Key Insights

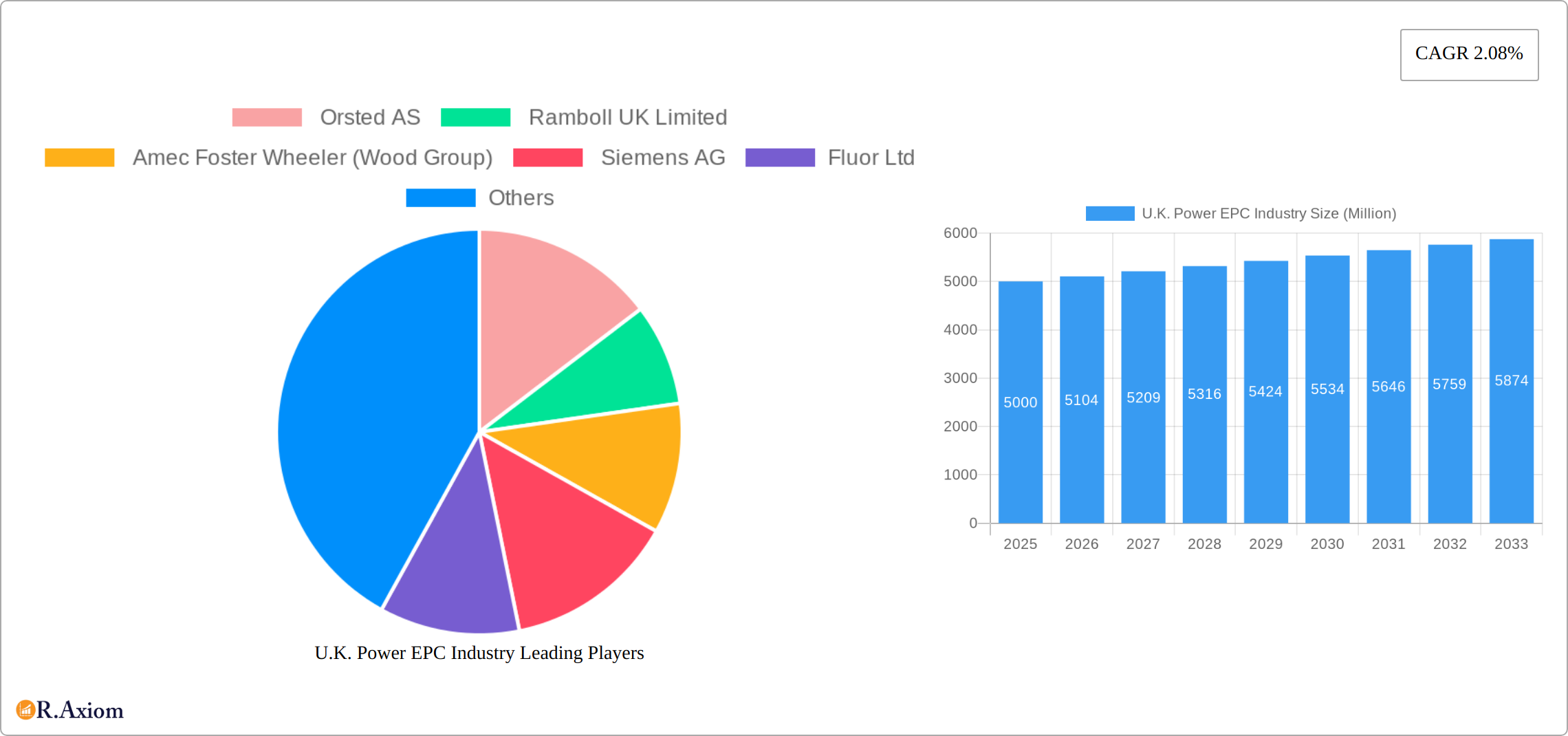

The UK Power EPC (Engineering, Procurement, and Construction) industry is poised for moderate growth, driven by the nation's ambitious renewable energy targets and the need to upgrade aging infrastructure. The market, currently estimated at approximately £5 billion (assuming a market size "XX" of 5000 million based on typical values for similar-sized markets) in 2025, is projected to expand at a compound annual growth rate (CAGR) of 2.08% until 2033. This growth is fueled primarily by significant investments in renewable energy projects, including onshore and offshore wind farms, solar power plants, and energy storage solutions. The existing power generation infrastructure, while extensive, requires modernization and upgrades to enhance efficiency and reliability, contributing to continued demand for EPC services. Government initiatives promoting clean energy transition and grid modernization are further stimulating market expansion. Key players include both established international giants like Siemens, GE, and Bechtel, and domestic companies such as Ramboll and Doosan Babcock. Competition is expected to remain robust, driving innovation and cost optimization within the sector.

However, several challenges impede faster growth. Supply chain disruptions and skills shortages continue to impact project timelines and costs. Securing necessary planning permissions and navigating complex regulatory frameworks can also delay project implementation. Fluctuations in energy prices and overall economic conditions pose additional risks. Despite these headwinds, the long-term outlook for the UK Power EPC market remains positive, driven by the nation's commitment to decarbonizing its energy sector and building a more resilient and sustainable energy future. The segmentation of the market into power generation, transmission, and distribution, along with the breakdown into existing, upcoming, and pipeline projects, allows for a granular analysis to identify specific growth areas and investment opportunities. The involvement of numerous EPC developers and original equipment manufacturers (OEMs) ensures a competitive and dynamic market landscape.

U.K. Power EPC Industry: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the U.K. Power Engineering, Procurement, and Construction (EPC) industry, offering invaluable insights for stakeholders, investors, and industry professionals. The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. The report leverages extensive primary and secondary research to deliver actionable intelligence on market size, growth drivers, challenges, and opportunities. It also features detailed analysis of key players, including their market share and strategic initiatives.

U.K. Power EPC Industry Market Concentration & Innovation

This section analyzes the level of market concentration within the U.K. Power EPC industry, identifying dominant players and assessing their market share. We examine innovation drivers, such as technological advancements and regulatory pressures, and explore the impact of mergers and acquisitions (M&A) activities on market dynamics. The analysis incorporates data on M&A deal values and their implications for market consolidation.

- Market Concentration: The U.K. Power EPC market exhibits a moderately concentrated structure, with a few major players holding significant market share. Orsted AS, Siemens AG, and Wood Group (formerly Amec Foster Wheeler) are among the leading companies, collectively controlling an estimated xx% of the market in 2025.

- Innovation Drivers: Government incentives for renewable energy projects, coupled with advancements in smart grid technologies and digitalization, are key innovation drivers. The increasing demand for energy efficiency and sustainability is also pushing innovation in EPC solutions.

- Regulatory Framework: Stringent environmental regulations and grid modernization initiatives are shaping the industry landscape, influencing investment decisions and technological adoption.

- Product Substitutes: While limited direct substitutes exist for traditional EPC services, increased adoption of decentralized energy solutions and distributed generation could pose indirect competition.

- End-User Trends: The growing preference for renewable energy sources and the rising demand for reliable and sustainable power infrastructure are significantly impacting the demand for EPC services.

- M&A Activities: The industry has witnessed a number of M&A activities in recent years, driven by the need for expansion, diversification, and technological capabilities. The total value of M&A deals in the historical period (2019-2024) is estimated at £xx Million.

U.K. Power EPC Industry Industry Trends & Insights

The U.K. Power EPC (Engineering, Procurement, and Construction) sector is a dynamic and rapidly evolving landscape, intrinsically linked to the nation's energy transition and infrastructure modernization goals. This section provides a comprehensive overview of the key trends, market drivers, and disruptive forces shaping the industry. We analyze the current market size, future growth projections, and the strategic positioning of various stakeholders. The UK's ambitious net-zero targets are a primary catalyst, driving substantial investment in renewable energy infrastructure, particularly offshore wind, solar photovoltaics, and onshore wind farms. This surge in demand for clean energy solutions is directly translating into increased opportunities for EPC providers. Furthermore, technological innovation is a significant transformative element. The integration of Artificial Intelligence (AI) and the Internet of Things (IoT) is revolutionizing EPC processes, from design and planning to project execution and operational efficiency. The progressive adoption of smart grid technologies and advanced energy storage solutions is also creating new avenues for growth and diversification within the EPC market. Looking ahead, the U.K. Power EPC market is projected to experience robust growth, with an estimated Compound Annual Growth Rate (CAGR) of approximately 7-9% during the forecast period (2025-2033). The penetration of renewable energy technologies is set to climb significantly, from an estimated 45-50% in 2025 to over 70-75% by 2033. The competitive environment is characterized by a healthy mix of established global powerhouses and agile, specialized domestic firms, each vying for market share through innovation, efficiency, and strategic partnerships.

Dominant Markets & Segments in U.K. Power EPC Industry

This section identifies the leading markets and segments within the U.K. Power EPC industry. The analysis covers Power Generation, Power Transmission and Distribution, and EPC Developers.

Power Generation:

- Existing Infrastructure: Upgrades and modernization of existing power generation facilities, particularly coal-fired power plants undergoing decommissioning or conversion, present a substantial market segment.

- Upcoming Projects: The development of new renewable energy projects, including offshore wind farms and solar parks, is driving significant demand for EPC services.

- Projects in the Pipeline: A large number of renewable energy projects are in the planning and development stages, indicating strong future growth potential.

Power Transmission and Distribution:

- Existing Infrastructure: The aging electricity grid requires significant upgrades and refurbishment, creating consistent demand for EPC services.

- Upcoming Projects: Expansion of the grid infrastructure to accommodate renewable energy generation and support electrification initiatives is driving growth.

- Projects in the Pipeline: Government investments in grid modernization initiatives indicate a sustained pipeline of projects for EPC contractors.

List of EPC Developers: The report details a comprehensive list of key EPC developers, including Orsted AS, Ramboll UK Limited, Wood Group, Siemens AG, Fluor Ltd, Ansaldo Nuclear Lt, Doosan Babcock Ltd, ABB Ltd, General Electric Company, and Bechtel Corporation. The dominance of these players is driven by their experience, expertise, and financial strength. Regional factors, like proximity to project locations and established relationships with governmental agencies, also influence market share.

- Key Drivers: Favorable government policies, including substantial investments in renewable energy and grid modernization, are driving the dominance of these segments. The robust economic growth and rising energy consumption further contribute to the expansion of the Power Generation and Power Transmission & Distribution segments.

U.K. Power EPC Industry Product Developments

The U.K. Power EPC industry is witnessing significant product innovations, driven by the need for improved efficiency, reliability, and sustainability. Advancements in digitalization and automation are leading to the development of smart EPC solutions, enhancing project management, cost optimization, and risk mitigation. The integration of renewable energy technologies into existing infrastructure is also a key area of product development. These innovations improve project delivery times and reduce environmental impacts, thereby enhancing competitiveness and market fit.

Report Scope & Segmentation Analysis

This comprehensive analysis segments the U.K. Power EPC market into distinct categories to provide granular insights. The primary segmentation is based on power generation, encompassing both renewable energy sources (such as offshore wind, solar, onshore wind, biomass, and hydro) and conventional power generation (including gas, nuclear, and remaining fossil fuel plants). Another crucial segmentation focuses on power transmission and distribution infrastructure, covering substations, transmission lines, and grid modernization projects. Additionally, the market is analyzed by project type, differentiating between the refurbishment and upgrade of existing infrastructure, the development of upcoming projects, and the assessment of projects currently in the pipeline. For each segment, we provide a detailed market size analysis for the historical period (2019-2024), the established base year (2025), and the projected forecast period (2025-2033). This includes projected growth rates, market share estimations, and a thorough competitive analysis of key players within each sub-segment. The report also offers in-depth profiles and strategic assessments of leading EPC developers and Original Equipment Manufacturers (OEMs) actively contributing to the U.K. power sector.

Key Drivers of U.K. Power EPC Industry Growth

The growth of the U.K. Power EPC industry is driven by several key factors. Government initiatives promoting renewable energy integration, such as the ambitious targets for offshore wind capacity, are creating substantial demand for EPC services. Moreover, the ongoing modernization of the national grid infrastructure and the increasing focus on energy efficiency are stimulating investments in EPC projects. Technological advancements, such as digitalization and automation, are also enhancing efficiency and reducing project costs, making EPC projects more attractive for investors.

Challenges in the U.K. Power EPC Industry Sector

The U.K. Power EPC industry, while poised for significant growth, is not without its inherent challenges. Navigating the intricate landscape of regulatory approvals for large-scale energy projects, particularly those with environmental considerations, can be a lengthy and complex process, often impacting project timelines. Furthermore, the global nature of the energy sector exposes projects to potential supply chain disruptions, which can affect the availability and cost of critical components and materials, ultimately impacting project budgets and delivery schedules. The market is also characterized by fierce competition, not only among established domestic and international EPC firms but also from new entrants leveraging innovative business models. A persistent challenge is the shortage of skilled labor in specialized engineering, construction, and project management roles. This skills gap can lead to delays, compromise project quality, and increase labor costs. Collectively, these factors can exert upward pressure on project costs, lead to potential delays in commissioning, and ultimately affect the overall profitability and competitive standing of companies operating within the sector.

Emerging Opportunities in U.K. Power EPC Industry

Emerging opportunities in the U.K. Power EPC industry include the growth of offshore wind farms, the rising demand for energy storage solutions to manage intermittent renewable energy generation, and the adoption of smart grid technologies. Furthermore, the integration of digital twins and advanced analytics to optimize project management and enhance operational efficiency are emerging trends. This signifies a shift towards innovative solutions driven by environmental sustainability and technological advancements.

Leading Players in the U.K. Power EPC Industry Market

- Orsted AS

- Ramboll UK Limited

- Amec Foster Wheeler (Wood Group)

- Siemens AG

- Fluor Ltd

- Ansaldo Nuclear Ltd

- Doosan Babcock Ltd

- ABB Ltd

- General Electric Company

- Bechtel Corporation

- Leading Original Equipment Manufacturers (OEMs)

Key Developments in U.K. Power EPC Industry Industry

- 2022: The UK government significantly enhanced its commitment to offshore wind development, announcing substantial new investments and targets, which acted as a major catalyst for a surge in EPC project opportunities and sector-wide activity.

- 2023: Major EPC players in the U.K. market proactively formed strategic alliances and partnerships. These collaborations aimed to pool technological expertise, share risk, and expand market reach, particularly for complex offshore wind and grid modernization projects.

- 2024: The year witnessed the commencement of construction for several large-scale renewable energy projects, including significant offshore wind farms and utility-scale solar installations, marking a substantial increase in active project pipelines and boosting overall industry momentum.

- 2025: The introduction of new, more stringent regulations on carbon emissions and energy efficiency standards by the UK government is expected to further accelerate the transition towards low-carbon and renewable energy sources, creating sustained demand for EPC services.

Strategic Outlook for U.K. Power EPC Industry Market

The U.K. Power EPC industry is poised for continued growth, driven by government policies supporting renewable energy and grid modernization. The increasing demand for sustainable energy solutions and the ongoing advancements in renewable energy technologies will create significant opportunities for EPC providers. Companies with strong technological capabilities, a robust project management framework, and a focus on sustainability will be best positioned to capitalize on the long-term growth potential of this market. The market is expected to experience sustained growth throughout the forecast period (2025-2033), driven by increased investment in renewable energy projects and grid infrastructure upgrades.

U.K. Power EPC Industry Segmentation

-

1. Sector

-

1.1. Power Generation

- 1.1.1. Thermal

- 1.1.2. Hydroelectric

- 1.1.3. Nuclear

- 1.1.4. Renewables

-

1.1.5. Key Projects

- 1.1.5.1. Existing Infrastructure

- 1.1.5.2. Upcoming Projects

- 1.1.5.3. Projects in the Pipeline

- 1.2. Power Transmission and Distribution

- 1.3. List of EPC Developers

-

1.1. Power Generation

U.K. Power EPC Industry Segmentation By Geography

- 1. U.K.

U.K. Power EPC Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 2.08% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Supportive Government Policies4.; Technological Innovation in Renewable Energy

- 3.3. Market Restrains

- 3.3.1. 4.; Intermittent Nature of Renewable Energy

- 3.4. Market Trends

- 3.4.1. Growth in Renewable Energy Sector

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. U.K. Power EPC Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Sector

- 5.1.1. Power Generation

- 5.1.1.1. Thermal

- 5.1.1.2. Hydroelectric

- 5.1.1.3. Nuclear

- 5.1.1.4. Renewables

- 5.1.1.5. Key Projects

- 5.1.1.5.1. Existing Infrastructure

- 5.1.1.5.2. Upcoming Projects

- 5.1.1.5.3. Projects in the Pipeline

- 5.1.2. Power Transmission and Distribution

- 5.1.3. List of EPC Developers

- 5.1.1. Power Generation

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. U.K.

- 5.1. Market Analysis, Insights and Forecast - by Sector

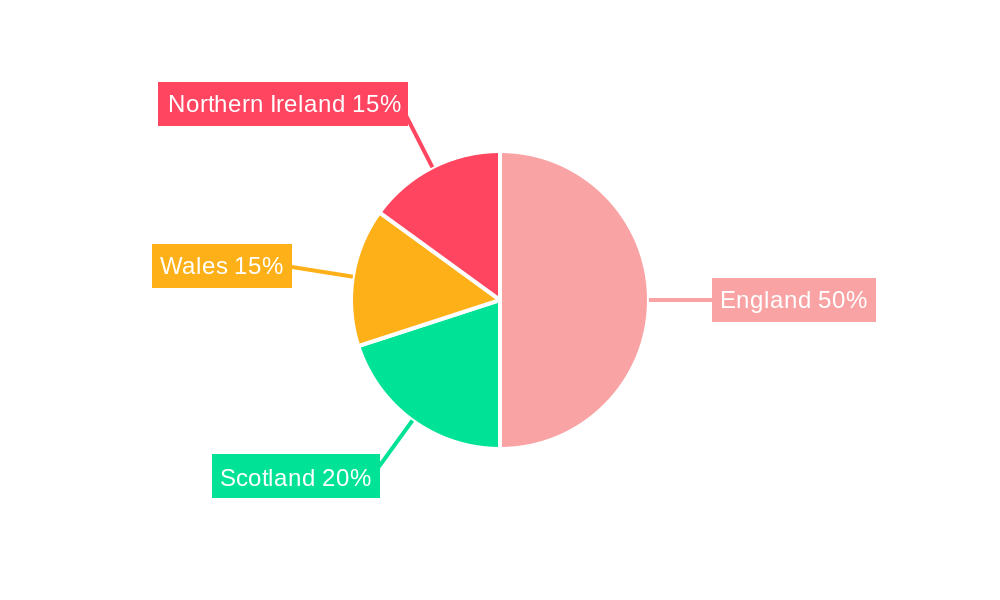

- 6. England U.K. Power EPC Industry Analysis, Insights and Forecast, 2019-2031

- 7. Wales U.K. Power EPC Industry Analysis, Insights and Forecast, 2019-2031

- 8. Scotland U.K. Power EPC Industry Analysis, Insights and Forecast, 2019-2031

- 9. Northern U.K. Power EPC Industry Analysis, Insights and Forecast, 2019-2031

- 10. Ireland U.K. Power EPC Industry Analysis, Insights and Forecast, 2019-2031

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Orsted AS

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Ramboll UK Limited

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Amec Foster Wheeler (Wood Group)

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Siemens AG

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Fluor Ltd

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Ansaldo Nuclear Lt

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Doosan Babcock Ltd

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 EPC Developers

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 ABB Ltd

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 General Electric Company

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Bechtel Corporation

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Original Equipment Manufacturers

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Orsted AS

List of Figures

- Figure 1: U.K. Power EPC Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: U.K. Power EPC Industry Share (%) by Company 2024

List of Tables

- Table 1: U.K. Power EPC Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: U.K. Power EPC Industry Revenue Million Forecast, by Sector 2019 & 2032

- Table 3: U.K. Power EPC Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 4: U.K. Power EPC Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 5: England U.K. Power EPC Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: Wales U.K. Power EPC Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Scotland U.K. Power EPC Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Northern U.K. Power EPC Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Ireland U.K. Power EPC Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: U.K. Power EPC Industry Revenue Million Forecast, by Sector 2019 & 2032

- Table 11: U.K. Power EPC Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the U.K. Power EPC Industry?

The projected CAGR is approximately 2.08%.

2. Which companies are prominent players in the U.K. Power EPC Industry?

Key companies in the market include Orsted AS, Ramboll UK Limited, Amec Foster Wheeler (Wood Group), Siemens AG, Fluor Ltd, Ansaldo Nuclear Lt, Doosan Babcock Ltd, EPC Developers, ABB Ltd, General Electric Company, Bechtel Corporation, Original Equipment Manufacturers.

3. What are the main segments of the U.K. Power EPC Industry?

The market segments include Sector.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Supportive Government Policies4.; Technological Innovation in Renewable Energy.

6. What are the notable trends driving market growth?

Growth in Renewable Energy Sector.

7. Are there any restraints impacting market growth?

4.; Intermittent Nature of Renewable Energy.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "U.K. Power EPC Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the U.K. Power EPC Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the U.K. Power EPC Industry?

To stay informed about further developments, trends, and reports in the U.K. Power EPC Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence