Key Insights

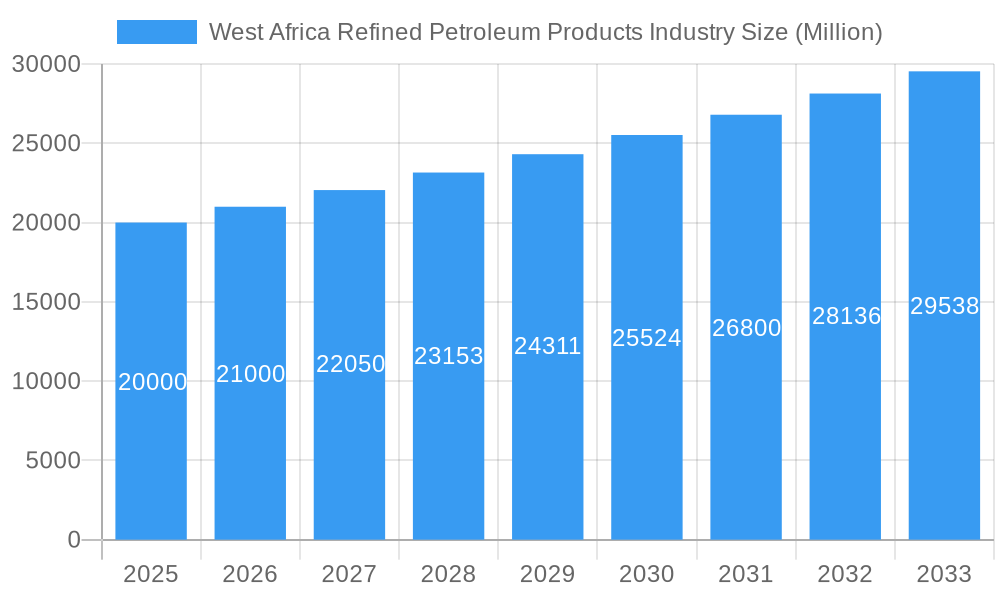

The West African Refined Petroleum Products market, valued at approximately $55.86 billion in 2024, is projected for robust expansion, with a projected Compound Annual Growth Rate (CAGR) of 5.7% through 2031. This growth is driven by several factors: increasing demand from the burgeoning automotive sector, industrialization, and urbanization, which fuels consumption of gasoline and diesel. Additionally, the expanding aviation and marine industries, particularly in coastal nations, contribute to higher fuel needs. Rising populations and disposable incomes are also stimulating overall energy consumption. While global crude oil price volatility and infrastructural challenges in distribution networks pose constraints, strategic government initiatives focused on energy infrastructure improvement and economic diversification offer partial mitigation. The Liquefied Petroleum Gas (LPG) segment is anticipated to experience significant growth due to its increasing adoption as a cleaner cooking fuel.

West Africa Refined Petroleum Products Industry Market Size (In Billion)

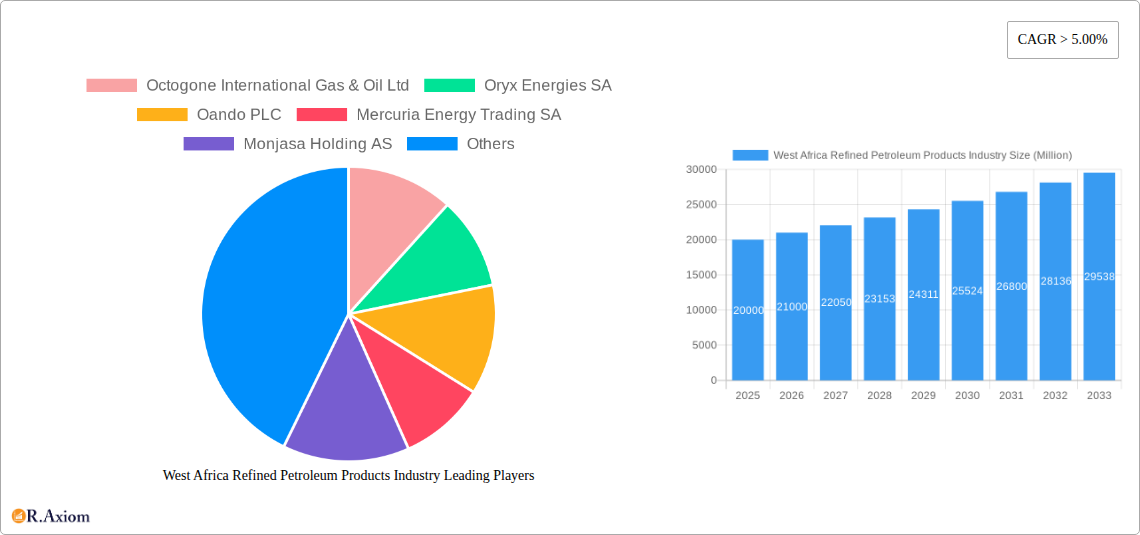

The market is segmented by fuel type, including Automotive Fuels, Marine Fuels, Aviation Fuels, Liquefied Petroleum Gas (LPG), and Others. Key market participants such as Octogone International Gas & Oil Ltd, Oryx Energies SA, Oando PLC, Mercuria Energy Trading SA, and Vitol Holdings BV are actively engaged in the region. Competition centers on pricing, supply chain efficiency, and distribution network optimization. Regional growth variations are expected, with leading economies and higher energy consumers anticipated to drive expansion. The forecast period (2024-2031) indicates substantial market potential, underpinned by sustained economic development and escalating energy requirements across West Africa.

West Africa Refined Petroleum Products Industry Company Market Share

West Africa Refined Petroleum Products Industry: 2019-2033 Market Analysis & Forecast Report

This comprehensive report provides a detailed analysis of the West Africa refined petroleum products industry, covering the period from 2019 to 2033. It offers invaluable insights into market dynamics, competitive landscapes, and future growth potential, making it an essential resource for industry stakeholders, investors, and strategic planners. The report leverages extensive data analysis and expert insights to deliver actionable intelligence, facilitating informed decision-making in this dynamic sector.

West Africa Refined Petroleum Products Industry Market Concentration & Innovation

This section analyzes the market concentration, innovation drivers, regulatory frameworks, product substitutes, end-user trends, and M&A activities within the West African refined petroleum products industry. The market is characterized by a mix of multinational corporations and local players, leading to a moderately concentrated market structure. Market share data for 2024 reveals that Vitol Holdings BV holds approximately xx% market share, followed by Trafigura Group Pte Ltd at xx%, and Sahara Group Limited at xx%. The remaining market share is distributed amongst numerous smaller players.

- Innovation Drivers: Technological advancements in refining processes, biofuel development, and the increasing adoption of cleaner fuels are major innovation drivers.

- Regulatory Frameworks: Government regulations concerning fuel quality standards, environmental protection, and pricing policies significantly impact market dynamics. The level of regulatory stringency varies across countries in the region.

- Product Substitutes: The emergence of renewable energy sources and electric vehicles poses a long-term threat, although their current market penetration remains relatively low (xx%).

- End-User Trends: Increasing urbanization and economic growth are driving demand for refined petroleum products, particularly automotive fuels.

- M&A Activities: The past five years have witnessed several significant M&A deals, with total deal values exceeding $xx Million. These deals primarily focused on expanding market access and strengthening supply chains.

West Africa Refined Petroleum Products Industry Industry Trends & Insights

The West African refined petroleum products market exhibits robust growth, driven by rising energy demand and economic expansion. The Compound Annual Growth Rate (CAGR) for the period 2019-2024 was xx%, and is projected to be xx% during the forecast period (2025-2033). This growth is primarily fueled by the increasing automotive sector and industrialization across the region. However, challenges persist due to infrastructural limitations, supply chain disruptions, and fluctuating crude oil prices. Market penetration of premium fuels remains limited due to affordability concerns. Technological disruptions, such as the adoption of advanced refining technologies and biofuels, are gradually reshaping the industry. Competitive dynamics are intense, characterized by price wars and strategic alliances amongst major players.

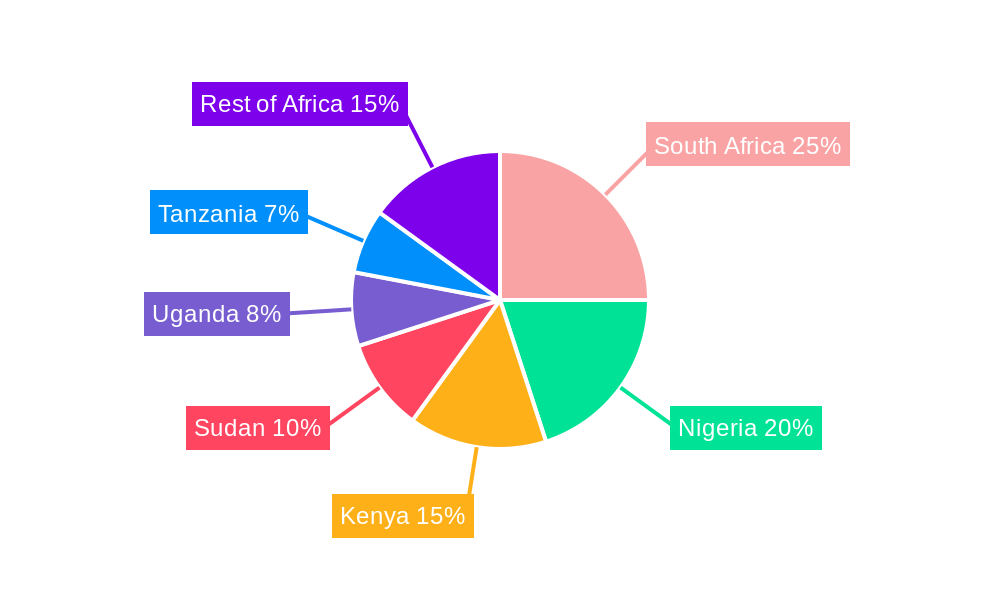

Dominant Markets & Segments in West Africa Refined Petroleum Products Industry

Nigeria represents the largest market within the West African refined petroleum products industry, accounting for approximately xx% of total regional consumption in 2024. This dominance is driven by its large population, robust economy, and high vehicle ownership rates. Other significant markets include Ghana, Ivory Coast, and Senegal. The automotive fuels segment remains the dominant market segment, accounting for over xx% of total consumption.

Key Drivers for Nigeria's Dominance:

- Large and growing population

- Significant economic activity and industrialization

- Extensive road network (although requiring further development)

- Relatively high vehicle ownership rates.

Automotive Fuels: This segment's dominance is attributed to the widespread use of gasoline and diesel in transportation. Growth is expected to continue, albeit at a slower pace than in previous years, due to the increasing adoption of alternative transportation methods.

Marine Fuels: The marine fuels segment displays considerable growth potential, driven by increasing shipping activity in the region.

Aviation Fuels: This segment is projected to see steady growth, aligned with the expansion of air travel within West Africa.

Liquefied Petroleum Gas (LPG): LPG consumption is growing gradually, reflecting increased adoption for cooking and heating purposes.

Others: This segment encompasses specialty fuels and other refined products.

West Africa Refined Petroleum Products Industry Product Developments

Recent product innovations have focused on improving fuel efficiency, reducing emissions, and enhancing fuel quality. The introduction of cleaner fuels compliant with international standards is gaining traction. Several companies are investing in research and development to develop advanced biofuels and other alternative fuels to meet growing environmental concerns and diversify energy sources. These innovations aim to improve market competitiveness and enhance environmental sustainability.

Report Scope & Segmentation Analysis

This report segments the West African refined petroleum products market by product type: Automotive Fuels, Marine Fuels, Aviation Fuels, Liquefied Petroleum Gas (LPG), and Others. Each segment's growth projections, market sizes, and competitive dynamics are thoroughly analyzed. The report considers the historical period (2019-2024), base year (2025), and forecast period (2025-2033).

- Automotive Fuels: This segment holds the largest market share and is projected to maintain its dominance throughout the forecast period. Competition is fierce, with several major players vying for market share.

- Marine Fuels: This segment is experiencing moderate growth, driven by increasing shipping activity and port development.

- Aviation Fuels: This segment exhibits steady growth, aligned with the expansion of the aviation sector.

- Liquefied Petroleum Gas (LPG): The LPG segment demonstrates promising growth due to increased adoption for residential and industrial use.

- Others: This segment includes specialty fuels and other refined petroleum products, with growth influenced by niche market demands.

Key Drivers of West Africa Refined Petroleum Products Industry Growth

The growth of the West African refined petroleum products industry is driven by several factors, including:

- Economic Growth: Sustained economic expansion across the region is increasing demand for energy.

- Population Growth: Rapid population growth, especially in urban areas, fuels demand for transportation and other energy-intensive activities.

- Infrastructure Development: Investments in infrastructure, including roads, ports, and airports, supports the growth of transportation-related fuel consumption.

- Government Policies: Supportive government policies aimed at attracting investment in the energy sector and improving energy access enhance market growth.

Challenges in the West Africa Refined Petroleum Products Industry Sector

The West African refined petroleum products industry faces several challenges:

- Infrastructure Deficiencies: Inadequate infrastructure, including refining capacity, storage facilities, and distribution networks, hampers efficient market operations.

- Supply Chain Disruptions: Political instability and security concerns in some parts of the region can disrupt the supply chain.

- Price Volatility: Fluctuations in global crude oil prices significantly impact the profitability of refined petroleum products.

- Regulatory Uncertainty: Changes in government policies and regulations can create uncertainty for businesses operating in the industry.

Emerging Opportunities in West Africa Refined Petroleum Products Industry

Several emerging opportunities exist within the West African refined petroleum products market:

- Investment in Refining Capacity: Significant opportunities exist for investment in new refining facilities to meet growing demand.

- Biofuel Development: The development and adoption of biofuels offer a pathway to greater energy security and sustainability.

- Improved Infrastructure: Investment in upgrading existing infrastructure and developing new infrastructure will support efficient market operations.

- Expansion of LPG Use: Promoting the use of LPG as a cleaner cooking fuel presents a significant opportunity for growth.

Leading Players in the West Africa Refined Petroleum Products Industry Market

Key Developments in West Africa Refined Petroleum Products Industry Industry

- November 2021: Dangote group announced the commissioning of its 650,000 b/d refinery in Lagos, Nigeria, significantly impacting local refining capacity and potentially altering market dynamics. The NNPC's planned 20% stake acquisition further underscores the strategic importance of this project.

- 2020: BUA Group's contract with Axens Group for the construction of a 200,000 b/d integrated refining and petrochemical plant in Akwa Ibom, Nigeria, signals significant investment in expanding the country's refining capabilities.

Strategic Outlook for West Africa Refined Petroleum Products Industry Market

The West African refined petroleum products market holds significant long-term growth potential, driven by robust economic growth, population expansion, and increasing energy demand. Strategic investments in refining capacity, infrastructure development, and the adoption of cleaner fuels will be crucial for realizing this potential. The industry will need to adapt to evolving consumer preferences, technological disruptions, and environmental regulations to ensure sustainable growth and profitability.

West Africa Refined Petroleum Products Industry Segmentation

-

1. Type

- 1.1. Automotive Fuels

- 1.2. Marine Fuels

- 1.3. Aviation Fuels

- 1.4. Liquefied Petroleum Gas(LPG)

- 1.5. Others

-

2. Geography

- 2.1. Nigeria

- 2.2. Ghana

- 2.3. Senegal

- 2.4. Others

West Africa Refined Petroleum Products Industry Segmentation By Geography

- 1. Nigeria

- 2. Ghana

- 3. Senegal

- 4. Others

West Africa Refined Petroleum Products Industry Regional Market Share

Geographic Coverage of West Africa Refined Petroleum Products Industry

West Africa Refined Petroleum Products Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Expanding Pipeline Infrastructure4.; Growing Energy Demand

- 3.3. Market Restrains

- 3.3.1. 4.; Political Instability and Militant Attacks on Pipeline Infrastructure

- 3.4. Market Trends

- 3.4.1. Automotive fuels Expected to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. West Africa Refined Petroleum Products Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Automotive Fuels

- 5.1.2. Marine Fuels

- 5.1.3. Aviation Fuels

- 5.1.4. Liquefied Petroleum Gas(LPG)

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. Nigeria

- 5.2.2. Ghana

- 5.2.3. Senegal

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Nigeria

- 5.3.2. Ghana

- 5.3.3. Senegal

- 5.3.4. Others

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Nigeria West Africa Refined Petroleum Products Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Automotive Fuels

- 6.1.2. Marine Fuels

- 6.1.3. Aviation Fuels

- 6.1.4. Liquefied Petroleum Gas(LPG)

- 6.1.5. Others

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. Nigeria

- 6.2.2. Ghana

- 6.2.3. Senegal

- 6.2.4. Others

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Ghana West Africa Refined Petroleum Products Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Automotive Fuels

- 7.1.2. Marine Fuels

- 7.1.3. Aviation Fuels

- 7.1.4. Liquefied Petroleum Gas(LPG)

- 7.1.5. Others

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. Nigeria

- 7.2.2. Ghana

- 7.2.3. Senegal

- 7.2.4. Others

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Senegal West Africa Refined Petroleum Products Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Automotive Fuels

- 8.1.2. Marine Fuels

- 8.1.3. Aviation Fuels

- 8.1.4. Liquefied Petroleum Gas(LPG)

- 8.1.5. Others

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. Nigeria

- 8.2.2. Ghana

- 8.2.3. Senegal

- 8.2.4. Others

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Others West Africa Refined Petroleum Products Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Automotive Fuels

- 9.1.2. Marine Fuels

- 9.1.3. Aviation Fuels

- 9.1.4. Liquefied Petroleum Gas(LPG)

- 9.1.5. Others

- 9.2. Market Analysis, Insights and Forecast - by Geography

- 9.2.1. Nigeria

- 9.2.2. Ghana

- 9.2.3. Senegal

- 9.2.4. Others

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Octogone International Gas & Oil Ltd

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Oryx Energies SA

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Oando PLC

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Mercuria Energy Trading SA

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Monjasa Holding AS

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Vitol Holdings BV

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Puma Energy Holdings Pte Ltd

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Sahara Group Limited

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Trafigura Group Pte Ltd

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 FuelSupply Co

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Octogone International Gas & Oil Ltd

List of Figures

- Figure 1: West Africa Refined Petroleum Products Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: West Africa Refined Petroleum Products Industry Share (%) by Company 2025

List of Tables

- Table 1: West Africa Refined Petroleum Products Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 2: West Africa Refined Petroleum Products Industry Volume Thousand liters Forecast, by Type 2020 & 2033

- Table 3: West Africa Refined Petroleum Products Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 4: West Africa Refined Petroleum Products Industry Volume Thousand liters Forecast, by Geography 2020 & 2033

- Table 5: West Africa Refined Petroleum Products Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 6: West Africa Refined Petroleum Products Industry Volume Thousand liters Forecast, by Region 2020 & 2033

- Table 7: West Africa Refined Petroleum Products Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 8: West Africa Refined Petroleum Products Industry Volume Thousand liters Forecast, by Type 2020 & 2033

- Table 9: West Africa Refined Petroleum Products Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 10: West Africa Refined Petroleum Products Industry Volume Thousand liters Forecast, by Geography 2020 & 2033

- Table 11: West Africa Refined Petroleum Products Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 12: West Africa Refined Petroleum Products Industry Volume Thousand liters Forecast, by Country 2020 & 2033

- Table 13: West Africa Refined Petroleum Products Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 14: West Africa Refined Petroleum Products Industry Volume Thousand liters Forecast, by Type 2020 & 2033

- Table 15: West Africa Refined Petroleum Products Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 16: West Africa Refined Petroleum Products Industry Volume Thousand liters Forecast, by Geography 2020 & 2033

- Table 17: West Africa Refined Petroleum Products Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 18: West Africa Refined Petroleum Products Industry Volume Thousand liters Forecast, by Country 2020 & 2033

- Table 19: West Africa Refined Petroleum Products Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 20: West Africa Refined Petroleum Products Industry Volume Thousand liters Forecast, by Type 2020 & 2033

- Table 21: West Africa Refined Petroleum Products Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 22: West Africa Refined Petroleum Products Industry Volume Thousand liters Forecast, by Geography 2020 & 2033

- Table 23: West Africa Refined Petroleum Products Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 24: West Africa Refined Petroleum Products Industry Volume Thousand liters Forecast, by Country 2020 & 2033

- Table 25: West Africa Refined Petroleum Products Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 26: West Africa Refined Petroleum Products Industry Volume Thousand liters Forecast, by Type 2020 & 2033

- Table 27: West Africa Refined Petroleum Products Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 28: West Africa Refined Petroleum Products Industry Volume Thousand liters Forecast, by Geography 2020 & 2033

- Table 29: West Africa Refined Petroleum Products Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 30: West Africa Refined Petroleum Products Industry Volume Thousand liters Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the West Africa Refined Petroleum Products Industry?

The projected CAGR is approximately 5.7%.

2. Which companies are prominent players in the West Africa Refined Petroleum Products Industry?

Key companies in the market include Octogone International Gas & Oil Ltd, Oryx Energies SA, Oando PLC, Mercuria Energy Trading SA, Monjasa Holding AS, Vitol Holdings BV, Puma Energy Holdings Pte Ltd, Sahara Group Limited, Trafigura Group Pte Ltd, FuelSupply Co.

3. What are the main segments of the West Africa Refined Petroleum Products Industry?

The market segments include Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 55.86 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Expanding Pipeline Infrastructure4.; Growing Energy Demand.

6. What are the notable trends driving market growth?

Automotive fuels Expected to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Political Instability and Militant Attacks on Pipeline Infrastructure.

8. Can you provide examples of recent developments in the market?

In November 2021, the Dangote group announced that they are likely to commission Dangote refinery in early 2022. The 650,000 b/d refinery is located in Lagos, Nigeria, and is believed to be Africa's largest upcoming integrated refinery, and the world's biggest single train facility. The state-owned company NNPC is expected to acquire 20% stake in the project.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in Thousand liters.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "West Africa Refined Petroleum Products Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the West Africa Refined Petroleum Products Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the West Africa Refined Petroleum Products Industry?

To stay informed about further developments, trends, and reports in the West Africa Refined Petroleum Products Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence