Key Insights

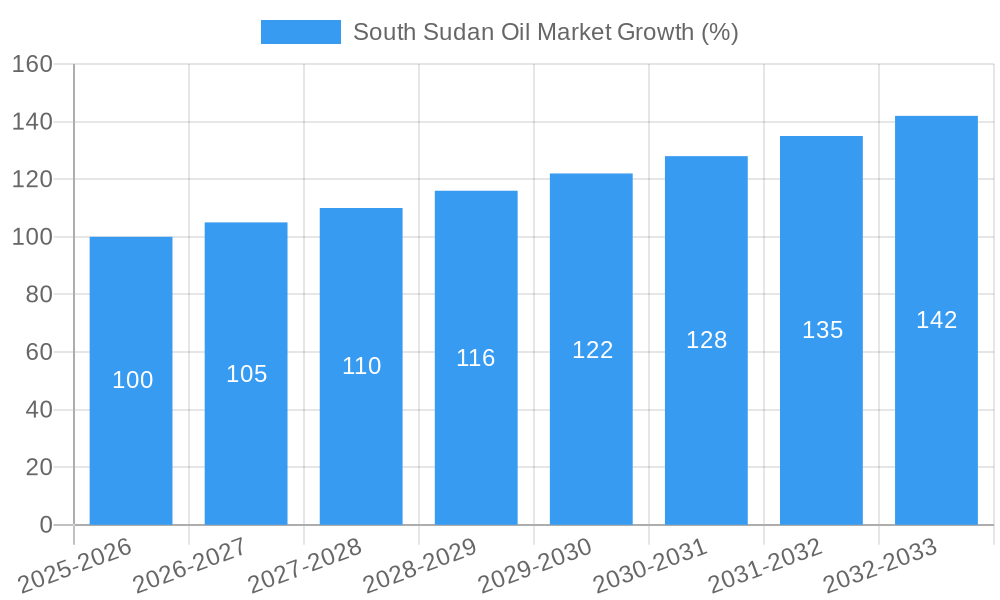

The South Sudan oil market, while facing significant challenges, presents a complex landscape with considerable potential for growth. The market, valued at an estimated $XX million in 2025 (assuming a reasonable market size based on comparable African nations with similar oil production and a CAGR of >5%), is projected to experience robust expansion throughout the forecast period (2025-2033). This growth is primarily driven by increasing global demand for crude oil, coupled with ongoing efforts to enhance domestic oil production and infrastructure development within South Sudan. Key players like Nile Petroleum Corporation, Petronas, TotalEnergies, and ONGC Videsh are actively involved, albeit navigating the inherent risks associated with political instability and security concerns in the region. Upstream activities, encompassing exploration, drilling, and production, remain crucial to the market's trajectory, although midstream and downstream segments – transportation, storage, processing, refining, and product distribution – also contribute significantly and offer opportunities for growth. While the industry benefits from the country's substantial oil reserves, constraints like geopolitical instability, limited infrastructure, and regulatory hurdles pose significant challenges that impede the full realization of South Sudan's oil potential.

Sustained investment in infrastructure development, coupled with improved security and political stability, is pivotal for accelerating market growth. The government's role in fostering a favorable investment climate, streamlining regulatory processes, and promoting transparent practices will be crucial. Furthermore, strategic partnerships with international oil companies possessing the necessary expertise and financial resources are essential for mitigating risk and stimulating sustainable development of the oil sector. The segmentation of the market – upstream, midstream, and downstream – presents varied opportunities for investors, ranging from exploration and production to refined product distribution. A thorough understanding of these segments and the associated risks and rewards is vital for successful participation in this dynamic and complex market. The anticipated CAGR of over 5% suggests significant growth potential over the next decade, however, realizing this potential depends heavily on addressing the existing challenges related to security, infrastructure, and governance.

South Sudan Oil Market: A Comprehensive Report (2019-2033)

This detailed report provides a comprehensive analysis of the South Sudan oil market, covering the period from 2019 to 2033. It offers invaluable insights for industry stakeholders, investors, and policymakers seeking to understand the dynamics, challenges, and opportunities within this crucial sector of the South Sudanese economy. The report utilizes a robust methodology, incorporating historical data (2019-2024), a base year of 2025, and forecasts extending to 2033. All monetary values are expressed in Millions of US Dollars.

South Sudan Oil Market Market Concentration & Innovation

This section analyzes the market concentration, innovation drivers, regulatory frameworks, product substitutes, end-user trends, and mergers and acquisitions (M&A) activities within the South Sudan oil market. The South Sudan oil market exhibits a moderate level of concentration, with key players such as Nile Petroleum Corporation, China National Petroleum Corporation, and Petronas holding significant market share. However, the ongoing licensing rounds suggest potential for increased competition. Innovation is currently driven by the need to improve efficiency in exploration and production, enhance refining capabilities, and adapt to evolving environmental regulations. The regulatory framework, while undergoing reform, continues to influence market dynamics. Substitute products like biofuels have limited market penetration due to infrastructure constraints and cost competitiveness. End-user demand is primarily driven by domestic consumption and regional exports. M&A activity has been relatively low in recent years, with deal values averaging xx Million in the historical period.

- Market Share: Nile Petroleum Corporation (xx%), China National Petroleum Corporation (xx%), Petronas (xx%), Others (xx%).

- M&A Deal Values (2019-2024): Average xx Million; Total xx Million.

- Key Regulatory Bodies: South Sudan Ministry of Petroleum, SUDAPET.

South Sudan Oil Market Industry Trends & Insights

The South Sudan oil market is characterized by a complex interplay of factors influencing its growth trajectory. The historical period (2019-2024) witnessed fluctuating production levels primarily due to political instability and infrastructural limitations. The forecast period (2025-2033) projects a Compound Annual Growth Rate (CAGR) of xx%, driven by increased investment in exploration and production activities, coupled with efforts to improve refining capacity. Market penetration of refined petroleum products remains high, with the domestic market the primary driver of demand. Technological disruptions, while limited, are focused on improving operational efficiency and environmental sustainability. Competitive dynamics are shaped by the interplay between international oil companies and national entities. The market penetration of refined products is estimated to be xx%.

Dominant Markets & Segments in South Sudan Oil Market

South Sudan's oil market is heavily weighted towards the upstream sector, dominated by crude oil exploration and production activities. This is largely due to the nation's substantial oil reserves and ongoing licensing rounds designed to attract foreign investment. While the midstream sector plays a vital role, it faces considerable limitations stemming from insufficient infrastructure, particularly pipeline networks. The downstream sector remains relatively underdeveloped, characterized by limited refining capacity and a dependence on imports.

Upstream Segment:

- Key Drivers: Abundant oil reserves, government incentives (including tax breaks and streamlined licensing procedures), and ongoing licensing rounds attracting international and national energy companies.

- Dominance Analysis: A concentrated market with a few major international and national oil companies holding significant market share. Competition exists, but is often shaped by existing relationships and government policies.

Midstream Segment:

- Key Drivers: Government investment in pipeline infrastructure (although progress has been slow), increasing regional export demand, and the potential for improved transportation efficiency.

- Dominance Analysis: Currently constrained by limited pipeline capacity, security concerns impacting transportation routes, and logistical challenges. This creates bottlenecks and limits the potential for growth in the upstream and downstream sectors.

Downstream Segment:

- Key Drivers: Rising domestic demand for refined petroleum products, planned refinery developments (such as the proposed Trinity Energy refinery), and the potential to reduce reliance on expensive imports.

- Dominance Analysis: Significant untapped potential for growth. The current underdevelopment presents a major opportunity for investment and development. The competitive landscape is likely to become more dynamic as new refineries come online.

South Sudan Oil Market Product Developments

Product innovations within the South Sudan oil market are mainly focused on improving the efficiency of exploration and production techniques, optimizing refining processes to produce higher-quality products, and exploring opportunities in petrochemicals. Technological trends include the adoption of advanced seismic imaging for exploration and enhanced oil recovery techniques for increased production. The market fit for these innovations is largely dependent on securing sufficient investment and resolving infrastructure challenges.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the South Sudan oil market, segmented into three key areas: Upstream, Midstream, and Downstream. The analysis includes market sizing, growth projections, competitive landscape assessments, and an evaluation of key challenges and opportunities.

Upstream Segment: This segment encompasses exploration, appraisal, development, and production of crude oil. Growth is projected at [Insert Specific CAGR]% from 2025 to 2033, driven by new licensing rounds and increased investment. The market size is estimated at [Insert Specific Value] Million USD in 2025. Competition is [Describe level of competition - e.g., moderate, with both international and national players].

Midstream Segment: This segment includes the transportation, storage, and processing of crude oil and natural gas. Growth is anticipated at [Insert Specific CAGR]%, significantly constrained by infrastructure limitations. The market size in 2025 is estimated at [Insert Specific Value] Million USD. Competition is [Describe level of competition - e.g., limited, with a dominance of state-owned entities].

Downstream Segment: This segment covers the refining of crude oil and the production of refined petroleum products. Growth is expected at [Insert Specific CAGR]%, driven by planned refinery projects and increasing domestic demand. The market size in 2025 is estimated at [Insert Specific Value] Million USD. The competitive landscape is anticipated to evolve significantly with the emergence of new private refineries.

Key Drivers of South Sudan Oil Market Growth

The South Sudan oil market's growth trajectory is primarily determined by its substantial oil reserves, government initiatives to attract foreign direct investment (including transparent licensing rounds and improved regulatory frameworks), and the increasing domestic demand for refined petroleum products. Technological advancements in exploration and production techniques contribute to improved efficiency and increased output. Furthermore, ongoing, albeit challenging, efforts to upgrade infrastructure are crucial for long-term expansion.

Challenges in the South Sudan Oil Market Sector

The South Sudan oil market faces significant challenges including political instability, which has historically disrupted production; limited infrastructure (especially pipelines), hindering efficient transportation and export; and security concerns impacting operations. These challenges have resulted in production fluctuations and constrained market growth. Overcoming these will be crucial to unlocking the market’s full potential. The cumulative negative impact of these challenges is estimated to cost the sector xx Million annually.

Emerging Opportunities in South Sudan Oil Market

Significant opportunities exist within the downstream sector, particularly in refining to satisfy domestic needs and decrease reliance on imports. Investment in robust pipeline infrastructure is vital for effective transportation and export capabilities. The ongoing licensing rounds offer prospects for new market entrants to expand exploration and production activities. Finally, the potential to access regional export markets presents significant growth opportunities.

Leading Players in the South Sudan Oil Market Market

- Nile Petroleum Corporation

- Akon Refinery Company Ltd

- China National Petroleum Corporation

- Petroliam Nasional Berhad (Petronas)

- PetroDar Operating Company

- South Sudan Ministry of Petroleum

- SUDAPET

- TotalEnergies

- ONGC Videsh

Key Developments in South Sudan Oil Market Industry

- June 2021: Launch of the first-ever oil licensing round, aiming to revitalize the oil sector. Blocks A2, A5, B1, B4, and D2 are offered.

- October 2020: Trinity Energy announces plans for a USD 500 Million crude oil refinery in Paloch oilfield.

Strategic Outlook for South Sudan Oil Market Market

The future of the South Sudan oil market hinges on overcoming the existing challenges related to political stability, infrastructure development, and security. Successful implementation of the licensing round and attracting substantial foreign investment are critical for unlocking the significant potential of this resource-rich nation. The strategic focus should be on creating a stable and conducive investment climate to attract private sector participation, particularly in the development of downstream capabilities. The long-term potential for significant growth remains substantial provided these challenges are addressed effectively.

South Sudan Oil Market Segmentation

- 1. Upstream

- 2. Midstream

- 3. Downstream

South Sudan Oil Market Segmentation By Geography

- 1. South Sudan

South Sudan Oil Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 5.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Electricity Demand4.; Rsing Investments in the Coal Industry

- 3.3. Market Restrains

- 3.3.1. 4.; Increasing Installation of Renewable Energy Sources

- 3.4. Market Trends

- 3.4.1. Downstream Sector to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South Sudan Oil Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Upstream

- 5.2. Market Analysis, Insights and Forecast - by Midstream

- 5.3. Market Analysis, Insights and Forecast - by Downstream

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. South Sudan

- 5.1. Market Analysis, Insights and Forecast - by Upstream

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Nile Petroleum Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Akon Refinery Company Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 China National Petroleum Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Petroliam Nasional Berhad (Petronas)*List Not Exhaustive

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 PetroDar Operating Company

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 South Sudan Ministry of Petroleum

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 SUDAPET

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Petronas

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 TotalEnergies

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 ONGC Videsh

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Nile Petroleum Corporation

List of Figures

- Figure 1: South Sudan Oil Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: South Sudan Oil Market Share (%) by Company 2024

List of Tables

- Table 1: South Sudan Oil Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: South Sudan Oil Market Volume liter Forecast, by Region 2019 & 2032

- Table 3: South Sudan Oil Market Revenue Million Forecast, by Upstream 2019 & 2032

- Table 4: South Sudan Oil Market Volume liter Forecast, by Upstream 2019 & 2032

- Table 5: South Sudan Oil Market Revenue Million Forecast, by Midstream 2019 & 2032

- Table 6: South Sudan Oil Market Volume liter Forecast, by Midstream 2019 & 2032

- Table 7: South Sudan Oil Market Revenue Million Forecast, by Downstream 2019 & 2032

- Table 8: South Sudan Oil Market Volume liter Forecast, by Downstream 2019 & 2032

- Table 9: South Sudan Oil Market Revenue Million Forecast, by Region 2019 & 2032

- Table 10: South Sudan Oil Market Volume liter Forecast, by Region 2019 & 2032

- Table 11: South Sudan Oil Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: South Sudan Oil Market Volume liter Forecast, by Country 2019 & 2032

- Table 13: South Sudan Oil Market Revenue Million Forecast, by Upstream 2019 & 2032

- Table 14: South Sudan Oil Market Volume liter Forecast, by Upstream 2019 & 2032

- Table 15: South Sudan Oil Market Revenue Million Forecast, by Midstream 2019 & 2032

- Table 16: South Sudan Oil Market Volume liter Forecast, by Midstream 2019 & 2032

- Table 17: South Sudan Oil Market Revenue Million Forecast, by Downstream 2019 & 2032

- Table 18: South Sudan Oil Market Volume liter Forecast, by Downstream 2019 & 2032

- Table 19: South Sudan Oil Market Revenue Million Forecast, by Country 2019 & 2032

- Table 20: South Sudan Oil Market Volume liter Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South Sudan Oil Market?

The projected CAGR is approximately > 5.00%.

2. Which companies are prominent players in the South Sudan Oil Market?

Key companies in the market include Nile Petroleum Corporation, Akon Refinery Company Ltd, China National Petroleum Corporation, Petroliam Nasional Berhad (Petronas)*List Not Exhaustive, PetroDar Operating Company , South Sudan Ministry of Petroleum , SUDAPET , Petronas , TotalEnergies , ONGC Videsh.

3. What are the main segments of the South Sudan Oil Market?

The market segments include Upstream, Midstream, Downstream.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Electricity Demand4.; Rsing Investments in the Coal Industry.

6. What are the notable trends driving market growth?

Downstream Sector to Witness Significant Growth.

7. Are there any restraints impacting market growth?

4.; Increasing Installation of Renewable Energy Sources.

8. Can you provide examples of recent developments in the market?

In June 2021, South Sudan has launched its first-ever licensing round as the landlocked African nation seeks to get its staple oil sector back on track after years of insecurity following its split from Sudan in 2011. Under the Oil Licensing Round, Blocks A2, A5, B1, B4, and D2 are up for as informed by the Ministry of Petroleum in the country.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in liter .

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South Sudan Oil Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South Sudan Oil Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South Sudan Oil Market?

To stay informed about further developments, trends, and reports in the South Sudan Oil Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence