Key Insights

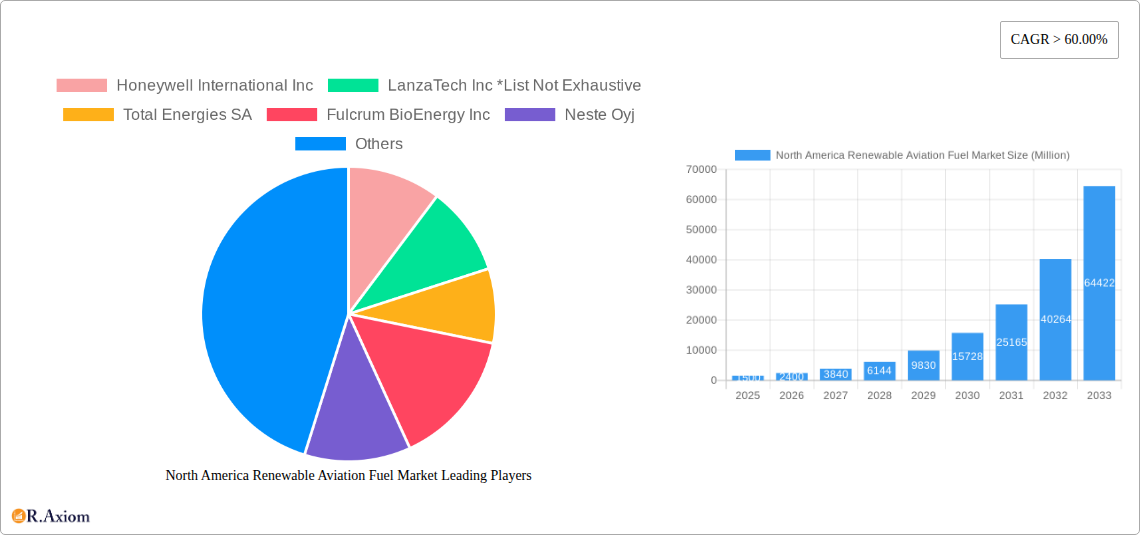

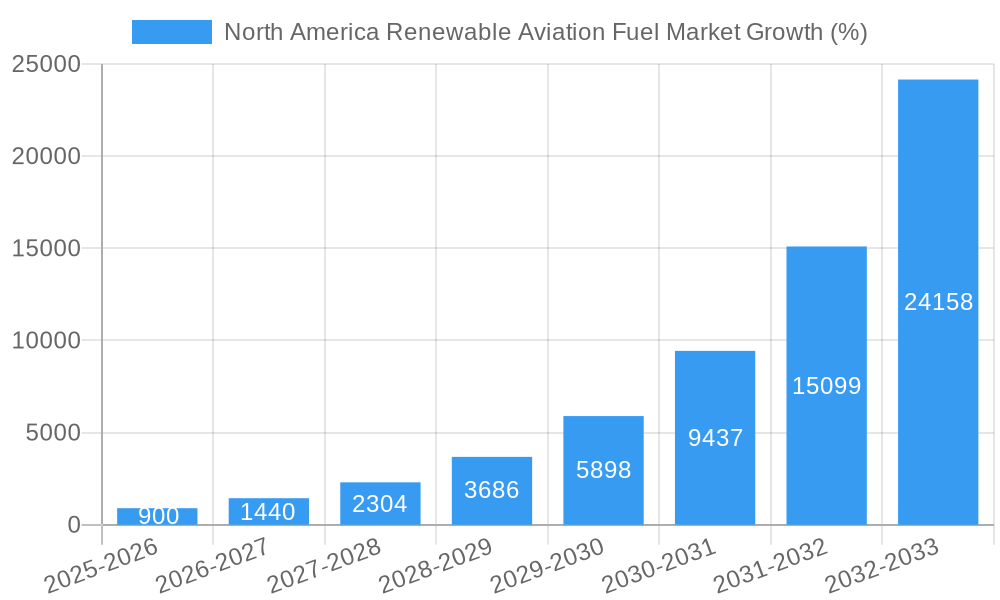

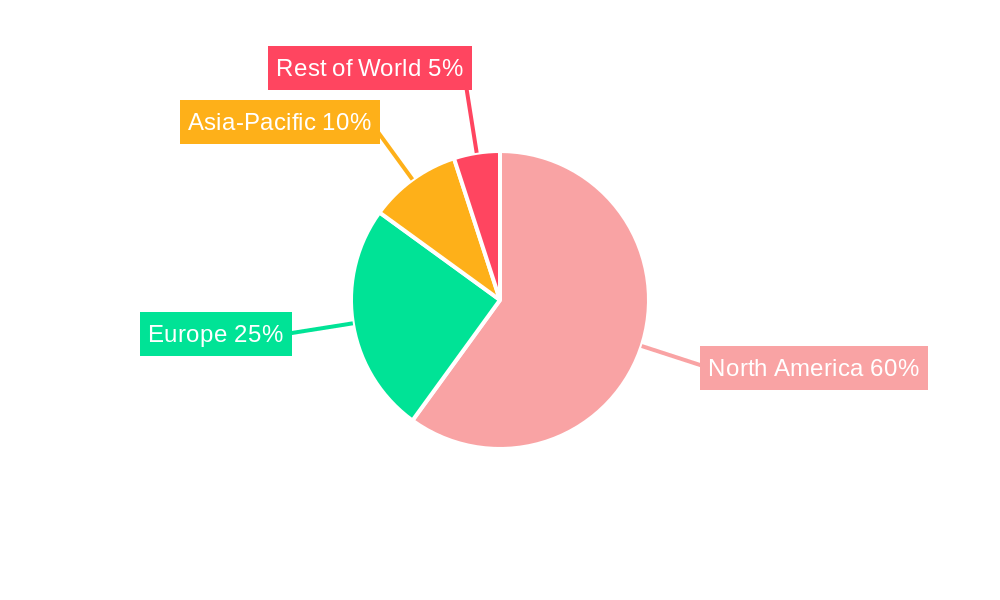

The North American Renewable Aviation Fuel (RAF) market is experiencing explosive growth, projected to maintain a Compound Annual Growth Rate (CAGR) exceeding 60% from 2025 to 2033. This surge is driven by stringent government regulations aimed at reducing aviation's carbon footprint, increasing consumer demand for sustainable travel options, and technological advancements in RAF production. Key technologies fueling this expansion include Fischer-Tropsch (FT) synthesis, Hydroprocessed Esters and Fatty Acids (HEFA), Synthesized Iso-Paraffinic (SIP) fuels, and Alcohol-to-Jet (AJT) pathways. The market is segmented by application, with commercial aviation currently dominating, followed by the defense sector, which is anticipated to show significant growth due to increasing military commitments to sustainability. Major players like Honeywell International Inc., LanzaTech Inc., Total Energies SA, and Neste Oyj are heavily investing in research and development, production capacity, and strategic partnerships to capitalize on this burgeoning market. The North American market, particularly the United States, is leading the charge due to supportive government policies, a robust biofuel infrastructure, and the presence of key technology developers and fuel producers. This region's dominance is expected to continue throughout the forecast period.

The restraints on market growth include the relatively high production costs of RAF compared to conventional jet fuel, the limited availability of sustainable feedstocks, and the need for significant infrastructure investments to support widespread adoption. However, ongoing technological innovations are continuously driving down production costs, and research into alternative feedstock sources (including waste products) is mitigating supply chain challenges. Furthermore, government incentives and carbon offset programs are actively addressing price parity issues, making RAF increasingly competitive. The long-term outlook for the North American RAF market remains incredibly positive, with substantial opportunities for continued growth and expansion across various technological segments and application areas. The market's future success hinges on ongoing technological advancements, supportive government policies, and increased consumer awareness and demand for sustainable aviation.

North America Renewable Aviation Fuel Market: A Comprehensive Report (2019-2033)

This detailed report provides a comprehensive analysis of the North America Renewable Aviation Fuel market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. The study covers the period from 2019 to 2033, with 2025 serving as the base and estimated year. The forecast period spans 2025-2033, while the historical period encompasses 2019-2024. Key players analyzed include Honeywell International Inc, LanzaTech Inc, Total Energies SA, Fulcrum BioEnergy Inc, Neste Oyj, Red Rock Biofuels LLC, SG Preston Company, and Gevo Inc. The market is segmented by technology (Fischer-Tropsch (FT), Hydroprocessed Esters and Fatty Acids (HEFA), Synthesisized Iso-Paraffinic (SIP), and Alcohol-to-Jet (AJT)) and application (Commercial, Defense). The report projects a xx Million market size by 2033, exhibiting a CAGR of xx% during the forecast period.

North America Renewable Aviation Fuel Market Concentration & Innovation

The North American renewable aviation fuel market exhibits a moderately concentrated landscape, with a few major players holding significant market share. However, a wave of innovation is driving the entry of new players and diversification of technologies. Honeywell International Inc. and Neste Oyj, for example, currently hold a significant portion of the market, while other companies are rapidly expanding their presence. The market share distribution among the top 5 players is estimated at xx%. Mergers and acquisitions (M&A) are also shaping the market. Recent deals, while not publicly disclosing exact values, indicate significant investment in this sector. The total M&A deal value for the period 2019-2024 is estimated at xx Million. Key innovation drivers include stringent environmental regulations aimed at reducing carbon emissions from aviation, coupled with increasing consumer demand for sustainable travel options. Government incentives and policies further fuel the development of advanced biofuels and sustainable aviation fuel (SAF) technologies. The regulatory framework is evolving, with ongoing discussions surrounding SAF mandates and carbon pricing mechanisms. Competition from traditional jet fuel remains a key challenge, but the increasing cost-competitiveness of renewable fuels is slowly changing the dynamics. End-user trends indicate a growing preference for airlines and defense sectors to adopt SAF options to achieve sustainability goals.

- Market Share: Top 5 players hold approximately xx%

- M&A Deal Value (2019-2024): xx Million

- Key Innovation Drivers: Stringent environmental regulations, consumer demand, government incentives.

- Competitive Challenges: Traditional jet fuel competition, technology maturity.

North America Renewable Aviation Fuel Market Industry Trends & Insights

The North American renewable aviation fuel market is experiencing robust growth, driven by a confluence of factors. The increasing awareness of aviation's environmental impact is a primary driver, pushing airlines and governments to adopt sustainable alternatives. This is further bolstered by rising fuel costs and the potential for carbon pricing mechanisms. Technological advancements, including improvements in HEFA and AJT production processes, are significantly reducing production costs and increasing efficiency. This leads to higher market penetration and increased adoption of renewable aviation fuel blends. The industry is also witnessing significant consumer preference shifts, with many travelers expressing a willingness to pay a premium for more sustainable travel options. This growing demand fuels further investment and innovation in the sector. The competitive landscape is dynamic, with both established players and emerging companies vying for market share through product differentiation, strategic partnerships, and technological advancements. The market is expected to witness a significant expansion, with a predicted CAGR of xx% from 2025 to 2033. Market penetration for renewable aviation fuels in the total jet fuel market is currently at xx%, but is projected to reach xx% by 2033.

Dominant Markets & Segments in North America Renewable Aviation Fuel Market

The Commercial application segment currently dominates the North American renewable aviation fuel market, driven by the substantial fuel consumption of the airline industry. This segment is expected to continue its strong growth trajectory due to rising passenger traffic and increasing airline commitments to sustainability goals. The HEFA technology segment also holds a dominant position, owing to its relatively mature technology and established supply chains. However, the AJT technology is poised for significant growth in the coming years due to its potential for higher production yields and lower costs.

Key Drivers:

- Commercial Segment: High airline fuel consumption, increasing passenger traffic, sustainability commitments.

- HEFA Segment: Mature technology, established supply chains.

- AJT Segment: Potential for higher yields, cost reduction.

- Geographic Dominance: California, due to supportive policies and infrastructure.

The dominance of specific regions and countries within North America is heavily influenced by factors like government policies, the availability of feedstocks (e.g., used cooking oil, agricultural residues), and the presence of established infrastructure. California currently leads in renewable fuel production and adoption, largely due to its proactive environmental regulations and supportive policies.

North America Renewable Aviation Fuel Market Product Developments

Recent advancements in renewable aviation fuel technologies are focused on increasing production efficiency, lowering costs, and expanding the range of feedstocks that can be utilized. New catalyst systems and process optimization techniques for HEFA and AJT production are improving yields and reducing emissions. The development of drop-in fuels that are compatible with existing aircraft engines and infrastructure is crucial for wider market adoption. Companies are also exploring innovative feedstock sources, such as algae and municipal waste, to enhance sustainability and reduce reliance on food crops. The competitive advantage lies in securing efficient and cost-effective production processes, along with establishing reliable supply chains and securing strategic partnerships with airlines and aircraft manufacturers.

Report Scope & Segmentation Analysis

This report provides a detailed segmentation of the North American renewable aviation fuel market by technology and application.

By Technology:

Fischer-Tropsch (FT): This segment is projected to witness moderate growth driven by advancements in catalyst technology and feedstock diversification. The market size is estimated at xx Million in 2025. Competitive dynamics are shaped by technological innovation and cost efficiency.

Hydroprocessed Esters and Fatty Acids (HEFA): This segment currently holds a significant market share due to its established technology and relatively lower production costs. The market size is estimated at xx Million in 2025 and is expected to maintain steady growth.

Synthesisized Iso-Paraffinic (SIP): This segment exhibits potential for strong growth due to its scalability and potential cost advantages. The market size is estimated at xx Million in 2025. The competitive landscape is evolving with several companies investing in this technology.

Alcohol-to-Jet (AJT): This segment shows promising prospects due to its potential for high yields and utilization of diverse feedstocks. The market size is estimated at xx Million in 2025, and significant growth is anticipated in the future.

By Application:

- Commercial: This segment represents the largest market share driven by high fuel consumption in the airline industry. The market size is estimated at xx Million in 2025. The competitive landscape is intense with many airlines focusing on SAF adoption.

- Defense: This segment is projected to experience moderate growth due to increasing defense budgets and the drive towards environmental sustainability. The market size is estimated at xx Million in 2025.

Key Drivers of North America Renewable Aviation Fuel Market Growth

Several key factors fuel the growth of the North American renewable aviation fuel market:

- Stringent environmental regulations: Government mandates and carbon emission reduction targets are driving the adoption of sustainable alternatives.

- Increasing fuel costs: The volatility of fossil fuel prices makes renewable fuels a more cost-competitive option in the long term.

- Technological advancements: Improvements in production processes and feedstock utilization are reducing costs and enhancing efficiency.

- Consumer preference for sustainable travel: Growing awareness among travelers is pushing airlines to adopt more eco-friendly practices.

Challenges in the North America Renewable Aviation Fuel Market Sector

Despite the promising growth trajectory, the North American renewable aviation fuel market faces several challenges:

- High production costs: The production cost of renewable aviation fuels is still higher than that of traditional jet fuel.

- Limited feedstock availability: Securing sufficient quantities of sustainable feedstocks can be challenging.

- Infrastructure limitations: The lack of widespread infrastructure for distributing and handling renewable aviation fuels presents a significant hurdle.

- Regulatory uncertainty: The evolving regulatory landscape can create uncertainty and impact investment decisions.

Emerging Opportunities in North America Renewable Aviation Fuel Market

The North American renewable aviation fuel market presents several emerging opportunities:

- Development of advanced biofuels: New technologies with improved efficiency and cost-effectiveness are continuously being developed.

- Expansion of feedstock sources: Exploring diverse and sustainable feedstock options reduces reliance on food crops and enhances environmental benefits.

- Strategic partnerships and collaborations: Collaboration between airlines, fuel producers, and technology providers can facilitate market expansion.

- Government support and incentives: Continued government support through tax credits, grants, and other incentives can significantly accelerate market growth.

Leading Players in the North America Renewable Aviation Fuel Market Market

- Honeywell International Inc

- LanzaTech Inc

- Total Energies SA

- Fulcrum BioEnergy Inc

- Neste Oyj

- Red Rock Biofuels LLC

- SG Preston Company

- Gevo Inc

Key Developments in North America Renewable Aviation Fuel Market Industry

- March 2022: Aemetis Inc. announced a deal with Qantas Airways Limited to supply 20 Million liters of blended renewable aviation fuel starting in 2025. This signifies a significant commitment by a major airline to SAF adoption.

- January 2022: Airbus SE began manufacturing aircraft at its US facility, all of which will operate on a blend of renewable and conventional jet fuel. This highlights the growing integration of SAF into mainstream aircraft operations.

Strategic Outlook for North America Renewable Aviation Fuel Market Market

The North American renewable aviation fuel market is poised for substantial growth in the coming years. Continued technological advancements, supportive government policies, and increasing consumer demand will drive market expansion. The development of cost-effective and scalable production processes, along with the expansion of sustainable feedstock sources, will be critical for achieving wider market adoption and reducing the carbon footprint of the aviation industry. The strategic focus should be on fostering innovation, strengthening partnerships, and building the necessary infrastructure to support the transition to a more sustainable aviation sector.

North America Renewable Aviation Fuel Market Segmentation

-

1. Technology

- 1.1. Fischer-Tropsch (FT)

- 1.2. Hydroprocessed Esters and Fatty Acids (HEFA)

- 1.3. Synthesi

-

2. Application

- 2.1. Commercial

- 2.2. Defense

-

3. Geography

- 3.1. United States

- 3.2. Canada

- 3.3. Rest of North America

North America Renewable Aviation Fuel Market Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Rest of North America

North America Renewable Aviation Fuel Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 60.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Declining Solar Panel Costs4.; Supportive Government Policies

- 3.3. Market Restrains

- 3.3.1. 4.; High Upfront Cost

- 3.4. Market Trends

- 3.4.1. Defense Sector to be the Fastest-Growing Segment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Renewable Aviation Fuel Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 5.1.1. Fischer-Tropsch (FT)

- 5.1.2. Hydroprocessed Esters and Fatty Acids (HEFA)

- 5.1.3. Synthesi

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Commercial

- 5.2.2. Defense

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. United States

- 5.3.2. Canada

- 5.3.3. Rest of North America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.4.2. Canada

- 5.4.3. Rest of North America

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 6. United States North America Renewable Aviation Fuel Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 6.1.1. Fischer-Tropsch (FT)

- 6.1.2. Hydroprocessed Esters and Fatty Acids (HEFA)

- 6.1.3. Synthesi

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Commercial

- 6.2.2. Defense

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. United States

- 6.3.2. Canada

- 6.3.3. Rest of North America

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 7. Canada North America Renewable Aviation Fuel Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 7.1.1. Fischer-Tropsch (FT)

- 7.1.2. Hydroprocessed Esters and Fatty Acids (HEFA)

- 7.1.3. Synthesi

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Commercial

- 7.2.2. Defense

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. United States

- 7.3.2. Canada

- 7.3.3. Rest of North America

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 8. Rest of North America North America Renewable Aviation Fuel Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 8.1.1. Fischer-Tropsch (FT)

- 8.1.2. Hydroprocessed Esters and Fatty Acids (HEFA)

- 8.1.3. Synthesi

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Commercial

- 8.2.2. Defense

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. United States

- 8.3.2. Canada

- 8.3.3. Rest of North America

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 9. United States North America Renewable Aviation Fuel Market Analysis, Insights and Forecast, 2019-2031

- 10. Canada North America Renewable Aviation Fuel Market Analysis, Insights and Forecast, 2019-2031

- 11. Mexico North America Renewable Aviation Fuel Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of North America North America Renewable Aviation Fuel Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Honeywell International Inc

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 LanzaTech Inc *List Not Exhaustive

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Total Energies SA

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Fulcrum BioEnergy Inc

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Neste Oyj

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Red Rock Biofuels LLC

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 SG Preston Company

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Gevo Inc

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.1 Honeywell International Inc

List of Figures

- Figure 1: North America Renewable Aviation Fuel Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America Renewable Aviation Fuel Market Share (%) by Company 2024

List of Tables

- Table 1: North America Renewable Aviation Fuel Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America Renewable Aviation Fuel Market Volume K Tons Forecast, by Region 2019 & 2032

- Table 3: North America Renewable Aviation Fuel Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 4: North America Renewable Aviation Fuel Market Volume K Tons Forecast, by Technology 2019 & 2032

- Table 5: North America Renewable Aviation Fuel Market Revenue Million Forecast, by Application 2019 & 2032

- Table 6: North America Renewable Aviation Fuel Market Volume K Tons Forecast, by Application 2019 & 2032

- Table 7: North America Renewable Aviation Fuel Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 8: North America Renewable Aviation Fuel Market Volume K Tons Forecast, by Geography 2019 & 2032

- Table 9: North America Renewable Aviation Fuel Market Revenue Million Forecast, by Region 2019 & 2032

- Table 10: North America Renewable Aviation Fuel Market Volume K Tons Forecast, by Region 2019 & 2032

- Table 11: North America Renewable Aviation Fuel Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: North America Renewable Aviation Fuel Market Volume K Tons Forecast, by Country 2019 & 2032

- Table 13: United States North America Renewable Aviation Fuel Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: United States North America Renewable Aviation Fuel Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 15: Canada North America Renewable Aviation Fuel Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Canada North America Renewable Aviation Fuel Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 17: Mexico North America Renewable Aviation Fuel Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Mexico North America Renewable Aviation Fuel Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 19: Rest of North America North America Renewable Aviation Fuel Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Rest of North America North America Renewable Aviation Fuel Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 21: North America Renewable Aviation Fuel Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 22: North America Renewable Aviation Fuel Market Volume K Tons Forecast, by Technology 2019 & 2032

- Table 23: North America Renewable Aviation Fuel Market Revenue Million Forecast, by Application 2019 & 2032

- Table 24: North America Renewable Aviation Fuel Market Volume K Tons Forecast, by Application 2019 & 2032

- Table 25: North America Renewable Aviation Fuel Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 26: North America Renewable Aviation Fuel Market Volume K Tons Forecast, by Geography 2019 & 2032

- Table 27: North America Renewable Aviation Fuel Market Revenue Million Forecast, by Country 2019 & 2032

- Table 28: North America Renewable Aviation Fuel Market Volume K Tons Forecast, by Country 2019 & 2032

- Table 29: North America Renewable Aviation Fuel Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 30: North America Renewable Aviation Fuel Market Volume K Tons Forecast, by Technology 2019 & 2032

- Table 31: North America Renewable Aviation Fuel Market Revenue Million Forecast, by Application 2019 & 2032

- Table 32: North America Renewable Aviation Fuel Market Volume K Tons Forecast, by Application 2019 & 2032

- Table 33: North America Renewable Aviation Fuel Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 34: North America Renewable Aviation Fuel Market Volume K Tons Forecast, by Geography 2019 & 2032

- Table 35: North America Renewable Aviation Fuel Market Revenue Million Forecast, by Country 2019 & 2032

- Table 36: North America Renewable Aviation Fuel Market Volume K Tons Forecast, by Country 2019 & 2032

- Table 37: North America Renewable Aviation Fuel Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 38: North America Renewable Aviation Fuel Market Volume K Tons Forecast, by Technology 2019 & 2032

- Table 39: North America Renewable Aviation Fuel Market Revenue Million Forecast, by Application 2019 & 2032

- Table 40: North America Renewable Aviation Fuel Market Volume K Tons Forecast, by Application 2019 & 2032

- Table 41: North America Renewable Aviation Fuel Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 42: North America Renewable Aviation Fuel Market Volume K Tons Forecast, by Geography 2019 & 2032

- Table 43: North America Renewable Aviation Fuel Market Revenue Million Forecast, by Country 2019 & 2032

- Table 44: North America Renewable Aviation Fuel Market Volume K Tons Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Renewable Aviation Fuel Market?

The projected CAGR is approximately > 60.00%.

2. Which companies are prominent players in the North America Renewable Aviation Fuel Market?

Key companies in the market include Honeywell International Inc, LanzaTech Inc *List Not Exhaustive, Total Energies SA, Fulcrum BioEnergy Inc, Neste Oyj, Red Rock Biofuels LLC, SG Preston Company, Gevo Inc.

3. What are the main segments of the North America Renewable Aviation Fuel Market?

The market segments include Technology, Application, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Declining Solar Panel Costs4.; Supportive Government Policies.

6. What are the notable trends driving market growth?

Defense Sector to be the Fastest-Growing Segment.

7. Are there any restraints impacting market growth?

4.; High Upfront Cost.

8. Can you provide examples of recent developments in the market?

March 2022: Aemetis Inc announced that it agreed with Qantas Airways Limited to supply 20 million liters of blended renewable aviation fuel from 2025. The blended fuel will be produced at a facility in California and will primarily be used to power Boeing and Airbus planes being operated between the countries.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Renewable Aviation Fuel Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Renewable Aviation Fuel Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Renewable Aviation Fuel Market?

To stay informed about further developments, trends, and reports in the North America Renewable Aviation Fuel Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence