nuclear Reactor Construction Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Service

- 7.1.1. Equipment

- 7.1.2. Installation

- 7.2. Market Analysis, Insights and Forecast - by Reactor Type

- 7.2.1. Pressurized Water Reactor

- 7.2.2. Pressurized Heavy Water Reactor

- 7.2.3. Boiling Water Reactor

- 7.2.4. High-temperature Gas Cooled Reactor

- 7.2.5. Liquid Metal Fast Breeder Reactor

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. United States

- 7.3.2. Canada

- 7.3.3. Rest of North America

- 7.1. Market Analysis, Insights and Forecast - by Service

- 8. Rest of North America North America Nuclear Reactor Construction Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Service

- 8.1.1. Equipment

- 8.1.2. Installation

- 8.2. Market Analysis, Insights and Forecast - by Reactor Type

- 8.2.1. Pressurized Water Reactor

- 8.2.2. Pressurized Heavy Water Reactor

- 8.2.3. Boiling Water Reactor

- 8.2.4. High-temperature Gas Cooled Reactor

- 8.2.5. Liquid Metal Fast Breeder Reactor

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. United States

- 8.3.2. Canada

- 8.3.3. Rest of North America

- 8.1. Market Analysis, Insights and Forecast - by Service

- 9. United States North America Nuclear Reactor Construction Market Analysis, Insights and Forecast, 2019-2031

- 10. Canada North America Nuclear Reactor Construction Market Analysis, Insights and Forecast, 2019-2031

- 11. Mexico North America Nuclear Reactor Construction Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of North America North America Nuclear Reactor Construction Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Dongfang Electric Corporation Limited

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Larsen & Toubro Limited

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Doosan Heavy Industries & Construction Co Ltd

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Bilfinger SE

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 China National Nuclear Corporation

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Electricite de France SA (EDF)

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Westinghouse Electric Company LLC (Toshiba)

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Shanghai Electric Group Company Limited

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Rosatom State Nuclear Energy Corporation

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Mitsubishi Heavy Industries Ltd

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 GE-Hitachi Nuclear Energy Inc

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.1 Dongfang Electric Corporation Limited

List of Figures

- Figure 1: North America Nuclear Reactor Construction Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America Nuclear Reactor Construction Market Share (%) by Company 2024

List of Tables

- Table 1: North America Nuclear Reactor Construction Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America Nuclear Reactor Construction Market Revenue Million Forecast, by Service 2019 & 2032

- Table 3: North America Nuclear Reactor Construction Market Revenue Million Forecast, by Reactor Type 2019 & 2032

- Table 4: North America Nuclear Reactor Construction Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 5: North America Nuclear Reactor Construction Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: North America Nuclear Reactor Construction Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United States North America Nuclear Reactor Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Canada North America Nuclear Reactor Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Mexico North America Nuclear Reactor Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Rest of North America North America Nuclear Reactor Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: North America Nuclear Reactor Construction Market Revenue Million Forecast, by Service 2019 & 2032

- Table 12: North America Nuclear Reactor Construction Market Revenue Million Forecast, by Reactor Type 2019 & 2032

- Table 13: North America Nuclear Reactor Construction Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 14: North America Nuclear Reactor Construction Market Revenue Million Forecast, by Country 2019 & 2032

- Table 15: North America Nuclear Reactor Construction Market Revenue Million Forecast, by Service 2019 & 2032

- Table 16: North America Nuclear Reactor Construction Market Revenue Million Forecast, by Reactor Type 2019 & 2032

- Table 17: North America Nuclear Reactor Construction Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 18: North America Nuclear Reactor Construction Market Revenue Million Forecast, by Country 2019 & 2032

- Table 19: North America Nuclear Reactor Construction Market Revenue Million Forecast, by Service 2019 & 2032

- Table 20: North America Nuclear Reactor Construction Market Revenue Million Forecast, by Reactor Type 2019 & 2032

- Table 21: North America Nuclear Reactor Construction Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 22: North America Nuclear Reactor Construction Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Nuclear Reactor Construction Market?

The projected CAGR is approximately > -10.00%.

2. Which companies are prominent players in the North America Nuclear Reactor Construction Market?

Key companies in the market include Dongfang Electric Corporation Limited, Larsen & Toubro Limited, Doosan Heavy Industries & Construction Co Ltd, Bilfinger SE, China National Nuclear Corporation, Electricite de France SA (EDF), Westinghouse Electric Company LLC (Toshiba), Shanghai Electric Group Company Limited, Rosatom State Nuclear Energy Corporation, Mitsubishi Heavy Industries Ltd, GE-Hitachi Nuclear Energy Inc.

3. What are the main segments of the North America Nuclear Reactor Construction Market?

The market segments include Service, Reactor Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Growing Demand for Renewable Energy4.; Upcoming Investments in the Energy Sector and Supportive Renewable Energy Policies.

6. What are the notable trends driving market growth?

Pressurized Water Reactor to dominate the Market.

7. Are there any restraints impacting market growth?

4.; High Initial Investment Cost and Long Investment Return Period on Projects.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Nuclear Reactor Construction Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Nuclear Reactor Construction Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Nuclear Reactor Construction Market?

To stay informed about further developments, trends, and reports in the North America Nuclear Reactor Construction Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence